SSS Pension Payment Dates: If you’re gearing up to receive your SSS pension in November 2025, you’re in the right place to get all the deets you need! Staying in the loop about SSS pension payment dates, how to check eligibility, and what to expect during pension release is super important, whether you’re a retiree, a finance pro, or just curious about how this social security system works. This guide breaks everything down in a friendly, no-nonsense way that even a 10-year-old could grasp, while providing valuable insights for professionals managing finances or pensions. We’ll walk you through the key dates, eligibility rules, payment procedures, and the big pension reform that started in 2025 which impacts how much you get.

Table of Contents

SSS Pension Payment Dates

Knowing your SSS Pension Payment Dates for November 2025 and understanding the eligibility criteria and new pension reform is crucial for every retiree. This guide cuts through the jargon to give you a clear, friendly, and expert overview so you can brace yourself for November’s payout with confidence. Update your details, double-check your SSS account, and enroll in the SMS notification system to stay ahead of any surprises. The 2025 pension reform is a game-changer that bumps up your monthly pension steadily over the next few years, putting more money back in your hands so you can live your best life post-retirement.

| Topic | Details |

|---|---|

| November 2025 Pension Date | Second payout batch: November 14, 2025 (Friday) |

| Eligibility Age | 60+ years (optional retirement), 65+ (technical retirement) |

| Minimum Contributions | At least 120 monthly payments before retirement |

| Pension Reform | 10% increase started September 2025, structured over 3 years |

| Payment Method | Bank accounts, e-wallets, or in-person |

| Pension SMS Alert System | Alerts sent with payment dates and amounts |

| Reference | Official SSS announcement |

What’s the Deal With SSS Pension Payment Dates November 2025?

Every retiree or pensioner depends on that monthly SSS pension deposit to keep life smooth—whether paying bills, buying groceries, or investing for the future. In November 2025, the SSS pension payout will follow the usual batch system, with the second disbursement scheduled for November 14, 2025. This payout is aligned with the last digit of your SSS number, so payments are staggered but punctual.

This date is especially important because the weekend of November 15-16 falls on Saturday and Sunday, so the payment timing shifts slightly to accommodate banking schedules. The SSS advises pensioners to double-check their disbursement accounts to avoid delays. Many hiccups are due to outdated bank or contact details, so a quick review on your end can save you a headache.

Breaking Down SSS Pension Eligibility in 2025

Knowing if you qualify for the SSS pension is step one before you even think payment schedules. Here’s the lowdown on who makes the cut:

- Age Requirements: Generally, you gotta be at least 60 years old for optional retirement or 65 years old for technical retirement.

- Payment Contributions: Have you paid at least 120 monthly contributions (10 years of payments) before you retire? That’s a must.

- Employment Status: You must be separated from employment or self-employment at retirement.

- Special Cases: Some professions like underground mine workers or racehorse jockeys have different age thresholds.

Also, if you suffered total disability but have recovered and reached the retirement age, you might still qualify.

How to Apply for Your SSS Pension Payment?

New retirees might ask, “How do I actually get this pension ball rolling?” The process isn’t rocket science:

- File Your Retirement Claim – Visit your nearest SSS branch or apply online on the my.SSS portal.

- Prepare the Required Documents – Usually, these include your birth certificate, SSS ID, employment records, and bank details.

- Wait for Approval – The SSS will verify your documents and calculate your pension.

- Receive Your Notifications – You’ll get updates via SMS or email, so keep your contact info up to date.

- Start Receiving Monthly Payments – Once approved, expect payments on the scheduled dates.

The 2025 SSS Pension Reform: What It Means for You

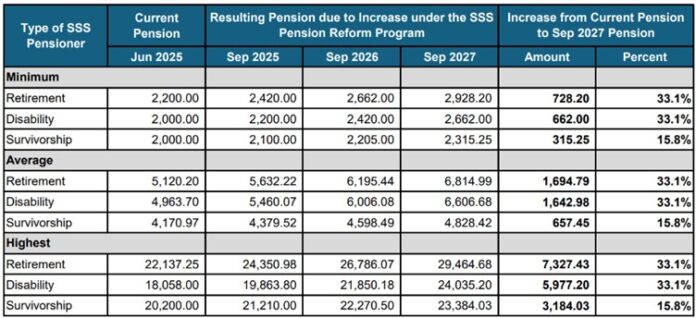

Hold up—did you hear about the new pension reform program that rolled out in September 2025? This is a biggie. For the first time in the history of SSS, pensions are getting a steady, structured boost over 3 years:

- 10% increase for retirement and disability pensioners

- 5% increase for survivors’ and death pensioners

- By 2028, pensions overall will increase by around 33%.

This reform means your November 2025 pension already benefits from a portion of this hike, putting more cash in your pocket without you doing anything extra. Payments and back pay (if applicable) will be automatically applied based on your pension status.

Managing Your SSS Pension Like a Pro

Getting your pension is just half the battle; making it last is where the real challenge lies. Here are some tips to keep your finances tight and smart:

- Budget Your Pension Wisely – List your monthly expenses and allocate your pension accordingly.

- Save Some Cash – Not all pension money needs to be spent immediately. Emergency funds can be lifesavers.

- Explore Additional Income Streams – Look for part-time or freelance gigs if your health allows.

- Avoid Scams – Keep your pension details private and verify all SSS communications to dodge phishing or fraud attempts.

Better Service and Support in 2025

SSS is not just handing out pensions; they’re working hard on improving services for pensioners. Some new initiatives coming into play include:

- Simplified Annual Confirmation of Pensioners (ACOP) program with easier requirements.

- Plans to conduct home visits for pensioners over 80 to ensure they still receive benefits without going through hassles.

- Continued efforts to provide lower interest rates on salary and calamity loans for members to ease financial burdens.

- Increasing coverage for self-employed professionals like doctors, engineers, and accountants to keep contributing and securing their pension perks.

These upgrades reflect SSS’s commitment to service excellence and pension sustainability, making 2025 a landmark year.

Comparing SSS with U.S. Social Security: A Snapshot

If you’re wondering how SSS stacks up with the US’s Social Security system, here’s a brief glimpse:

| Feature | SSS (Philippines) | U.S. Social Security |

|---|---|---|

| Minimum contribution period | 120 months (10 years) | Typically 40 quarters (10 years) |

| Retirement age | 60 (optional), 65 (technical) | Full benefits at 66-67, early at 62 |

| Pension increase mechanism | Structured increases over 3 years (2025 reform) | Cost-of-living adjustments annually |

| Payment method | Bank credit, e-wallet, cash | Direct deposit or check |

| Disability & Survivor benefits | Included | Included |

This quick compare gives you a feel for how pension systems operate globally, reinforcing the importance of staying updated with your local schemes.

Common Pitfalls to Avoid When Dealing With SSS Pension Payments

- Not Updating Bank Information – This can delay or misdirect your pension.

- Ignoring SMS Notifications – Missing alerts can keep you in the dark about delays or issues.

- Failing to Submit Complete Documentation – Incomplete claims slow down processing.

- Delaying Application – The earlier the claim, the faster you start receiving benefits.

Step-by-Step: How to Check and Prepare for Your November SSS Pension Payment Dates

Step 1: Confirm Your Eligibility

Use the SSS online portal or visit a branch to confirm your eligibility status and contributions count.

Step 2: Update Your Disbursement Info

Check if your bank or e-wallet details and contact numbers are current in the SSS system.

Step 3: Register for Pension SMS Alerts

Sign up using your mobile number to get real-time updates about your pension.

Step 4: Know Your Payment Schedule

Find out your assigned batch payout date based on your SSS number’s last digit.

Step 5: Prepare Documentation

Keep your retirement or pension documents handy for any verification or inquiries.

Step 6: Monitor Your Account

On payout day (November 14, 2025), check your bank or e-wallet for the credited pension.

SSS ₱1000 Senior Citizen Pension 2025 – Are You Eligible in the Philippines?

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65

₱18,500 GSIS Pension Hike Coming 2025; Are You One of the Beneficiaries? Check Eligibility