In October 2025, certain Social Security beneficiaries will receive two payments, marking a temporary shift in the regular payment schedule. This adjustment affects Supplemental Security Income (SSI) recipients and aligns with the SSA’s commitment to ensuring timely payments despite calendar quirks. Understanding the eligibility criteria and payment dates is essential for those impacted by these changes.

Social Security issuing 2 payments

| Key Fact | Detail/Statistic |

|---|---|

| Recipients Affected | SSI recipients are impacted |

| October 2025 Payment Dates | October 1 and October 31 |

| Reason for Double Payments | November payment issued early due to Saturday |

| Payment Mode Change | All Social Security payments now electronic |

| Official Website | Social Security Administration |

For most recipients, the transition to electronic payments means that Social Security benefits will be received faster and more securely. However, those impacted by the October double payments should verify their payment method to ensure their benefits are properly deposited into the correct account. If you haven’t already, ensure that your payment information is up to date with the SSA to avoid delays.

Looking ahead, the SSA continues to monitor and adjust its policies to ensure that benefits are distributed efficiently and securely, despite the complexities of the calendar year.

With these improvements, Social Security recipients can expect greater stability and ease in managing their benefits, an essential support for millions of Americans.

Why Two Payments in October 2025?

Social Security Administration (SSA) will issue two payments for some beneficiaries in October 2025, addressing calendar constraints. This adjustment primarily affects Supplemental Security Income (SSI) recipients, who will see their regular October payment made on October 1. The second payment, typically issued in November, will instead be issued on October 31 due to the timing of November 1 falling on a Saturday.

The rationale for this shift is rooted in SSA’s policy of ensuring that recipients receive their monthly payments promptly, even if their scheduled date falls on a weekend or holiday. November’s SSI payment will thus be processed earlier, in line with the SSA’s strategy of minimizing payment delays.

The Impact on Social Security Recipients

SSI Recipients

For those receiving Supplemental Security Income (SSI), October will be an unusual month. Typically, SSI payments are issued on the first of the month, but when the first falls on a weekend or holiday, payments are made earlier in the preceding month. In 2025, because November 1 falls on a Saturday, October 31 will serve as the second payment date for SSI recipients, covering November.

SSI recipients will see two payments:

- October 1 – Payment for the month of October.

- October 31 – Payment for the month of November.

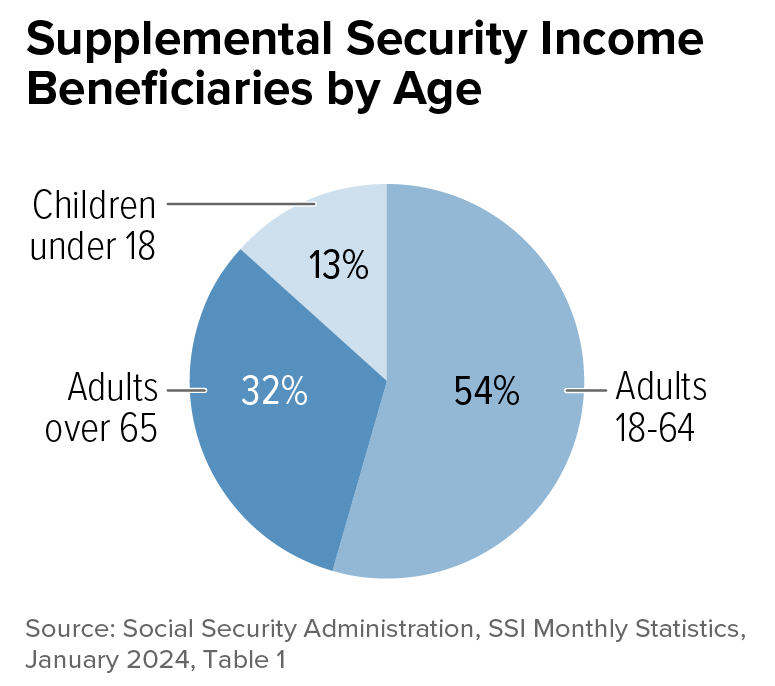

These changes ensure there are no delays in benefits, which are particularly crucial for individuals relying on SSI for basic needs. SSI payments are generally reserved for elderly, blind, or disabled individuals who have little or no income and who meet the income and asset limits set by the SSA.

Social Security Retirement, Disability, and Survivors Benefits

While SSI recipients experience the dual payment schedule, other Social Security beneficiaries, including those receiving retirement, disability, and survivor benefits, will not see a change in their payment dates. These payments will continue to follow the usual monthly distribution schedule based on the recipient’s birthdate.

For Social Security retirement, survivors, and disability insurance benefits (RSDI), payments are issued as follows:

- October 8 – For individuals born between the 1st and 10th of the month.

- October 15 – For those born between the 11th and 20th.

- October 22 – For recipients born between the 21st and 31st.

Electronic Payments in Full Force

In line with broader trends to enhance security and efficiency, the SSA has moved entirely to electronic payments for most beneficiaries as of September 30, 2025. No paper checks will be issued for Social Security or SSI payments, marking a significant transition aimed at reducing fraud and administrative costs. Recipients must have either a direct deposit account or a Direct Express prepaid debit card to receive their benefits.

This transition to electronic payments has been a gradual but necessary shift over the past several years. As of the deadline, all recipients must comply with the new electronic system, a move which will save taxpayers millions of dollars annually. It also ensures recipients can access their funds immediately and securely without the risk of delayed or lost checks in the mail.

Why This Matters for Recipients

For the majority of Social Security beneficiaries, the October changes will be minor. However, for SSI recipients, the advance payment ensures there are no disruptions in support during a month when the standard payment cycle might otherwise be impacted by weekend or holiday schedules.

This adjustment comes at a time when Social Security benefits have become a vital lifeline for millions of Americans, particularly those with disabilities, seniors, and those facing economic hardships. The SSA’s efforts to streamline payment processes, such as by moving entirely to electronic transfers, aim to mitigate delays and errors.

The shift to two payments in October will also help beneficiaries adjust financially, as some may rely on the steady timing of their monthly payments for essential needs, such as rent, utilities, and food. Any delays can have serious ramifications for those living paycheck to paycheck.

Upcoming Payment Changes in December

This two-payment schedule will not be unique to October. December 2025 will also feature double payments for SSI recipients. The usual December payment will be made on December 1, while another payment will be issued on December 31 for January 2026.

As the SSA adapts to the calendar in the coming months, recipients can continue to rely on timely payments, especially during months with unusual scheduling. The SSA works diligently to avoid payment delays in months with calendar conflicts, which is why many recipients will see double payments in both October and December.

The Future of Social Security Payments

Looking ahead, the Social Security Administration plans to continue its emphasis on improving the efficiency of benefit distribution, including through enhanced technological infrastructure. With the full move to electronic payments, beneficiaries can expect greater convenience, fewer delays, and increased security.

Moreover, the SSA’s continued efforts to modernize its systems are expected to include improvements to fraud prevention, ensuring that Social Security payments remain secure in an increasingly digital world. The push for electronic payments is not just about convenience—it’s about safeguarding the funds of millions of Americans.

Potential Challenges in the Transition

While the transition to electronic payments has been largely successful, not all recipients are equally equipped to manage these changes. Some may face challenges in accessing the necessary technology or understanding how to set up a bank account or direct deposit. This presents a critical issue, particularly for older recipients who may not be familiar with digital banking or online systems.

The SSA has been working to address these issues by providing guidance and support for those in need. Community outreach programs and local offices continue to assist recipients in setting up electronic payment methods, ensuring that no one is left behind in the transition.

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule

Cost of Living Payout 2025: Every Singaporean Gets $200–$400, Check Eligibility

Impact of Dual Payments on Beneficiaries

Experts in financial assistance and social policy have weighed in on the implications of dual payments for Social Security recipients. Dr. Margaret Anderson, an economist specializing in Social Security programs at the Brookings Institution, noted that “this approach to ensure timely payments is a positive step toward addressing the financial stability of vulnerable populations, especially during the holiday season.”

Anderson further explained, “The October and December double payments will help mitigate any potential disruption caused by the timing of weekends or holidays. This ensures that beneficiaries will not face unnecessary hardships due to delayed benefits.”

Experts also highlight the importance of budgeting for dual payments, especially since some recipients may be tempted to treat the second payment as a windfall. Financial planning assistance is crucial during these times to avoid overspending and ensure funds last throughout the month.