Seniors 63+ Getting a New Social Security Payment: If you’re 63 or older, chances are you’ve seen news or social media posts claiming that “Seniors 63+ are getting a new Social Security payment in days.” Sounds exciting, right? But what does it actually mean — and are you one of the folks who’ll get that check? In this in-depth guide, we’ll break down exactly what’s going on. We’ll look at who’s eligible, how the payment schedule works, and what you can do right now to make sure you don’t miss a dime of what you’ve earned. Whether you’re already collecting benefits or thinking about filing soon, this article will help you understand what’s real, what’s rumor, and how to make the most of your Social Security.

Table of Contents

Seniors 63+ Getting a New Social Security Payment

If you’re 63 or older, this so-called “new Social Security payment” likely refers to your regular or newly initiated benefit check — not a surprise bonus. You’ve worked for it, you’ve earned it, and it’s your right to collect it when the time is right for you. The key takeaway: claiming age, earnings history, and timing make all the difference. By setting up your online SSA account, understanding your payment schedule, and planning strategically, you’ll make sure your retirement years are stable and stress-free. Remember, Social Security is more than just a government check — it’s your financial safety net built from decades of hard work. So make the most of it, stay informed, and enjoy the retirement you deserve.

| Topic | What to Know |

|---|---|

| Earliest age to claim benefits | Age 62 is the earliest you can start retirement benefits. |

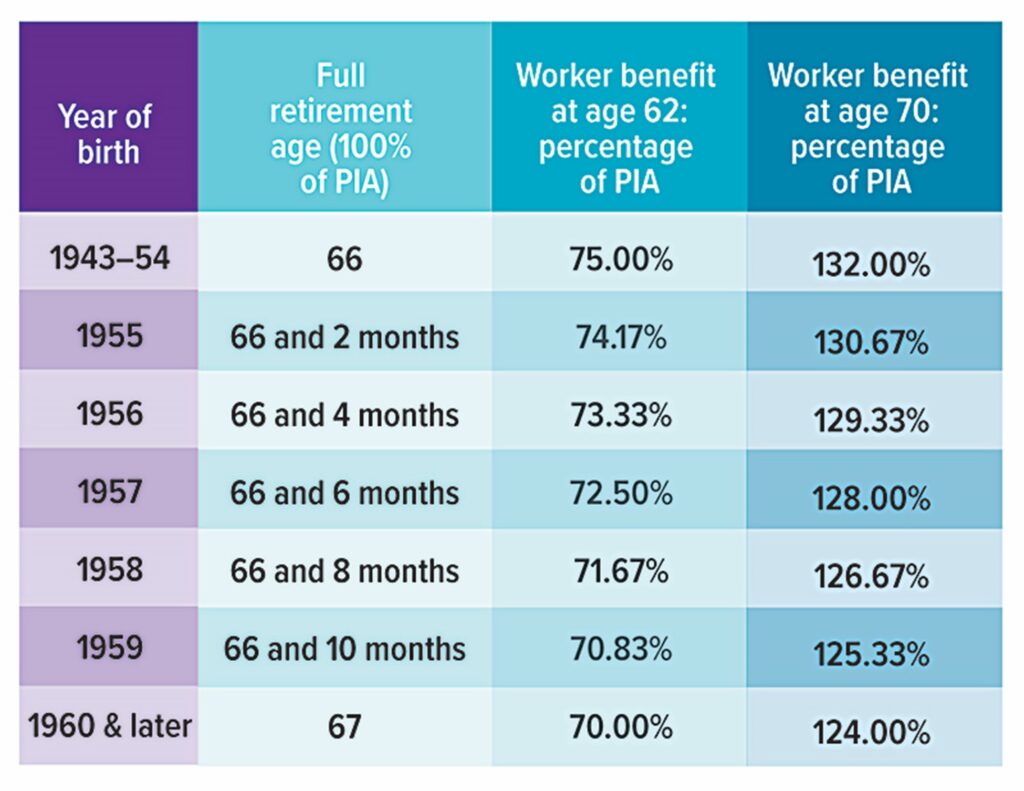

| Full Retirement Age (FRA) | For people born 1960 or later, FRA = 67. |

| Average monthly benefit (2025) | Around $2,002 per retired worker. |

| Maximum possible benefit (2025) | Up to $5,108 for those who delay until 70. |

| Payment schedule | Based on your birthday: 2nd, 3rd, or 4th Wednesday of the month. |

| Best next step | Set up your my Social Security account and check your personalized estimate. |

What’s the deal with this “new payment”?

The phrase “new Social Security payment in days” usually pops up whenever there’s a scheduled monthly benefit, a cost-of-living adjustment (COLA), or a change in payment schedule. It can also refer to new or increased benefits that retirees become eligible for as they reach certain ages or meet new income thresholds.

If you’re 63 or older, that means you’re already within the eligible age bracket to receive retirement benefits — provided you’ve worked enough years to earn the required number of credits. And if you’ve just applied, it’s true: you might receive your first check in a matter of days, depending on when the Social Security Administration (SSA) finalizes your claim.

So yes — there is a new payment coming, but it’s not a one-time “bonus.” It’s either part of the regular SSA payment cycle or the result of an adjustment like COLA or a newly approved claim.

Who’s eligible for a New Social Security Payment?

To receive retirement benefits, you must:

- Be at least 62 years old.

- Have earned 40 work credits (roughly equal to 10 years of work under the U.S. Social Security system).

- File an application with the SSA.

If you meet these criteria and you’re already 63 or older, you’re eligible. However, the amount you receive depends on when you claim your benefits relative to your Full Retirement Age (FRA).

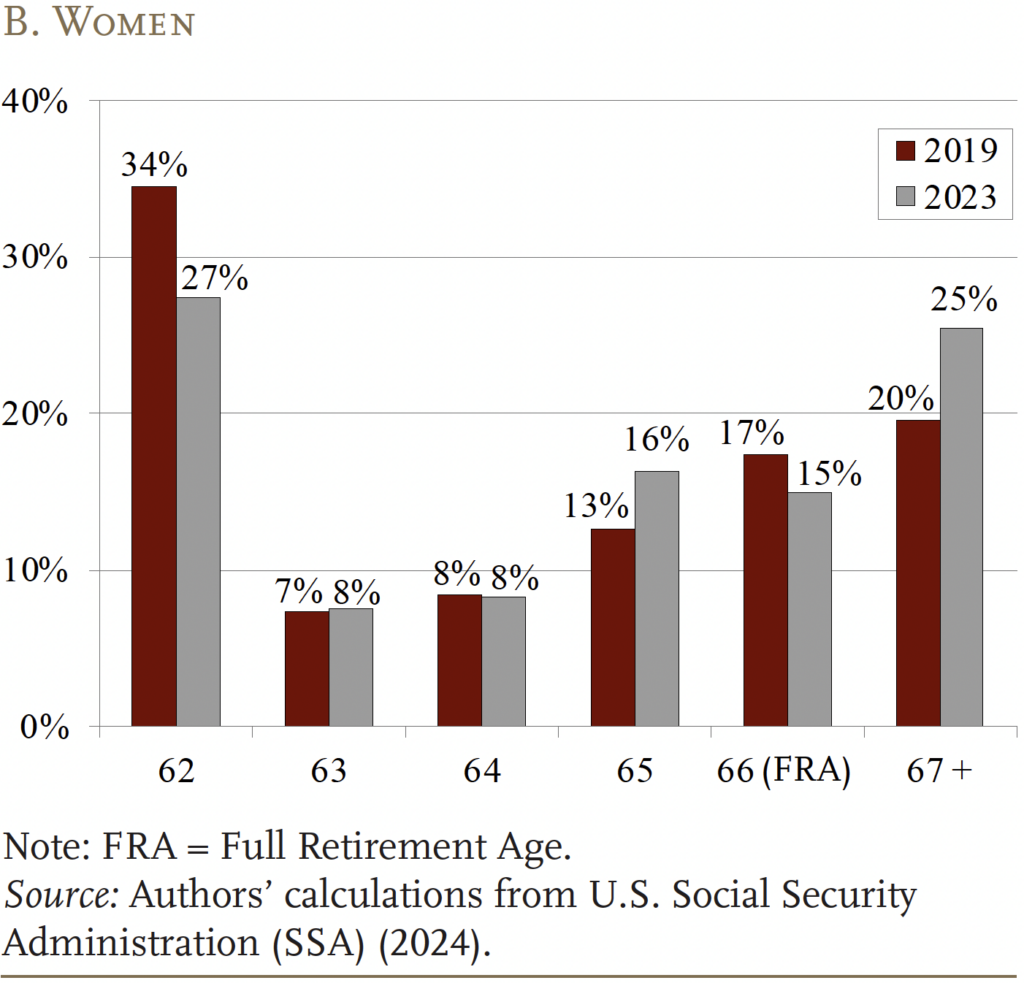

How claiming age affects your benefits?

Let’s say your FRA is 67 (for those born in 1960 or later). Here’s what you can expect:

- Claim at 62 → about a 30% reduction in benefits.

- Claim at 63 → around a 25% reduction.

- Claim at 64 → about a 20% reduction.

- Claim at 65 → about a 13% reduction.

- Claim at 66 → about a 7% reduction.

- Claim at 67 → you get 100% of your benefit.

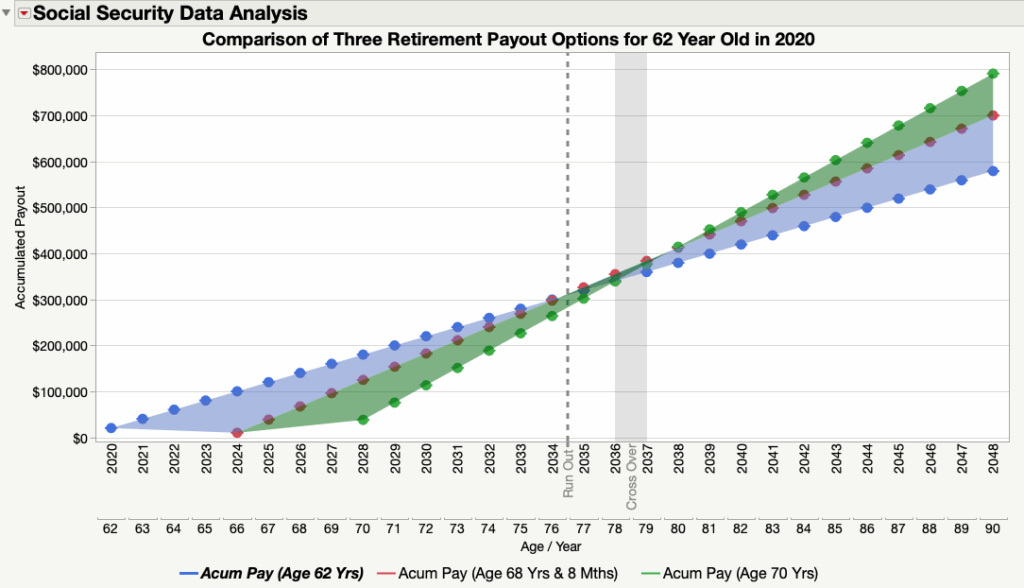

Each year you delay after your FRA (up to age 70) increases your benefit by about 8% per year, thanks to delayed retirement credits.

That means waiting just a few years can add hundreds of dollars to your monthly income for life.

Understanding the payment schedule

The SSA uses a birthdate-based schedule for retirees who filed after May 1997:

- Birthdays 1st–10th: Paid on the 2nd Wednesday of the month.

- Birthdays 11th–20th: Paid on the 3rd Wednesday.

- Birthdays 21st–31st: Paid on the 4th Wednesday.

If you receive both Social Security and SSI, or if you filed before May 1997, your payment usually arrives on the 3rd of each month instead.

This structure keeps payments spaced out and helps the SSA manage deposits more efficiently.

How much will you actually receive?

The exact amount of your Social Security benefit depends on your lifetime earnings, claiming age, and work record.

Current average and maximum benefits

- The average monthly benefit for retired workers in 2025 is $2,002.

- The maximum benefit at age 70 is $5,108 per month.

- Claiming early, at age 63, can reduce the payment to around $1,364–$1,500 monthly for an average earner.

If you’ve had a high income throughout your career, your benefit will be on the higher end. If you had lower lifetime earnings or took years off work, your benefit may be smaller.

Cost-of-Living Adjustments (COLA)

Every January, benefits increase slightly to keep up with inflation. In 2025, the COLA adjustment is projected to be around 3.2%, following 2024’s increase of 3.4%. You don’t need to do anything — the increase is applied automatically.

Step-by-Step Guide to Ensure You Get a New Social Security Payment

Step 1: Create your “My Social Security” account

Visit SSA.gov/myaccount to set up your profile. You’ll be able to view your earnings history, check your benefit estimates, and track your payments.

Step 2: Verify your earnings record

Errors in your reported wages can lower your benefit. Cross-check your SSA record against your W-2s or tax filings to ensure it’s correct.

Step 3: Use the Retirement Estimator

The SSA’s Retirement Estimator lets you see how your benefit changes depending on the age you choose to start. Try running a few scenarios (age 63 vs 67 vs 70) to understand your options.

Step 4: Decide when to file

Consider your health, income needs, and whether you’re still working. If you’re in good health and can wait, delaying can pay off in the long run.

Step 5: File online or at your local SSA office

You can apply entirely online or schedule an appointment at your nearest office. Make sure to have your identification, Social Security number, and banking details ready for direct deposit.

Step 6: Track your payment

Once approved, you’ll receive your first payment about a month after your benefit start date. Direct deposits are the fastest and safest way to receive your funds.

Practical tips from professionals

- Avoid claiming too early. Unless you really need the money, waiting until your FRA or later ensures you get the full benefit you’ve earned.

- Watch the earnings limit. If you claim benefits before FRA and still work, your benefits might be temporarily reduced if you earn over $22,320 (2024 limit). After you reach FRA, there’s no limit.

- Coordinate with your spouse. If you’re married, spousal benefits can impact when each of you should claim for maximum income.

- Don’t fall for scams. The SSA never calls to demand payments or ask for personal info via phone or text. If someone does, it’s a scam.

- Keep your taxes in mind. Up to 85% of your Social Security income can be taxable depending on your combined income.

Example scenarios

| Example | Age When Claimed | FRA | Monthly Benefit | Key Takeaway |

|---|---|---|---|---|

| Linda, 63 | 63 | 67 | ~$1,450 | Claims early due to medical bills; reduced benefit but immediate income. |

| Robert, 66 | 66 | 67 | ~$1,900 | Waits longer, nearly full benefit; plans to continue part-time work. |

| Janet, 70 | 70 | 67 | ~$2,500 | Delayed claiming, receives about 25% more per month for life. |

Common reasons for a “new payment”

- Newly approved application – Your first benefit check is being issued.

- Annual COLA increase – Adjustments for inflation.

- Back pay – If your claim took months to process, you may receive lump-sum back payments.

- Recalculation of benefits – SSA reviews earnings annually, and new income may slightly boost your benefit.

- Survivor or spousal benefits – If your spouse or partner recently passed away, you may be eligible for higher survivor benefits.

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

Social Security Boost: How a Simple Strategy Can Increase Your Monthly Payments by $100s

Social Security Disability Insurance (SSDI) Payments in October 2025: Check Payout Amount and Date

Looking ahead: Social Security in 2026 and beyond

Social Security undergoes small adjustments every year. In 2026, the full retirement age (FRA) for all new retirees will officially be 67, marking the end of the gradual increase that began decades ago. Meanwhile, policymakers continue to debate long-term funding solutions. The SSA’s trust fund is projected to be able to pay full benefits until about 2035, after which partial reductions may occur if no legislative action is taken. That’s why understanding your benefits now — and planning ahead — is more important than ever.