Singapore $1,080 Payment: The Singapore $1,080 payment coming in October 2025 has sparked fresh conversations around financial security for seniors. This cash supplement, under the Silver Support Scheme, is aimed at older Singaporeans who may not have built up big CPF savings or steady retirement income. For many families, this is more than an allowance—it’s a way of easing the financial pressure of aging in one of the world’s most expensive cities. This article breaks down everything you need to know: eligibility criteria, payment amounts, how it compares globally, and how families can plan ahead. Whether you’re a retiree, caregiver, policymaker, or financial advisor, this is your one-stop guide.

Singapore $1,080 Payment

The Singapore $1,080 payment in October 2025 is more than a cash transfer—it’s a recognition of seniors’ contributions and an assurance that they won’t be left behind. By targeting seniors with modest savings, smaller homes, and lower household incomes, the Silver Support Scheme keeps retirement secure, independent, and dignified. For seniors, it’s peace of mind. For families, it’s a lighter burden. For policymakers, it’s proof that targeted welfare can work.

| Topic | Details |

|---|---|

| Program Name | Silver Support Scheme (Singapore Government) |

| Payment Amount | Up to S$1,080 per quarter (every 3 months) |

| Start Date | October 2025 (quarterly schedule continues) |

| Eligibility Age | Singapore Citizens aged 65+ |

| Income & CPF Requirement | CPF contributions ≤ S$140,000 at age 55; or net trade income ≤ S$27,600 (for self-employed between ages 45–54) |

| Housing Requirement | Must live in 1–5 room HDB flat, not own private property or multiple properties |

| Household Income | ≤ S$2,300 per person |

| Automatic Enrollment? | Yes — no application required |

| Official Reference | CPF Silver Support Scheme |

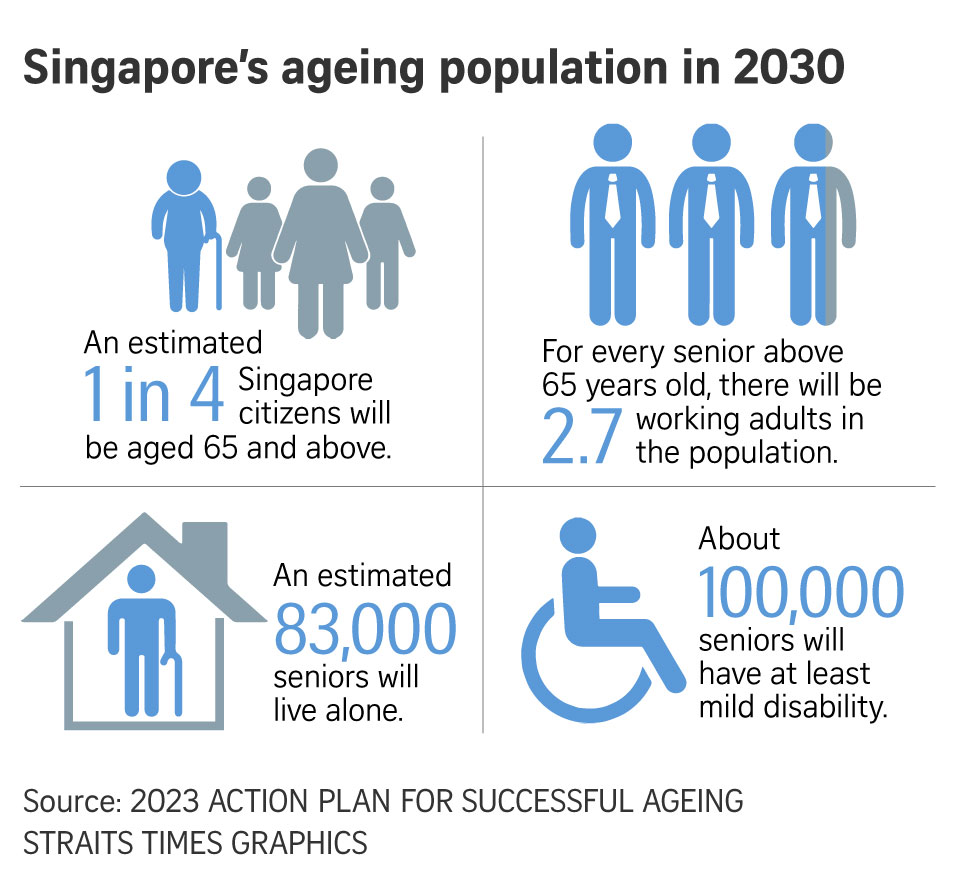

Why Now? The 2025 Context

Singapore regularly ranks as one of the most expensive cities in the world, according to the Economist Intelligence Unit. From MRT fares to groceries, healthcare bills to utilities, the rising cost of daily life hits retirees especially hard.

Consider this:

- A bowl of noodles at a hawker center now averages S$4–S$6.

- Monthly utility bills for a small HDB flat range between S$120–S$200.

- Doctor visits, even subsidized at polyclinics, can cost S$40–S$60 per appointment with medicine.

For seniors who may only have minimal savings, these numbers aren’t abstract—they’re a source of stress. The S$1,080 quarterly payout translates into about S$360 per month, enough to ease the load on basic essentials.

A Quick Look Back: How Silver Support Evolved

The Silver Support Scheme was introduced in 2016 as part of Singapore’s social safety net. It was designed to plug the gaps for seniors who:

- Worked in low-wage jobs

- Didn’t have stable CPF contributions

- Relied heavily on family or small savings

Key Milestones:

- 2016: Launch, covering about 140,000 seniors.

- 2020: Expanded coverage; payout amounts increased to keep up with living costs.

- 2025: Maximum payout raised to S$1,080 per quarter, reflecting inflation and higher expenses.

This evolution shows the government’s recognition that even in a self-reliant CPF-based system, some seniors need extra support.

Payment Schedule for 2025–2026

The payments aren’t lump sums—they’re structured to provide consistent quarterly support.

For seniors receiving the maximum payout:

- October 2025: S$1,080

- January 2026: S$1,080

- April 2026: S$1,080

- July 2026: S$1,080

Total: S$4,320 annually.

That steady, predictable rhythm makes it easier for seniors to budget, rather than receiving one large sum that might be harder to stretch across months.

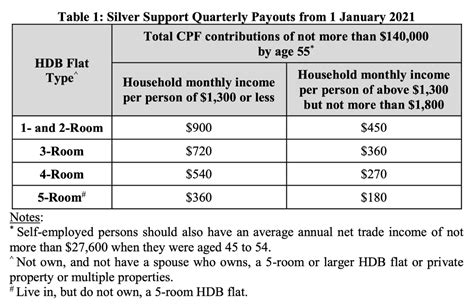

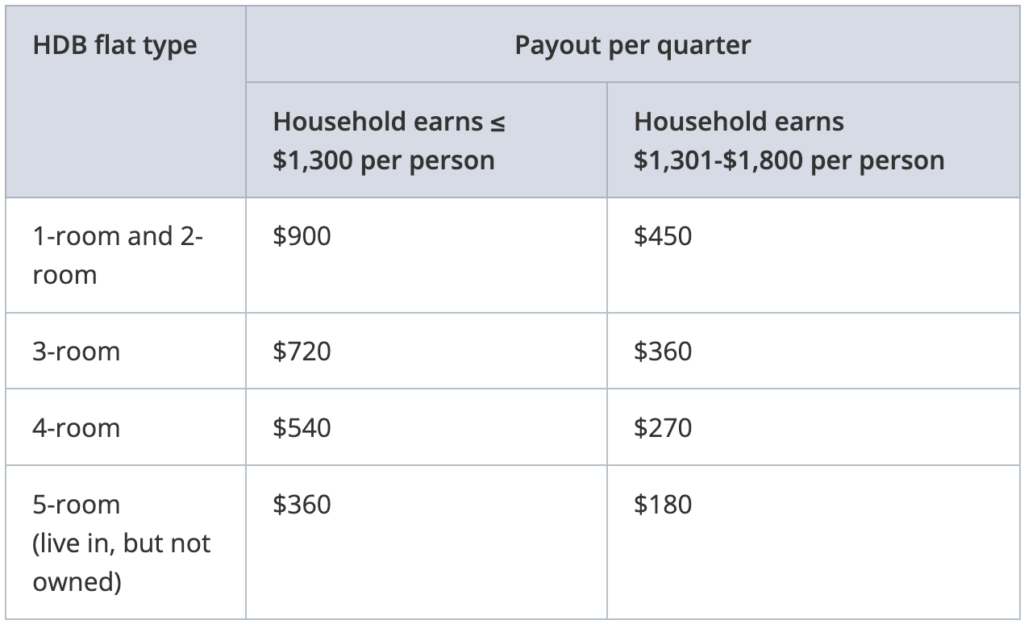

Step-by-Step Eligibility Criteria for Singapore $1,080 Payment

1. Age & Citizenship

- Must be a Singapore Citizen

- Must be 65 years or older

2. CPF Contributions / Income Test

- CPF contributions (Ordinary + Special Accounts) at age 55 must not exceed S$140,000

- For self-employed individuals, average trade income between 45–54 must not exceed S$27,600

3. Housing Rules

- Must live in a 1–5 room HDB flat

- Cannot own or co-own a large HDB flat (5-room or bigger), private property, or multiple homes

4. Household Income Test

- Household monthly income per person must be ≤ S$2,300

5. Automatic Enrollment

- Seniors don’t apply—the CPF Board auto-assesses and sends letters by December each year.

Why Singapore $1,080 Payment Matters: Real-Life Scenarios

- Uncle Tan, 70: Lives alone in a 2-room flat with no CPF savings. He qualifies for the full S$1,080 quarterly payout, which covers groceries and bills.

- Auntie Siti, 68: Lives with her husband in a 4-room flat. They receive a partial payout of S$720 each quarter, which helps with medical costs.

- Mr. Wong, 66: Lives in a 5-room flat with his daughter. Despite low CPF savings, he is not eligible due to housing ownership.

These examples show how targeted the program is—it supports those with genuine financial need, but it can exclude seniors in higher-value housing even if they feel financially stretched.

Global Comparisons: How Singapore Stands

Singapore vs. USA

- USA Social Security: Paid based on lifetime contributions. Average monthly retirement benefit: about US$1,900 (2025 projection).

- USA SSI: Means-tested, around US$914 per month for individuals.

- Singapore Silver Support: Similar to SSI, but automatic and targeted to lower-income seniors.

Singapore vs. Japan

- Japan provides a National Pension, but payouts can be as low as ¥55,000/month (~S$500) if contributions are incomplete. Silver Support fills a similar “gap” role in Singapore.

Singapore vs. Malaysia

- Malaysia’s EPF (Employees Provident Fund) is the main retirement scheme. Without strong government cash transfers like Silver Support, seniors with low EPF balances struggle more.

This comparison shows that while Singapore doesn’t have a universal pension, Silver Support is among the most targeted safety nets in Asia.

Social and Family Impact

The “sandwich generation”—middle-aged adults supporting both kids and elderly parents—feels constant financial strain. Silver Support lightens that load by giving seniors independent cash.

For society, this reduces inequality among the elderly. Seniors who worked low-wage jobs (hawkers, cleaners, caregivers) get recognition and support, while reducing dependence on their children. It’s not just financial—it’s social dignity.

Expert Commentary

According to the World Bank, targeted social pensions like Silver Support help reduce elderly poverty rates by up to 15–20% in developing economies.

The OECD notes Singapore’s system as an example of balancing self-reliance (through CPF) with government support for the most vulnerable.

Financial planners in Singapore emphasize that Silver Support is best seen as one layer of retirement security, alongside CPF Life annuities, MediSave, and family support.

Practical Tips for Families

- Check CPF Updates: Log in to My CPF to confirm eligibility letters.

- Update Banking Info: Payments can be delayed if accounts aren’t current.

- Stack Benefits: Combine Silver Support with GST Vouchers, Workfare, and ComCare if eligible.

- Encourage Independence: Allow seniors to use their payouts personally.

- Plan Healthcare Early: Silver Support helps, but doesn’t replace long-term care insurance like CareShield Life.

Singapore $2,250 AP Payout Confirmed – When You’ll Be Paid & How to Qualify

Singapore’s $1,080 Support for Seniors in October 2025 – Dates, Eligibility & Key Details

Cost of Living Payout 2025: Every Singaporean Gets $200–$400, Check Eligibility