US $4983 Direct Deposit: If you’ve been scrolling through Facebook, TikTok, or YouTube lately, you’ve probably seen posts shouting about a “$4,983 direct deposit for everyone in October 2025!” Sounds amazing, right? A surprise check from the government just before the holidays? Well, before you start planning that vacation or upgrading your iPhone, let’s take a step back. There’s a lot of half-truths and clickbait floating around, and this particular claim has Americans scratching their heads. So, let’s dig into what’s really going on — what the $4,983 payment actually is, who might qualify, and what you can realistically expect this October.

US $4983 Direct Deposit

There’s no universal $4,983 check coming in October 2025. That number represents the maximum Social Security benefit available only to those who earned high incomes for decades and waited until age 70 to retire. Most Americans will see around $1,900 a month — and maybe a little more thanks to COLA increases. So next time you see a viral video claiming “everyone’s getting $4,983,” remember: it’s not a scam if you know the facts.

| Detail | Information |

|---|---|

| Payment Amount | Up to $4,983 (Not universal; only applies to high-earning Social Security retirees) |

| Eligibility | Retirees who delayed claiming benefits until age 70 and had maximum taxable income for 35+ years |

| Payment Month | October 2025 |

| Payment Dates | Oct 3, 8, 15, and 22 (based on your birth date) |

| Average Benefit (2025 est.) | Around $1,915/month (SSA projection) |

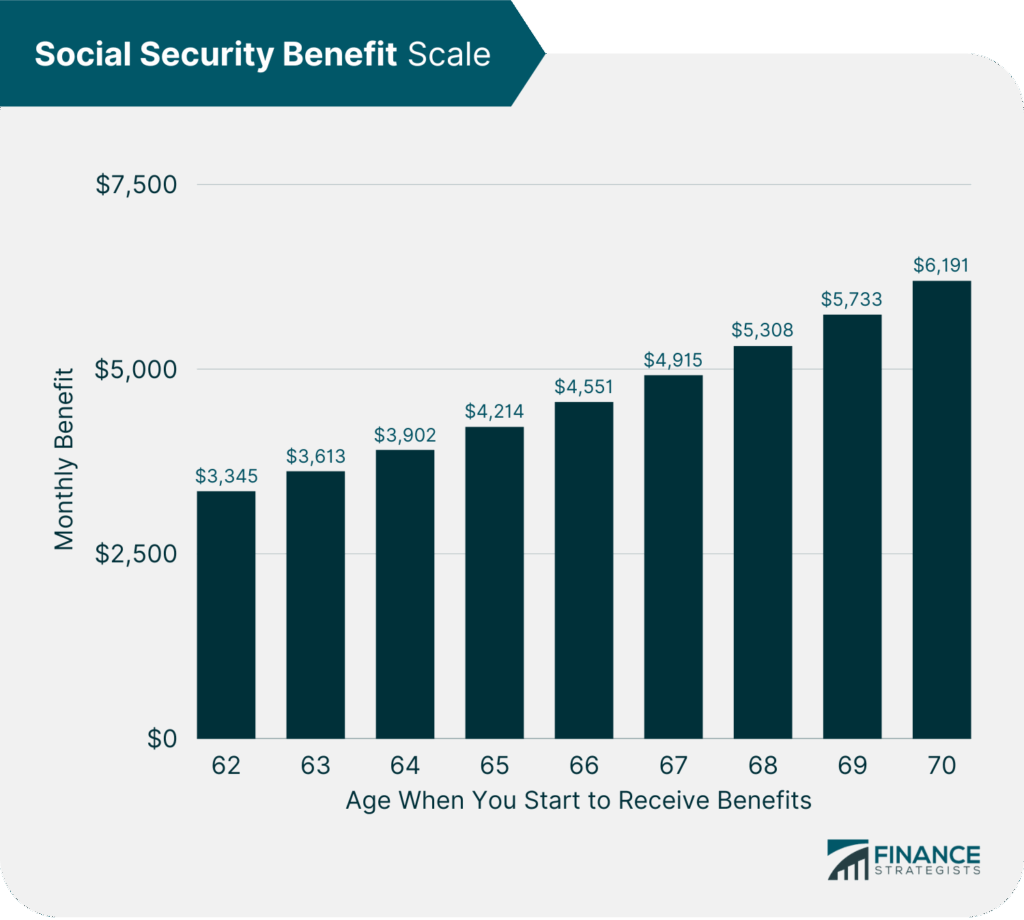

| Maximum Benefit (2025) | $4,983/month (for top earners retiring at 70) |

| Program Type | Regular Social Security benefit, not a “stimulus” |

| Official Source | Social Security Administration (SSA.gov) |

| Related Programs | SSI, SSDI, and Railroad Retirement benefits |

| Category | Federal Benefits / Retirement / Financial News |

Where the US $4983 Direct Deposit Claim Really Came From?

Let’s be clear: the $4,983 number isn’t a new “bonus” or “stimulus.”

That figure represents the maximum monthly Social Security benefit projected by the Social Security Administration (SSA) for 2025.

Essentially, $4,983 is what the highest-earning Americans — those who worked 35+ years at or near the Social Security wage cap — could receive monthly if they wait until age 70 to retire.

According to the SSA’s official 2025 COLA forecast, the Social Security taxable maximum (the most income subject to Social Security tax) will increase from $168,600 in 2024 to around $174,900 in 2025. That’s part of what bumps the top benefit amount to nearly $5,000 a month.

So, if you’ve seen a TikTok saying “everyone will get $4,983,” that’s simply false. This isn’t a new federal program or universal payout.

October 2025 Social Security Payment Schedule

Social Security doesn’t drop everyone’s payments on the same day. Instead, the payment dates depend on your birthday and the type of benefit you receive.

Here’s the breakdown straight from SSA.gov:

- Birthdays 1–10: Payment on Wednesday, October 8, 2025

- Birthdays 11–20: Payment on Wednesday, October 15, 2025

- Birthdays 21–31: Payment on Wednesday, October 22, 2025

- Those receiving benefits before May 1997: Payment on Friday, October 3, 2025

For Supplemental Security Income (SSI) recipients:

- Regular October SSI will be paid on Wednesday, October 1, 2025

- The November SSI check will arrive early — on Thursday, October 30, 2025 (since November 1 falls on a Saturday).

Who Qualifies for the US $4983 Direct Deposit?

Here’s the truth — only a small fraction of retirees qualify for the maximum benefit.

To get that magic $4,983, you must meet all three conditions below:

1. Work for at Least 35 Years

Social Security calculates your benefit based on your highest 35 years of earnings. Fewer years mean smaller checks.

2. Earn the Maximum Taxable Amount

You must have earned the maximum taxable income (around $160K–$170K annually) for most of your career. That’s usually CEOs, doctors, or engineers with long careers.

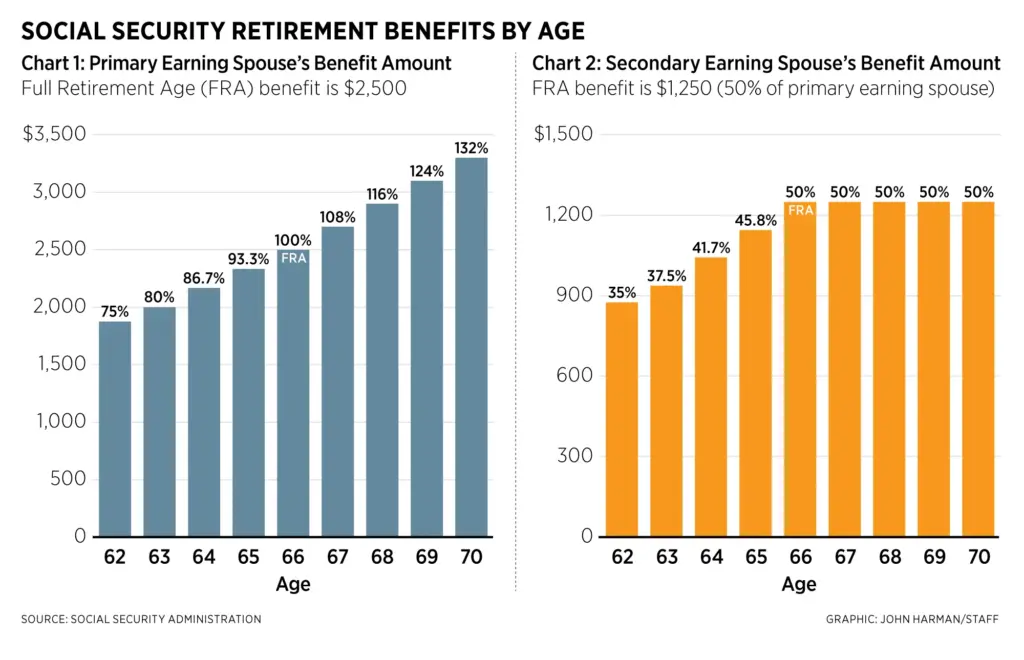

3. Delay Retirement Until Age 70

If you wait until 70 to claim benefits, you earn delayed retirement credits — roughly 8% more per year after your full retirement age (usually 66–67).

Bottom line:

If you retired early or had lower-income years, your benefit won’t come close to $4,983 — but that’s okay! Even the average payment helps millions of Americans stay financially secure.

What the Average American Will Actually Get

According to SSA data, the average monthly Social Security benefit in 2025 will be about $1,915 for individuals and $3,230 for married couples.

The 2025 Cost-of-Living Adjustment (COLA) is projected to be around 3.0%, slightly higher than the 2024 increase (3.2%). That boost will help offset rising costs for groceries, healthcare, and gas.

For context:

- 2024 average benefit: $1,909

- 2025 projected: $1,915

- Annual difference: about $72 more per year

Practical Tips: How to Maximize Your Social Security Benefits

Whether you’re years away from retirement or already collecting, you can still make smart moves. Here are some pro tips:

1. Work as Long as You Can

Each additional year you work (especially a high-earning year) replaces a lower-earning year in your 35-year calculation.

2. Delay Claiming if Possible

Every year you delay after your full retirement age earns you an extra 8% up until 70. That’s like getting a guaranteed raise.

3. Coordinate with Your Spouse

Married? Learn about spousal and survivor benefits — they can help your family maximize income even if one partner earns more.

4. Use the MySSA Portal

Sign up at SSA.gov/myaccount to track your earnings, estimate benefits, and fix any reporting errors.

5. Plan for Taxes

Remember — Social Security benefits may be taxable depending on your income.

Beware of Scams and Fake “Stimulus” Promises

Whenever there’s buzz about government payments, scammers follow.

Here’s how to stay safe:

- The SSA and IRS will never text, call, or email you asking for your banking info.

- Always double-check claims at SSA.gov/news or IRS.gov/newsroom.

- Report scam attempts to the Office of the Inspector General (OIG).

If you get an email claiming you’ll receive a “$4,983 bonus check,” delete it — it’s likely a phishing scam.

$725 Monthly Stimulus Benefits Coming in October 2025: Check FESP Payment Eligibility & Payment Date

$1,390 Stimulus Payment For these People in October 2025 – Check Eligibility & Payment Date

SSI and SSDI Payments in October 2025: Check Official Payment Schedule and Eligibility Criteria!

The Bigger Picture: Why This Matters

The $4,983 story might be exaggerated online, but it sparks an important conversation: retirement readiness.

Millions of Americans rely on Social Security as their main income — but with inflation, longer lifespans, and uncertain markets, that’s not enough.

By understanding how benefits work — and what’s realistic — you can plan smarter. Whether you’re 30 or 60, every year of earnings, saving, and planning counts.

“Social Security was never meant to be your only income in retirement,” says Andrew Biggs, a former SSA official. “It’s a foundation — your job is to build the rest.”