U.S. Minimum Wage Increase: The U.S. minimum wage increase of 2025 is one of the most significant changes in labor policy in over a decade. Starting November 1, 2025, the federal minimum wage will rise to $12.50 per hour, up from the stagnant $7.25 rate that has held steady since 2009. For millions of workers and employers, this adjustment signals a major shift in earnings, living standards, and business operations. This comprehensive guide unpacks the details, offering clear explanations, historical context, practical advice, and insights into what you can expect at the state and local levels.

Table of Contents

U.S. Minimum Wage Increase

The 2025 U.S. minimum wage increase is a landmark event, finally lifting the federal wage floor after years of stagnation. With minimum wages rising to $12.50 and many states exceeding $17 and $18, millions of workers benefit from fairer pay and improved livelihoods. Employers face new challenges in budgeting and compliance, but overall, this change promises stronger economic fairness and growth. Staying educated and proactive will help workers and businesses thrive in the evolving wage landscape.

| Feature | Details |

|---|---|

| Federal Minimum Wage (2025) | $12.50 per hour, effective November 1, 2025 |

| Highest Local Minimum Wage | Burien, WA – $21.16 per hour for large employers |

| California Minimum Wage | $18.00 per hour |

| New York Minimum Wage | Approx. $17.00 per hour |

| Number of Workers Affected | 22 million (approx. 15% of workforce) |

| Additional Wages Provided | Estimated $70 billion annually |

| Average Increase Per Worker | About $3,200 per year |

| Number of Jurisdictions Raising Wages | 23 states and 65 local jurisdictions by end of 2025 |

| Official Resource | U.S. Dept. of Labor Minimum Wage |

Understanding the 2025 U.S. Minimum Wage Increase

The federal minimum wage’s bump to $12.50 is the biggest since it was last raised over 16 years ago. Although many states and cities have already exceeded the federal rate with their own laws, this increase sets a new nationwide baseline.

- The increase provides significant relief to the lowest-paid workers, helping them manage rising living expenses and inflation.

- Several states—like California, Washington, and New York—have minimum wages between $17 and $18.50 an hour, illustrating regional economic diversity.

- The wage hike is part of a larger legislative push, such as the Raise the Wage Act of 2025, aiming ultimately for a federal floor of $17 by 2030.

This means workers earning minimum wage will see a meaningful boost in their paychecks, potentially lifting millions out of poverty.

The History and Context Behind the Increase

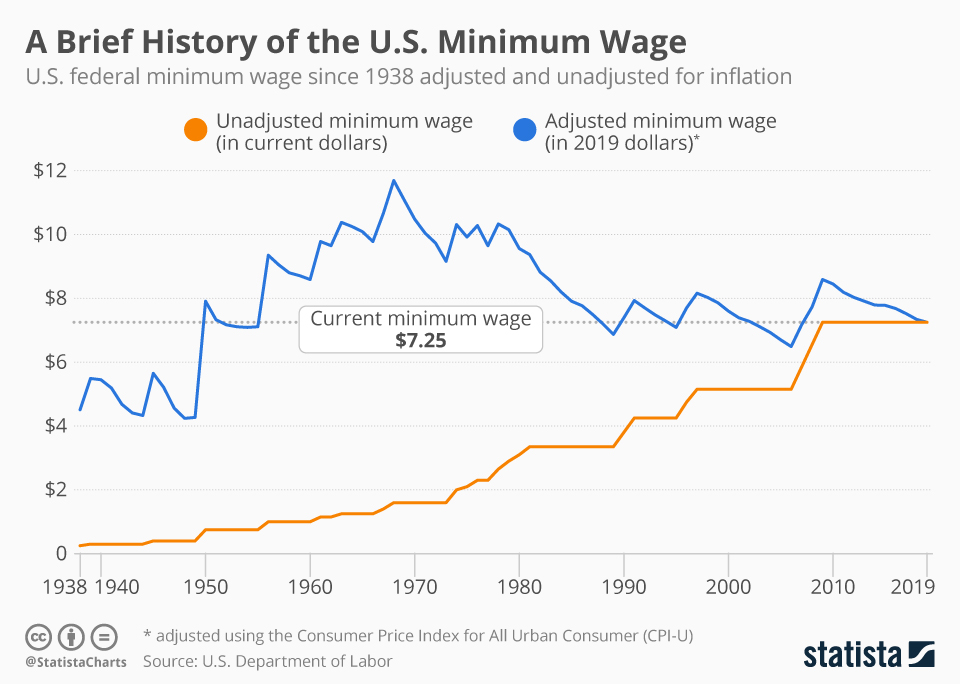

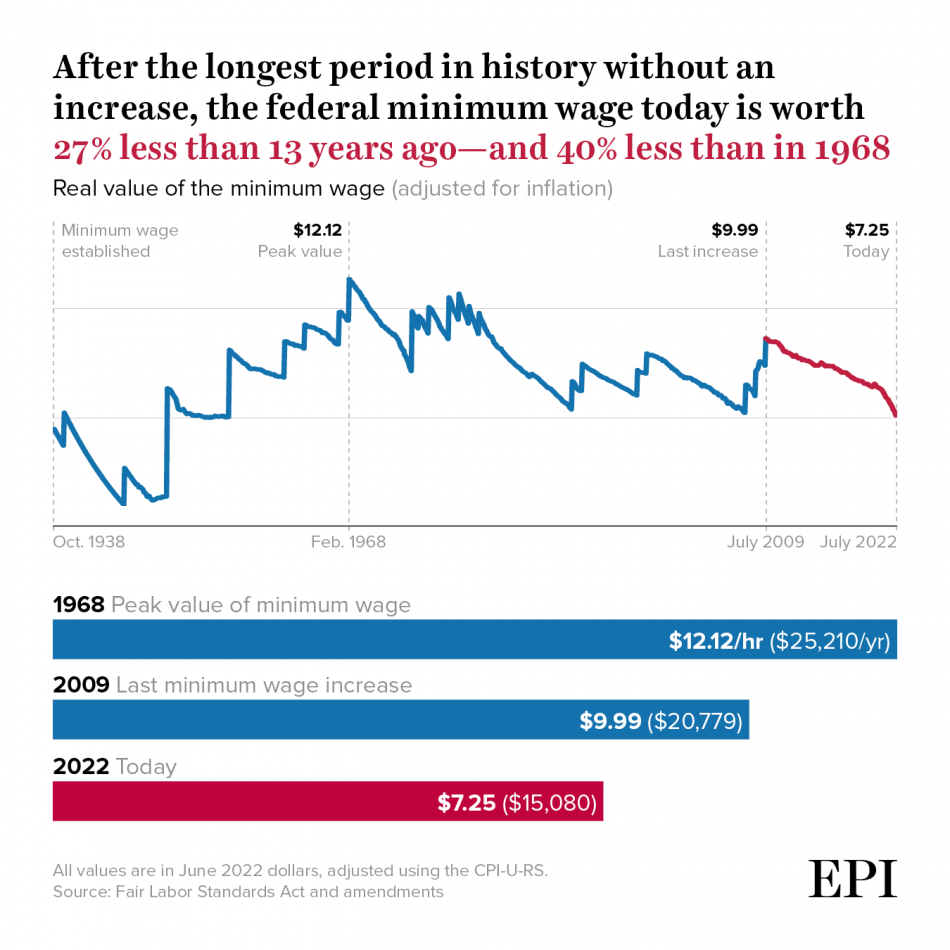

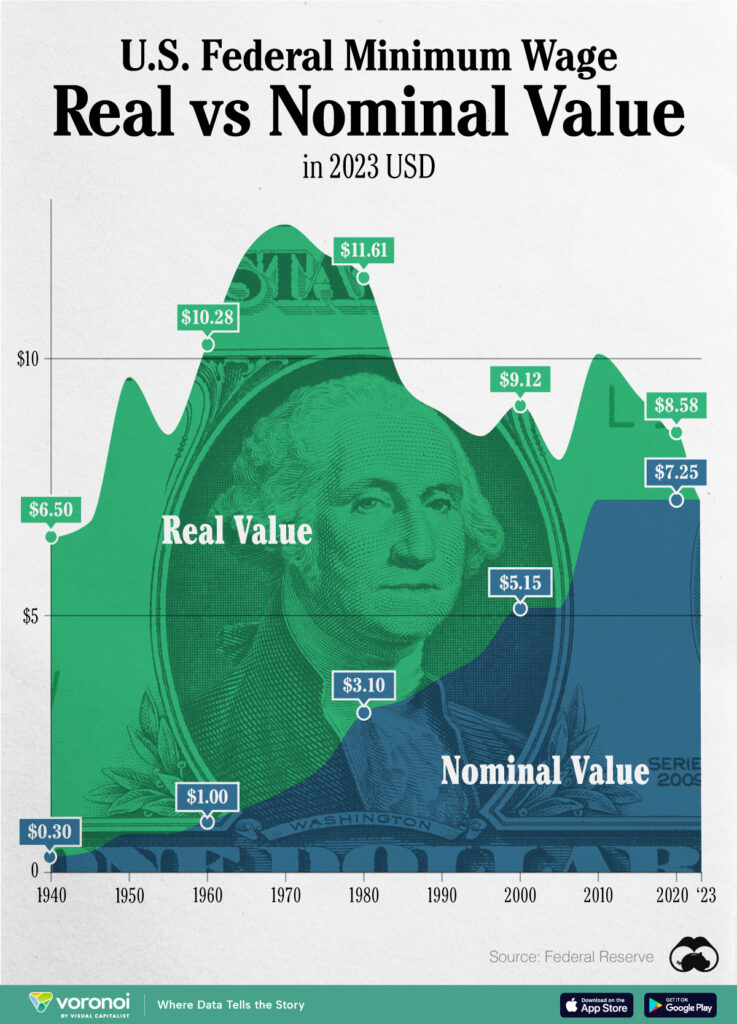

Minimum wage laws in the U.S. trace back to the 1938 Fair Labor Standards Act, which started the wage floor at $0.25 per hour. Over time, federal rates rose to keep pace with economic changes, but the last federal increase was in 2009, holding at $7.25. This frozen wage lost purchasing power as inflation and costs of living increased dramatically.

The growing disconnect led states and cities to enact their own minimum wage laws, many targeting $15 or more per hour well before recent federal action. The 2025 hike is a critical federal step acknowledging the realities faced by millions:

- Inflation-adjusted declines: Experts note that the real value of minimum wage declined by over 20% from 2009–2025.

- Legislative efforts: The Raise the Wage Act introduced in April 2025 aims for incremental boosts beyond 2025, working toward $17 per hour by 2030.

- Equity focus: This wage increase also attempts to narrow racial and gender pay disparities prominent among low-wage workers.

Minimum Wage Variations Across States in 2025

Each state, city, and county governs its minimum wage—meaning you won’t find one single rate that applies nationwide. Some highlights:

- Burien, Washington: Highest local minimum wage at $21.16 for large employers.

- California: Statewide rate at $18.00, with higher wages in cities like San Francisco.

- New York: Around $17.00 per hour across NYC and surrounding counties.

- Florida: Gradual scheduled increases bring it to $14.00 by late 2025.

- Texas: Follows federal baseline of $12.50, but some cities may mandate higher local rates.

- District of Columbia: District-wide minimum wage rising to $18.00 effective mid-2025.

States without their own effective minimum wages, like Alabama and Louisiana, fall back on the federal level.

Impact of U.S. Minimum Wage Increase on Workers and Their Families

Raising the minimum wage brings tangible benefits for workers struggling to make ends meet:

- Increased earnings: Full-time workers see several hundred dollars more monthly.

- Reduced poverty and hardship: More income enables better access to housing, food security, and healthcare.

- Economic empowerment: Higher wages lead to increased worker satisfaction and reduced turnover.

- Broader labor force participation: Competitive wages attract more people into the workforce.

Additionally, the wage increase narrows income inequality gaps and supports historically marginalized communities disproportionately represented in minimum wage jobs.

What Employers Must Know and Do?

For businesses, especially small to medium-sized enterprises, this represents a shift requiring action:

- Payroll system upgrades: Ensure compliance for new minimum wage rates starting November 1.

- Financial adjustments: Plan for higher labor costs that may range from 15% to 50% increases for hourly employees previously paid the old federal minimum.

- Pricing considerations: Some businesses may pass increased costs to consumers where feasible.

- Legal compliance: Stay current with complex local, state, and federal wage laws to avoid fines.

- Workforce benefits: Higher wages can translate to improved morale, reduced absenteeism, and retention.

Health care employers, restaurants, retail, hospitality, and service industries often feel the impact most strongly.

Practical Steps to Adapt to the 2025 U.S. Minimum Wage Increase

For Employees:

- Find your new wage: Check if local or state minimum wage laws apply higher rates.

- Calculate your earnings: Multiply new hourly rates by your weekly hours to estimate income increase.

- Adjust budgets: Plan for new household finances, accounting for both increased income and cost of living.

- Explore benefits: See if wage hikes qualify you for additional programs or assistances.

For Employers:

- Assess payroll impacts: Update payroll systems and contracts.

- Staff communication: Clearly explain wage changes to employees.

- Revisit budgeting: Account for wage cost changes and possible operational efficiency improvements.

- Stay updated: Monitor changes beyond 2025 as minimum wages often are indexed to inflation or posted for further steps.

Broader Economic and Social Implications

Higher minimum wages contribute to healthier economies:

- Consumer spending boost: More disposable income fosters stronger local business sales.

- Lower poverty rates: Studies link minimum wage hikes to poverty reduction, especially in single-parent households.

- Workforce stability: Competitive wages help businesses maintain skilled employees.

- Inflation dialogue: While wage boosts may induce some inflation, economists emphasize the necessity of balancing living standards with price stability.

USA Minimum Wage Increase Expected In November 2025 – Check New Hourly Wage Rate, Eligibility

USA Minimum Wage Increase 2025 – New Hourly Pay Rates Just Announced!

New Florida Minimum Wage for 2025: Check Your Pay Against All 50 States