The Trump administration has introduced a bold new initiative aimed at providing every child born in the United States between 2025 and 2028 with an initial $1,000 deposit into a special savings account. This proposal, known as the Trump Accounts, is designed to help families build financial security for their children from birth, with the potential for the initial deposit to grow significantly—up to $93,000—by the time the child reaches adulthood. The initiative is part of broader efforts to address economic disparities, promote financial literacy, and increase savings among American families.

Table of Contents

$1000 Baby Stimulus

| Key Fact | Detail/Statistic | Source |

|---|---|---|

| Initial Deposit per Child | $1,000 upon birth | Brookings Institution |

| Potential Growth by Age 67 | Up to $93,000 with compound interest (7% annual return) | Economic Times |

| Contribution Limits | $5,000 annual, with $3,000 tax-deductible | Brookings Institution |

| Eligibility Window | Children born between January 1, 2025, and December 31, 2028 | Economic Times |

The Trump Accounts initiative represents a promising step toward fostering long-term financial security for American children. By providing an initial deposit of $1,000 and allowing for ongoing contributions, the program could help families build a significant financial foundation for their children’s futures. However, its success will depend on participation rates and its ability to address concerns about wealth inequality and access.

As the program moves forward, policymakers will need to closely monitor its impact and consider potential adjustments to ensure it benefits all families, regardless of income.

What Are “Trump Accounts”?

The Trump Accounts initiative is a proposal aimed at providing long-term financial support to American children. Each eligible child will receive a one-time deposit of $1,000 into an investment account upon birth, with the potential to grow substantially through compounded interest over time. The government will invest the funds in IRS-approved, moderately risky portfolios, allowing for tax-free growth.

Parents and guardians are also encouraged to contribute to these accounts, with an annual contribution limit of $5,000. Of this amount, $3,000 will be tax-deductible, giving families a further incentive to save. Employers can contribute up to $2,500 annually without affecting the employee’s taxable income.

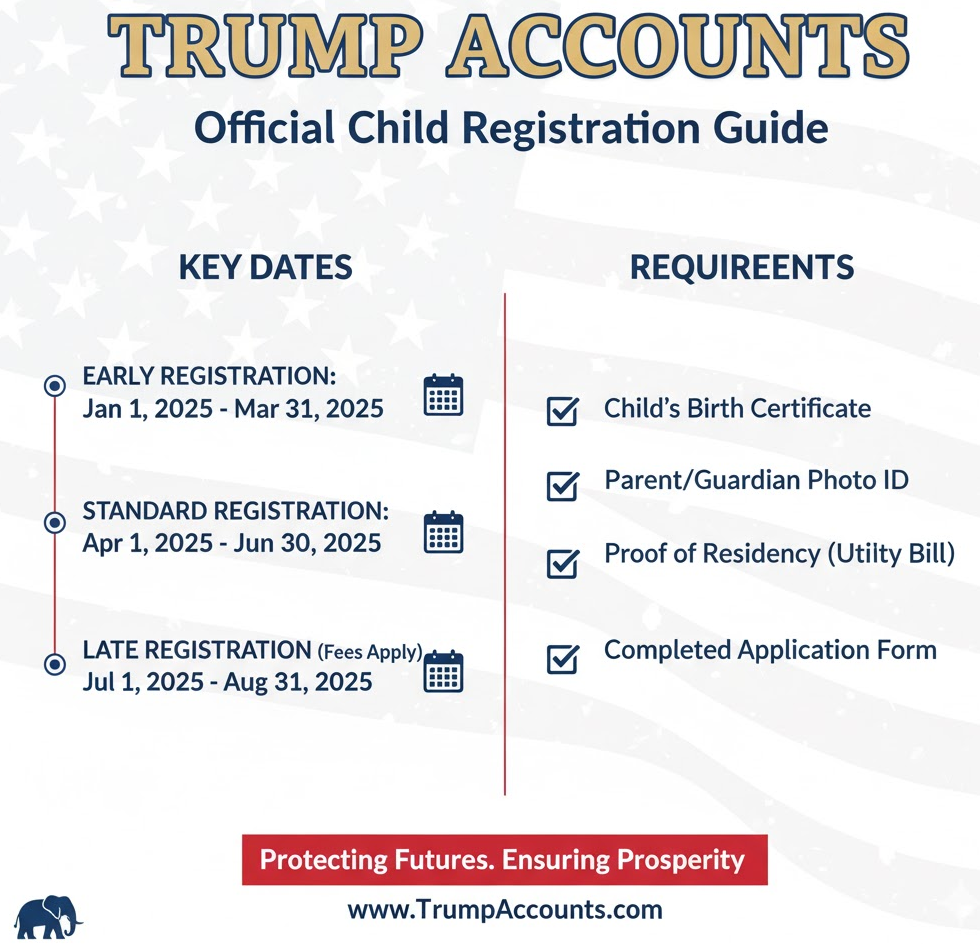

The initiative targets children born between January 1, 2025, and December 31, 2028, and requires registration with the Social Security Administration within 60 days of the child’s birth. The account can be used for qualifying expenses such as education, purchasing a home, or saving for retirement.

How Could the $1000 Grow to $93,000?

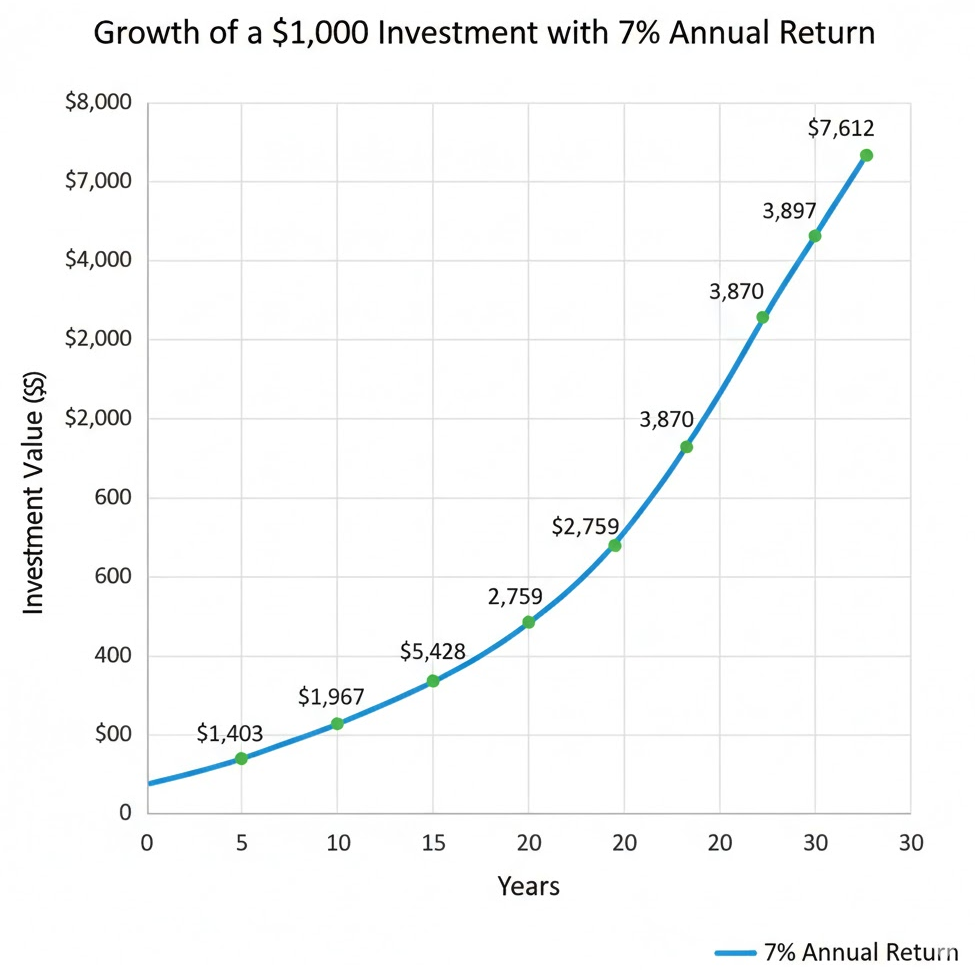

The key selling point of the Trump Accounts is the potential for the initial $1,000 deposit to grow into a significant amount by the time the child turns 67. This growth is primarily driven by compound interest—the process by which investment gains accumulate over time, earning interest on both the principal amount and the accumulated interest.

Assuming an average annual return of 7%, a $1,000 initial deposit could grow to approximately $93,000 by the time the child reaches adulthood. This estimate assumes the funds are left untouched and invested in moderate-risk index portfolios. While the return rate is based on historical stock market performance, individual returns may vary depending on the specific investments chosen and the market conditions at the time.

Additionally, parents or guardians can contribute up to $5,000 annually, with $3,000 being tax-deductible, which could significantly increase the total savings over time. With regular contributions, the potential final amount could easily surpass $93,000, offering a robust financial cushion for children as they enter adulthood.

Financial Mechanisms and Investment Strategies

The Trump Accounts are structured to encourage long-term financial planning and to provide children with a solid foundation for future financial needs. While the government’s $1,000 deposit serves as a starting point, the real power of the program lies in the ability of the investments to grow over time. The funds will be invested in a range of IRS-approved financial instruments, likely focused on diversified index funds with moderate risk.

These index funds typically track the performance of broader market indices, such as the S&P 500, offering relatively stable growth over time. The program’s design reflects an understanding of compound interest and how it can transform small investments into large sums. However, it is important to note that market conditions can impact the growth of the account. During economic downturns, returns may be lower than expected.

A Historical Look at Similar Programs

The Trump Accounts initiative shares similarities with programs that have been tested in other countries, particularly those that aim to reduce wealth inequality and encourage savings among younger populations. One such program is the baby bond concept, which has been discussed in the United Kingdom and the U.S. over the years.

The United Kingdom introduced the Child Trust Fund in 2005, offering an initial deposit to all children born between 2002 and 2011. The government contributed £250 at birth and an additional £250 when the child turned 7. While the program was praised for encouraging saving, it was criticized for being too limited in scope and for not providing enough financial education.

In the U.S., similar initiatives have been proposed over the years but have yet to be fully realized. The concept of providing a financial start to all children, particularly those from low-income families, has been championed by various policymakers as a way to bridge the wealth gap and ensure equal opportunities for future generations.

Expert Opinions on Trump Accounts

The proposal has sparked debate among economists and financial experts. Dr. Anya Sharma, a senior fellow at the Brookings Institution, highlighted the potential long-term benefits of the initiative. “If implemented correctly, Trump Accounts could serve as a powerful tool for increasing financial literacy and helping future generations secure financial independence,” she said. “However, the program’s success will largely depend on how accessible it is to lower-income families who might struggle to contribute beyond the initial deposit.”

On the other hand, Dr. Paul Johnson, an economist at the American Economic Association, raised concerns about the program’s fairness. “While this is a positive step toward encouraging saving, wealthier families are more likely to be able to make regular contributions, which could further entrench inequality. Without accompanying policies that address wealth distribution, this program may not be as effective as intended.”

Impact on Different Demographics

The Trump Accounts program could have varying effects depending on a family’s income level. Families with higher incomes are more likely to take full advantage of the program’s tax-deductible contribution option, potentially growing the account far beyond the initial $1,000 deposit. For middle- and lower-income families, however, the ability to make regular contributions may be limited, reducing the overall impact of the program.

That said, the program could still offer significant benefits to all families by encouraging a culture of saving and providing children with a financial head start. For lower-income families, the initial $1,000 deposit alone could make a meaningful difference, especially when used for long-term goals like education or homeownership.

Long-Term Economic Impacts

The long-term economic impact of the Trump Accounts initiative remains to be seen, but early projections suggest that it could have a significant positive effect on the economy. If widely adopted, the program could encourage higher rates of saving among young people, leading to greater financial security in retirement and reduced dependence on social welfare programs.

Moreover, the initiative could also have broader economic benefits by fostering financial literacy from an early age, which could lead to more informed spending and investment decisions as children grow into adults.

However, critics argue that the program may not be enough to address the root causes of wealth inequality, which are often linked to factors such as income, education, and access to resources. Without comprehensive reforms in these areas, the program may only offer a partial solution.

$2000 IRS Direct Deposit This October? Here’s What You Need to Know About Potential Stimulus Checks

$1800 Automatic Stimulus Payment in October 2025: SSI, SSDI & VA Benefit Eligibility, Pay Date

$1600 Stimulus Checks October 2025 Date: Will You get this? Check Eligibility & Payment Date

FAQ

1. How does the Trump Accounts program work?

The Trump Accounts program provides every eligible child born between 2025 and 2028 with a $1,000 deposit into a special savings account. Parents and guardians can also contribute up to $5,000 annually, with $3,000 being tax-deductible.

2. What are the eligibility requirements for the program?

Children must be born between January 1, 2025, and December 31, 2028, and must have a valid Social Security number. Parents or guardians must register the child with the Social Security Administration and confirm participation within 60 days.

3. How much can the $1,000 grow over time?

Assuming an average annual return of 7%, the initial $1,000 deposit could grow to about $93,000 by the time the child reaches 67 years old. Regular contributions could increase this amount even further.

4. Can I withdraw the money early?

The funds in the Trump Accounts are designed for long-term use, but withdrawals are allowed without penalty for specific purposes, such as education, purchasing a home, or saving for retirement.