Seniors Age 60-70 Get a $1,599 CPP Boost: If you’re a senior between the ages of 60 and 70 watching your retirement income, you might have heard buzz about a $1,599 boost to the Canada Pension Plan (CPP) coming in October 2025. Let’s separate fact from fiction with a clear, easy-to-understand guide whether you’re just starting to plan or you’re a seasoned pro looking to stay on top of your finances. The Canada Pension Plan (CPP) is a key retirement income source for millions, but it can be confusing as heck sometimes. This article breaks down the facts, shares practical advice, and explains how CPP works so you can make smart choices for your golden years.

Table of Contents

Seniors Age 60-70 Get a $1,599 CPP Boost

The Canada Pension Plan remains a crucial pillar for your retirement security, especially for seniors aged 60 to 70. Although rumors of a $1,599 boost this October 2025 are false, CPP still offers reliable, inflation-adjusted monthly payments, with the maximum for new retirees at age 65 set at $1,433. Know your eligibility, apply early, and plan your finances around your unique situation for smoother, worry-free retirement years.

| Topic | Details |

|---|---|

| Maximum CPP Monthly Payment (Oct 2025) | $1,433 (for retirees starting at age 65) |

| Average CPP Monthly Payment | $848.37 |

| Official CPP Payment Date | October 29, 2025 |

| Eligibility Age | 60 years or older |

| Contribution Requirement | At least one valid CPP contribution during working years |

| Rumored $1,599 Boost | No official or confirmed boost or double payment for October 2025 |

| Official Website | Canada.ca |

What is the Canada Pension Plan (CPP)?

Imagine CPP as a government-run piggy bank where both you and your employer have been throwing in coins throughout your working life. Once you hit retirement, that piggy bank starts paying you monthly to help cover your living expenses.

In 2025, the maximum monthly CPP retirement benefit is $1,433 for someone starting payments at age 65. Not everyone hits max payout — it depends on how much and how long you’ve contributed. Many people receive less, but every bit helps.

Clearing Up the Seniors Age 60-70 Get a $1,599 CPP Boost

Let’s get real—there is no official $1,599 boost or double payment coming in October 2025. The Canada Revenue Agency (CRA) officially confirms one regular monthly payment on October 29, 2025.

Why the rumors? Good question. People want extra support as costs go up, but chasing unverified info can lead to bad planning. Stick with official updates to keep your money game tight.

Eligibility: Are You In?

To qualify for CPP payments, here’s what you need:

- Be at least 60 years old.

- Have made at least one valid CPP contribution during your working years, either from yourself or credits transferred after divorce or separation.

- You must be a Canadian citizen or permanent resident.

- You should have lived in Canada for at least 10 years after age 18.

- Your payment amount depends on your contribution history.

- You must apply to receive CPP; it doesn’t start automatically.

Valid contributions mean you contributed through work in Canada, or credits via a spouse’s contributions after a marriage separation. If you’re still working past age 60 and contributing, you can benefit from the CPP Post-Retirement Benefit, which increases your retirement income for life.

For folks who lived or worked in Quebec, the Québec Pension Plan (QPP) functions similarly to CPP. If you worked in both Quebec and other provinces, those contributions coordinate for retirement benefits.

And if you lived/ worked in other countries with social security agreements with Canada, you might qualify for CPP alongside pensions from those countries.

When is the Payment Made?

Circle October 29, 2025 on your calendar. CPP payments drop monthly via direct deposit or by check, ready to cover your bills or that next fishing trip.

How Much Will You Actually Receive?

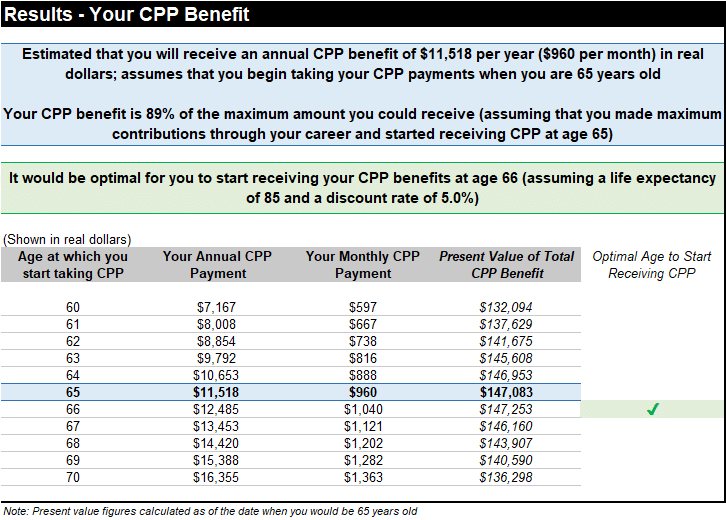

Here’s what the numbers look like depending on your situation:

| Contribution Level | Estimated Monthly CPP Payment |

|---|---|

| Maximum Contributions (39+ years) | $1,433 |

| Moderate Contributions | $800 – $1,000 |

| Limited or Sporadic Contributions | $400 – $700 |

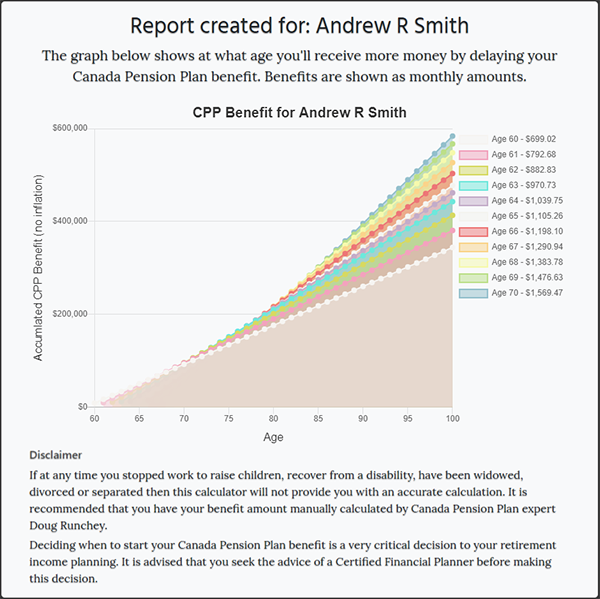

Starting CPP early (60-64) means you get a reduced payment — approximately 64% of the full amount — because you’re collecting longer. Waiting to age 70 can boost your monthly payment by up to 42% above the full amount at 65, meaning around $2,030/month if you maxed out your contributions.

How CPP Compares to US Social Security?

For US readers or those familiar with Social Security: CPP and Social Security work on similar ideas — workers contribute during their career for future retirement income, but the formulas and benefit levels differ.

CPP tends to cover about 25-33% of your pre-retirement income, which is lower than US Social Security’s average replacement rate. Unlike Social Security, CPP contributions are mandatory for Canadian workers (except Quebec contributors who pay into QPP). Both systems allow taking benefits early with a reduced payment or delaying for bigger amounts.

The Impact of Inflation on CPP Payments

CPP payments adjust quarterly for inflation to help keep up with rising costs. But don’t expect massive jumps every year. Inflation adjustments help but can’t always cover everything especially when prices for housing or healthcare rise sharply.

Planning beyond CPP is smart—consider savings, investments, and other income streams to cushion inflation’s bite.

Taxation of CPP Benefits

Heads-up: CPP income counts as taxable income in Canada. If you live in the US and receive CPP, you may be taxed by both countries, but you can usually claim foreign tax credits thanks to the Canada-US tax treaty.

Understanding tax implications will help you budget and avoid unwelcome surprises at tax time.

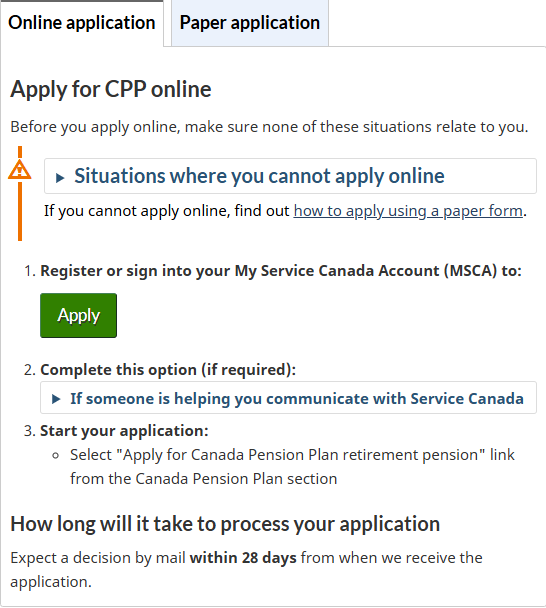

How to Apply for Seniors Age 60-70 Get a $1,599 CPP Boost?

Here’s a straightforward way:

- Apply online through the Service Canada website.

- Or apply by mail or in person using forms available on the site or at Service Canada offices.

- Gather your documents: Social Insurance Number (SIN), government-issued photo ID, proof of age, proof of Canadian residence, banking info for direct deposit, and work history showing CPP contributions.

- Apply a few months before you want payments to start.

Common Mistakes to Avoid

- Waiting too long to apply when you want payments to start.

- Expecting automatic payments without applying.

- Falling for scams or misinformation claiming extra boosts or bonus payments.

- Not considering the tax impacts on your CPP income.

- Forgetting that starting CPP early means permanent reductions.

Tips to Maximize Your CPP

- Delay retirement payments until age 70 if you can — that 42% bump is a big deal.

- Combine CPP with private savings, workplace pensions, or Old Age Security (OAS).

- Stay updated on government changes — retirement ages and contribution rates can shift.

- Consider working part-time after retirement; CPP payments don’t get reduced if you keep working.

Where to Get Help with CPP?

If you need assistance or have questions, Service Canada is your best resource:

- Phone: 1-800-277-9914

- Website: Service Canada Contact

- Local Service Canada Centers for in-person help

CRA Announces Payment Dates for October 2025: Know CRA latest payment date and amount

Canada CRA $1693 CPP Increase in 2025 – Will you get this payment? Check Eligibility & Payment Date

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates