RSDI Payments of $1,546-$1,580-$1,978: You’ve probably seen the headlines claiming that RSDI payments of $1,546-$1,580-$1,978 are “set for Social Security recipients” in October 2025. Sounds promising, right? But before you start planning how to spend that check, let’s unpack what those numbers really mean. This isn’t just about rumor or hype — it’s about understanding how Social Security works, who qualifies for what, and how to make sure you’re getting your fair share. Whether you’re a retiree, a disabled worker, a surviving spouse, or just planning for your future, this guide breaks it all down in plain English.

RSDI Payments of $1,546-$1,580-$1,978

The claim that RSDI payments of $1,546-$1,580-$1,978 are set for October 2025 is partly true — those figures reflect real national averages for different Social Security categories.

But there’s no single “special payment.” Your actual check depends on your work history, age, and timing. The smartest move? Understand your rights, and plan your claiming strategy. Social Security isn’t just a government benefit — it’s a reward for years of contribution and resilience.

| Topic | Data / Fact (2025) | Why It Matters | Official Source |

|---|---|---|---|

| Average Retiree Benefit | ~$1,976/month | Typical benefit for retirees at full retirement age | SSA.gov |

| Average SSDI Benefit | ~$1,530/month | Common disability payment range | Evans Disability |

| Survivor Benefit Range | ~$1,546–$1,580/month | Usual benefit for widows/widowers | |

| 2025 COLA | 2.5% | Boost applied to all SSA benefits | |

| Maximum Benefit (FRA) | $4,018/month | Highest benefit for those with max earnings | |

| SSI Federal Benefit | $967 (individual) / $1,450 (couple) | For low-income or disabled adults |

Understanding RSDI: The Heart of Social Security

RSDI stands for Retirement, Survivors, and Disability Insurance — three of the main benefit programs managed by the Social Security Administration (SSA).

- Retirement Insurance (OASI) helps workers who paid Social Security taxes during their careers.

- Survivors Insurance supports spouses, children, or dependents of deceased workers.

- Disability Insurance (SSDI) assists those unable to work due to a qualifying medical condition.

It’s important to remember that these are earned benefits — not handouts. You’ve paid into the system with every paycheck, and now, the system is designed to pay you back.

Why the RSDI Payments of $1,546-$1,580-$1,978 Figures Matter?

Those three numbers aren’t random. They represent average benefit amounts across different categories of Social Security recipients in 2025:

- $1,546 – $1,580: Average payments for survivor and disability beneficiaries.

- $1,978: Average payment for retired workers as of early 2025.

They are averages, not guarantees. What you personally receive depends on your earnings history, age, work credits, and timing of your claim.

How RSDI Payments Are Calculated — The Nuts and Bolts

Understanding how Social Security calculates your benefit helps you see where you fit in the $1,546–$1,978 range.

Step 1: Earning Credits

In 2025, every $1,810 you earn equals one Social Security credit. You can earn up to four per year.

You’ll need at least 40 credits (roughly 10 years of work) to qualify for retirement benefits.

Step 2: Your Average Indexed Monthly Earnings (AIME)

The SSA adjusts your 35 highest-earning years for inflation to calculate your average monthly income.

If you worked fewer than 35 years, the missing years count as zero, which can lower your average.

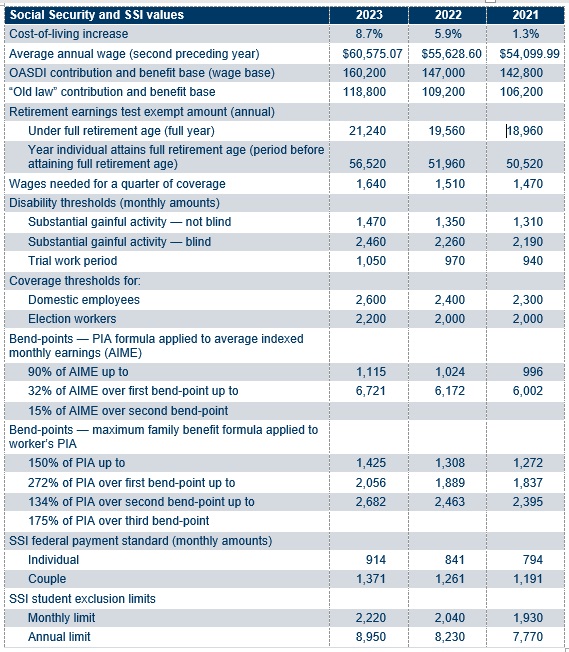

Step 3: Applying the PIA Formula

Your Primary Insurance Amount (PIA) is calculated using a formula with “bend points”:

- 90% of the first $1,226 of AIME

- 32% of the next portion up to $7,391

- 15% of the remainder

This gives your monthly benefit at full retirement age (FRA).

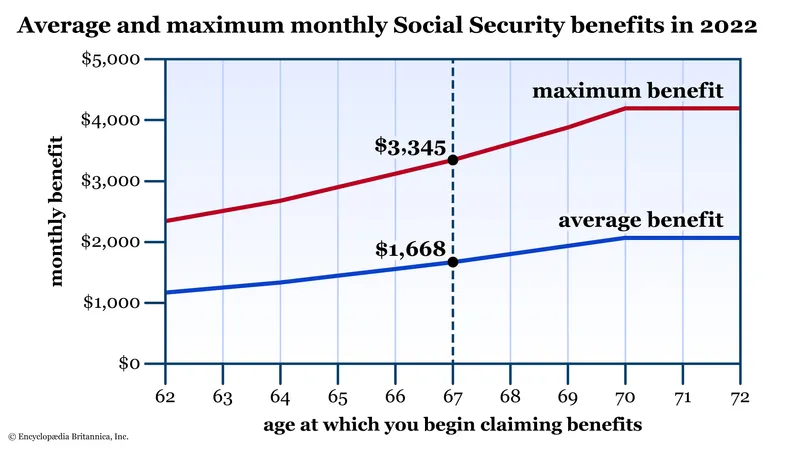

Step 4: Early or Late Claiming Adjustments

- Claiming early (as early as 62) can cut your monthly check by 25–30%.

- Waiting past FRA (up to age 70) earns delayed retirement credits of about 8% per year.

Step 5: Apply COLA (Cost-of-Living Adjustment)

In 2025, the COLA increase is 2.5%, automatically raising your benefit. That’s how SSA ensures your check keeps pace with inflation.

The Real October 2025 Payment Schedule

Social Security payments are made monthly, but not everyone gets paid on the same day.

For RSDI beneficiaries:

- Birthdays 1–10 → Paid Wednesday, October 8, 2025

- Birthdays 11–20 → Paid Wednesday, October 15, 2025

- Birthdays 21–31 → Paid Wednesday, October 22, 2025

For SSI recipients:

- Paid October 1, 2025, and October 31, 2025 (the second check is an advance for November).

That “double payment” floating around online isn’t extra money — it’s simply a calendar adjustment.

Eligibility Rules — Who Qualifies for What?

To receive RSDI payments, you must meet certain eligibility requirements:

- Have a sufficient work history and have paid Social Security taxes (usually 10 years).

- Be at least 62 years old for retirement benefits.

- Have a disability recognized by the SSA for SSDI.

- Be a spouse, child, or dependent of a deceased worker (for survivor benefits).

You might also qualify for SSI if your income and assets fall below specific thresholds, even without a strong work record.

Factors That Influence Your Benefit Amount

1. Your Lifetime Earnings

The higher your income (up to the taxable wage cap, which is $168,600 in 2025), the larger your benefit.

2. Claiming Age

Waiting until full retirement age (66–67) or beyond can significantly increase your monthly payout.

3. Work History Gaps

Years without covered earnings reduce your average — consider part-time or flexible work to fill those gaps.

4. Offsets and Reductions

Programs like the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) may reduce benefits for those with non-Social-Security pensions.

5. Taxes

Depending on your income, up to 85% of your Social Security benefits may be taxable.

How to Estimate and Maximize Your Benefit

If you’re wondering what your number looks like, here’s a roadmap:

- Create a “mySocialSecurity” account at SSA.gov/myaccount.

- Review your earnings record to ensure it’s accurate — mistakes can lower your benefit.

- Use the SSA Benefit Calculator to estimate your payments at different ages.

- Compare early vs. delayed claiming to see how waiting affects your payout.

- Avoid retiring too early if you can — extra high-earning years can lift your lifetime average.

- Work part-time post-retirement if possible; it keeps you active and may boost your earnings record.

- Plan your taxes — use retirement accounts like Roth IRAs to limit taxable income.

Common Scenarios — Real-Life Examples

Mary (Retiree)

Mary worked 35 years and earned around $55,000 annually. She claims at her full retirement age of 67.

Her 2025 benefit is roughly $1,975 per month — right in line with the national average.

James (Disabled Worker)

James was a truck driver injured in an accident at 52. He qualified for SSDI and receives $1,560 per month, adjusted annually for inflation.

Susan (Survivor)

Susan’s husband paid into Social Security for 40 years before his passing. She now receives a survivor benefit of $1,580 per month.

These examples reflect how different life paths still fall within that familiar range of $1,546-$1,978.

Pro Tips to Protect and Grow Your Social Security Benefits

- Set up direct deposit to avoid payment delays or lost checks.

- Watch for annual COLA announcements every October.

- Stay alert for scams — SSA will never call asking for money or your Social Security number.

- Use reputable sources only: SSA.gov, AARP.org, or USA.gov.

- Coordinate with other benefits (pensions, 401(k), IRA) for tax efficiency.

- Consult a financial planner if your income sources are complex.

October Social Security Payments: Why You Might Get Two SSI Checks This Month

The Bigger Picture: Why This Matters

For many Americans, Social Security is more than a check — it’s stability, dignity, and a bridge to independence. Understanding your benefits helps you plan better, avoid scams, and live confidently in retirement.

For professionals, financial advisors, or tribal community leaders, staying informed about RSDI is key to helping others manage their finances effectively — especially in communities where Social Security serves as a lifeline.