Why Canadians need Canada Grocery Rebate: If you’ve been hearing about the Canada Grocery Rebate October 2025 and wondering what it’s all about, you’re not alone. With grocery bills feeling heavier these days, this rebate is turning heads across the country. From single parents hustling through their weekly shop, to seniors trying to stretch every dollar, this government support is making a big difference. But what is it really, who’s eligible, how much will you get, and when does the money hit your bank account? Let’s dive into the full scoop, breaking it down so everyone can understand, while also packing in all the insider insights for those who love to stay informed.

Food prices in Canada have been on the rise, making it tougher for many families and individuals to afford the basics. This ongoing inflation squeeze has prompted the federal government to extend the Canada Grocery Rebate into October 2025. This move is about easing the pinch for those feeling the heat in their wallets. The rebate is a one-time, tax-free payment designed to put some cash back in your pocket and help with grocery bills.

Table of Contents

Why Canadians need Canada Grocery Rebate?

The Canada Grocery Rebate for October 2025 is a much-needed lifeline for many families and individuals navigating higher living costs. By providing a tax-free, automatic payment up to $628 per household, the government is addressing food affordability head-on. Keep informed, plan your grocery budget carefully, and use this support to reduce stress and stretch your dollars further.

| Key Highlights | Details |

|---|---|

| Payment Date | October 7 to 14, 2025 |

| Maximum Rebate Amount | Up to $628 per household |

| Eligibility Based On | 2024 Tax Return |

| Administered By | Canada Revenue Agency (CRA) |

| Application Needed? | No, automatic if eligible |

| Taxable? | No, it’s tax-free |

| Impact on Other Benefits | None; does not affect GST/HST Credit, CCB, OAS, or GIS |

| Deposit Method | Direct deposit or mailed cheque |

| Target Group | Low to modest-income Canadians |

| Purpose | Help offset rising grocery and living costs |

| Official Website | Canada Revenue Agency |

The Inflation Backstory: Why Grocery Bills Are So High

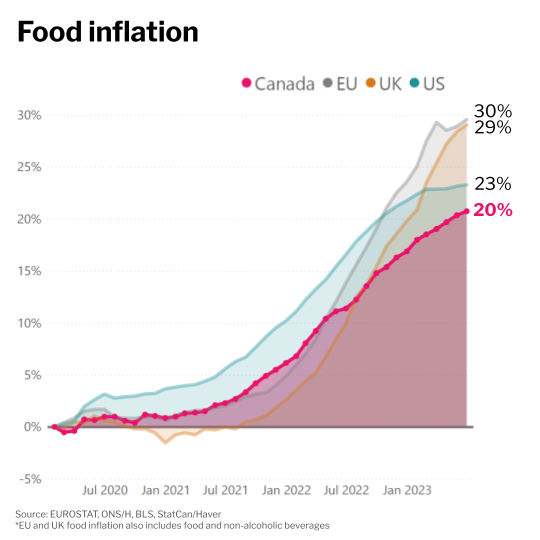

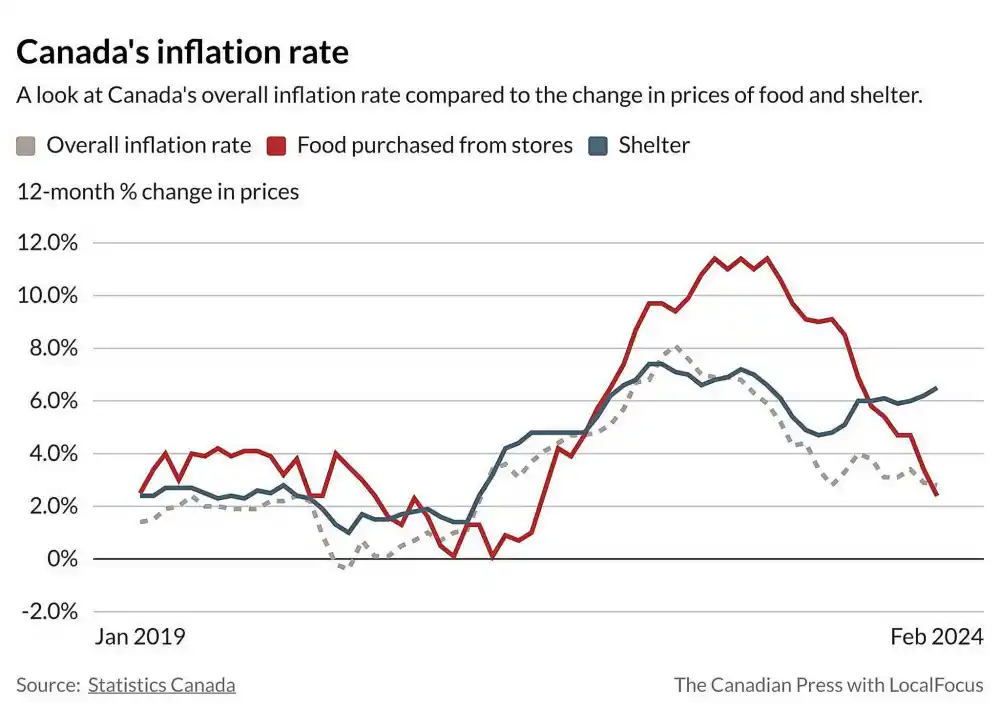

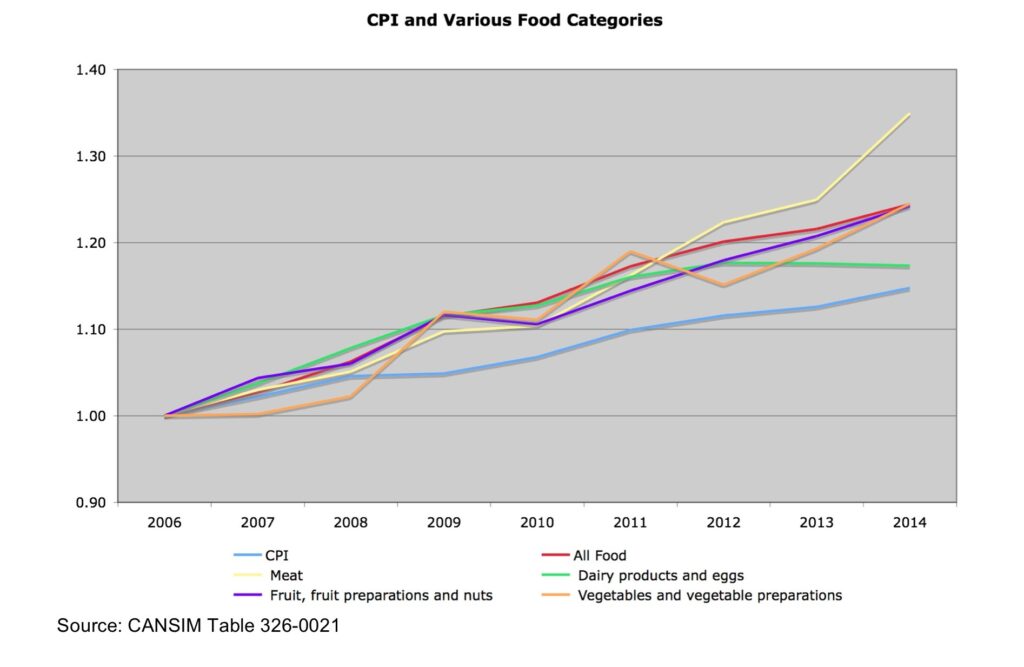

Over the last few years, Canada, much like the United States, has faced rising inflation, especially around food prices. Experts estimate that grocery prices are forecasted to increase by 3% to 5% in 2025 alone. For the average Canadian family of four, this means spending about $16,833.67 on food in 2025, which is roughly $801.56 more than the year before. The biggest price hikes are expected in categories like meat (4-6% increase), vegetables (3-5%), and restaurant meals (3-5%). This sustained increase hits hardest on everyday essentials like bread, dairy, and fresh produce.

The combination of pandemic-related supply chain disruptions, extreme weather events affecting agriculture, and global commodity price volatility has created one of the most challenging periods for food affordability in decades. These income pressures have pushed the government to keep supporting families through targeted programs like the grocery rebate.

What Exactly Is the Canada Grocery Rebate?

The Canada Grocery Rebate is a one-time, tax-free payment from the federal government to ease grocery costs for low-to-modest income Canadians. If you received the GST or HST Credit earlier this year, the rebate will be automatically deposited, no extra forms or applications needed.

Think of it like a little boost from the government to help you keep your fridge stocked during these challenging times. It’s designed for people who genuinely need a hand covering the everyday costs of feeding their families, seniors, and single parents among them.

How Much Can You Expect to Get? Here’s the Breakdown

The amount varies depending on household size and income from your 2024 tax return. Here’s a simple breakdown of the typical payments:

| Household Type | Estimated Rebate Amount (October 2025) |

|---|---|

| Single individual (no kids) | $234 |

| Married/common-law couple (no kids) | $306 |

| Single parent with one child | $387 |

| Couple with one child | $467 |

| Couple with two children | $628 |

This setup ensures families with more members and presumably higher grocery needs get more support.

When Does the Money Drop?

Payments are scheduled between October 7 and October 14, 2025. Direct deposits will arrive in your usual account if you’re set up for it. Otherwise, the government will mail you a cheque, but depending on where you live, mail could take longer.

Who’s Eligible for Canada Grocery Rebate?

- Filed 2024 taxes and received GST/HST Credit.

- Canadian resident for tax purposes.

- Low-to-modest income based on CRA criteria.

- Age 18 or older as of October 2025.

High-income earners are excluded as this benefit targets those needing the most relief.

A Real-Life Example: How the Grocery Rebate Helps a Typical Family

Meet the Johnsons, a family of four in Ontario. Mr. Johnson works a modest-paying job, and Mrs. Johnson is a part-time teacher. They’ve felt grocery prices jumping about 10% at their local supermarket. With two kids heading back to school, their usual grocery budget is stretched tight.

This October, they get a $628 rebate deposited. That money means an extra $75 a week for almost two months, just in time for winter groceries and holiday meal fixes. It’s not a fortune, but it’s enough to ease the stress and keep the family well-fed without cutting back on essentials.

Stretching Your Grocery Rebate: Practical Tips

- Buy in bulk: Stock up on staples like rice, beans, and frozen veggies during sales.

- Meal prep: Plan weekly meals around sales and seasonal produce.

- Use coupons and apps: Take advantage of store discounts and grocery apps.

- Shop local: Farmers’ markets sometimes offer fresher seasonal produce at better prices.

- Reduce food waste: Freeze leftovers and get creative with meal leftovers.

Government Programs to Know About Alongside the Rebate

Besides the grocery rebate, Canadians can tap other supports such as the Canada Child Benefit (CCB), GST/HST Credit, and Guaranteed Income Supplement (GIS) for seniors. These programs work together to cushion various financial pressures and ensure a broader safety net for vulnerable Canadians.

How Does Canada Compare? A Quick Look at the U.S.

In the United States, programs like SNAP (Supplemental Nutrition Assistance Program) provide ongoing food assistance to eligible low-income families—something Canada supports through these rebates and benefit systems. Both countries recognize food affordability as a key issue and continue to tackle it via tailored programs.

Additional Steps to Maximize Your Financial Health Today

Besides using the grocery rebate smartly, consider:

- Regularly reviewing your tax filings to ensure accuracy.

- Signing up for CRA My Account for easy tracking of benefits and payments.

- Exploring community food banks and local assistance programs if needed.

- Keeping an eye on inflation trends which may impact your household budget in coming months.

- Preparing for seasonal price changes by stocking up when prices are lower.

Canada $4100 CRA Direct Payment in October 2025: Check Payment Date & Eligibility Criteria

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Grocery Rebate Canada – $628 is coming to all eligible in October 2025; Is it true?