VA Disability Pay 2026: The U.S. Department of Veterans Affairs (VA) has unveiled the new disability compensation rates for 2026. Veterans with qualifying service-connected disabilities will see a 2.7% increase in their monthly benefits, effective December 1, 2025. These adjustments aim to keep pace with the rising cost of living, providing veterans with a necessary boost as inflation continues to impact the economy. The updated rates will be reflected in January 2026 payments.

Veterans, particularly those with dependents or higher disability ratings, will feel the immediate effect of the new rates. The 2.7% increase, while modest, reflects the government’s ongoing commitment to providing economic support to those who have served the country. This rate adjustment, however, also raises questions about how future economic conditions could influence veterans’ benefits in the years ahead.

Table of Contents

VA Disability Pay 2026

| Key Fact | Detail/Statistic |

|---|---|

| Effective Date | December 1, 2025 |

| First Payment | January 1, 2026 |

| COLA Increase | 2.7% |

| Impact on Veterans | Applies to all veterans with a disability rating of 10% or higher |

| Official Website | U.S. Department of Veterans Affairs |

The 2026 VA disability pay increase marks an important step in addressing the economic challenges faced by veterans. The 2.7% COLA increase will provide vital financial support to veterans and their families, reflecting the government’s commitment to honoring their sacrifices. While the increase will certainly help mitigate some of the effects of rising costs, veterans should stay informed and prepared to make the most of their benefits.

As inflation continues to affect the economy, it is likely that additional increases will be needed in the future to ensure that veterans’ benefits keep pace with living costs. For now, however, the 2026 rates provide a much-needed financial cushion for many veterans across the country.

Overview of 2026 VA Disability Compensation Rates

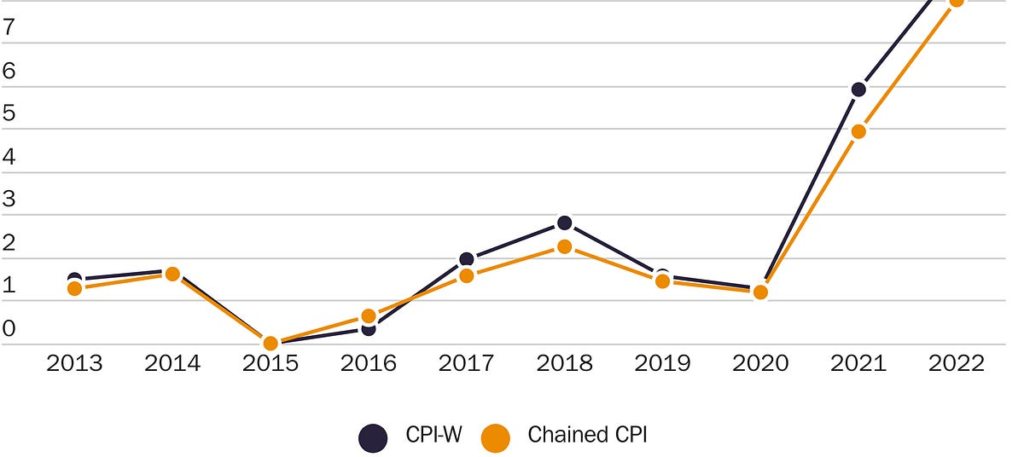

For veterans receiving disability compensation, the 2026 rate adjustment is one of the most significant changes in recent years. The 2.7% Cost-of-Living Adjustment (COLA) increase, which is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), is designed to ensure that veterans’ benefits keep up with inflation. This increase is calculated annually and affects both the base compensation for disabled veterans and their additional benefits for dependents.

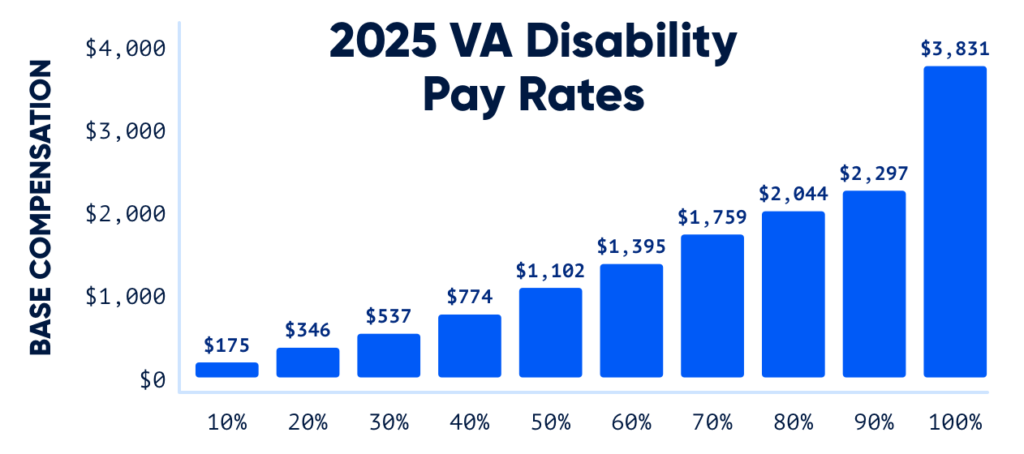

The 2026 rate adjustment will impact veterans at all levels of disability ratings, from 10% to 100%. Those with a 100% disability rating will see their monthly compensation rise to approximately $3,934.74, a significant increase compared to previous years. Veterans with lower disability ratings will also see similar increases in their payments.

Full Schedule of 2026 VA Disability Compensation Rates

The new disability pay rates for veterans in 2026, including compensation for dependents, are as follows:

| Disability Rating | Veteran Alone | Veteran & Spouse | Veteran, Spouse & 1 Parent | Veteran, Spouse & 2 Parents | Aid & Attendance (Spouse) |

|---|---|---|---|---|---|

| 100% | $3,934.74 | $4,154.12 | $4,330.19 | $4,506.26 | $201.21 |

| 90% | $2,360.00 | $2,556.85 | $2,714.75 | $2,872.66 | $181.06 |

| 80% | $2,100.10 | $2,274.84 | $2,414.85 | $2,554.85 | $161.06 |

| 70% | $1,806.69 | $1,959.32 | $2,082.49 | $2,205.65 | $141.06 |

| 60% | $1,433.62 | $1,565.20 | $1,670.47 | $1,775.74 | $120.00 |

| 50% | $1,131.79 | $1,241.27 | $1,328.64 | $1,416.02 | $100.00 |

| 40% | $795.06 | $882.44 | $951.91 | $1,021.39 | $80.00 |

| 30% | $551.93 | $617.19 | $669.83 | $722.46 | $60.00 |

Understanding the 2.7% COLA Increase

This annual increase is part of the government’s ongoing efforts to address the economic challenges that veterans face. The COLA adjustment is linked directly to inflation, ensuring that veterans’ benefits maintain their value despite the rising cost of goods and services. The 2.7% increase reflects the economic conditions of the previous year, including changes in consumer prices.

Veterans Affairs Secretary Denis McDonough emphasized that the increase in benefits is intended to help veterans maintain financial stability. “These adjustments are vital to ensure that our veterans, who have given so much for our country, are not left behind as the cost of living increases,” McDonough said in a statement.

The impact of this increase can be significant for veterans living on fixed incomes, especially as inflation affects various goods, including housing and healthcare. For veterans who rely solely on VA compensation, this increase offers a crucial lifeline.

Who Is Eligible for the 2026 Rate Adjustment?

The 2.7% increase will apply to veterans with a service-connected disability rating of 10% or higher. Those with dependents—spouses, children, or dependent parents—are eligible for additional benefits, as outlined in the schedule above. However, veterans with a rating below 10% do not receive extra compensation for dependents.

Veterans should be aware that these rate adjustments are automatic, meaning there is no need for veterans to take any action to receive the increased benefits. The adjusted compensation will be reflected in the January 2026 payments, based on the December 1, 2025, effective date.

The Role of Dependents in VA Disability Compensation

Veterans with dependents are entitled to additional compensation, which increases their total monthly payment. The dependency allowances are based on the number of dependents a veteran has, including spouses, children, and dependent parents. This system ensures that veterans with greater family responsibilities are provided with additional financial support.

The dependency pay is often a critical part of the financial security for veterans with families. For instance, a veteran with a spouse and two parents can receive up to $4,506.26 per month with a 100% disability rating in 2026. This is a substantial increase compared to the previous year and reflects the government’s recognition of the financial demands placed on families.

What Veterans Can Do to Prepare for the 2026 Rate Adjustment

Veterans should review their benefits and ensure that their personal information is up-to-date with the VA. This includes confirming details about dependents, as errors or outdated information could affect the calculation of their compensation.

Additionally, veterans may want to consult financial advisors to better understand how the increased compensation can be best utilized in the context of their overall financial planning. Financial resources and support are available through various veterans’ organizations, including the Veterans of Foreign Wars (VFW) and the American Legion, both of which offer advice and services related to VA benefits.

The Bigger Picture: Veterans’ Economic Challenges

While the 2.7% COLA increase provides vital financial support, it’s important to understand the broader economic context in which these increases are happening. Inflation has been rising globally, and U.S. veterans are not immune to the pressures this creates on their financial well-being. Basic living costs such as food, healthcare, and housing have seen substantial increases in recent years.

Dr. James Thompson, a professor of economics at the University of California, noted that while COLA increases are important, they do not always fully account for the realities that many veterans face. “For veterans living in high-cost areas, such as major cities or coastal regions, these increases may still fall short of what is necessary to maintain their quality of life,” Thompson said.

For example, healthcare costs for veterans can be particularly high. While the VA provides healthcare services, veterans still face costs related to non-VA providers or additional health needs not covered by the system. In addition, many veterans are also experiencing the same housing affordability issues that are affecting the broader population, further complicating their financial situation.

VA Disability Compensation and Its Impact on Mental Health

Beyond the financial implications, the level of compensation can affect veterans’ mental health. Many veterans experience a sense of financial insecurity, especially those who are unable to return to work due to their disabilities. The VA’s disability compensation is designed to offer a stable income, which plays an important role in reducing anxiety and stress for those who may already be dealing with physical or emotional trauma from their service.

Dr. Ellen Harris, a clinical psychologist specializing in veterans’ mental health, said that financial stability can be a key factor in improving mental well-being. “Financial stress can exacerbate mental health challenges for veterans, especially those who are dealing with the long-term effects of PTSD, depression, and anxiety,” Harris noted. The 2.7% COLA increase, while a necessary boost, can help veterans focus on recovery rather than on financial strain.

$1700 ACTC Coming In October 2025 – Who will get this? Check Eligibility & Payment Schedule

$3284 Stimulus Checks in October 2025 for these People: Check Your Eligibility & Payment Dates

The Future of VA Disability Compensation: What’s Next?

Looking beyond the 2026 rates, experts suggest that veterans should be prepared for further adjustments based on economic conditions. As inflationary pressures continue to evolve, it’s possible that future COLA increases could be larger or smaller, depending on the trajectory of the economy. For example, if inflation continues to rise significantly, veterans could see larger increases in subsequent years.

Dr. Michael Carpenter, an economist at the Institute for Veterans Affairs, noted that ongoing economic challenges could make it necessary for the government to explore new ways of supporting veterans. “In addition to COLA increases, we may see additional targeted support for veterans facing particular financial hardships,” Carpenter explained.

One area of focus could be providing more assistance for veterans in high-cost areas or expanding healthcare coverage to reduce out-of-pocket expenses. While COLA increases are an important part of the overall strategy, veterans’ needs are evolving, and the VA may need to adapt its policies accordingly.