SSS Government Calamity Loan: When life throws a curveball — whether it’s a typhoon tearing through your roof, a flood sweeping through your home, or an earthquake shaking your business to the ground — it’s hard to get back on your feet. The SSS Government Calamity Loan 2025 is designed exactly for moments like that. This program from the Social Security System (SSS) of the Philippines gives members a quick financial boost after a natural disaster strikes. It’s not a handout — it’s a smart, low-interest loan meant to help you rebuild, recover, and move forward. Whether you’re a worker clocking in daily, a small business owner, or an OFW supporting your family, understanding this loan could make all the difference when disaster hits.

Table of Contents

SSS Government Calamity Loan

The SSS Government Calamity Loan 2025 is more than a financial aid — it’s a bridge to stability. By lowering costs, simplifying requirements, and expanding eligibility, the SSS has made it easier for Filipinos to recover after nature’s worst blows. If you’re affected by a calamity, apply early, use the funds wisely, and stay current with payments. That way, you not only rebuild your home but also strengthen your long-term financial resilience. When disaster strikes, being informed and prepared isn’t just survival — it’s strength.

| Topic | Key Details / Figures |

|---|---|

| Program Name | SSS Government Calamity Loan / Calamity Loan Assistance Program (CLP / CLAP) |

| Purpose | Financial assistance for SSS members in government-declared calamity zones |

| Maximum Loan Amount | Up to ₱20,000 or equivalent to 1 Monthly Salary Credit (MSC) |

| Interest Rate | 7% per annum (lowered from 10% in 2024) |

| Repayment Term | 24 months (2 years) |

| Service Fee | 1% of the loan amount |

| Penalty | 1% per month on overdue amortization |

| Eligibility | Minimum 36 total contributions, 6 within last 12 months, resident of declared calamity area, under 65 years old |

| Activation Period | Within 7 working days after calamity declaration |

| Official Site | SSS Calamity Loan |

What Is the SSS Government Calamity Loan 2025?

The Calamity Loan Assistance Program (CLAP) is a short-term credit facility for SSS members affected by natural disasters. The goal is to offer quick, low-cost help so people can replace damaged property, pay urgent bills, or restart their small businesses.

The 2025 version of the program introduces faster processing, a lower interest rate, and a more flexible renewal option. According to the Philippine News Agency (PNA), over ₱3.4 billion in calamity loans were released to 186,000+ members in the first half of 2025 alone — a strong indicator that this program remains one of the most trusted financial relief options for Filipinos.

This loan isn’t just for one disaster; it applies every time a member’s community is officially placed under a State of Calamity by the national or local government.

Why the Calamity Loan Matters for Filipinos?

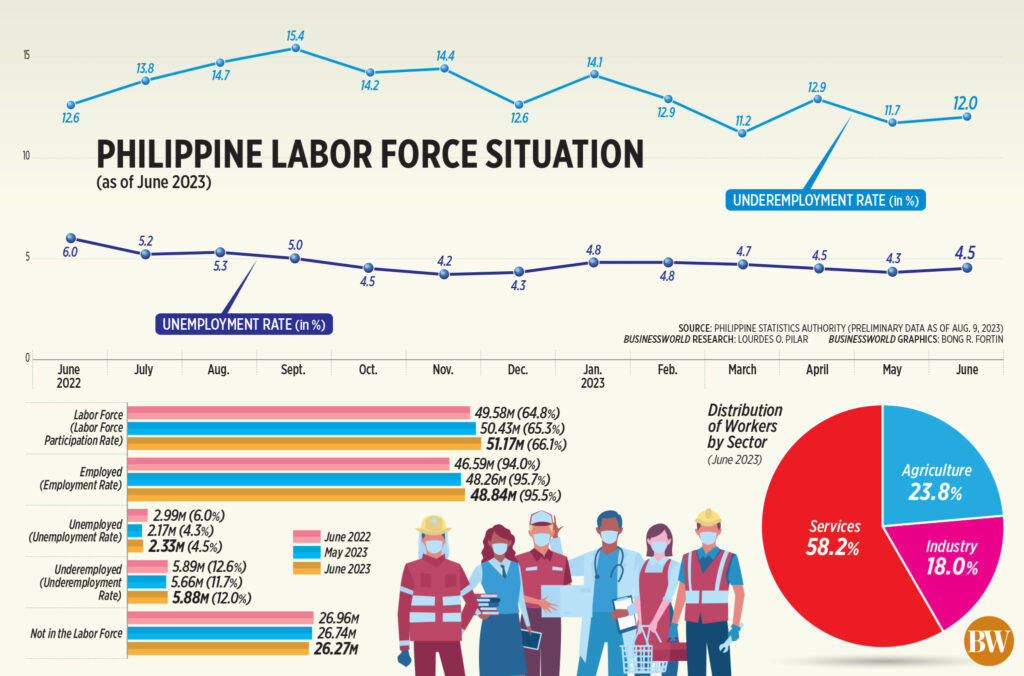

The Philippines faces an average of 20 tropical cyclones annually, not counting earthquakes and floods. For many families, a single disaster can erase months or years of savings. Insurance isn’t common among low-income earners — so the SSS loan serves as a financial buffer that helps people survive and recover.

This is where the SSS shows its true role — not just as a retirement fund, but as a lifeline during crisis. By lowering interest rates and simplifying the process, the agency ensures that workers, small entrepreneurs, and OFWs can recover faster without sinking into high-interest debt.

As SSS President and CEO Rolando Ledesma Macasaet noted in 2025, “Our calamity loan program is part of our social responsibility — to help our members rebuild their lives with dignity and confidence.”

Eligibility: Who Can Apply?

To qualify, applicants must meet all of the following requirements:

- Active SSS membership and registration in the My.SSS online portal.

- At least 36 monthly contributions posted, with 6 contributions within the last 12 months.

- Residence or property must be within an officially declared calamity area.

- Applicant must be below 65 years old at the time of application.

- Must not have received final benefits such as retirement or total disability.

- Must not have any overdue, restructured, or unpaid short-term SSS loans.

- For employed members, the employer must be up-to-date in SSS payments and must certify the application online.

- For self-employed, voluntary, or OFW members, at least six contributions under the current membership type are required.

Failing any of these conditions usually results in automatic disqualification, so double-checking your SSS records before applying is essential.

How Much Can You Borrow?

Your loanable amount depends on your average Monthly Salary Credit (MSC) over the past 12 months, rounded up to the nearest ₱1,000.

Formula:

Loan Amount = Average of last 12 MSCs (rounded up)

Maximum: ₱20,000

Example:

If your 12-month average MSC is ₱15,200 → round up to ₱16,000. You may borrow ₱16,000.

If your average exceeds ₱20,000, you’ll still only get ₱20,000 due to the cap.

This keeps the program fair and sustainable while ensuring members can access enough funds for essential recovery needs.

Interest, Fees, and Repayment Terms

The 2025 guidelines make repayment lighter and more transparent:

- Interest Rate: 7% per annum (on diminishing balance).

- Service Fee: 1% of loan amount, deducted upfront.

- Repayment Period: 24 months (2 years), in equal monthly payments.

- First Payment Due: Second month after approval.

- Late Payment Penalty: 1% per month.

- Default Interest: 10% per annum on unpaid balance, plus 1% monthly penalty.

- Renewal: Allowed after six months if the current loan is in good standing.

If a borrower fails to pay, the balance can be deducted from future SSS benefits such as retirement, disability, or death claims — so keeping up with payments matters.

Step-by-Step Guide: How to Apply for the SSS Government Calamity Loan

Step 1: Check Your Eligibility

Log into My.SSS to verify your total and recent contributions. Confirm that your residential area is officially under a State of Calamity.

Step 2: Prepare and Enroll Your Disbursement Account

Enroll a PESONet-participating bank account or UMID-ATM card using the Disbursement Account Enrollment Module (DAEM) in My.SSS. This ensures faster electronic fund transfers once your loan is approved.

Step 3: File Your Application Online

- Go to My.SSS → E-Services → Apply for Calamity Loan.

- Fill out the form and upload required documents (valid ID, proof of address if needed).

- If employed, your employer must certify your loan through their My.SSS account.

- Submit the application and wait for a notification via email or SMS.

Step 4: Approval and Fund Release

Once approved, the proceeds (minus service fee and pro-rated interest) are credited directly to your bank account or UMID-ATM within 3–7 working days.

Step 5: Repay On Time

Payments can be made through SSS branches, accredited payment centers, or online banking partners. Keep your payment receipts — late fees add up fast.

Real-World Example

Let’s say Liza, a 40-year-old teacher in Cavite, lost her roof and appliances during Typhoon “Egay.”

- Average MSC: ₱17,500 → rounded up = ₱18,000

- Loan amount approved: ₱18,000

- Service fee (1%) = ₱180

- Net proceeds: ₱17,820 credited to her bank

- Repayment: ₱775/month for 24 months

- Total interest paid: around ₱1,300 over two years

With that loan, she repaired her house and replaced school materials — proof that even a modest loan can restore stability.

Financial Planning Tips After a Calamity

Recovering financially after a disaster takes discipline. Here’s what experts suggest:

- Prioritize essentials — focus on home repairs, utilities, and food first.

- Create a short-term budget separating emergency needs from long-term spending.

- Avoid overlapping debts. Don’t take another loan until you’ve stabilized income.

- Track every peso using free budgeting tools or spreadsheets.

- Set aside savings — even ₱100 weekly builds resilience over time.

- Seek community help — LGUs, NGOs, and cooperatives often offer grants or free supplies.

- Educate your family on emergency spending habits to avoid unnecessary expenses.

Common Mistakes to Avoid

- Applying late — You only have 30 days from SSS’ public announcement to apply.

- Wrong account info — Errors in DAEM enrollment delay disbursement.

- Ignoring old loans — Clear them before applying.

- Assuming automatic approval — Your area must be officially declared under calamity status.

- Missing monthly payments — Even one missed payment triggers penalties.

Pro tip: mark payment reminders on your phone calendar to stay consistent.

Alternative Aid Programs

If the calamity loan isn’t enough, several other government programs can complement it:

- PAG-IBIG Calamity Loan: Borrow up to 80% of total savings, 5.95% interest, 24-month term

- PhilHealth Calamity Coverage: Helps cover hospitalization for disaster victims.

- DSWD AICS Program: Direct financial or food assistance.

- Local Government Assistance: LGUs often provide cash aid, construction materials, or livelihood starter kits.

Combining these resources ensures both immediate relief and long-term recovery.

Economic Impact and Government Perspective

From an economic viewpoint, the SSS calamity loan is part of the broader national disaster risk reduction framework. By providing liquidity to individuals quickly, it stabilizes local economies and prevents predatory lending.

According to SSS data, for every ₱1 disbursed through CLAP, an estimated ₱3–₱4 in local economic activity is generated — from construction to retail recovery. It’s not just about helping individuals; it’s about keeping communities moving.

Financial experts, including the Asian Development Bank (ADB), highlight such micro-lending programs as essential tools in disaster recovery, complementing national insurance and infrastructure efforts.

SSS ₱1000 Senior Citizen Pension 2025 – Are You Eligible in the Philippines?

SSS ₱8980 Direct Payment for 60+ Seniors 2025 – Check Eligibility & Payout Dates

Why It’s a Smart Move?

With a 7% annual interest rate and flexible two-year term, the SSS Calamity Loan is one of the most affordable emergency loans in the Philippines. Compare that to private lenders charging 18–25% — the difference is massive.

It’s also more reliable: no hidden fees, no collateral, and government-backed. For workers, it’s the safest way to stay afloat without falling into high-interest debt traps.