Singapore $2,250 AP Payout: The Singapore $2,250 AP Payout has been confirmed, and it’s one of the most talked-about government initiatives in recent years. From coffee shop chatter to corporate boardrooms, everyone wants to know: “When will I actually receive the payout?” and “How much will I qualify for?” This payout is part of the Assurance Package (AP), a scheme designed to help Singaporeans cope with rising living costs — especially after the Goods & Services Tax (GST) hike. Unlike a one-time windfall, this package is spread across five years (2022–2026), with money arriving every December. In this guide, I’ll break down everything you need to know, from eligibility and disbursement methods to practical tips on making the most of your payout.

Singapore $2,250 AP Payout

The Singapore $2,250 AP Payout is a cornerstone of the Assurance Package, reflecting the government’s commitment to shielding citizens from inflation and tax hikes. While not everyone qualifies for the full amount, the scheme ensures those who need support most receive it consistently through 2026. The smart move? Set up PayNow-NRIC, confirm eligibility, and use the payout wisely. Whether you’re a fresh graduate, a parent, or a retiree, these annual December payouts can make life just a little easier.

| Category | Details |

|---|---|

| Total Payout | Up to S$2,250 over 5 years |

| Disbursement Period | Annual December payouts (2022–2026) |

| Eligibility | Singapore Citizens aged 21 and above |

| Criteria | Based on assessable income and property ownership |

| Payment Methods | PayNow-NRIC, bank transfer, or GovCash |

| Official Info | govbenefits.gov.sg – Assurance Package |

Why the Assurance Package Exists?

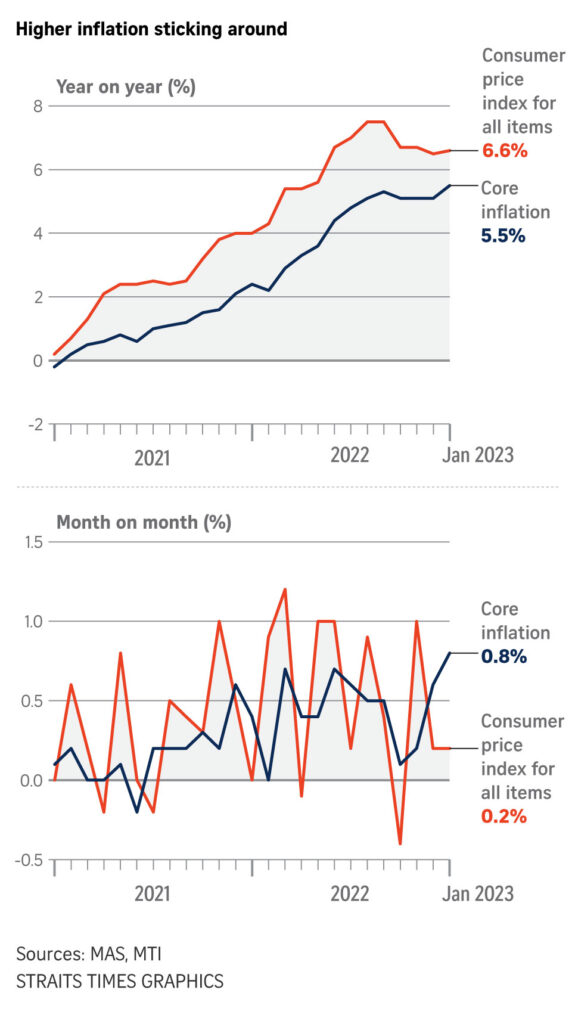

Singapore’s GST hike — from 7% to 8% in 2023, and to 9% in 2024 — was a major policy shift. GST is a consumption tax, which means everybody feels the pinch, from low-income families buying groceries to professionals paying for services.

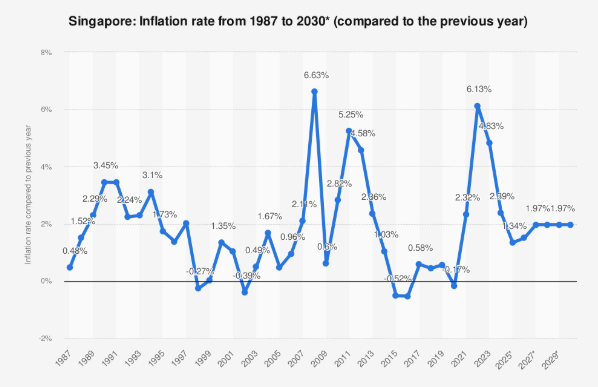

At the same time, global inflation soared due to supply chain disruptions, energy price shocks, and post-pandemic recovery. Singapore, being a highly open economy, wasn’t immune. According to the Monetary Authority of Singapore (MAS), core inflation averaged 3.1% in 2023, with food prices rising over 5% year-on-year.

The Assurance Package was created to offset these challenges. It’s a targeted cushion, ensuring the GST hike doesn’t disproportionately hurt lower- and middle-income Singaporeans. This isn’t the first time Singapore introduced such support — earlier schemes like GST Vouchers existed — but the AP is broader, larger, and lasts longer.

Breakdown of AP Payouts by Year (2022–2026)

Here’s how the payout schedule works:

- 2022: First AP payouts credited in December (S$100–S$700 depending on eligibility).

- 2023: Second payout issued in December, following the same tiered structure.

- 2024: Third payout to be rolled out in December.

- 2025: Fourth annual payout scheduled for December.

- 2026: Final payout to complete the Assurance Package.

Across the five years, the maximum payout is S$2,250, but annual amounts vary. Citizens can expect between S$200 and S$700 per year, based on their tier.

This staggered rollout provides stability, ensuring families can count on year-end support as costs rise.

Who Qualifies and How Much Will You Get?

Eligibility depends on two main factors:

- Income (assessable income declared for tax purposes).

- Property ownership (number of residential properties owned).

Here’s the breakdown:

- Full payout (S$2,250 total)

- Annual assessable income ≤ S$34,000.

- Owns 0–1 property.

- Reduced payout (S$1,350–S$1,750 total)

- Annual assessable income ≤ S$100,000.

- Owns 0–1 property.

- Minimal or no payout

- Annual assessable income > S$100,000.

- Owns more than one property.

This tiered system ensures resources are directed to those who need them most. The wealthier you are, the less likely you’ll benefit.

When You’ll Be Paid Singapore $2,250 AP Payout?

The Assurance Package payout arrives every December. It’s designed to coincide with the holiday season when expenses naturally rise.

If your eligibility status changes (for example, if your income goes up or you purchase a second property), your payout will be reassessed. In such cases, adjustments are made within two months of reassessment.

So far, most Singaporeans have seen their payouts deposited in early-to-mid December, just in time for festive spending or to cover school-related costs for the upcoming year.

How You’ll Be Paid?

There are three main ways the payout reaches you:

- PayNow-NRIC – If your NRIC is linked to your bank account, this is the fastest, safest method. Funds are credited instantly in December.

- Bank Transfer – If you’ve given your bank details to the government (e.g., during past schemes), payouts go directly into your account.

- GovCash – For those without bank accounts, payouts are made through GovCash, accessible at OCBC ATMs. Simply log in with Singpass Face Verification to withdraw cash.

Real-Life Scenarios

To make this more relatable, let’s meet some fictional but realistic Singaporeans:

- Jason, 25, fresh graduate: Annual income of S$30,000, lives in his parents’ HDB flat. Eligible for the full S$2,250 payout. He’ll get about S$450 every December.

- Aisha, 38, working professional: Earns S$85,000 annually, owns one HDB flat with her spouse. Eligible for about S$1,350 in total payouts across five years.

- Mr. Lim, 70, retiree: Owns two private condos, with an income of S$120,000 from rental. He doesn’t qualify for the Assurance Package at all.

These cases show how the payout prioritizes those with tighter budgets, while excluding high-income or multi-property individuals.

Why Singapore $2,250 AP Payout Matters for Different Age Groups?

- Young Adults (21–35): Just starting out, many are juggling student loans, transport costs, and entry-level wages. The AP payout helps with savings, investments, or daily essentials.

- Middle-Aged Adults (36–55): This group often supports children, mortgages, and aging parents simultaneously. December payouts provide timely relief, especially for year-end bills.

- Seniors (55 and above): With limited income sources and rising healthcare costs, seniors benefit most from stable, yearly payouts.

By tailoring payouts to life stages, the government ensures broad support while still targeting those who need help most.

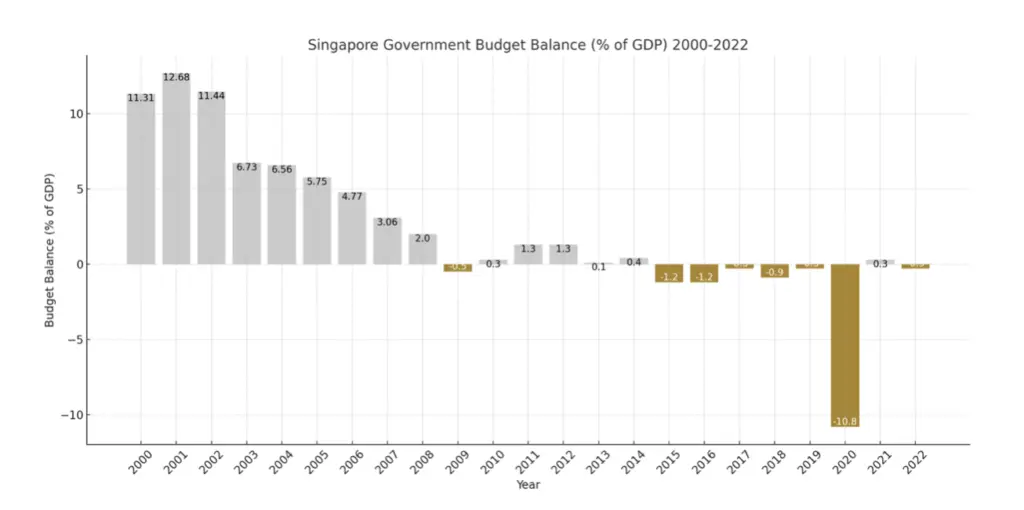

The Bigger Picture: Budget and Economy

The Assurance Package isn’t just about payouts; it reflects Singapore’s fiscal philosophy. Unlike some countries that rely on debt, Singapore funds such packages through careful budgeting and reserves.

The government allocated over S$9 billion for the AP. This large-scale support reassures citizens while maintaining Singapore’s AAA credit rating and reputation for financial prudence.

Economically, the payouts also serve as a mild stimulus. By putting cash into citizens’ hands, the government boosts consumer spending, which in turn supports businesses.

Practical Tips: How to Use the Singapore $2,250 AP Payout

It’s tempting to splurge, but here are smarter ways:

- Families: Use payouts to cover groceries, utilities, or school fees. Singapore households spend about 24% of income on housing and utilities (SingStat), so this helps.

- Young Professionals: Invest in CPF Special Account or robo-advisors. Even S$450 a year can compound significantly.

- Seniors: Prioritize healthcare or set aside funds for emergencies. Medical inflation is estimated at around 10% yearly (MOH).

Treat the payout as strategic support, not free play money.

Step-by-Step Guide to Ensure You Get Singapore $2,250 AP Payout

- Confirm Eligibility on the GovBenefits portal.

- Link PayNow-NRIC with your bank for the fastest method.

- Update Bank Details if PayNow isn’t set up.

- Download Singpass App to access GovCash.

- Track December Dates and monitor your bank statements.