Pension Boost Canada: If you’re retired or planning to retire soon, you’ve probably heard some buzz about the Pension Boost in Canada in November 2025. Everyone’s wondering: How much will CPP and OAS go up this year?

With the cost of living rising and groceries stretching every dollar thinner, it’s no surprise Canadians are paying closer attention to how their Canada Pension Plan (CPP) and Old Age Security (OAS) benefits are adjusted. These two programs form the backbone of most Canadians’ retirement income, so even a small increase can make a meaningful difference. Let’s break down exactly what’s changing for 2025, why it matters, and how you can make the most of these updates.

Table of Contents

Pension Boost Canada

In November 2025, Canadians will benefit from a 2.6% CPP increase and a 0.7% OAS quarterly bump — both automatic, both designed to keep up with inflation. While these boosts won’t make you rich overnight, they’re a reminder that steady, indexed income remains one of the best protections against the rising cost of living.

| Item | Details (2025) |

|---|---|

| CPP inflation adjustment | +2.6% increase starting January 1, 2025 |

| Max CPP benefit (age 65) | $1,433/month (≈ $17,197 per year) |

| Average CPP payment (2025) | $808.14/month |

| OAS max benefit (age 65–74) | $727.67/month |

| OAS quarterly increase (Oct–Dec 2025) | +0.7% vs. prior quarter |

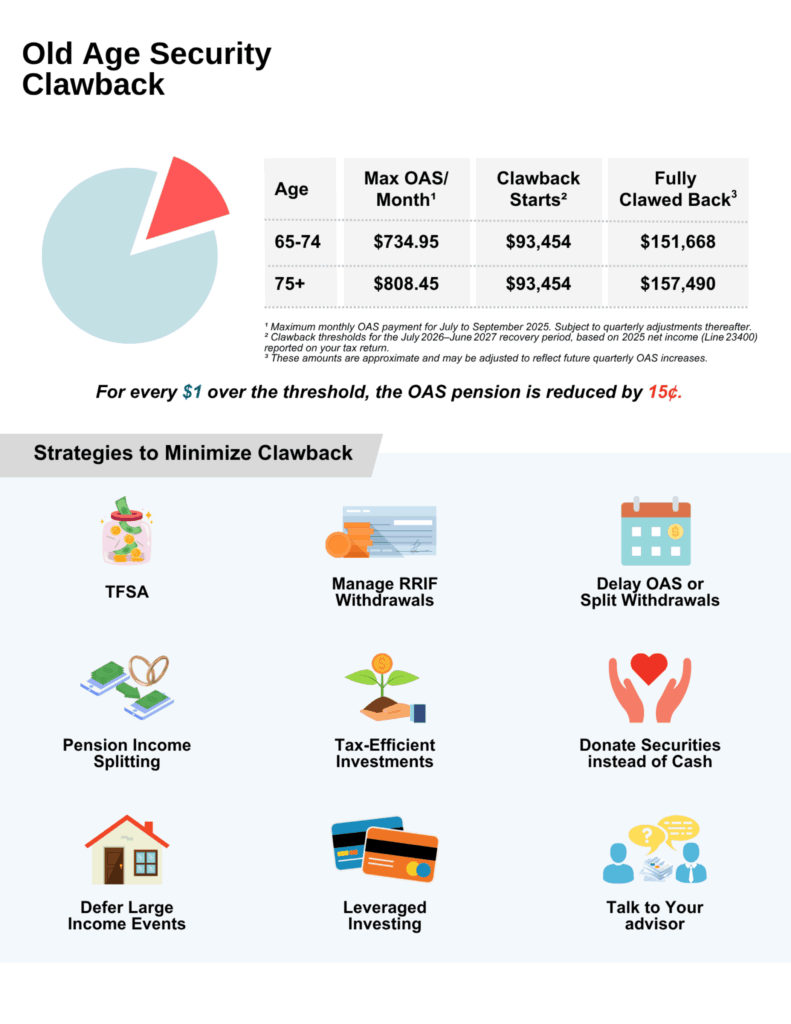

| OAS clawback range (recovery tax) | $93,454 – $151,668 (net income) |

| Delaying OAS | +0.6% per month delayed, up to +36% at age 70 |

| CPP Enhancement fully phased in | Yes – higher replacement rate and earnings ceiling |

| Official Source | Canada.ca |

Why This Year’s Pension Boost Canada Matters?

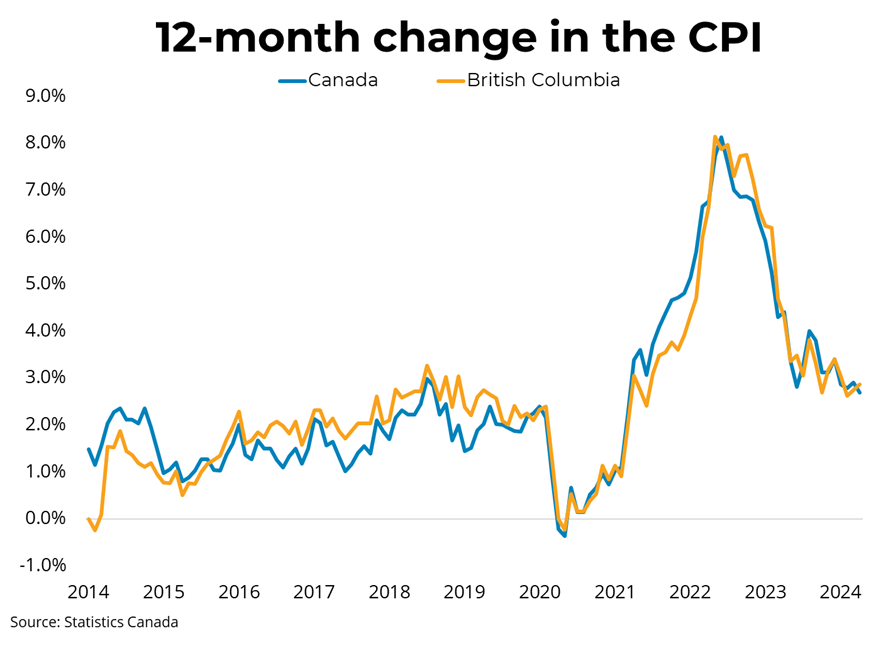

Inflation may have cooled since its 2022 highs, but everyday costs remain stubbornly high. Statistics Canada’s Consumer Price Index (CPI) shows that average prices in 2025 are still around 15% higher than in 2020. Food, rent, and healthcare continue to rise faster than most incomes.

That’s why annual CPP and OAS adjustments exist — to help seniors maintain purchasing power as prices change. These benefits are indexed to inflation, meaning they automatically rise (or stay flat) depending on the CPI.

Canada now has over 7.3 million seniors aged 65 and older, and by 2030, one in four Canadians will be over 60. For millions of people, these updates are not just numbers — they’re the difference between comfort and stress in retirement.

Comparing 2024 vs 2025 Pension Payments

| Benefit Type | 2024 Monthly Max | 2025 Monthly Max | Change |

|---|---|---|---|

| CPP (full benefit, age 65) | $1,396 | $1,433 | +2.6% |

| Average CPP payment | $787 | $808 | +2.7% |

| OAS (age 65–74) | $715.83 | $727.67 | +1.6% |

| OAS quarterly bump (Q4) | +0.5% | +0.7% | +0.2 points |

These numbers might not seem life-changing, but they help retirees preserve their standard of living. A couple receiving both CPP and OAS can see several hundred dollars more per year without lifting a finger.

What the November 2025 Pension Boost Canada Means?

CPP: The 2025 Inflation Adjustment

Every January, the CPP benefit increases to reflect the 12-month change in the CPI. For 2025, the government confirmed a 2.6% increase, effective January 1, 2025.

That means:

- If you received $1,000/month in 2024, you’ll now get about $1,026/month.

- If you qualified for the maximum benefit, you’ll receive $1,433/month, or $17,197/year.

- For new retirees under the CPP Enhancement rules, the long-term payout potential continues to rise.

The CPP increase is automatic — there’s no need to reapply.

OAS: Quarterly Boost and Eligibility Rules

Unlike CPP, Old Age Security adjusts every three months to stay current with inflation. The October to December 2025 quarter sees a 0.7% increase over the prior period.

If you’re getting $727.67/month, that’s roughly $5.10 more per month.

Eligibility is based on age (65+) and years of residency in Canada. You need at least 10 years in Canada after age 18 to qualify for partial benefits, and 40 years for the full amount.

Higher-income seniors need to watch out for the OAS clawback — the recovery tax kicks in once your annual income exceeds $93,454 and completely claws back at around $151,668 for ages 65–74.

If you delay your OAS, you’ll earn an extra 0.6% per month delayed, up to 36% if you wait until 70.

Step-by-Step: How to Make the Most of Your 2025 Pension Boost Canada

Step 1: Review Your Records

Check your My Service Canada Account for your CPP contribution history and OAS eligibility. Verify your income, years worked, and residency status to ensure accuracy.

Step 2: Use the Pension Calculator

Use the Canadian Retirement Income Calculator on Canada.ca. Enter your income and age to project your 2025 payments and future boosts.

Step 3: Decide When to Start CPP and OAS

You can start CPP as early as age 60 (reduced benefit) or delay up to 70 (increased benefit). For every month you delay after 65, your CPP grows by 0.7%; OAS grows by 0.6%.

If you’re healthy and can wait, delaying can significantly increase your lifetime benefit — especially if you live into your 80s or beyond.

Step 4: Know the Tax Implications

CPP and OAS are taxable income, which means they count toward your annual tax bracket. Combined with RRSPs, RRIFs, or private pensions, this can affect your net tax rate — and whether your OAS gets clawed back.

To reduce taxes:

- Split pension income with your spouse.

- Use TFSA withdrawals (they’re not taxable).

- Plan RRIF withdrawals before starting OAS.

Step 5: Watch Inflation and Cost of Living

While the official CPP/OAS adjustments help, they don’t always reflect seniors’ real inflation. Rent, medication, and groceries often rise faster than the CPI. Build a buffer in your budget for these costs.

Real-World Examples

Example 1: Mary, 68, receiving CPP and OAS

Mary worked full-time and has full CPP contributions. In 2024, she earned $1,396/month. With the 2.6% increase, she’ll now receive $1,433/month in 2025. Her OAS rises by 0.7%, taking her payment from $727 to about $732.

Her combined pension income grows by nearly $50 per month, or $600 per year — small, but steady protection against inflation.

Example 2: John, 60, delaying CPP and OAS

John plans to work part-time until 70. By waiting, his CPP benefit could grow by up to 42%, and his OAS by 36%. If he would’ve received $1,000/month at 65, waiting until 70 means roughly $1,420/month for CPP and $990/month for OAS — a big jump that lasts for life.

Taxes and Retirement Planning: What to Watch

CPP and OAS payments can push some retirees into higher tax brackets, especially if combined with other income. A few strategies to stay efficient:

- Income Splitting: Share up to 50% of eligible pension income with your spouse for tax savings.

- TFSA Withdrawals: Use tax-free savings withdrawals for living expenses — they won’t affect OAS clawback thresholds.

- Partial RRSP Conversion: Convert part of your RRSP to a RRIF before starting OAS to balance taxable income.

- Stay Below the Clawback Line: Keep taxable income under $93,454 (for 2025) if possible to avoid OAS recovery.

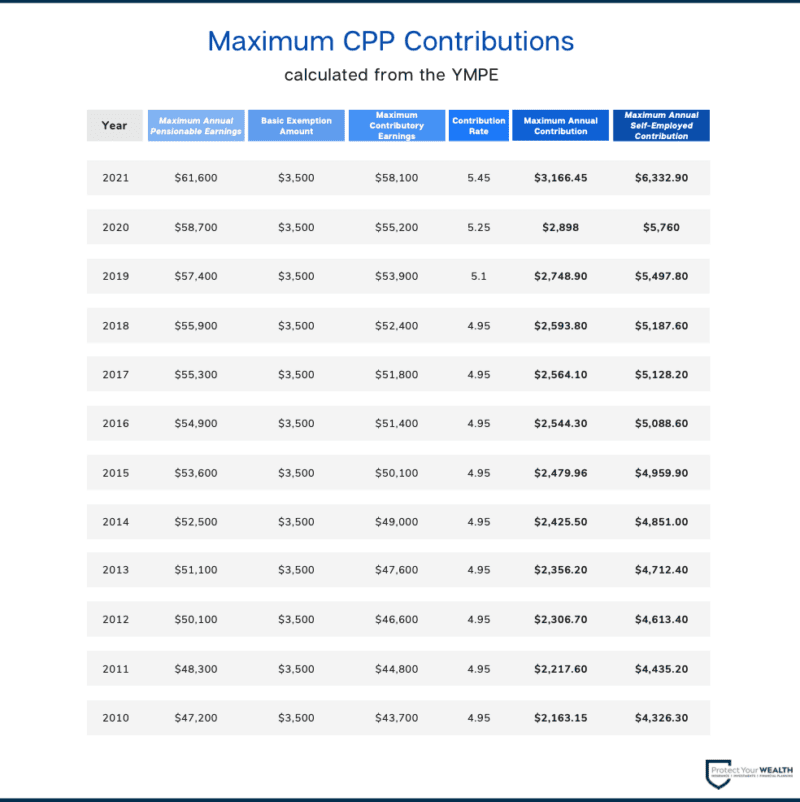

Long-Term Planning and the CPP Enhancement

By 2025, the CPP Enhancement — a multi-year expansion launched in 2019 — is fully phased in. It raises the income replacement rate from 25% to 33.33% and increases the maximum earnings ceiling used to calculate benefits.

That means younger Canadians (and those still working) are paying a bit more into CPP but will receive higher benefits later. Over time, this will make a major difference in retirement income.

So if you’re in your 40s or 50s, it’s worth reviewing your pay stub and contribution limits — those few extra dollars now are your future security.

65+ Seniors will get $3900 CRA Pension in November 2025, Check Eligibility, Process, Date

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

Canadian Seniors to Receive $2,400 in November 2025 – Payment Dates and Eligibility Criteria

Expert Insights

As a financial planner, I often tell clients: the key isn’t just the increase — it’s what you do with it.

Understanding how CPP and OAS fit into your broader financial plan lets you optimize taxes, spending, and lifestyle choices. The 2025 pension boosts may seem modest, but over time, these adjustments preserve stability and peace of mind. Combined with smart investing and good budgeting, CPP and OAS can form a solid base for retirement security.