In January 2026, Social Security recipients will receive a 2.8% cost-of-living adjustment (COLA) increase, adding approximately $56 to the average monthly benefit. This increase is part of the annual process meant to help seniors keep pace with inflation. While this adjustment will raise the average monthly Social Security benefit to about $2,071, many seniors worry that this increase will not be enough to cover the soaring costs of healthcare, housing, and food.

Table of Contents

Social Security 2026 COLA Is 2.8%

| Key Fact | Detail/Statistic |

|---|---|

| COLA Increase | 2.8% increase in Social Security benefits for 2026 |

| Average Monthly Benefit | Approximately $2,071 per month |

| Projected Medicare Premium | Expected to rise to $206.50 per month in 2026 |

| Percentage of Seniors Concerned | 77% believe the COLA does not keep up with inflation |

| Official Website | Social Security Administration |

While the 2026 COLA increase provides some much-needed relief, it remains to be seen whether it will be enough to meet the needs of seniors struggling with rising living costs. As inflation continues to outpace the COLA increases, retirees may need to explore additional sources of income or consider alternative financial planning strategies.

The future of Social Security is closely tied to broader economic and political trends, and ongoing debates about reform will shape the benefits available to future generations of retirees.

The 2026 Social Security COLA: What Is It and How Is It Calculated?

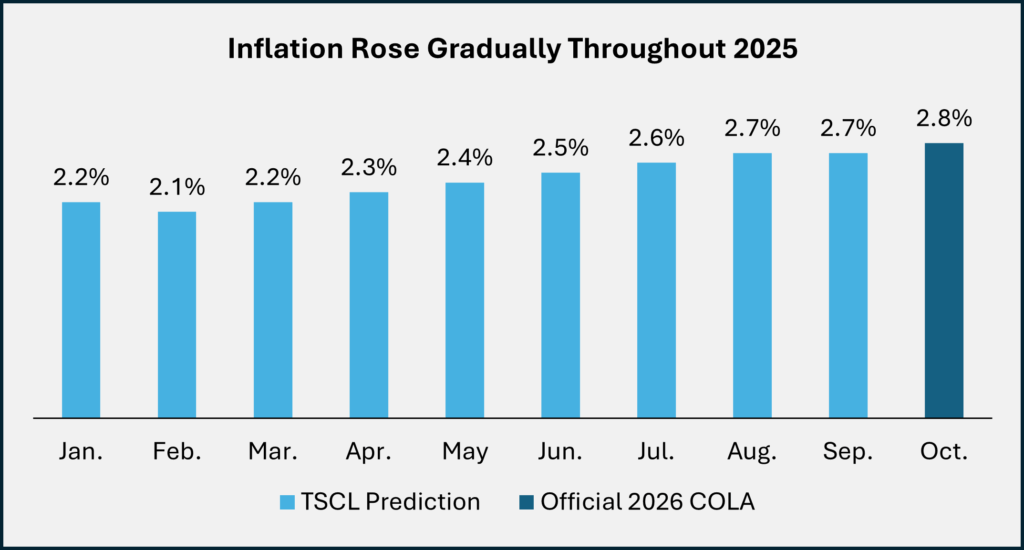

The 2026 Social Security COLA adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation across a wide range of goods and services in the economy. The 2.8% increase is designed to offset the rising costs of living, but experts argue that this calculation does not accurately reflect the reality of senior spending patterns.

Unlike the general population, seniors often face higher medical expenses, prescription costs, and housing prices. The CPI-W, which is used to calculate the COLA, does not fully account for these costs, leading some critics to suggest that it may not provide sufficient protection for seniors.

One proposed solution to this issue is to use the Consumer Price Index for the Elderly (CPI-E), which takes into account the specific spending habits of seniors, particularly in areas like healthcare and housing. Some advocates argue that a shift to CPI-E would provide a more accurate picture of the costs seniors face.

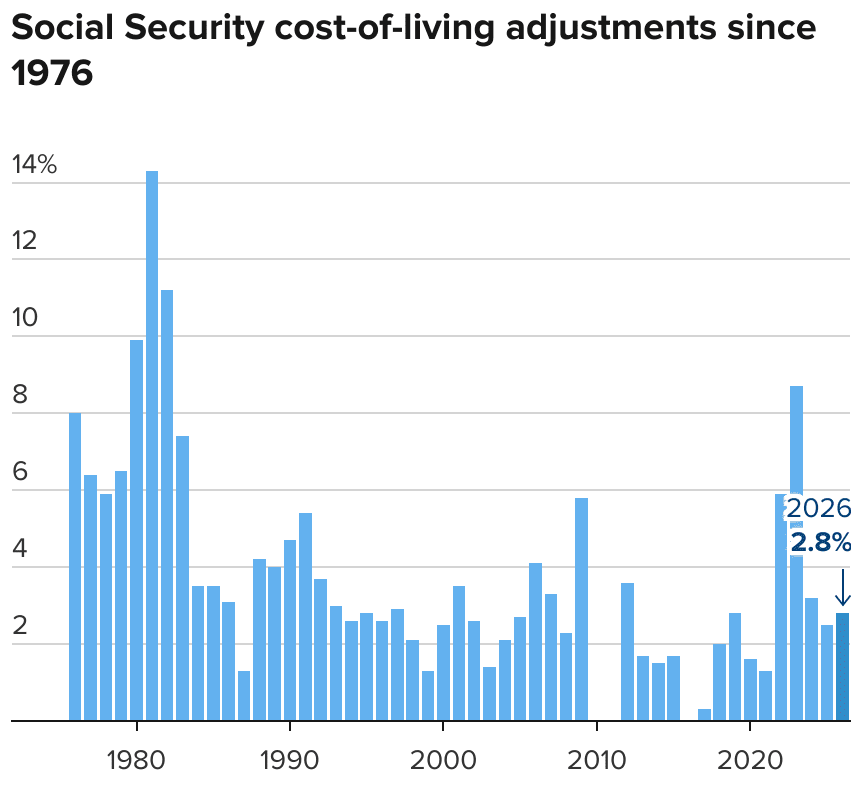

A Historical Overview of Social Security COLA Adjustments

To better understand the 2026 increase, it’s useful to look at how Social Security COLA adjustments have evolved over the years. In the 1970s, the U.S. government introduced the automatic COLA adjustments to protect Social Security beneficiaries from inflation. Prior to that, benefit amounts were fixed, leaving seniors vulnerable to the effects of rising prices.

Since then, COLA adjustments have varied, with some years seeing very small increases (or no increase at all) while others have seen substantial boosts. For instance, in 2009, the COLA was zero due to the effects of the Great Recession, while in 2011, it was just 0.0%. In contrast, 2023 saw an inflation-driven adjustment of 8.7%, one of the largest increases in recent history.

The Real Impact of Inflation on Seniors

While the 2.8% COLA increase will certainly help, it still falls short of addressing the full impact of inflation on seniors. According to a 2023 AARP survey, 77% of seniors believe that the COLA adjustments do not adequately cover the rising costs of healthcare and housing. These two sectors have seen particularly sharp increases in prices in recent years, with medical expenses rising faster than inflation, and rent and home prices climbing across the country.

For many retirees, the increase in the COLA is quickly consumed by higher healthcare premiums, prescription costs, and out-of-pocket expenses for medical care. Housing costs, which often account for a significant portion of seniors’ monthly budgets, have also surged, with many elderly renters facing steep rent hikes.

A case study from Florida highlights the struggles of retirees who live in high-demand rental markets. “Even with the COLA increase, I’m still struggling to pay my rent and cover my prescriptions,” said Mary Thompson, a 70-year-old retiree. “My rent went up by $200 last year, and my healthcare costs have increased significantly. The COLA is helpful, but it doesn’t go far enough.”

Medicare Premiums and Other Rising Costs

Another issue that diminishes the benefit of the 2.8% COLA increase is the rise in Medicare premiums. For 2026, the standard Medicare Part B premium is expected to rise to $206.50, up from $185 in 2025. This increase could consume a significant portion of the COLA adjustment, leaving seniors with less disposable income.

Given that many seniors rely heavily on Medicare for their healthcare coverage, the rising premiums present a major financial challenge. This is particularly true for those with chronic conditions who require ongoing medical care, as well as for seniors who face additional out-of-pocket costs for prescription drugs and other services not covered by Medicare.

How Can Seniors Supplement Their Social Security?

While the 2.8% COLA increase provides some relief, seniors may need to find additional ways to supplement their income. Some seniors continue to work part-time, while others explore options like reverse mortgages or renting out extra space in their homes. Financial experts suggest that delaying Social Security benefits until age 70 can increase monthly payments, providing a larger safety net in retirement.

Other retirement planning strategies include investing in a diversified portfolio, managing healthcare costs through supplemental insurance plans, and reducing fixed expenses like debt or housing costs. Financial advisors also recommend creating a budget to prioritize essential expenses and limit discretionary spending.

The Long-Term Outlook for Social Security

Looking beyond 2026, questions remain about the long-term sustainability of Social Security. As the U.S. population ages, the number of beneficiaries is expected to increase, placing greater strain on the system. Experts predict that, without reforms, Social Security may face funding shortfalls in the coming decades.

Proposals to address these challenges include increasing the payroll tax cap, which would subject higher earnings to Social Security taxes, and expanding Social Security benefits to cover a larger portion of the population. However, these proposals face significant political hurdles, and it remains uncertain when or if they will be implemented.