Social Security Disability Insurance: When it comes to Social Security Disability Insurance (SSDI) payments in October 2025, millions of Americans lean on this crucial benefit to help manage their monthly expenses. Whether you’re a longtime beneficiary or applying for the first time, knowing when your payment arrives and how much you can expect is essential. This guide unpacks everything about SSDI payouts this October—from payment schedules and amounts, to eligibility, recent changes, and tips to keep your benefits flowing smoothly. It’s written so that even a 10-year-old can get it, but also packed with valuable insights for adults managing these benefits. Let’s get into the nuts and bolts of SSDI payments for October 2025 and beyond.

Social Security Disability Insurance

Social Security Disability Insurance (SSDI) payments in October 2025 are delivered on a schedule tailored to birthday groups, easing distribution. SSI recipients will enjoy an uncommon bonus with two payments this month. Knowing your payment date, expected amount, and how to keep your info current will help you manage benefits like a pro. With good info and preparation, you can confidently handle your SSDI benefits into 2026 and beyond.

| Topic | Details |

|---|---|

| SSDI Payment Dates | October 3 (early starters), 8, 15, 22 based on birth date |

| SSI Special Note for October | Two SSI payments: Oct 1 and Oct 31 due to Nov 1 weekend |

| Average SSDI Payment (2025) | Around $1,760 per month (varies by individual) |

| Maximum SSI Payment (2025) | $967 individual, $1,450 couple, $484 essential person |

| How to Check Payment Status | Use SSA online account or call Social Security Administration |

| Official Source | Social Security Administration |

What is SSDI? A Friendly Overview

SSDI is a federal program managed by the Social Security Administration (SSA) that provides monthly cash benefits to folks who can’t work because of a disability, but who have paid Social Security taxes while employed. The program started way back in 1956 to help protect workers from financial hardship if they become disabled and unable to hold a job.

Think of SSDI like insurance you pay for through payroll each week—if you get hurt or sick and can’t work, SSDI comes through with a paycheck. This safety net is different from Supplemental Security Income (SSI), which is need-based and for disabled or elderly people who may not have enough work history to qualify for SSDI.

Who Qualifies for SSDI? Understanding Eligibility Criteria

Not everyone qualifies for SSDI, so here’s the lowdown on who can get it:

- Disability Definition: Your medical condition has to meet SSA’s definition of disability. This means it must prevent you from working for at least 12 months or likely lead to death. The disability should be severe enough to limit your ability to perform any substantial gainful activity.

- Work Credits: Generally, you must have earned 40 work credits, with 20 earned during the last 10 years prior to becoming disabled. Work credits are calculated based on your yearly earnings and payroll taxes.

- Age Factor: You typically have to be under full retirement age (usually 67) to qualify. Over that age, disability benefits turn into normal retirement benefits.

- Residency and Citizenship: You must be a U.S. citizen or meet certain residency requirements.

The application process can be lengthy and complex, often taking months or even years, particularly if you have to appeal an initial denial. So, patience and proper documentation are key to success.

Social Security Disability Insurance in October 2025: When and How Much?

Payment Schedule for October 2025

SSA doesn’t pay everyone on the same day. Instead, payments are spread throughout the month based on either your birth date or the date you started receiving benefits. For October 2025, the schedule is:

- October 3: For beneficiaries who started receiving payments before May 1997 or those who receive both SSDI and SSI.

- October 8: If your birth date falls between the 1st and the 10th.

- October 15: If your birth date falls between the 11th and 20th.

- October 22: If your birth date falls between the 21st and the 31st.

This approach smooths out the workload for the SSA and ensures payments don’t overload banks or systems on a single day.

October 2025 SSI Double Payment

Here’s a twist for October 2025—if you receive Supplemental Security Income (SSI), you’ll get two payments this month. This happens because November 1, the normal SSI payment day for November, lands on a Saturday. So, SSA sends the November payment early on October 31.

This bonus means that SSI recipients will receive:

- October 1 (regular October payment)

- October 31 (November’s payment sent early)

No separate payment will be made on November 1. This double payout can help many families gear up for winter expenses.

How Much SSDI Will You Get?

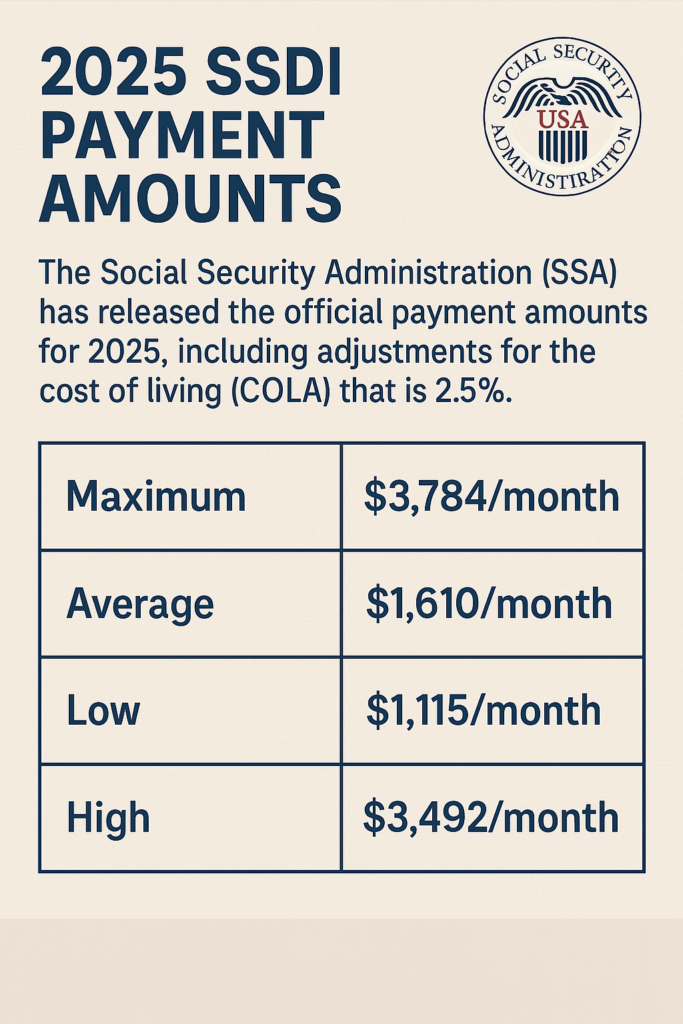

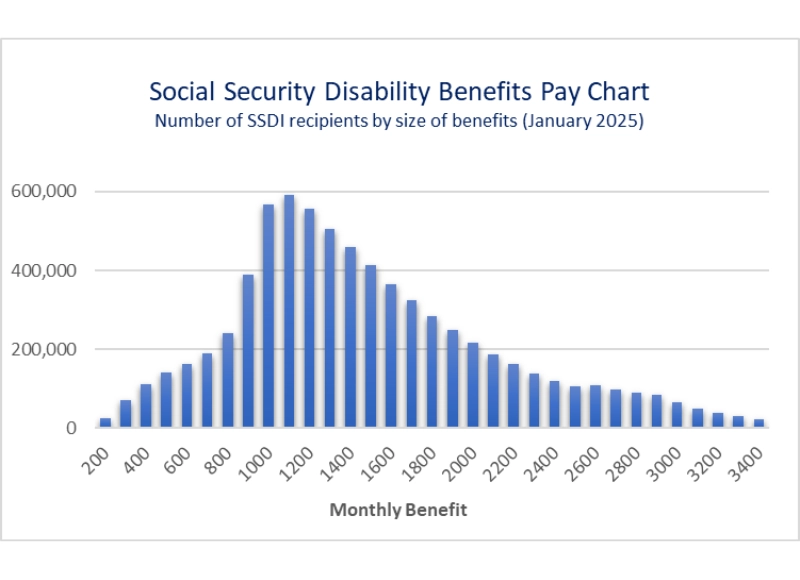

SSDI payments depend on your lifetime earnings, but here’s a broad snapshot based on 2025 data:

- Average monthly SSDI payment: about $1,760.

- Maximum monthly SSDI payment: can go as high as $4,018, typically for high earners with strong work history.

- Additional payments: Spouses and children may also receive benefits, roughly $460–$485 per month for each eligible dependent.

For SSI in 2025:

- $967 maximum for individuals,

- $1,450 maximum for couples,

- $484 for an “essential person” (someone who relies financially on the SSI recipient).

Some states add their own supplements, boosting these numbers locally.

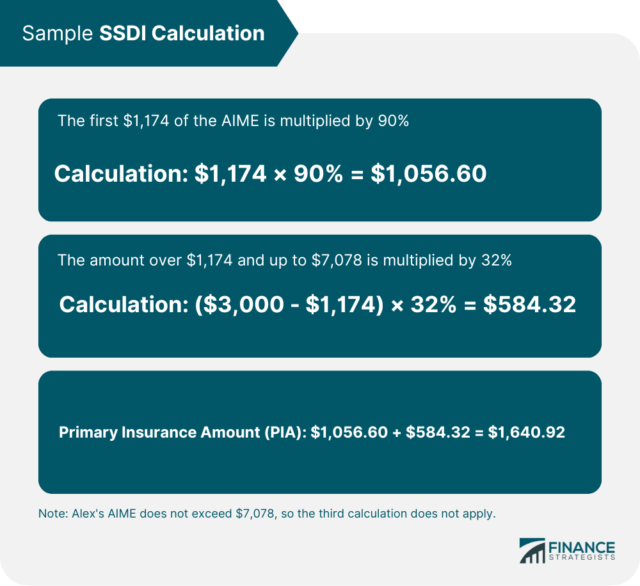

How Are Social Security Disability Insurance Payments Calculated?

Your SSDI benefits are calculated using your average indexed monthly earnings (AIME) over your 35 highest-earning years, adjusted for inflation, and then applying a formula to reach your Primary Insurance Amount (PIA). This amount represents your monthly benefit at full retirement age.

If you start benefits before full retirement age, your monthly amount may be reduced.

How to Check Your SSDI Payment Details?

Want to know exactly when to expect your money and how much it will be? Here’s how:

- Create or log into your SSA account online at ssa.gov/myaccount. This lets you see upcoming payments, amounts, and other details.

- Call Social Security: The SSA’s help desk is available at 1-800-772-1213 (Monday – Friday, 8 a.m. to 7 p.m. local time).

- Bank statements: Keep an eye on your direct deposit or check status in your bank account around your expected payment date.

It’s critical to keep your personal information updated with SSA—address changes, bank account updates, and changes in disability status all affect your payments.

Common SSDI Challenges and Tips

When Payments Stop or Change

SSDI may stop if your condition improves or if you return to work and earn over the allowed amount. The SSA conducts continuing disability reviews periodically to check eligibility.

Work While on SSDI

You can test the waters with a “trial work period,” where you can earn money for up to nine months without losing benefits. But exceeding substantial gainful activity (SGA) limits typically affects your benefits.

Appeals Process

Many initial SSDI claims are denied. Don’t give up! You have the right to appeal, request a hearing, or pursue further review. Hiring a qualified disability lawyer can boost your chances.

SSDI and Other Benefits: What You Should Know

If you’re on SSDI for two years, you usually become eligible for Medicare. If you have limited income, you might also qualify for Medicaid.

Benefits like food assistance (SNAP), housing vouchers, and state disability programs can sometimes work alongside SSDI, but rules vary by state.

Recent Updates for 2025

SSA announced a 2.7% Cost-of-Living Adjustment (COLA) starting January 2026, which will increase monthly SSDI and SSI payments slightly to keep up with inflation. October’s unique double SSI payment is rare, triggered by the calendar and the weekend fall of November 1.

Impact of Emergencies and Government Shutdowns

SSDI payments are considered critical and continue even during government shutdowns, thanks to direct deposit systems and contingency plans SSA maintains. This reliability ensures recipients can count on their support.

October Social Security Payments: Why You Might Get Two SSI Checks This Month

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Goodbye Taxes? New U.S. Law Could Make 90% of Social Security Payments Tax-Free by 2026