R1400 Mortgage Relief Scheme Payment: If you’ve been feeling the squeeze from your monthly mortgage payments, here’s some good news. The R1400 Mortgage Relief Scheme for October 2025 is designed to give South African homeowners a helpful monthly break on their mortgage repayments. Whether you’re a first-time buyer or have been managing your bond for years, knowing about this scheme could be a game-changer for your financial health. This article unpacks everything you need to understand—eligibility, application steps, benefits, and the exact payment dates—in clear, friendly terms anyone can grasp. Plus, we include expert tips, real-life examples, and important background details to connect the dots and make things practical.

R1400 Mortgage Relief Scheme Payment

The R1400 Mortgage Relief Scheme for October 2025 is a crucial support tool for South African homeowners struggling with mortgage repayments. By directly subsidizing bond payments, it helps families keep their homes and maintain financial stability amid ongoing economic pressures. Preparing your documents, applying early, and managing your finances effectively can help you make the most of this assistance. This scheme not only safeguards families but also strengthens the broader housing market and economy.

| Detail | Information |

|---|---|

| Program Name | R1400 Mortgage Relief Scheme 2025 |

| Administered By | Department of Human Settlements, SASSA & Partner Banks |

| Subsidy Amount | R1400 per month |

| Eligibility | South African citizens/permanent residents, household income between R3,500 and R25,000 |

| Property Type | Primary residence only |

| Priority Groups | First-time homeowners, families with dependents |

| Application Method | Online via Department of Human Settlements |

| Disbursement | Direct credit into mortgage (bond) account |

| Official Website | Department of Human Settlements |

What Is the R1400 Mortgage Relief Scheme Payment?

Owning a home is a big deal, but keeping up with mortgage payments can be stressful, especially when interest rates jump or daily expenses rise. The R1400 Mortgage Relief Scheme helps lighten that load by providing a monthly subsidy of R1400 paid directly to your mortgage account. This reduces your monthly repayment amount, making it easier to cover your bond and keep your home secure.

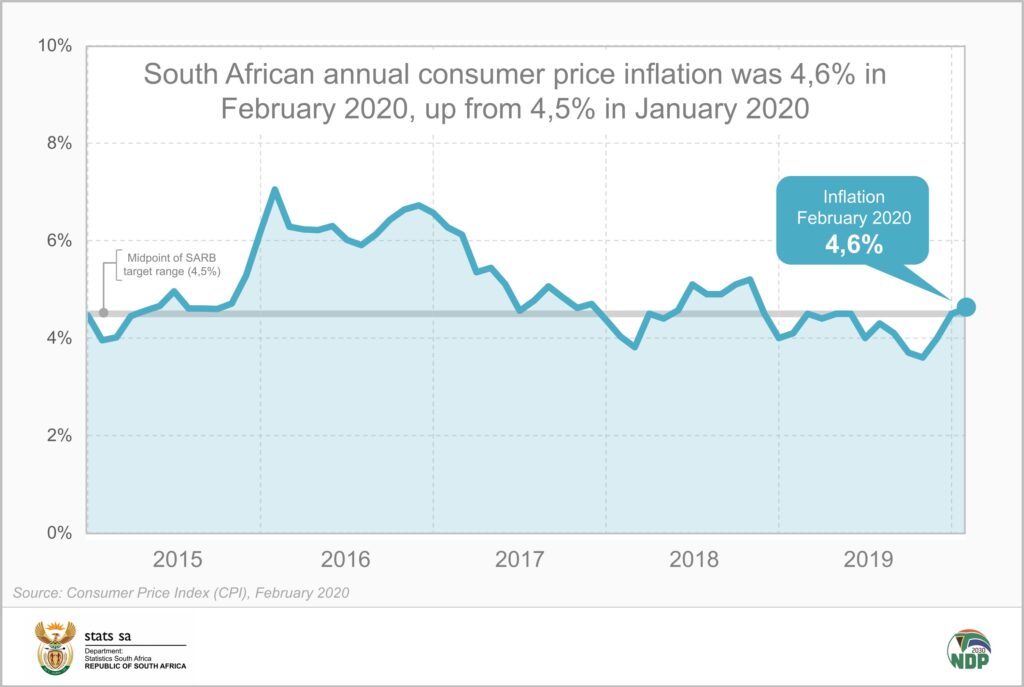

Introduced by the South African government in September 2025, this program targets low- to middle-income families who find themselves stretched thin between paying their bond and managing basic living expenses. It’s part of a broader effort to protect homeowners from the harsh impacts of rising interest rates and inflation.

Why This Matters: The Housing Challenge in South Africa

In South Africa, many households spend over 30% of their income on housing costs, often leaving little for essentials like food, healthcare, and education. High mortgage repayments combined with soaring inflation have pushed many families to the brink, risking home repossession and increasing financial distress.

The R1400 Mortgage Relief Scheme directly addresses these challenges by:

- Offsetting rising interest rates making bonds more expensive

- Helping households avoid default and repossession

- Providing financial breathing space to manage other expenses

- Supporting broader economic stability through housing security

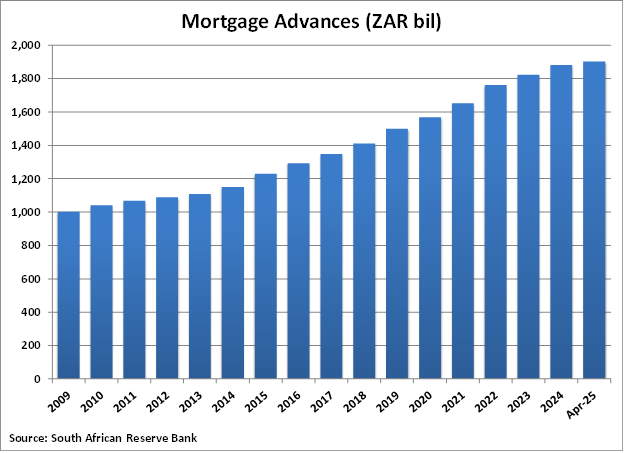

According to the South African Reserve Bank (SARB), phased interest rate reductions during 2025 have aimed to ease the mortgage burden, and this relief subsidy adds a layer of direct assistance to homeowners facing tough financial realities.

Who Can Apply? Eligibility Explained

The scheme is targeted specifically to ensure help reaches those most in need. To qualify, applicants must meet these criteria:

- Be a South African citizen or permanent resident

- Have a household income between R3,500 and R25,000 per month

- Hold a registered home loan (mortgage) with a South African bank

- The mortgage must be on the primary residence (not an investment or rental property)

- Be up to date or only recently in arrears on mortgage payments

- Priority is given to first-time homeowners and families with dependents

This focus ensures that middle- and lower-income families managing mortgage payments can benefit directly.

Documents You’ll Need to Gather

Preparing the correct documents ahead can speed up your application:

- Certified copy of your South African ID or valid residence permit

- Proof of income including recent payslips or bank statements

- Mortgage or bond account statement from your bank

- Proof of residence such as a municipal account or utility bill

- Household composition declaration (notes on dependents, spouse, etc.)

Submitting clear, up-to-date, and certified documents helps in smooth verification and prevents unnecessary delays.

How to Apply for R1400 Mortgage Relief Scheme Payment: A Step-by-Step Guide

Here’s how you can get started with the application:

Step 1: Visit the Official Portal

Go to the Department of Human Settlements and locate the Mortgage Relief Scheme application section.

Step 2: Complete the Online Application

Fill out the form with your personal, income, and mortgage details.

Step 3: Upload Required Documents

Scan your documents carefully and upload them in PDF format.

Step 4: Verification Process

The department, SASSA, and banks will verify your details and you may be contacted for additional information.

Step 5: Approval and Payment

If everything checks out, the monthly R1400 will be credited directly into your mortgage account.

Step 6: Annual Review

You must update your income and household information yearly to maintain eligibility.

Real-Life Example: How This Helped a Family

Consider Linda’s family in Johannesburg. With two kids and rising living costs, her monthly mortgage repayments were consuming a huge part of the budget. After applying for the relief scheme, she started receiving the R1400 subsidy monthly, which allowed her to cover school fees and groceries without falling behind on bond payments. This helped keep their home safe through challenging times.

Comparison to Other Assistance Programs

Unlike social grants that provide cash transfers for basic needs, the R1400 Mortgage Relief focuses specifically on reducing housing costs. Programs like the Social Relief of Distress Grant offer temporary relief for unemployed individuals but do not directly affect mortgage payments. The R1400 scheme complements these by targeting homeowners to prevent home loss and maintain economic stability.

Tips for Managing Mortgage Payments

Even with the subsidy, managing your finances proactively is key:

- Create and stick to a monthly budget balancing income and expenses

- Set up automatic debit orders for timely mortgage payments

- Contact your bank for possible bond restructuring if you anticipate trouble

- Consider financial counseling for budgeting and debt management

- Use any extra funds wisely, prioritizing essentials and emergency savings

Broader Impact on Economy and Housing Market

Preventing repossessions keeps the housing market stable and supports lenders. This stability protects jobs related to construction, real estate services, and retail sectors connected to homeownership. By helping families stay in their homes, the program reduces social problems linked with homelessness and promotes long-term economic resilience.

R370 SASSA Grant Payment Schedule For October 2025 – Check Grant Dates & Eligibility Criteria

SASSA HIV Grant 2025 Confirmed – Check If You Qualify, How Much You’ll Get & When It Pays Out

R560 Grant Aid in 2025 – Check October Aid Amount, Eligibility & Payment Date

Where to Get Help?

- Reach out to the Department of Human Settlements official website for detailed guides and contact information

- Call the helpline at 0800-123-456 for direct support

- Contact your mortgage lender for account-specific advice and assistance