Social Security November 2025 Payment Schedule: If you’re gearing up to check your Social Security or Supplemental Security Income (SSI) benefits this November, here’s the lowdown on the 2025 payment schedule, the double SSI payment, the latest Cost-of-Living Adjustment (COLA), and what this means for your wallet. Whether you’re a retiree, a disability beneficiary, or someone relying on SSI, understanding when and how much you get paid is key to planning your finances smartly. This article breaks it down in plain, friendly talk while keeping it professional and fact-based.

Table of Contents

Social Security November 2025 Payment Schedule

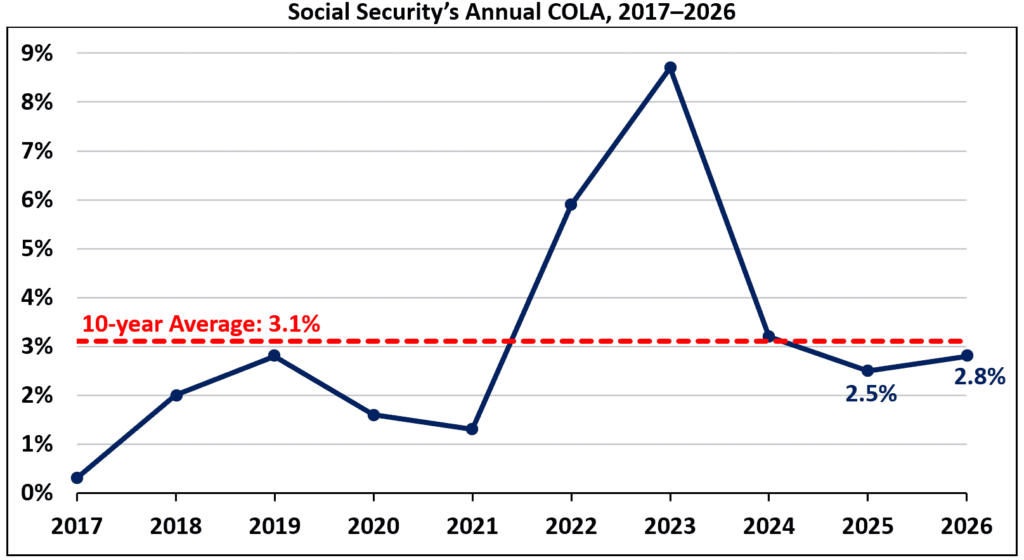

Understanding the November 2025 Social Security and SSI payment schedule, alongside COLA increases and program history, empowers you to plan your finances smarter. The double October payment for SSI recipients requires budgeting foresight, while 2.5% and 2.8% COLA adjustments for 2025 and 2026 help benefits keep pace with inflation. Coupled with protective measures against scams and a grasp of related Medicare and legislative developments, you’re better equipped to manage these vital programs.

| Topic | Details |

|---|---|

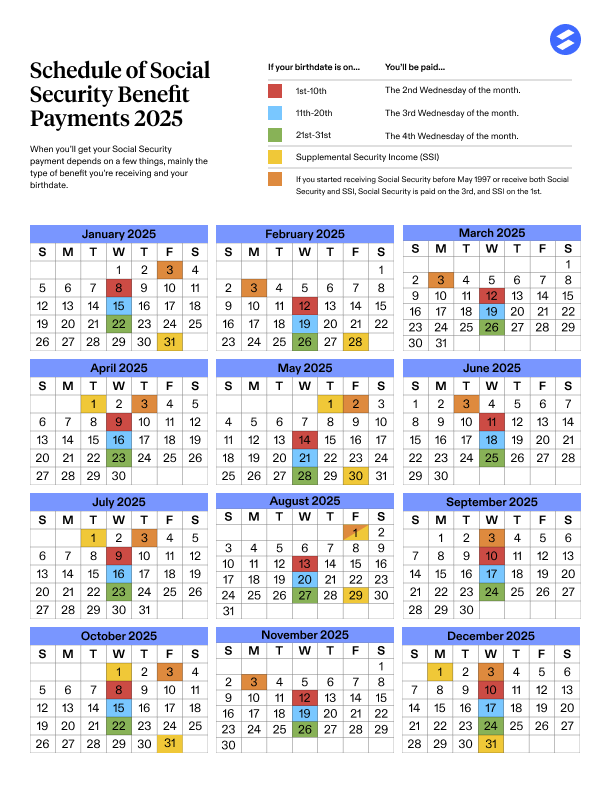

| November 2025 Payment Dates | Nov 3: Benefits started pre-May 1997 Nov 12: Birthdays 1-10 Nov 19: Birthdays 11-20 Nov 26: Birthdays 21-31 |

| SSI Payment Peculiarity | No SSI payment in November; double payment October 1 and 31 |

| 2025 COLA Increase | 2.5% increase in Social Security benefits beginning January 2025 |

| 2026 COLA Increase | 2.8% increase effective January 2026 payments |

| Average 2025 Benefit | ~$1,907 per month after 2.5% COLA increase |

| Maximum 2025 Benefit (Age 70) | Up to $5,108 monthly |

What is Social Security and SSI? A Quick Primer

Before diving into the November 2025 payment details, it’s important to understand what Social Security and SSI are, and who they serve.

- Social Security is a federal program established in 1935 during the Great Depression under President Franklin D. Roosevelt. It was created to protect workers and their families from financial hardship due to retirement, disability, or death of a breadwinner. Funded by payroll taxes under the Federal Insurance Contributions Act (FICA), it serves retired workers, disabled workers, survivors, and dependents.

- SSI (Supplemental Security Income) is a separate program started in 1974 to serve people who are aged (65+), blind, or disabled and have limited income and resources. Unlike Social Security benefits, payments are not based on work history and are funded by general tax revenue, not Social Security taxes. SSI replaced a patchwork of inconsistent state welfare programs, serving as a unified federal safety net.

Together, these programs provide monthly benefits to some 70 million Americans, functioning as critical supports for financial stability.

What’s Happening with Social Security in November 2025?

Here’s the scoop: Social Security payments for retirement, disability, and survivors are distributed in November based on your birthday — the usual system. But SSI recipients face a unique scheduling quirk this year: a double payment in October and no payment in November. This isn’t a glitch or shutdown issue but a planned scheduling adjustment.

Also, the Social Security Administration (SSA) confirmed a 2.5% COLA increase for 2025, making your checks larger than last year. Another 2.8% COLA boost is coming for 2026, continuing to help combat inflation’s impact.

Understanding the Social Security November 2025 Payment Schedule

The SSA organizes payments based on your birthdate to balance monthly outflows. This scheduling is meant to spread payments evenly for administrative ease and beneficiary convenience.

In November 2025, payments occur on these dates:

- November 3: For those receiving benefits before May 1997.

- November 12: For birthdays 1 through 10.

- November 19: For birthdays 11 through 20.

- November 26: For birthdays 21 through 31.

By knowing your birthdate bucket, you can anticipate exactly when your payment will hit, helping with budgeting and bill payment planning. The system remains consistent year over year, offering predictability to millions.

What About SSI Payments?

SSI functions differently. Traditionally, SSI payments are disbursed on the first day of each month. But for November 2025, the SSA made a deviation — the November payment was issued early on October 31. This created a “double dip,” with payments on October 1 and October 31, but no SSI check in November itself.

This timing tweak is common to avoid weekend or holiday delays and keeps payments on schedule overall. The cycle then returns to normal with December’s SSI payment on December 1.

Understanding this can help SSI recipients avoid surprises. Plan ahead to manage the month without November’s payment and use the double October payment wisely for added cushion.

The 2025 and 2026 Cost-of-Living Adjustments (COLA): What You Need to Know

Each year, the SSA adjusts Social Security benefits to keep up with inflation — this is called a Cost-of-Living Adjustment or COLA. It’s based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

- For 2025, the COLA was set at 2.5%, reflecting recent increases in living costs, which raised the average monthly benefit to about $1,907 up from around $1,865 in 2024.

- For 2026, the SSA announced a 2.8% COLA increase, effective with January payments. This further increment helps beneficiaries maintain purchasing power amid continuing inflation.

Practical Example

If you received a $1,000 monthly benefit in 2024, expect it to rise to approximately $1,025 in 2025 (2.5% increase) and about $1,053 in 2026 (after applying the 2.8% increase). It’s a steady, if modest, boost helping Social Security keep pace with everyday expenses.

How to Check Your Social Security or SSI Payment Status Online?

Want to confirm when your payment hits or look up your benefit amount? The SSA’s official website offers a secure resource:

- Sign up for a my Social Security account at ssa.gov/myaccount. This lets you view your payment history, estimated future benefits, tax statements, and more.

- Use the site to update personal info like address or bank info safely.

- Be wary of scams and always ensure you are on the official government site.

By proactively managing your SSA online account, you can better plan finances confidently and prevent missed payments or fraud.

Protecting Your Benefits: Scam Awareness and Tips

Scammers targeting Social Security recipients are ruthless. Here’s how to stay safe:

- The SSA will never call, email, or text to threaten you or demand immediate payment by gift cards or wiring money.

- Avoid sharing your Social Security Number or banking info over unsolicited calls.

- Always verify suspicious contacts by calling the SSA directly at 1-800-772-1213.

- Report fraud attempts to the SSA Office of Inspector General hotline or website.

Protection is about vigilance—never hesitate to question odd requests or offers claiming to be from Social Security.

Related Benefits: Medicare and Social Security

If you’re receiving Social Security retirement or disability benefits, you are usually eligible for Medicare health insurance, starting at age 65, or earlier if disabled.

Medicare parts cover hospital care, medical insurance, and prescription drugs. Enrollment is often automatic when eligible. Knowing how Medicare ties into Social Security helps you plan healthcare costs and coordinate benefits properly.

Recent Legislative Changes Affecting Social Security

Recent years have seen ongoing discussions in Congress about:

- Adjusting the payroll tax cap for high earners to ensure long-term funding.

- Exploring changes to COLA calculations that might alter annual benefit increases.

- Debating gradual increases in retirement age to reflect longer lifespans.

- Enhancing benefits for certain vulnerable groups.

While no major reforms have yet passed, staying informed about proposals can help you anticipate future impacts on your benefits.

Social Security History: The Road to Today

The Social Security Act, signed on August 14, 1935, during the Great Depression, created the foundation to protect Americans from destitution in old age, disability, or loss of a family provider.

The first monthly benefit was paid in 1940 to Ida May Fuller, underscoring the program’s longevity and pivotal role in U.S. social policy. Over time, Social Security expanded to include survivors and disability benefits, and Medicare was added in 1965 to provide health coverage.

SSI was created in 1974 to federalize and standardize welfare payments previously managed inconsistently by states. It offers a uniform level of support to those with low income and resources, filling a critical gap. The program has evolved with changes in funding, eligibility, and benefit amounts, always aiming to provide a lifeline to vulnerable Americans.

How to Contact the Social Security Administration (SSA)?

For personal assistance:

- Browse the SSA website for resources and live help.

- Call 1-800-772-1213 (TTY 1-800-325-0778) for phone assistance.

- Visit your local SSA office—appointments can be scheduled online or by phone.

SSA representatives can guide you through benefit questions, applications, or resolving issues.

Tools to Estimate Your Social Security Benefits

Plan ahead with free SSA calculators:

- Retirement Estimator estimates your benefit based on actual earnings.

- Benefits Calculators for disability and survivors.

- COLA Information to understand how inflation affects you.

These tools help you make informed retirement and financial decisions.

Tips to Maximize Your Social Security Benefits

Smart claiming strategies boost lifetime income:

- Delay claiming: Benefits increase up to age 70, rewarding later claimants.

- Work longer: Additional earnings can raise your benefit calculation.

- Coordinate with spouses: Spousal and survivor benefits can add financial security.

Consider working with financial planners to optimize your Social Security timing.

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

Seniors 63+ Getting a New Social Security Payment in Days; Check Eligibility & Payment Date

Social Security 2026 Hike Fizzles Out – Largest Medicare Deduction in History Takes a Bite