Millions of U.S. retirees are set to receive a modest increase in their benefits next year, but most will see that boost consumed by soaring Medicare costs. The Social Security 2026 COLA (cost-of-living adjustment) is projected at 2.8 percent, while the standard Medicare Part B premium is expected to rise 11.6 percent — the steepest single-year jump in the program’s history.

According to the Social Security Administration (SSA) and the Centers for Medicare & Medicaid Services (CMS), the average beneficiary could see their net monthly income rise by only a fraction of the announced increase, as healthcare inflation continues to outpace broader economic trends.

Table of Contents

Social Security 2026 Hike

| Key Fact | Detail |

|---|---|

| 2026 Social Security COLA | 2.8% increase (approx. $56/month for average retiree) |

| Medicare Part B premium | $206.50/month projected (up 11.6%) |

| Part B deductible | Expected to rise to $288 |

| Net impact | Much of COLA increase offset by rising health costs |

| Official Website | SSA |

A Modest Increase Meets Record Costs

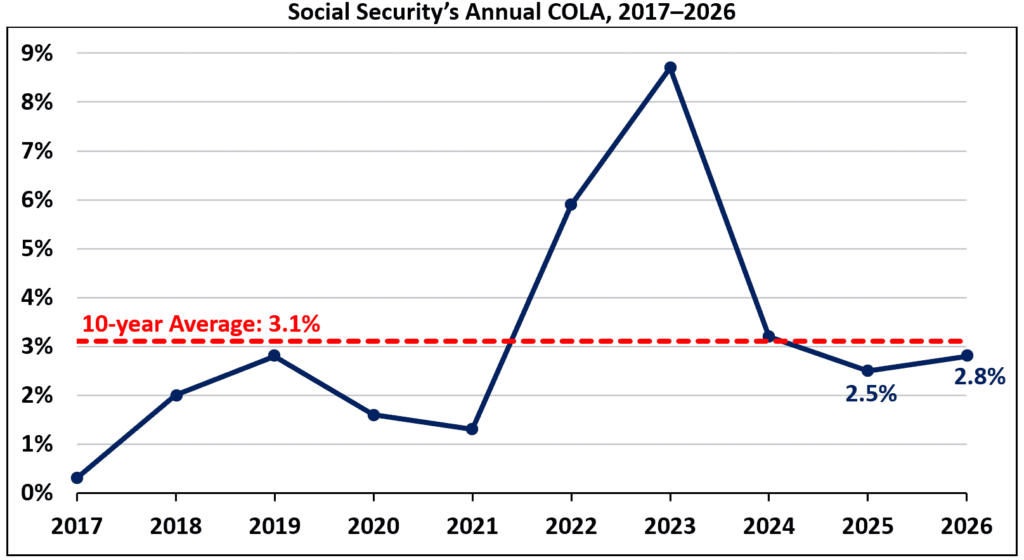

The 2026 cost-of-living adjustment is designed to protect purchasing power by linking benefits to inflation measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While inflation has moderated from its peak in 2022, medical costs remain stubbornly high.

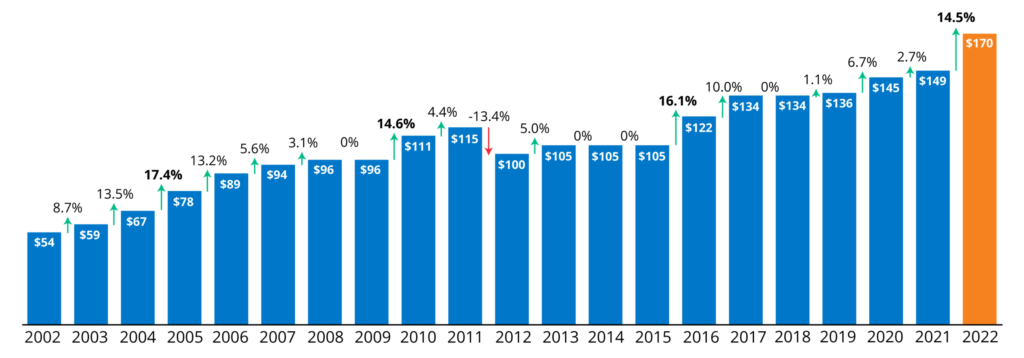

CMS attributes the premium spike to increased spending on outpatient services, more expensive pharmaceuticals, and higher utilization rates among the aging Baby Boomer population. The standard Part B premium will reach $206.50, a rise of $21.50 from 2025.

“This is the steepest Part B premium increase we’ve ever seen,” said Mary Johnson, a Social Security and Medicare policy analyst at The Senior Citizens League. “For many retirees, the COLA increase will effectively disappear after their premium deduction.”

The Math Behind the COLA vs. Premium Squeeze

An average retiree currently receiving $1,995 a month will see their gross benefit rise by about $56. But nearly half of that increase will be consumed by the Medicare premium hike.

For lower-income retirees who depend almost entirely on Social Security, this means little to no net gain — and in some cases, a real decline in purchasing power once inflation in food, rent, and utilities is factored in.

Historical Trends Show a Persistent Gap

This imbalance between COLA increases and Medicare premium hikes is not new. Over the past decade, COLA has averaged around 2.2 percent annually. Medicare Part B premiums, meanwhile, have grown by an average of 5.5 percent each year, according to CMS data.

During years of low inflation, such as 2016 and 2021, Medicare premium increases outpaced COLA so sharply that some retirees saw no net gain at all. Experts say this structural mismatch is eroding the real value of Social Security benefits over time.

“COLA doesn’t reflect the real basket of goods seniors buy,” said Dr. Elena Martinez, a health economist at Georgetown University. “Medical inflation consistently runs higher than general inflation, meaning seniors lose purchasing power even when benefits rise.”

Real-Life Impact: Seniors Feel the Pinch

For retirees on fixed incomes, these adjustments are more than numbers on a government chart — they shape daily life.

Evelyn Harper, 72, from Arizona, said her monthly Social Security check is her primary source of income. “Last year, my Medicare premium went up more than my COLA. I didn’t get a raise. I got a reminder that everything costs more,” she said.

Similarly, James Richardson, 68, from Florida, noted that his prescription drug costs have climbed steadily. “Every extra dollar seems to get eaten up by healthcare. It feels like I’m running in place.”

Hold Harmless Rule: Protection for Some, Not All

The “hold harmless” provision in federal law ensures that for most Social Security beneficiaries, Medicare premium increases cannot reduce their net benefit payments. However, this protection does not cover everyone.

High-income beneficiaries — those earning more than $103,000 annually — pay higher income-related premiums and will feel the full impact of the increase. New enrollees and individuals who pay premiums directly (rather than through their Social Security check) also lack this protection.

“The hold harmless rule prevents benefit checks from shrinking, but it doesn’t guarantee meaningful growth,” explained David Certner, legislative counsel for AARP. “For many, the increase is neutralized.”

The Broader Economic Picture

The 2026 COLA and Medicare adjustments reflect broader demographic and fiscal trends. By 2030, 1 in 5 Americans will be over the age of 65, according to the U.S. Census Bureau. Rising healthcare demands will continue to pressure Medicare funding, while the Social Security Trust Fund faces long-term solvency challenges.

The Medicare Trustees Report projects that Part A (Hospital Insurance) funds could become insolvent by 2036, and the Social Security Trust Fund may face shortfalls by the early 2030s unless Congress intervenes.

“We’re entering a period where demographic realities and fiscal pressures collide,” said Paul Van de Water, senior fellow at the Center on Budget and Policy Priorities. “Without policy reforms, these annual benefit adjustments will increasingly feel like a shell game.”

Policy Debates Intensify

The growing gap between COLA increases and healthcare costs is fueling political debate in Washington. Democrats have proposed expanding Social Security benefits and using a more senior-specific inflation index — the CPI-E (Consumer Price Index for the Elderly) — to calculate COLA.

Republican lawmakers, meanwhile, have floated proposals to reduce long-term program costs through means testing, eligibility adjustments, or raising the full retirement age.

“We need to protect earned benefits and lower costs for seniors,” said Sen. Debbie Stabenow (D-Mich.) in a statement.

“Reforms must focus on sustainability, not just short-term relief,” countered Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee.

Alternative Proposals and Reform Ideas

Several policy proposals are on the table:

- CPI-E adoption: Tying COLA to a seniors’ cost index would likely result in higher annual adjustments.

- Medicare cost containment: Negotiating more aggressively on drug prices or limiting premium growth.

- Trust fund stabilization: Options include raising payroll tax caps or adjusting benefits for high earners.

- Integrated retirement reform: Some analysts argue for a holistic reform addressing both Social Security and Medicare funding together, rather than in isolation.

“A piecemeal approach won’t work,” said Dr. Jason Adler, professor of public policy at the University of Michigan. “We need a structural fix that balances fiscal responsibility with protecting older Americans.”

Planning Ahead: What Retirees Can Do

While the policy debate unfolds, financial planners stress the importance of personal preparedness. Experts recommend:

- Reviewing Medicare Advantage or Medigap plans during open enrollment to ensure coverage aligns with health needs.

- Budgeting for healthcare inflation, which has historically outpaced general inflation.

- Exploring supplemental income options, such as part-time work, annuities, or retirement savings drawdowns.

“Even modest planning can help buffer against these shocks,” said Tina Ellis, a certified financial planner based in Chicago. “Many retirees underestimate how much healthcare will cost over time.”

State-Level Impacts: High Retiree Populations Hit Hardest

States with the largest retiree populations, including Florida, Texas, California, and Arizona, are likely to feel the sharpest economic ripple effects. These states face increased demand for medical services, senior housing, and state-level assistance programs.

Florida, where nearly 22 percent of the population is over 65, may see rising strain on healthcare infrastructure and local budgets. Some state governments are exploring measures to expand Medicaid or offer targeted subsidies to seniors.

“The COLA-Medicare gap isn’t just a federal issue,” said Dr. Janet Liu, a senior policy analyst at the Urban Institute. “States are increasingly on the front lines of aging-related challenges.”

Looking Ahead: A Structural Challenge

The 2026 Social Security COLA highlights a long-term structural problem: benefit adjustments are not keeping pace with healthcare realities. As the U.S. population ages, the financial pressure on Social Security and Medicare will intensify, forcing policymakers to confront difficult choices.

“This isn’t just about next year’s check,” said Johnson of The Senior Citizens League. “It’s about how we ensure dignity and security for millions of Americans in retirement.”

Social Security 2026 COLA Is 2.8%, But Many Seniors Are Still Struggling – Check Details

Social Security Shift: Millions to Receive SSI Payments Early — Here’s the Real Reason Why

$600 Bonus for Retirees: Social Security COLA Increase Is Almost Here for Those 62 and Older

FAQ About Social Security 2026 Hike Fizzles Out

Q: When will the Social Security 2026 COLA take effect?

A: Payments reflecting the 2026 COLA will begin in January 2026. Notices will be sent to beneficiaries in December 2025.

Q: Why are Medicare premiums increasing so sharply?

A: The CMS attributes the rise to growing healthcare costs, increased use of outpatient services, and overall program spending.

Q: Does the COLA guarantee higher take-home pay?

A: Not necessarily. For many retirees, higher Medicare premiums and other healthcare costs will reduce or eliminate the net increase.

Q: Who is protected by the “hold harmless” rule?

A: Most Social Security beneficiaries with premiums deducted directly are protected from net payment reductions, but high-income individuals and others may not be covered.

Q: Will Congress intervene to address the funding gap?

A: Several proposals are under debate, including adjusting COLA calculations, reforming Medicare costs, and stabilizing trust funds. No final decisions have been made.