USA Minimum Wage Increase: If you’ve ever worked a summer job, hustled at a diner, or managed payroll for a small business, you know the minimum wage is a big deal. It affects workers’ wallets, business costs, and even the prices on your favorite cheeseburger. Now that 2025 is here, the buzz around minimum wage hikes is louder than ever. So what’s really happening? Are we finally seeing a federal wage bump? Or is this another year where only certain states are making moves? Let’s break it down in plain English — what’s changing, who it affects, and how you can prepare. Whether you’re an employee trying to understand your paycheck or an employer planning payroll, this is the guide you need.

Table of Contents

USA Minimum Wage Increase

The USA Minimum Wage Increase 2025 isn’t a single federal raise — it’s a patchwork of local and state-level changes that together are reshaping the American pay landscape. For millions of workers, it means more breathing room. For employers, it means new compliance responsibilities — and new opportunities to build fairer, more sustainable workplaces. Whether you earn hourly wages or run payroll, one truth stands out: understanding minimum wage laws isn’t optional — it’s essential. So, stay informed, check your local rates, and remember — fair pay isn’t just a number on paper. It’s about dignity, opportunity, and keeping the American dream within reach for everyone.

| Topic | Data / Fact | Why It Matters |

|---|---|---|

| Federal minimum wage (2025) | $7.25/hr – unchanged since 2009 | Sets the national pay floor for most workers. |

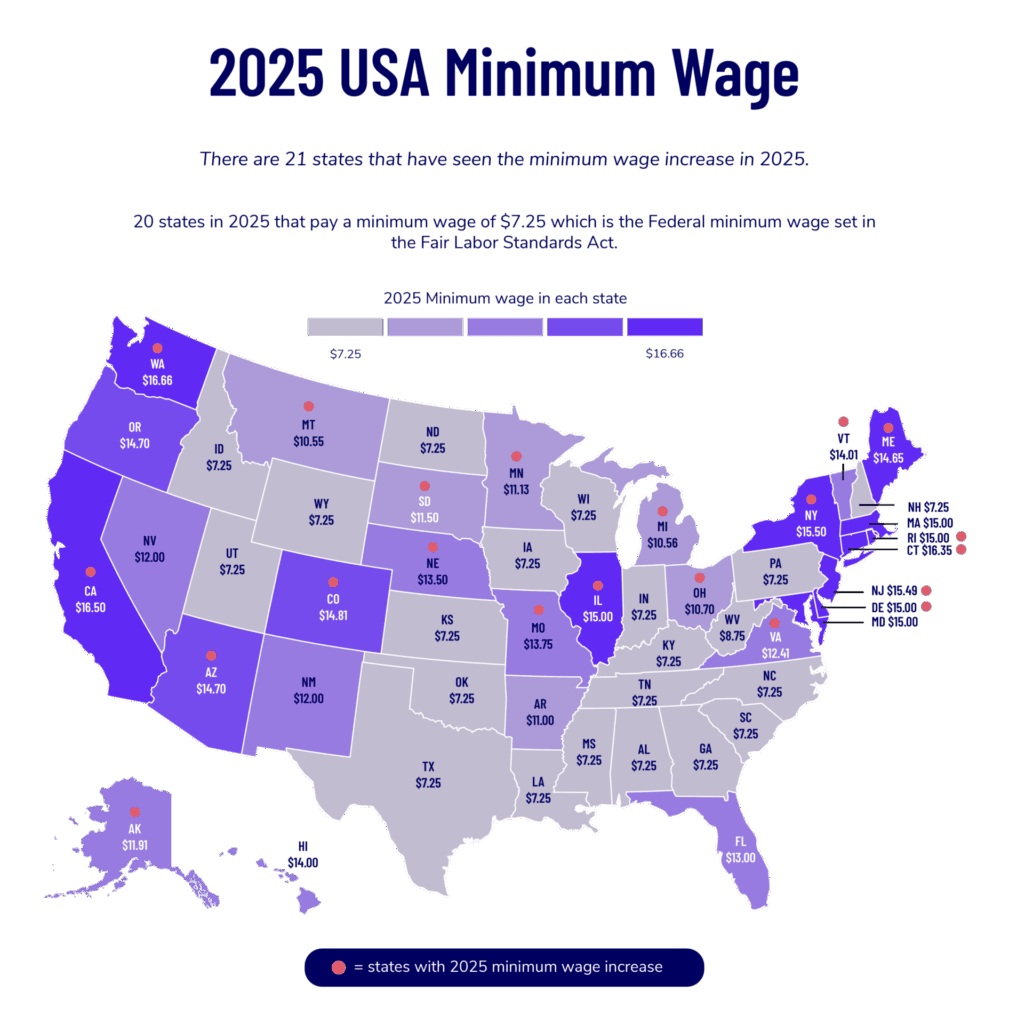

| State & city increases | 20+ states and dozens of cities raised rates on Jan 1, 2025 | Millions of workers see larger paychecks this year. |

| Highest 2025 rate | Washington, D.C. → $18.00/hr (from July 1, 2025) | Aims to match inflation and cost of living. |

| Proposed new federal bill | Raise the Wage Act 2025 – targets $17/hr by 2030 | Still in Congress, not yet law. |

| Workers at/below federal minimum | 869,000 people (≈1.1% of hourly workers) | Many earn more due to state/local laws. |

| Living wage gap | MIT estimates $22–$25/hr needed in many states (MIT Living Wage Calculator) | Highlights the real cost-of-living challenge. |

Understanding the Basics: Federal vs. State Minimum Wage

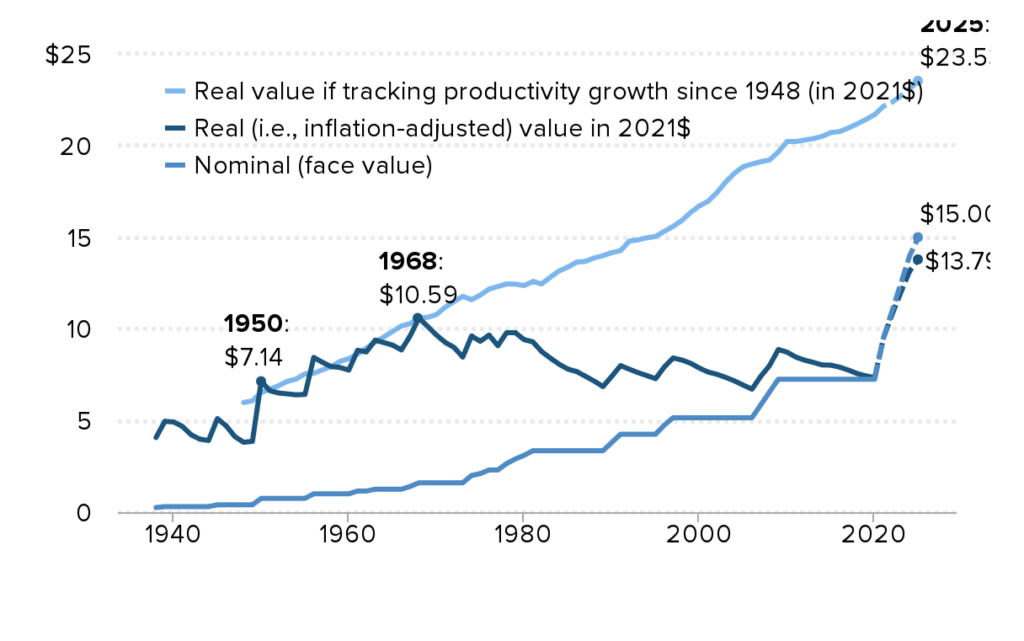

The federal minimum wage is the baseline that all U.S. employers must follow — unless their state or city has a higher rate. It’s been stuck at $7.25/hour since 2009, which means it’s lost over 30% of its purchasing power thanks to inflation.

Think about it: $7.25 in 2009 is worth roughly $5.10 in today’s dollars. That’s like getting a 30% pay cut over time without anyone saying a word.

That’s why so many states — and even individual cities — have decided to raise their own minimums to reflect real-world costs. Employers must always pay whichever is highest between the federal, state, or local minimum wage.

For instance:

- In Texas, the minimum wage is still $7.25/hr (federal default).

- In California, the statewide minimum is $16.50/hr.

- In D.C., workers earn $18/hr starting July 1, 2025.

That’s a huge difference for two workers doing the same job in different zip codes.

What’s New in 2025: State-by-State Updates

Here are some notable changes effective in 2025, based on data from Paycor and NELP:

- California: $16.50/hr statewide. Some cities (like San Francisco, Los Angeles, and Mountain View) exceed $18/hr.

- New York: $16.50/hr for NYC, Long Island, and Westchester; $15/hr for the rest of the state.

- Washington State: $17.25/hr, with several cities (like SeaTac) over $19/hr.

- District of Columbia: $18/hr effective July 1, 2025.

- Florida: $14/hr as of September 30, 2025 — part of a scheduled increase to $15/hr by 2026.

- Hawaii: $14/hr, rising again to $16 in 2026 and $18 by 2028.

- Colorado: $15.30/hr, with Denver at $18.30/hr.

- Oregon: Expected $15.70/hr (varies by region).

More than 55 jurisdictions nationwide will have wage floors of $15 or more by the end of 2025, while some localities in Washington, California, and Massachusetts will exceed $20/hr.

Why the USA Minimum Wage Increase?

The short version: life got expensive, fast.

The longer version involves a mix of inflation, worker shortages, and cost-of-living differences. Over the last few years, inflation outpaced wage growth, squeezing millions of workers who were already living paycheck to paycheck.

States with higher living costs — especially on the West Coast and Northeast — realized that $7.25/hour simply doesn’t cut it anymore. That’s less than $15,000/year before taxes for full-time work. Try renting an apartment, buying groceries, and filling your gas tank on that — not happening.

So policymakers started indexing minimum wages to inflation. That means every year, rates automatically adjust based on the Consumer Price Index (CPI). States like Washington, Oregon, and Arizona already use this model, helping wages keep pace with rising prices.

Economic & Social Impact

Raising the minimum wage sparks heated debate — but here’s what the data says:

- Worker benefits: Higher pay can reduce poverty, improve morale, and boost local spending power.

- Business impacts: Some small businesses face tighter margins, but research from the Economic Policy Institute shows that gradual increases have minimal impact on overall employment.

- Community effects: More money in workers’ pockets tends to circulate locally — think groceries, rent, and childcare — strengthening community economies.

Critics worry about automation and job cuts, but many employers report positive results — lower turnover, better performance, and fewer “no-shows.”

The Business Side: How Employers Can Prepare

If you’re running a business or managing HR, here’s what you should do now to stay ahead of 2025 wage changes:

- Audit your workforce.

Identify which locations, roles, and pay brackets will be affected. - Update payroll systems.

Double-check your HR software (ADP, QuickBooks, Gusto, etc.) to ensure new rates go into effect on January 1 (or state-specific dates). - Adjust budgets.

Factor in increased labor costs for 2025–2026. Remember to include overtime, benefits, and taxes. - Revisit pay structures.

If entry-level pay rises, don’t forget to adjust mid-level roles — compression between tiers can frustrate experienced employees. - Communicate early and clearly.

Transparency builds trust. Let staff know what’s changing, when, and why. - Stay compliant.

Post updated labor law notices and keep wage records accessible.

A good rule of thumb? Plan, don’t panic. Wage hikes are predictable — use them as a chance to strengthen retention and productivity.

For Workers: Making the Most of a Pay Raise

If you’re one of the millions getting a raise in 2025, congrats! Here’s how to make that extra money count:

- Create a budget. Even small raises can make a big difference if you plan ahead.

- Save before you spend. Set aside part of your raise in a high-yield savings account or toward paying off credit cards.

- Know your rights. Employers must pay you the new rate starting on the effective date. If not, contact your state’s Department of Labor.

- Track your paychecks. Double-check your first 2025 pay stub — errors happen.

Example: If you worked 40 hours at $15/hr in 2024 and now earn $16.50/hr, that’s an extra $60 per week — or over $3,000 more annually before taxes.

The Living Wage Gap

While higher state wages help, many experts argue they still fall short of a living wage — the amount needed for basic expenses. According to MIT’s Living Wage Calculator, the numbers are eye-opening:

- Single adult in California: needs ~$23/hr to meet expenses.

- Single parent with one child in Texas: needs ~$26/hr.

- Two working adults with two kids in Florida: each needs ~$20/hr.

That’s why advocates push not just for legal minimums, but for “living wage” standards that reflect real costs.

Step-by-Step Guide: Getting Ready for USA Minimum Wage Increase

Step 1: Identify your jurisdiction.

Check your state and city’s laws.

Step 2: Learn the effective date.

Most states update January 1, but others (like D.C. or Florida) change mid-year.

Step 3: Update your systems.

Sync payroll, time tracking, and job postings to reflect new rates.

Step 4: Reassess total compensation.

Include tips, bonuses, and benefits — not just hourly pay.

Step 5: Stay informed.

Subscribe to your state’s labor department newsletter or bookmark their updates page.

Looking Ahead: The Future of U.S. Wages

There’s growing political and social momentum for a federal increase. The proposed Raise the Wage Act of 2025 would gradually boost the federal minimum to $17/hour by 2030, then tie it to median wage growth thereafter.

If passed, it could benefit over 22 million workers nationwide and lift roughly 12 million out of poverty, according to the Economic Policy Institute.

Until then, expect state and city governments to keep leading the charge.

New Florida Minimum Wage for 2025: Check Your Pay Against All 50 States

US Visa Waiver Program October 2025: Updated List of Eligible Countries and Key Changes

Social Security Boost: How a Simple Strategy Can Increase Your Monthly Payments by $100s