The SSS ₱1000 Senior Citizen Pension 2025 continues to provide monthly assistance to indigent older Filipinos, aiming to ease the economic burden of vulnerable elderly populations. Administered by the Department of Social Welfare and Development (DSWD), the benefit targets poor seniors aged 60 and above with no regular income or pension, according to government announcements made in early 2025.

Table of Contents

SSS ₱1000 Senior Citizen Pension 2025

| Key Fact | Detail / Statistic |

|---|---|

| Monthly Pension Amount | ₱1,000 |

| Eligible Age | 60 years old and above |

| Ineligible Groups | Current SSS, GSIS, PVAO pensioners |

| Implementation Year | 2025 |

| Official Website | DSWD |

Why the Program Exists: A Look Back

The social pension program began in 2010, offering ₱500 monthly assistance to indigent seniors. At the time, the government sought to provide a basic safety net for those excluded from formal pension systems like the Social Security System (SSS) or Government Service Insurance System (GSIS).

Over the years, inflation and rising living costs eroded the value of the original ₱500 benefit. In 2022, Republic Act 11916 was passed to double the monthly assistance to ₱1,000, reflecting an effort to better support the daily needs of the country’s aging population.

The Department of Budget and Management allocated ₱48 billion for the program in the 2025 national budget, making it one of the largest direct cash transfer programs in the Philippines.

Eligibility Requirements for the SSS ₱1000 Senior Citizen Pension 2025

Age and Indigence

To qualify, beneficiaries must be 60 years old or above and considered indigent. The DSWD defines indigent as a person who is poor, frail, or disabled; without permanent income; or lacking financial support from family members or other sources.

Pension Status

Seniors already receiving a pension from SSS, GSIS, PVAO, or similar programs are not eligible for this benefit. This restriction prioritizes citizens who have no formal retirement benefits.

“The ₱1,000 pension is meant for those who do not receive any other regular pension,” said Assistant Secretary Romel Lopez, DSWD spokesperson. “This ensures fair distribution of limited resources.”

Verification Process

Local government social welfare offices conduct household assessments, which may include home visits, barangay verification, and review of economic status. This is to ensure that only qualified individuals receive the benefit.

How to Apply for the Pension

Applications are accepted through local social welfare and development offices (LSWDOs). Senior citizens or their legal representatives must submit required documents, including:

- Valid ID or birth certificate

- Barangay clearance

- Certification of indigence

- Duly accomplished DSWD application form

Once approved, beneficiaries are enrolled and receive monthly payments either in cash during payout events or through digital transfers, depending on the local government’s capacity.

Human Stories Behind the Program

For many elderly Filipinos, the ₱1,000 pension can mean the difference between skipping a meal and eating three times a day.

Maria Santos, 74, from Nueva Ecija, uses the allowance to buy maintenance medicine for hypertension. “I don’t have children to support me,” she said. “This pension helps me survive.”

In Quezon City, Rodolfo “Mang Rudy” Cruz, a 68-year-old widower, uses the pension for rice and utilities. “It’s not much, but it’s something regular,” he said.

These stories mirror the experience of many Filipinos who spent years in informal work and reached old age with no retirement savings.

Regional Gaps and Implementation Challenges

While the program benefits millions, distribution remains uneven across regions. Urban centers often have faster digital disbursement systems, while remote provinces rely on manual cash payouts.

Local governments in Mindanao, for example, have reported delays of up to two months, partly due to transportation and banking limitations. Some beneficiaries walk long distances to reach payout centers.

“We are working to improve digital payments and minimize delays,” said DSWD Secretary Rex Gatchalian in a press briefing on 7 March 2025.

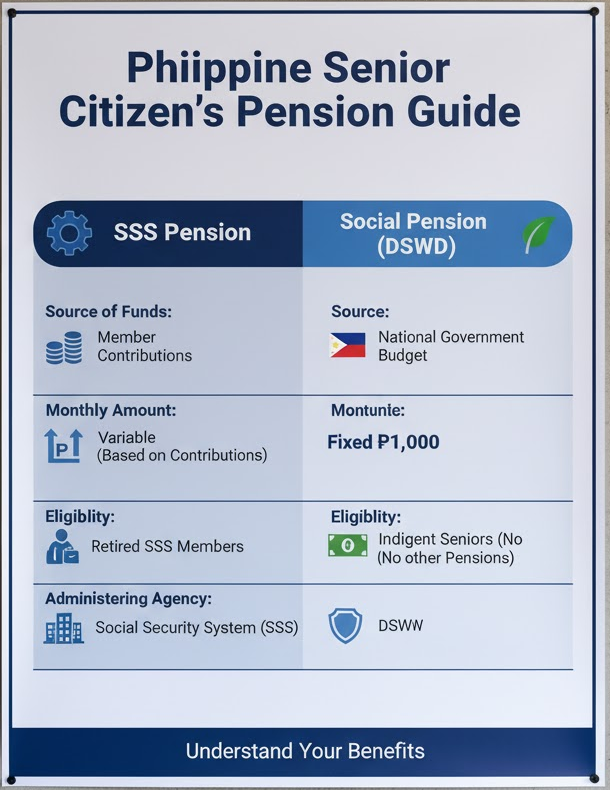

SSS Pension vs. Social Pension: Key Differences

The SSS pension is a contributory program for retirees who paid monthly contributions during their working years. The ₱1,000 social pension is non-contributory and intended for the poorest seniors with no other financial support.

| Feature | SSS Pension | Social Pension |

|---|---|---|

| Source of Funds | Member contributions | National government budget |

| Monthly Amount | Variable (based on contributions) | Fixed at ₱1,000 |

| Eligibility | Retired SSS members | Indigent seniors without other pensions |

| Administering Agency | Social Security System | DSWD |

Digital Transformation: Toward Faster Payments

To address delays, the DSWD has begun piloting e-wallet systems and cash cards to distribute pensions more securely and efficiently. The agency is working with Land Bank of the Philippines and other partners to reduce the need for in-person payouts.

The move is part of a broader government push toward financial inclusion, particularly for vulnerable groups. According to the Bangko Sentral ng Pilipinas, only 56 percent of Filipinos aged 60 and above use formal financial services.

International Perspective

The Philippines is not alone in providing social pensions. Many ASEAN countries operate similar schemes:

| Country | Monthly Social Pension (USD equivalent) | Coverage |

|---|---|---|

| Thailand | $23 | Universal for 60+ |

| Vietnam | $10–$30 | Targeted |

| Indonesia | $25 | Targeted |

| Philippines | $18 (₱1,000) | Indigent seniors only |

Experts argue that the Philippine program remains modest compared to its neighbors, especially given rising costs of living.

“The ₱1,000 monthly benefit is helpful but not sufficient,” said Dr. Aurora Mendoza, a social policy researcher at the University of the Philippines. “Policymakers need to link cash assistance with health coverage and long-term care.”

Policy Reforms on the Horizon

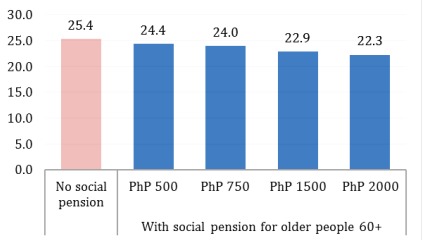

Several lawmakers have filed bills in Congress to increase the pension to ₱1,500 or ₱2,000 and expand eligibility to more seniors. Proposals also include automatic enrollment of qualified citizens and better monitoring systems to prevent exclusion errors.

The Senate Committee on Social Justice has scheduled hearings in mid-2025 to review these proposals, though funding remains a major consideration.

Social Pension and Poverty Reduction

Studies by the Philippine Institute for Development Studies (PIDS) show that the social pension has a measurable impact on reducing elderly poverty rates. Beneficiaries are more likely to afford medicine, food, and basic utilities.

“This is not just financial assistance; it is social protection,” said Dr. Jaime Cruz, a senior economist at PIDS. “It allows seniors to live with dignity.”

Sidebar: How to Avoid Scams

With the expansion of the program, reports of text scams and fake fixers have increased. Seniors and their families are urged to:

- Ignore text messages asking for personal information or payment to “process” pensions.

- Verify information only through official DSWD channels or local government offices.

- Report suspicious activities to the DSWD hotline: 8888.

Looking Ahead

As the SSS ₱1000 Senior Citizen Pension 2025 continues, the government faces pressure to further expand benefits or link the program with other safety nets like PhilHealth. Lawmakers acknowledge that a sustainable pension system is essential as the country’s population rapidly ages.

By 2030, the Philippine Statistics Authority projects that one in ten Filipinos will be 60 years or older. This demographic shift underscores the importance of strong and adaptive social protection systems.

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65

FAQ About SSS ₱1000 Senior Citizen Pension 2025

Q: Can I receive both SSS and social pension at the same time?

A: No. Beneficiaries of SSS, GSIS, or other pensions are not eligible for the DSWD social pension.

Q: How often is the ₱1000 pension paid?

A: Most payouts are made quarterly or in lump sums, depending on local arrangements.

Q: What if I am denied?

A: Applicants can file an appeal through their local DSWD office or submit updated proof of indigence.