The Social Security COLA announcement for 2026 has been postponed due to the ongoing U.S. government shutdown. The Bureau of Labor Statistics (BLS) delayed the release of September inflation data, forcing the Social Security Administration (SSA) to push back its annual cost-of-living adjustment announcement. Although benefit payments remain on schedule, the delay adds uncertainty for more than 71 million Americans who rely on Social Security as a core part of their income.

Table of Contents

Social Security 2026 COLA Update

| Key Fact | Detail/Statistic |

|---|---|

| Original CPI release date | October 15, 2025 |

| New CPI release date | October 24, 2025 |

| Expected COLA increase for 2026 | 2.7% to 2.8% |

| Affected population | 71 million Social Security beneficiaries |

| Benefit payment interruption | None expected |

| Official Website | SSA |

The Social Security COLA announcement will arrive later than usual, but the benefits themselves remain secure. Once the CPI data is published on October 24, the SSA is expected to finalize and release the 2026 adjustment swiftly. For millions of Americans, this adjustment remains a crucial buffer against the rising cost of living.

Shutdown Forces Delay in Key Inflation Data

The delay stems from the partial government shutdown, which has furloughed thousands of federal workers, including many at the BLS. The agency announced it would postpone the release of September’s Consumer Price Index (CPI) data—an essential input in determining the annual cost-of-living adjustment for Social Security.

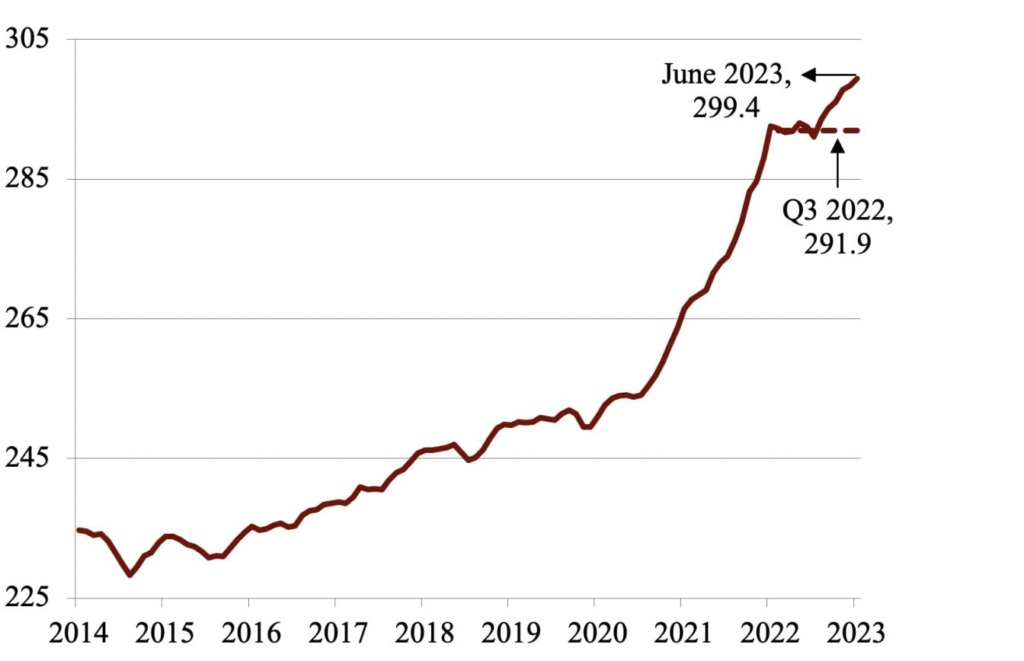

The CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) for July, August, and September forms the foundation of the annual COLA calculation. Without September’s data, the SSA cannot finalize or announce the increase.

“The shutdown has temporarily disrupted the release schedule for several key economic indicators,” said Julie Su, Acting U.S. Secretary of Labor. “We are working to minimize delays.”

How the Social Security COLA Is Calculated

The Social Security COLA is meant to ensure benefits keep pace with inflation. It is calculated using the average CPI-W from the third quarter of each year compared to the previous year. If prices increase, the COLA reflects that growth. If they stay flat or fall, benefits do not decrease, but the COLA may be zero.

This year, the BLS was scheduled to release the final CPI data on October 15. Due to the shutdown, the release has been postponed to October 24, compressing the timeline for SSA to process and communicate the new rate.

“Even with this delay, the COLA increase will still be applied to benefits starting in January 2026,” an SSA spokesperson said.

Historical Impact of Shutdowns on Social Security Operations

This is not the first time a government shutdown has disrupted federal economic reporting.

- During the 1995–96 shutdown, many data releases were delayed, though Social Security benefits continued uninterrupted.

- In 2013, a 16-day shutdown postponed key BLS and Census Bureau publications.

- In 2018–19, the longest shutdown in U.S. history delayed several economic indicators, creating uncertainty in financial markets.

However, benefit payments have never been missed because they are funded through mandatory spending, not annual appropriations.

“Past shutdowns give us a roadmap,” said Jason Fichtner, former SSA Chief Economist. “The infrastructure is built to keep payments flowing, even if administrative functions slow down.”

No Impact on Benefit Payments — But Administrative Delays Expected

Social Security checks will continue to be sent on time, even as some agency services are reduced. Critical functions such as claims processing, appeals, and card issuance may face temporary backlogs.

“Checks will go out on time, as they always have,” said Kathleen Romig, Director of Social Security and Disability Policy at the CBPP. “The real issue is the timing of the announcement, not the payments.”

Online services through My Social Security will remain available, but staffing to address inquiries may be limited.

What Beneficiaries Can Expect

Economists forecast a 2.7% to 2.8% COLA increase for 2026, in line with moderating inflation trends. This would result in an estimated $50 to $60 increase per month for the average retiree.

For millions of older Americans, this adjustment plays a critical role in covering everyday expenses.

“My grocery and medical bills have gone up steadily,” said Margaret Hill, a 74-year-old retiree from Ohio. “Even a small COLA increase makes a difference.”

Broader Economic Implications of a Delayed CPI Release

The postponed CPI data release has implications beyond Social Security. Financial markets, the Federal Reserve, and private sector analysts depend on inflation data to make critical decisions.

“When economic data gets delayed, uncertainty increases,” said Wendy Edelberg, Senior Fellow at the Brookings Institution. “This impacts everything from bond markets to household budgeting.”

Delayed data can compress the Fed’s timeline for evaluating inflation trends and interest rate policy. It can also influence federal budget negotiations, as cost-of-living increases affect outlays for Social Security and other indexed programs.

Political Context: Budget Gridlock and Its Consequences

The current shutdown stems from deadlocked negotiations in Congress over federal spending levels. Disagreements over discretionary spending, border security, and deficit reduction have prevented the passage of a continuing resolution.

While Social Security is shielded from direct funding cuts, administrative functions rely on discretionary budgets. Prolonged shutdowns can strain these capacities.

“A swift resolution would minimize disruptions for millions of Americans,” said Senator Patty Murray, Chair of the Senate Appropriations Committee.

International Perspective: How Other Countries Handle COLA Adjustments

While the United States ties Social Security COLA to CPI-W, other countries use different mechanisms:

- Canada indexes Old Age Security payments to CPI but allows adjustments to continue automatically without government intervention.

- Germany bases pension adjustments on wage growth rather than inflation.

- The U.K. uses the “triple lock” system, guaranteeing the highest of inflation, wage growth, or 2.5%.

This international comparison highlights that the U.S. system’s reliance on federal data releases makes it vulnerable to shutdown-related delays.

Contingency Planning and Automation

The SSA maintains contingency plans to manage payment operations during funding lapses. Automated systems ensure benefit delivery even when staffing is limited. Treasury’s reserve funds further support uninterrupted disbursement.

If the shutdown persists beyond late October, other SSA communications—such as official COLA notice letters—may face minor delays, but the COLA will still take effect on January 1, 2026.

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

FAQ

Q: Will my Social Security payment be affected by the shutdown?

No. Payments are considered mandatory spending and continue as scheduled.

Q: Why does the COLA depend on CPI data?

CPI-W reflects inflation experienced by wage earners, serving as the benchmark for benefit adjustments.

Q: How much will the COLA increase be for 2026?

Economists expect between 2.7% and 2.8%, translating to about $50–$60 more per month for the average retiree.

Q: What if the shutdown lasts into November?

Payments will continue. The announcement may face further administrative delays, but the COLA will still be applied.