SSI Benefits for Green Card Holders: If you’re a green card holder living in the United States, you’ve probably wondered whether you can get SSI benefits in 2025. The answer? Yes — but it’s complicated. Let’s break it down in plain English. The Supplemental Security Income (SSI) program helps people who are 65 or older, blind, or disabled and have limited income and resources. But for lawful permanent residents (LPRs) — a.k.a. green card holders — there are special rules, waiting periods, and exceptions you need to know before applying. Don’t worry; we’ll keep it friendly, real, and totally understandable. Grab a coffee, and let’s dig in.

SSI Benefits for Green Card Holders

Getting SSI benefits as a green card holder in 2025 can feel like navigating a maze, but the rules aren’t impossible. If you’re patient and organized — track your work credits, meet the 5-year rule, and stay below the income limits — you can absolutely qualify. America’s safety net may be tangled in red tape, but it’s there for those who play by the rules. Take it step by step, keep records handy, and don’t hesitate to ask for help from SSA or a legal aid office. Your hard work and patience can pay off in real dollars and dignity.

| Topic | What You Need to Know | Source / Link |

|---|---|---|

| Who Qualifies | U.S. citizens and certain “qualified aliens,” including lawful permanent residents. | SSA.gov – SSI for Noncitizens |

| 5-Year Rule | Green card holders admitted after Aug. 22, 1996, usually must wait 5 years before SSI eligibility. | SSA.gov – SSI Eligibility |

| 40 Work Credits | Most LPRs need 40 qualifying quarters (about 10 years of work). | |

| 7-Year Limit | Refugees, asylees, and similar groups can get SSI for up to 7 years, unless they naturalize. | |

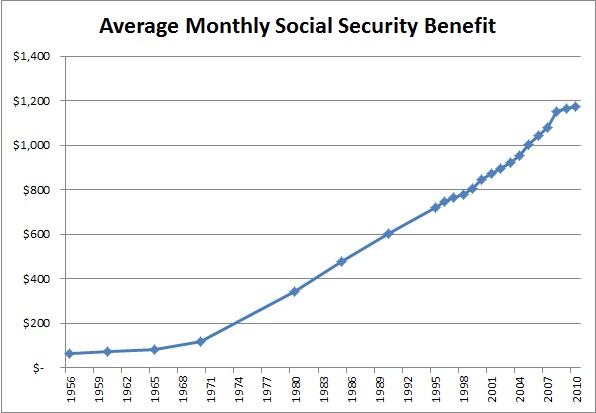

| 2025 Payment Amounts | $967 (individual) / $1,450 (couple); some states pay extra. | |

| Income & Resource Limits | Must have very low income + resources under $2,000 (single) / $3,000 (couple). | |

| Official Info | Supplemental Security Income for Noncitizens (PDF). |

What Exactly Is SSI?

SSI (Supplemental Security Income) is a federal safety-net program run by the Social Security Administration (SSA). It gives monthly cash assistance to people who are:

- Age 65 or older, or

- Blind, or

- Disabled (can’t work for at least 12 months or more),

- And who have very limited income and assets.

Think of it as help to cover basics — food, clothing, rent, and utilities — for people in tough financial spots.

Important: SSI is not the same as Social Security retirement or disability insurance (SSDI). You don’t need prior work history to get SSI, but your immigration status matters a lot.

SSI Eligibility for Green Card Holders

1. You Must Be a “Qualified Alien”

To even step into the SSI conversation, you must fall under the federal “qualified alien” definition. That includes:

- Lawful Permanent Residents (Green Card Holders)

- Refugees and Asylees

- Cuban or Haitian Entrants

- Amerasian Immigrants

- People Granted Withholding of Removal

- Victims of Human Trafficking

- Certain Survivors of Domestic Violence

If your status isn’t listed above — sorry, you’re not eligible for SSI.

2. The 5-Year Waiting Period (a.k.a. the “Five-Year Bar”)

If you became a lawful permanent resident on or after August 22, 1996, you must generally wait 5 years from the date you were granted your green card before you can receive SSI.

Example:

Let’s say Carlos became an LPR in 2021. That means he can apply for SSI in 2026, assuming he meets all other conditions (like disability or age 65+, and low income).

3. The 40-Work-Credits Rule

Here’s the kicker. Many LPRs must also show 40 qualifying quarters of work in the U.S. (That’s about 10 years.)

Each quarter equals roughly 3 months of work with a certain amount of earnings — for 2025, $1,730 per quarter.

Example: If you worked full-time for 10 years and paid Social Security taxes, you probably already earned your 40 credits.

Pro tip: Some people can use their spouse’s or parent’s credits toward their total. Always ask the SSA before giving up!

4. The 7-Year Limit for Refugees & Asylees

If you’re a refugee, asylee, Cuban/Haitian entrant, or victim of trafficking, you can get SSI for up to 7 years after your qualified status begins.

But once those 7 years are up, payments usually stop unless you:

- Become a U.S. citizen, or

- Adjust to a different eligible status.

5. Income & Resource Limits

Even if you qualify on paper, SSI is means-tested. Your countable income and resources must stay below strict limits.

| Category | Limit (2025) |

|---|---|

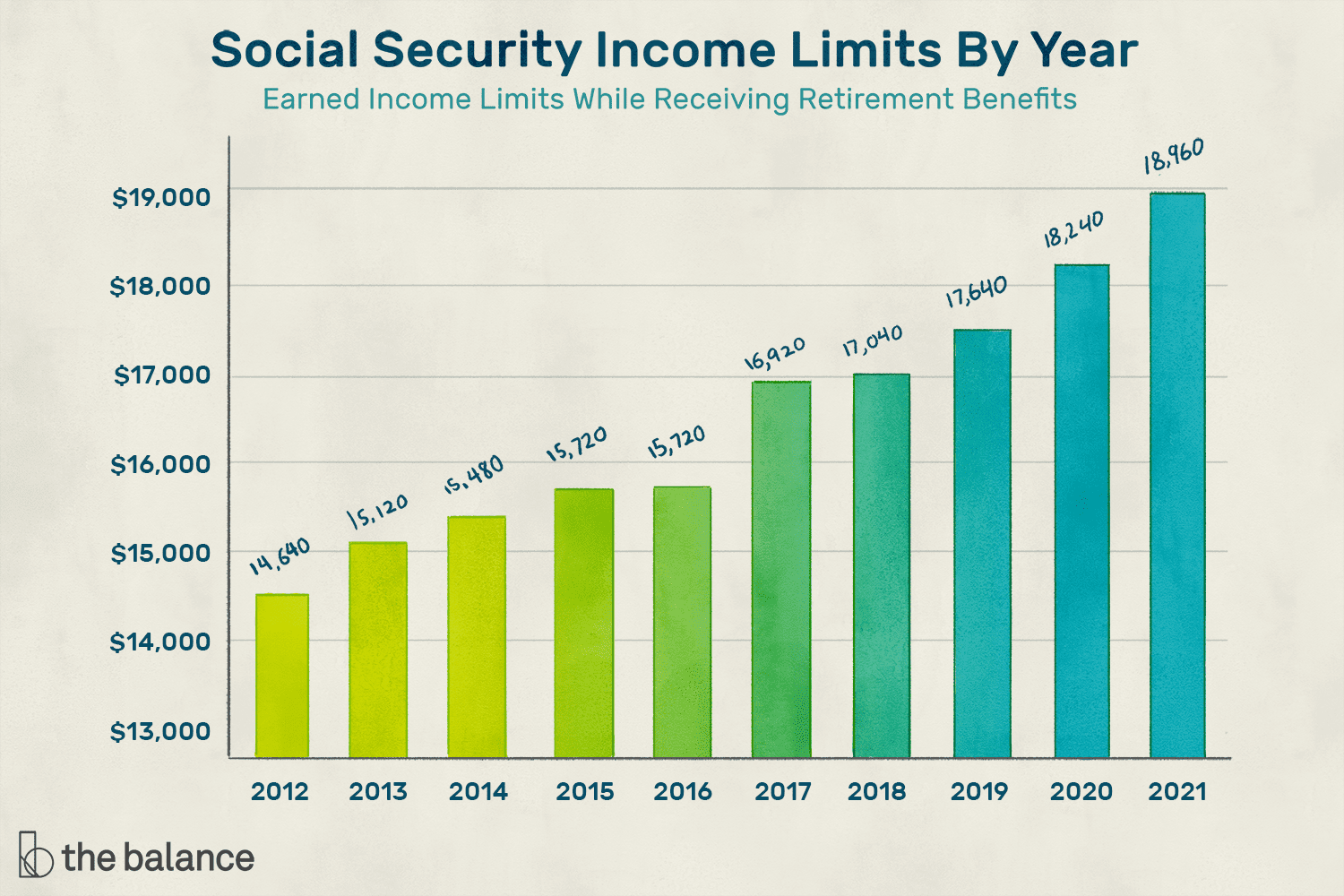

| Income | Roughly <$1,970/month (varies by state) |

| Resources | $2,000 (single) / $3,000 (couple) |

Countable resources include cash, bank accounts, and investments — not your primary home or one vehicle.

Step-by-Step Guide: How to Check If You Qualify for SSI Benefits for Green Card Holders

- Confirm Your LPR Date – Look at your Green Card (“Resident Since” date). If it’s after Aug 22 1996, the 5-year rule applies.

- Check Your Work Credits – Create a free account at ssa.gov/myaccount to see your lifetime credits.

- Review Your Income & Resources – Gather proof of income (pay stubs, bank balances, pensions).

- See If Exceptions Apply – Refugees, veterans, and spouses/children of U.S. service members may qualify faster.

- Apply Online or In Person – Visit your local SSA office or call 1-800-772-1213.

- Track Your Case – SSI reviews can take weeks or months; stay in touch with your SSA case worker.

Real-World Example

Imagine Rosa, age 67, from the Philippines. She got her green card in 2018, has worked 10 years in the U.S. as a caregiver, and has no other income.

She meets the 5-year rule (2018 → 2023).

She has 40 work credits.

Her bank balance is $1,200.

She’s over 65.

Rosa can now apply for SSI and could receive up to $967/month in 2025 (plus state bonus if she lives in California or New York).

Common Exceptions & Special Cases

1. Veterans & Military Families – LPRs who served in the U.S. Armed Forces (or their spouses/children) may skip the 5-year rule.

2. Victims of Trafficking or Abuse – You might be “deemed qualified” under the Violence Against Women Act (VAWA).

3. People Who Lived in the U.S. Before 1996 – If you were already lawfully living here before August 22, 1996, some rules don’t apply.

4. Blind or Disabled Children – Noncitizen children living with qualified parents can sometimes qualify for SSI even if they don’t yet have 40 credits.

SSI and SSDI Payments in October 2025: Check Official Payment Schedule and Eligibility Criteria!

October Social Security Payments: Why You Might Get Two SSI Checks This Month

Pro Tips & Resources

- Always Report Changes: If you move, get married, earn more, or gain citizenship, tell the SSA right away. Unreported changes can lead to overpayment penalties.

- Don’t panic over denials: More than 60% of SSI applications get denied initially. Appeal if you believe you qualify.

- Look into State Supplements: States like CA, NY, and NJ add extra SSI money each month.

- Get Free Help: Call SSA at 1-800-772-1213 or visit your local Social Security office. Nonprofits like AARP and Legal Aid also assist immigrants.