Senate Democrats Demand Answers: that headline has been trending across U.S. politics this week, stirring anxiety among retirees, workers, and financial planners alike. Social Security isn’t just another government program; it’s the backbone of retirement for over 71 million Americans. When the Social Security Commissioner hinted that raising the retirement age could be “on the table,” it sparked a political firestorm and left many wondering what it means for their future. This article unpacks the controversy in plain English, gives historical perspective, explores the political battle, and offers practical guidance on how to prepare. It’s written to be clear enough for a middle schooler but deep enough for professionals and policymakers.

Senate Democrats Demand Answers

The uproar over Senate Democrats demanding answers as Social Security Chief sparks retirement age confusion shows how personal this issue is. For millions, Social Security isn’t a political talking point — it’s rent money, grocery money, and medical bills. Right now, the official position is that raising the retirement age isn’t on the table. But history shows reforms eventually come, and the clock to 2034 is ticking. Your best move? Stay informed, plan early, and diversify your retirement strategy. That way, no matter what Washington decides, you’re ready.

| Topic | Details |

|---|---|

| Main Players | SSA Commissioner Frank Bisignano, Senate Democrats (Elizabeth Warren, Ron Wyden, Chuck Schumer) |

| The Spark | Bisignano said “everything’s being considered” on reforms, causing panic about raising the retirement age. Later clarified it’s not policy. |

| Current Retirement Age | 67 for anyone born 1960 or later |

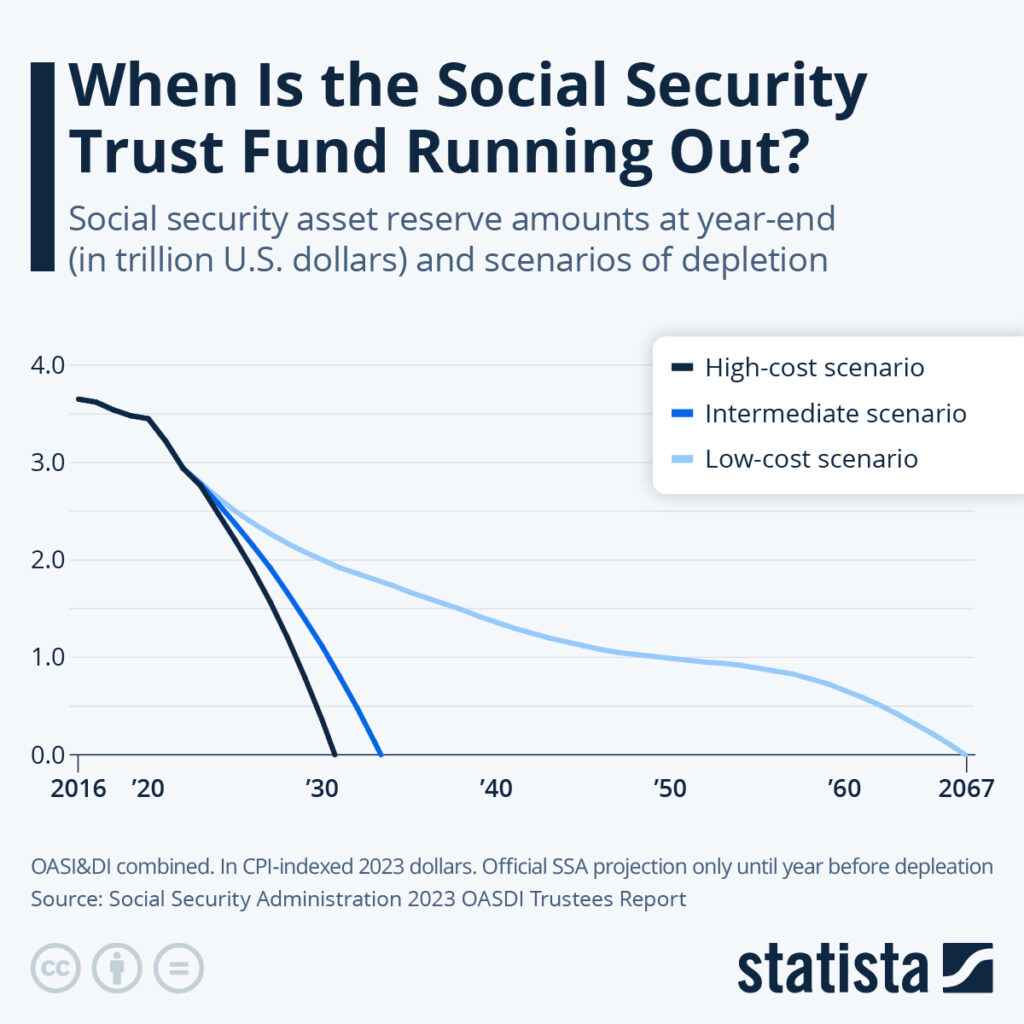

| Projected Insolvency | By 2034, trust funds could cover only ~80% of benefits |

| Historical Note | FRA raised from 65 to 67 in 1983 reforms |

| Public Opinion | 79% of Americans oppose raising the retirement age (Pew Research, 2023) |

| Average Monthly Benefit (2025) | $1,907 per retiree |

| More Info | Official SSA Website |

What Sparked the Firestorm?

In a September interview with Fox Business, Commissioner Frank Bisignano was asked about Social Security’s future. His response?

“I think everything’s being considered, will be considered.”

That single line caused panic. Headlines exploded with speculation that raising the full retirement age (FRA) — the age you qualify for full benefits — was back on the political agenda. Hours later, the SSA released a statement clarifying that raising the retirement age is not currently under consideration.

Still, the initial words hit a nerve. Senate Democrats quickly responded with a strongly worded letter demanding written assurances and full transparency by October 13, 2025.

Historical Context: Social Security’s Moving Goalposts

To understand why this struck a nerve, it helps to know that the retirement age has been raised before.

- 1935: Social Security Act sets FRA at 65.

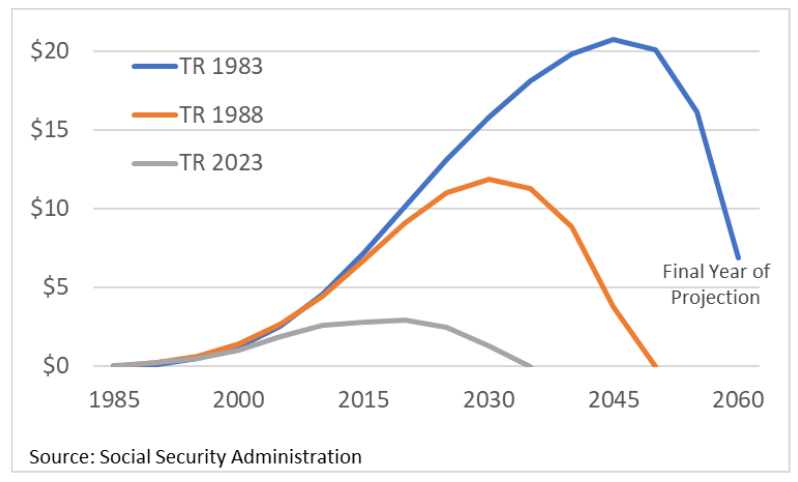

- 1983 Reforms: Facing insolvency, Congress passed bipartisan changes signed by President Ronald Reagan. FRA was gradually increased to 67 for people born in 1960 or later.

Those changes were pitched as a way to “save” Social Security. But for millions, it meant working two years longer or accepting reduced checks. Today’s debate feels like déjà vu — except the stakes are higher, since Boomers and Gen Xers are retiring in record numbers.

Why Senate Democrats Demand Answers?

Senators like Elizabeth Warren and Ron Wyden argue that raising FRA is a backdoor benefit cut. Their points include:

- Not everyone can keep working: White-collar workers may handle longer careers, but blue-collar workers (nurses, truck drivers, construction crews) often cannot.

- Retirement already stretched thin: Nearly half of older Americans have no retirement savings outside Social Security.

- Voters oppose cuts: According to Pew Research (2023), 79% of Americans oppose raising the retirement age.

Meanwhile, some Republicans and conservative think tanks argue that raising FRA is “common sense” given longer life expectancies. But Democrats counter that life expectancy gains are not equally distributed. Wealthier Americans live longer; lower-income workers, especially in manual jobs, do not.

Social Security’s Financial Picture

According to the 2024 Trustees Report:

- Trust funds will run short by 2034.

- Without changes, payroll taxes would cover only about 80% of promised benefits.

- Average monthly benefit (2025): $1,907.

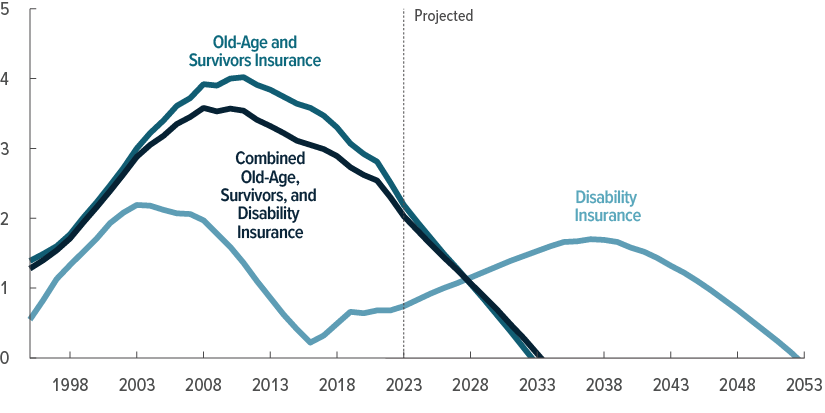

- Worker-to-beneficiary ratio: In 1960, 5.1 workers supported each retiree. In 2025, just 2.7 do.

The system’s math is tough: fewer workers, more retirees, longer life spans. That’s why reform talk keeps coming back.

Real-Life Impacts: Raising the FRA

What happens if FRA goes from 67 to 69? Let’s look at two examples.

Case 1: Maria the Nurse

Maria, 59, works long shifts on her feet. If FRA shifts to 69, she’d need to endure two more grueling years for full benefits. Retiring early at 62 would shrink her monthly check even more — making her struggle with rent and medical bills.

Case 2: Tom the Teacher

Tom, a 45-year-old high school teacher, might be able to work until 69, but burnout and age discrimination could force him out early. If that happens, he’d have to settle for permanently reduced benefits.

The bottom line: raising FRA doesn’t affect everyone equally. For workers with physical jobs, it’s essentially a pay cut.

Public Opinion and Polls

Americans have strong feelings about Social Security:

- 79% oppose raising FRA (Pew Research, 2023).

- 69% support raising taxes on high earners to keep the program solvent.

- 60% of younger adults worry that Social Security won’t be there when they retire (Gallup, 2024).

- Only 23% favor benefit cuts as part of reform.

This makes retirement age hikes politically toxic — one reason Senate Democrats are pressing for clarification now.

Political Landscape: What’s Really Going On

Here’s the political back-and-forth:

- Democrats: Push for expanding benefits, taxing wealthy Americans more, and ensuring no cuts to the program. Senator Warren has proposed lifting the cap on taxable income (currently $168,600 in 2025) so millionaires pay more.

- Republicans: Often talk about reform through raising FRA, adjusting cost-of-living formulas, or restructuring benefits for younger workers.

- The White House: Caught in the middle, balancing solvency concerns with election politics. Mixed messages only fuel public confusion.

The tension isn’t just policy — it’s also electoral. Social Security reform has been called the “third rail of politics” for a reason: touch it, and you get burned.

Step-by-Step Guide: How to Protect Yourself

You can’t control Washington, but you can control how prepared you are.

Step 1: Track Your Benefits

- Sign up at SSA.gov/myaccount to see your earnings record and benefit estimates.

Step 2: Save Outside Social Security

- Invest in a 401(k), IRA, or Roth IRA. Even small contributions compound over decades.

- Keep at least 6 months of expenses in an emergency fund.

Step 3: Diversify Your Income

- Consider part-time work, freelancing, or rental income as backup retirement support.

Step 4: Plan Multiple Retirement Scenarios

- Run the numbers for retiring at 62, 67, and 70. That way, you’re not blindsided if rules change.

Step 5: Get Expert Advice

- A single meeting with a certified financial planner can align your Social Security strategy with your health, career, and personal goals.

Expert Perspectives

Economists and policy experts warn that inaction is the real danger. If lawmakers do nothing, automatic benefit cuts of about 20% will hit in 2034. That’s worse than any single reform.

- The Center on Budget and Policy Priorities notes that modest payroll tax increases on higher earners could secure the program for decades.

- The Heritage Foundation, by contrast, has suggested phased retirement age increases to reflect “modern life expectancy.”

- Financial advisors across the board stress that individuals should prepare as though changes are coming — because history shows they eventually do.

$1,702 Stimulus Payments Are Coming in October 2025; Payment Credit Date, Eligibility

October Social Security Payments: Why You Might Get Two SSI Checks This Month

US $4,983 Direct Deposit In October 2025 – Check Eligibility and Expected Payment Date