SSS Sends Out ₱11,000 to Seniors: If you’ve been scrolling through Facebook or TikTok and stumbled across posts claiming that “SSS sends ₱11,000 to seniors in 2025”, you might be wondering if you just hit the jackpot. Let’s slow down a bit — because while there is good news coming, the truth is a little more nuanced than the viral headlines suggest. In this in-depth guide, we’ll unpack the facts behind the ₱11,000 rumor, explain what’s actually happening with the Social Security System (SSS) pension reform in 2025, break down how much seniors will really receive, and provide practical, professional advice on what to do next.

Table of Contents

SSS Sends Out ₱11,000 to Seniors

The rumor that SSS will send ₱11,000 to seniors in 2025 sounds exciting, but the truth is more measured — and more meaningful. The Pension Reform Program launching in September 2025 guarantees a sustainable 10% annual increase for retirement and disability pensions, and 5% for survivor pensions, over three years. That’s not a flashy lump sum — it’s a structured promise of dignity, stability, and long-term care for Filipino retirees. For millions of seniors, that’s real progress.

| Topic | What It Means | Figures / Notes |

|---|---|---|

| Reform Start | Launch of Pension Reform Program | September 2025 |

| Increase Schedule | Annual adjustments | 2025–2027 |

| Rate of Increase | 10% for retirement/disability, 5% for survivors | Applies each September |

| Total Beneficiaries | Estimated 3.8 million Filipino pensioners | Based on DOF estimates |

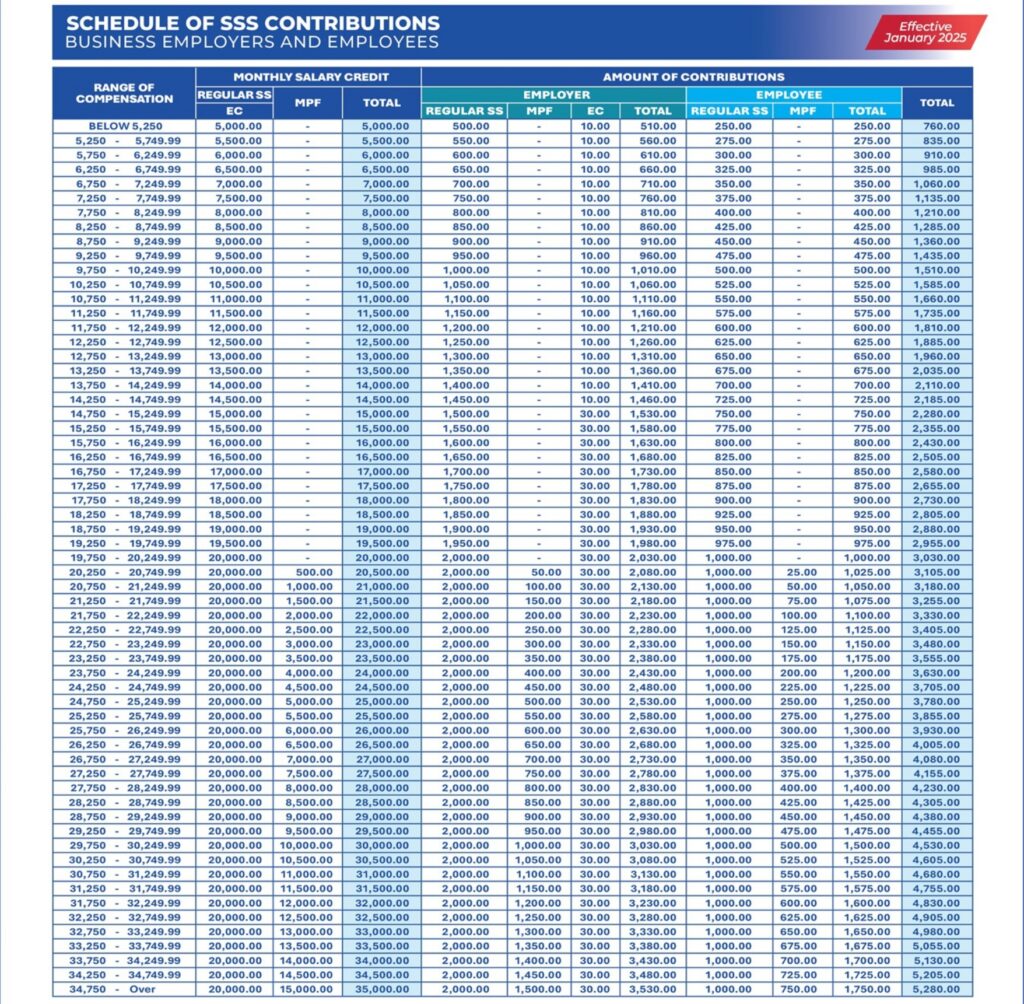

| Contribution Changes | None during 2025–2027 | Workers not affected |

| Official Verification | SSS News & Updates page | sss.gov.ph/news-and-updates |

The Truth: What’s Really Happening in 2025

Here’s the deal — the Philippine Social Security System (SSS) isn’t giving out a one-time ₱11,000 payment to seniors. What’s coming instead is a structured, multi-year pension increase program that starts in September 2025 and rolls out over three years.

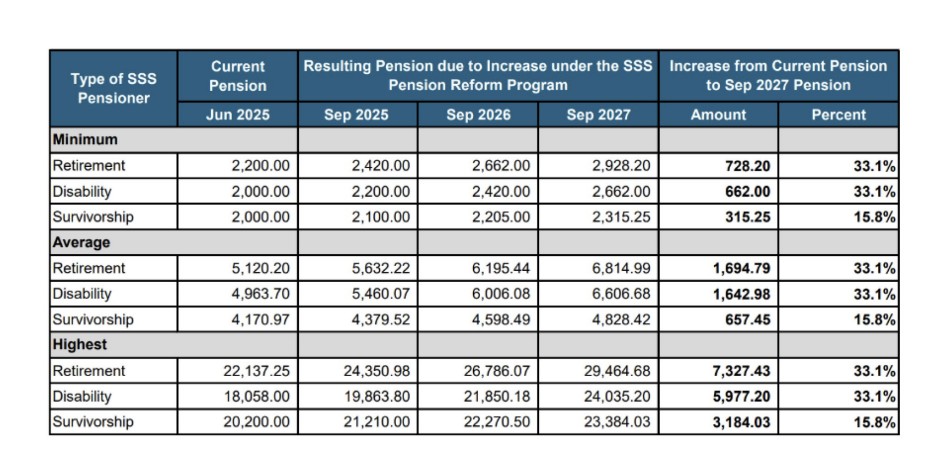

According to the SSS and the Department of Finance (DOF), this Pension Reform Program gives:

- A 10% increase per year for all retirement and disability pensions

- A 5% increase per year for survivor (death) pensions

This policy will run from 2025 to 2027 and aims to help retirees cope with inflation without adding new contribution burdens for current workers.

So, no — seniors won’t receive ₱11,000 all at once. But yes — their pensions are about to grow steadily over time.

Why SSS Sends Out ₱11,000 to Seniors Matters?

To understand why the government is taking this step, let’s look at the bigger picture. Inflation in the Philippines averaged around 3.8% in 2024, and older adults have been hit hardest by rising prices of medicine, electricity, and daily essentials. Many seniors rely on their SSS pension as their only income source. That’s where this reform comes in. The DOF noted that the increase “will uplift nearly 3.8 million Filipino households, ensuring they remain above the poverty threshold.” In short: the government is playing the long game — prioritizing sustainability over temporary relief. The ₱11,000 number floating online likely refers to the cumulative gain over time, not a single payout.

Official Word from SSS and DOF

To clear the air, here’s what SSS and government officials have actually said:

“We are not issuing lump-sum payments. The 2025 Pension Reform is a planned, annualized increase to strengthen our retirees’ purchasing power while keeping the fund stable,” said SSS President and CEO Rolando Macasaet.

Finance Secretary Ralph Recto added, “This initiative ensures no senior citizen is left behind in the country’s growth story. It’s both compassionate and fiscally responsible.”

That means the reform isn’t a “cash drop” — it’s a steady raise built to last.

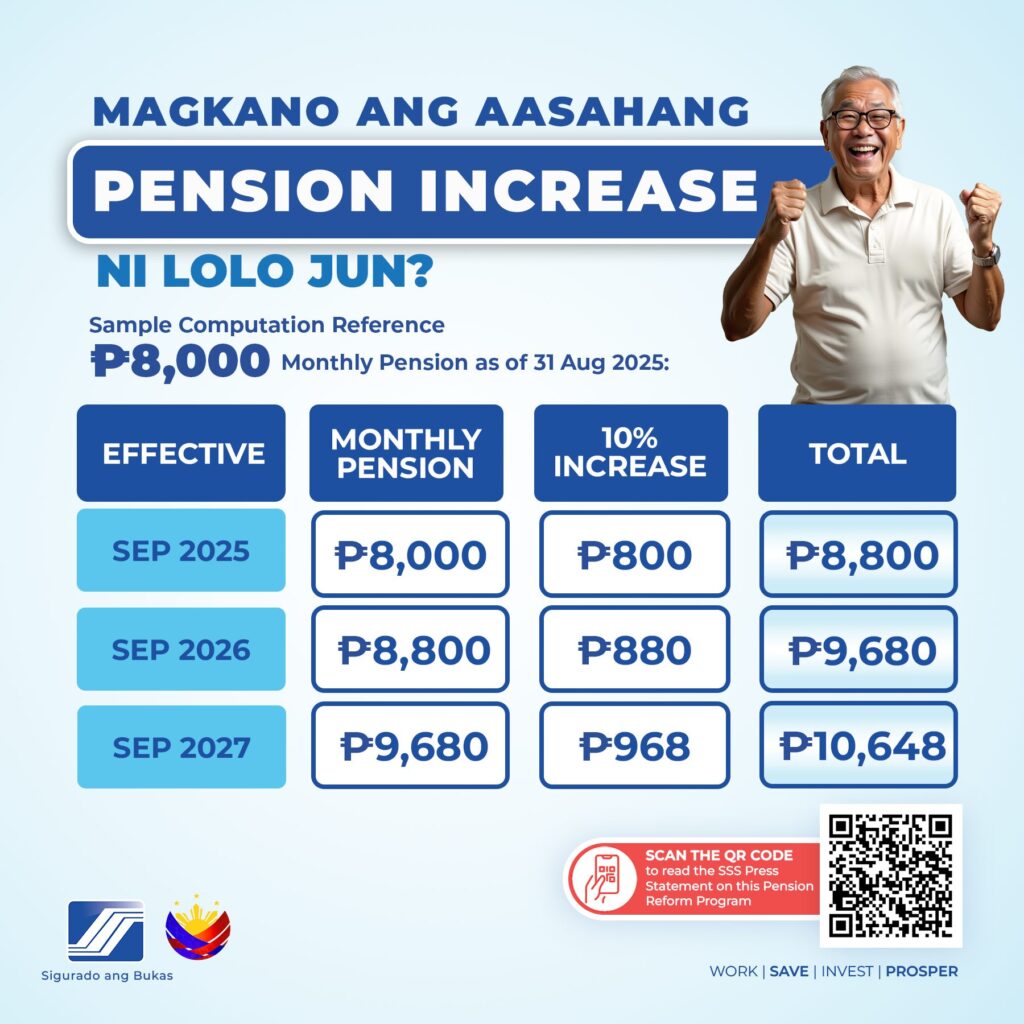

How the SSS Pension Increase Works?

Let’s break it down with an example.

Imagine you’re receiving ₱5,000 per month as your retirement pension.

- September 2025: 10% increase → ₱5,500

- September 2026: Another 10% → ₱6,050

- September 2027: Another 10% → ₱6,655

By 2027, you’re earning ₱1,655 more monthly — a total gain of 33.1% over three years.

If you’re receiving ₱11,000/month already, your pension rises to ₱12,100 in 2025, ₱13,310 in 2026, and ₱14,641 in 2027.

It’s not instant, but it’s compounding, which means your money keeps growing each year.

The Payment Schedule — Mark Your Calendar

The first increase rolls out in September 2025, and it follows the standard SSS pension disbursement schedule. That means no new payout dates — just a slightly bigger deposit when your usual pension comes in.

Here’s the timeline:

- September 2025: 1st increase (10% or 5%)

- September 2026: 2nd increase

- September 2027: 3rd and final increase in this reform phase

After 2027, another review will determine future adjustments depending on fund performance and inflation.

Who Qualifies (and Who Doesn’t)

To receive the pension increase, you must:

- Be an active pensioner as of August 31, 2025

- Receive a retirement, disability, or survivor pension

- Have a verified bank or UMID account registered with SSS

- Be compliant with Annual Confirmation of Pensioners (ACOP)

You don’t need to reapply — the system automatically applies the increase.

However, pensioners with suspended accounts due to missing ACOP or ID verification must update their records before August 2025.

The Legal Basis

The reform is grounded in Republic Act No. 11199, also known as the Social Security Act of 2018, empowering the SSS Commission to adjust benefits responsibly.

In July 2025, the SSS Board approved Resolution No. 340-s.2025, which formalized the new increase plan.

This ensures the program is legally enforceable and aligned with fiscal policy — not just a political promise.

Financial Impact: A Win for the Economy Too

This isn’t just about helping seniors. Economists point out that pension increases boost local economies, especially in rural towns.

When pensioners have more cash, they spend on essentials — groceries, transportation, medicine — supporting small businesses in their communities. That’s what economists call a “multiplier effect.”

A DOF analysis estimates that the pension reform could inject ₱45 billion into the Philippine economy over three years — money that circulates locally and strengthens consumer demand.

Practical Advice: Making the Most of the Increase

As someone who’s helped families plan their retirement finances, here’s some real-talk advice:

- Don’t blow it all at once. A pension bump isn’t lottery money. Think groceries, bills, and medicines first.

- Save at least 10%. Even small savings matter. Try setting aside ₱500 monthly into a high-interest savings account or Pag-IBIG MP2 program.

- Check your documents. Make sure your pension records are up-to-date — name, contact number, and bank details.

- Stay scam-aware. SSS never sends payment links via text or Facebook. Always double-check with official pages.

- Plan for longevity. The average Filipino lifespan is around 72 years. That means retirees may spend 15–20 years living off pensions — so budgeting is key.

How the Philippines Compares Globally?

In the United States, retirees under Social Security receive annual COLA (Cost-of-Living Adjustments) averaging around 3% to 3.5%.

By contrast, the Philippines’ 10% increase is generous — though local prices differ. The move aligns the country’s system with global standards on pension adequacy and equity.

Even regional neighbors like Thailand (5%) and Malaysia (3.8%) offer smaller increases. This underscores the Philippine government’s commitment to addressing senior welfare amid economic challenges.

Common Myths Busted

| Myth | Fact |

|---|---|

| All seniors get ₱11,000 lump sum | No, that’s misinformation. The increase is spread over three years. |

| You have to apply for the increase | False. It’s automatic for qualified pensioners. |

| Workers’ contributions will increase | Not until at least 2028, per the DOF. |

| You’ll receive extra bonuses in December | False. The reform is not tied to the 13th-month pension bonus. |

Expert Insight: From a Financial Planner’s Perspective

As a retirement consultant who’s worked with hundreds of pensioners, I can tell you one thing — planning beats guessing every time.

If you’re 60+, now’s the moment to:

- List your fixed expenses (rent, utilities, medication).

- Allocate your pension increase — part for savings, part for essentials.

- Avoid quick-profit schemes. Any group promising “double your pension” returns is likely a scam.

- Seek financial advice from registered professionals, not online influencers.

With discipline and awareness, even modest increases can add up over time. Financial literacy is your best defense — and your best investment.

SSS ₱1000 Senior Citizen Pension 2025 – Are You Eligible in the Philippines?

New ₱18,500 GSIS Pension Hike in 2025; Full Details on Eligibility and Pay Schedule

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65