SSS Pension Payment Dates: If you’ve been looking for the SSS Pension Payment Dates for October 2025, you’re in the right place. This comprehensive guide breaks down everything you need to know — from eligibility requirements to payout dates, common payment issues, and practical steps to ensure your pension arrives on time. Whether you’re a retiree, a caregiver, or someone helping a parent or grandparent with their pension, this article is designed to be both friendly and deeply informative — written by someone who’s spent years helping folks navigate the SSS system.

Table of Contents

SSS Pension Payment Dates

The SSS Pension Payment Dates for October 2025 mark a milestone month for millions of Filipino retirees. With the new 10% pension increase now in effect, this payout cycle offers a meaningful financial lift amid rising costs. To ensure smooth processing:

- Confirm you were a pensioner before August 31, 2025

- Update your bank or UMID-ATM details via DAEM

- Check official announcements for the exact payout dates

- Verify your account on your assigned crediting day

By staying proactive, pensioners can avoid delays, receive their full benefits on time, and enjoy the financial stability they’ve worked hard for.

| Item | Details |

|---|---|

| Payout Month | October 2025 |

| Pension Increase | +10% for retirees/disability; +5% for survivors |

| Eligibility Cutoff | Must be receiving pension by August 31, 2025 |

| Disbursement Method | UMID-ATM or enrolled bank account via DAEM |

| Expected Credit Period | First to second week of October 2025 |

| Number of Beneficiaries | 3.5 million (approx.) |

| Contact Info | Hotline: 1455 / Email: [email protected] |

Why October 2025 Is a Big Deal for Pensioners?

The October 2025 SSS pension release isn’t just another monthly payout. It’s a milestone month because it reflects the first phase of the three-year pension reform program approved by the Social Security System (SSS) in August 2025.

Starting in September 2025, the SSS began implementing a 10% annual pension increase for retirees and disability pensioners, and a 5% increase for survivor and death pensioners. This reform is the largest since the ₱1,000 pension hike introduced back in 2017.

To qualify for the increase, pensioners must have been actively receiving their monthly pension on or before August 31, 2025. Anyone approved after that date will start receiving the new rate the following year.

This move is part of the government’s effort to help pensioners cope with inflation and rising living expenses — a much-needed boost after years of clamor from retirees’ associations and advocacy groups.

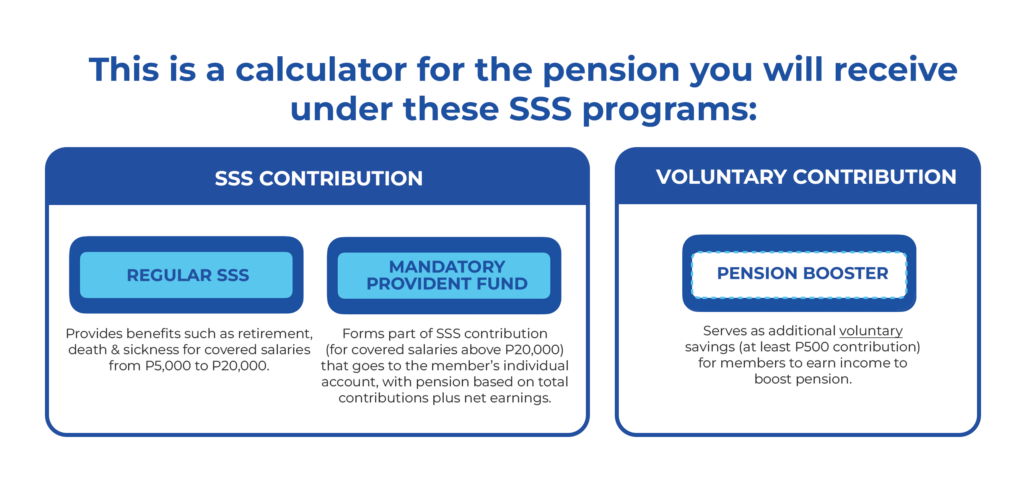

The 2025 Pension Reform – What You Should Know

The 2025–2027 reform program is a landmark project for the SSS. According to its board resolution, the move is designed to provide sustainable financial assistance to long-time contributors without jeopardizing the stability of the pension fund.

Here’s a quick look at what’s changing:

- 10% annual increase (2025–2027) for retirement and disability pensioners.

- 5% annual increase for survivors or death pensioners.

- Funded through improved contribution collection and investment returns.

- Beneficiaries automatically receive the adjustment — no reapplication needed.

This increase is expected to cost around ₱70 billion in total across the three years, with funding supported by SSS’s growing investment income, which hit ₱300 billion in 2024.

Who’s Eligible for the SSS Pension?

To receive the SSS monthly pension, a member must:

- Have at least 120 monthly contributions before the semester of retirement.

- Be at least 60 years old and no longer employed, or 65 years old regardless of employment status.

- Have no disqualifications or pending benefit issues.

For disability and survivor pensions, eligibility depends on contribution records, type of disability, and beneficiary relationship.

If you’re unsure, check your eligibility status through your My.SSS account at member.sss.gov.ph.

SSS Pension Payment Dates – October 2025 (Expected)

The official SSS October 2025 payment schedule has yet to be released, but based on recent years, here’s what you can expect:

| Last Digit of SSS Number | Estimated Payment Date |

|---|---|

| 0 – 2 | October 3, 2025 |

| 3 – 5 | October 7, 2025 |

| 6 – 8 | October 10, 2025 |

| 9 | October 12, 2025 |

This system helps the SSS spread disbursements evenly to prevent bank congestion. Actual dates may vary slightly depending on weekends, banking holidays, and system maintenance schedules.

Step-by-Step Guide to Ensure Smooth Pension Payment

Step 1: Verify Your Eligibility

Make sure you were receiving a pension before August 31, 2025 to qualify for the increase.

Step 2: Check Your Disbursement Account

Log in to your My.SSS account and confirm your enrolled bank details or UMID-ATM status. If your card or account has expired, update it through the Disbursement Account Enrollment Module (DAEM).

Step 3: Monitor SSS Announcements

Follow SSS on Facebook (@SSSPh) and Twitter (@PHLSSS) for official crediting dates. Avoid relying on unverified social media pages.

Step 4: Track Your Payment

On your expected payout day, log in to your banking app or ATM to confirm the deposit. Keep digital proof for future reference.

Step 5: Report Issues Promptly

If no payment appears within 48 hours after the expected date, contact SSS or your bank immediately.

Common Payment Issues and Solutions

1. Payment Delay or Missing Deposit

- Wait up to 48 hours. Some banks batch deposits in waves.

- Contact SSS through 1455 or send an email to [email protected].

2. Closed or Dormant Bank Account

- Update your new account under DAEM.

- Bring valid ID and proof of account ownership if updating in person.

3. UMID Card Issues

- Lost or blocked card? File for a replacement at your nearest SSS branch.

- Use your bank account in the meantime for continuity.

4. Suspended Pension Due to Missing “Proof of Life”

- For overseas retirees, submit your certification via the SSS Foreign Representative Office or through an online appointment system.

5. System Maintenance Delays

- If SSS posts a notice of maintenance, payments may be credited a few days later — usually announced on their official Facebook page.

Economic Context: Why the SSS Pension Payment Increase Matters

Inflation and living costs are key reasons behind this reform. According to the Bangko Sentral ng Pilipinas (BSP), the Philippines experienced an average 4.3% inflation rate in 2024, with essentials like rice, energy, and healthcare rising faster than income for most retirees.

A 10% increase in pension translates to roughly ₱1,000 to ₱2,000 more per month for the average pensioner. That might not sound huge, but it can mean an extra week’s worth of groceries or medicine.

This increase also aligns with international standards, where pension adjustments are periodically made to reflect the Consumer Price Index (CPI).

SSS Online Services and Digital Access

The My.SSS portal makes pension management easier than ever. Here’s how you can take advantage of it:

- Go to member.sss.gov.ph

- Register using your SSS number or CRN.

- Once logged in, you can:

- View your contribution history

- Update bank details via DAEM

- Check your pension status

- File benefit claims and maternity applications

- Schedule branch appointments

SSS also plans to enhance its mobile app by late 2025, adding features like real-time payment notifications and e-verification.

Real-Life Example

Maria Santos, 63, a retired nurse from Laguna, receives a monthly pension of ₱11,000. In October 2025, she saw her first increase — now ₱12,100 after the 10% adjustment. She had previously enrolled her bank account via DAEM, so the deposit appeared right on schedule.

Her friend, Arturo, who hadn’t updated his UMID-ATM information, missed his October payment and had to wait two more weeks after visiting an SSS branch. The lesson? Staying updated and digitally enrolled saves you from stress and delay.

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65