October Social Security Payments: If you’re keeping an eye on your October Social Security payments, you might be scratching your head wondering, “Why did I just get two SSI checks this month?” Don’t worry, you’re not alone. Many folks across the U.S. notice this quirky pattern a few times each year, and it always sparks questions. But here’s the deal: you’re not actually getting extra money—you’re just getting it a little earlier than usual. The reason has everything to do with the calendar, weekends, and federal holidays, not the Social Security Administration (SSA) suddenly being generous. So, let’s break it down in plain English, so even a 10-year-old can follow along, but with the depth and expertise professionals need to understand the financial impact.

October Social Security Payments

Getting two SSI checks in October 2025 might feel like you’ve hit a small jackpot, but don’t be fooled—it’s not extra income, it’s just November’s check coming early. The key is smart budgeting: set it aside, plan ahead, and treat it like any other monthly payment. Whether you’re a retiree, a working professional helping your parents manage their benefits, or someone living on SSI yourself, understanding these quirks helps avoid money stress.

| Topic | Details |

|---|---|

| Why two SSI checks in October? | October 1 is the regular payment, October 31 is the November payment (moved up because Nov. 1 falls on a Saturday). |

| Extra money? | No, it’s just an early payment for November. |

| Who does this affect? | SSI (Supplemental Security Income) recipients only. Social Security retirement, disability, or survivor benefit payments are not affected. |

| Payment authority | Social Security Administration official payment calendar |

| Practical tip | Budget carefully—remember, no SSI payment will arrive in November since it’s paid early on October 31. |

Why Two SSI Checks in October 2025?

Here’s what’s going on: SSI (Supplemental Security Income) is typically paid out on the first day of every month. Simple enough, right? But here’s the kicker: when the first lands on a weekend or a federal holiday, the SSA sends the money out on the last business day before that date.

In October 2025, this exact scenario happens. November 1st is a Saturday, so instead of waiting until Monday, the SSA drops the November SSI payment on October 31st—right on Halloween. That means:

- October 1st: You get your normal SSI check (for October).

- October 31st: You get your SSI check for November (early).

So yes, you’ll see two checks in October—but come November, no payment will hit your account since it already showed up early.

Who Qualifies for October Social Security Payments?

It helps to step back and understand who actually receives SSI. Unlike Social Security retirement benefits, which are based on your work history, SSI is a needs-based program.

You may qualify for SSI if you are:

- Age 65 or older,

- Blind or disabled (any age),

- And have limited income and financial resources.

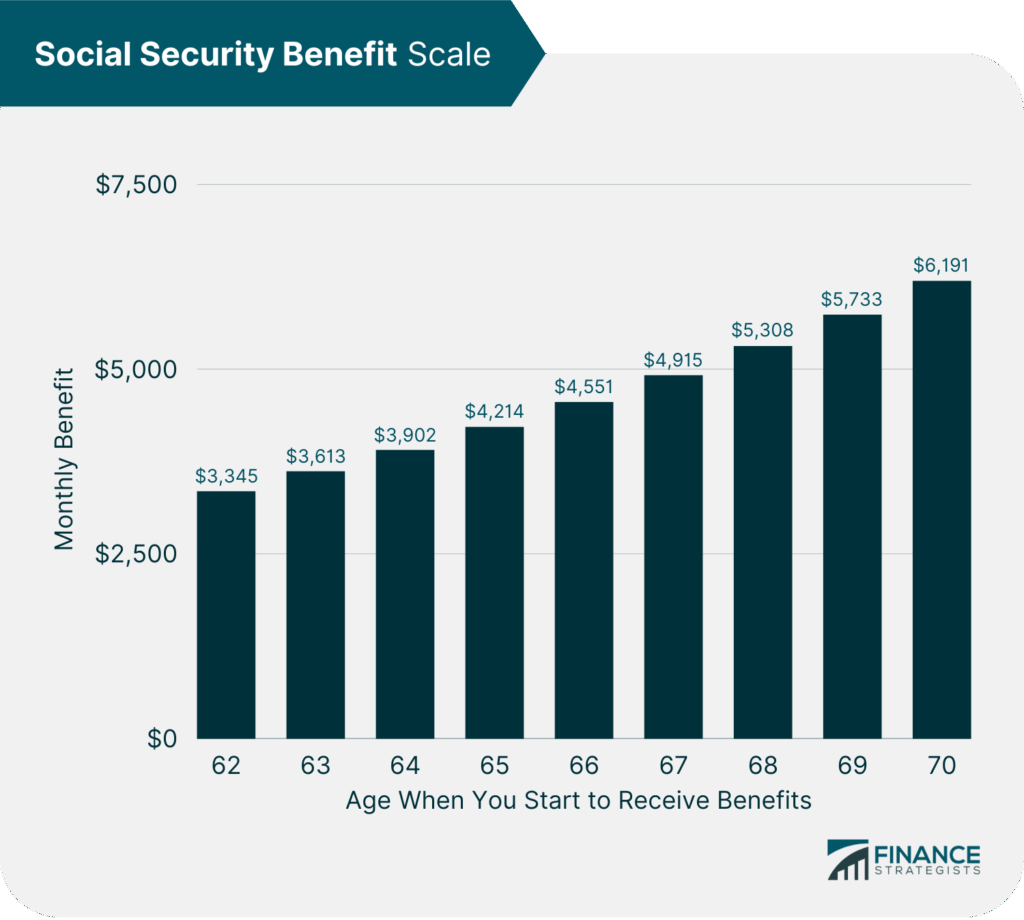

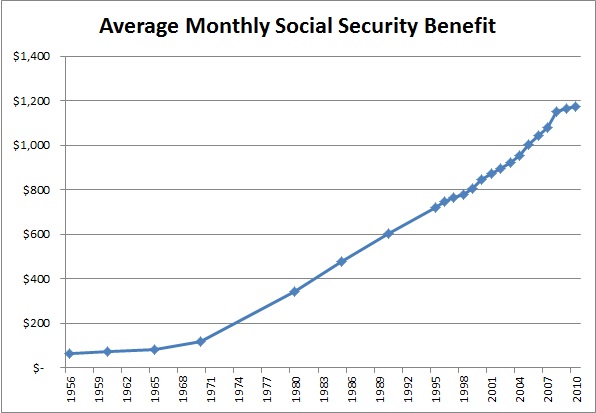

The standard federal benefit rate in 2024 is $943/month for individuals and $1,415/month for couples, though some states add extra funds. That number can adjust yearly with COLA (Cost-of-Living Adjustments)

A Look at the 2025 SSI Payment Schedule

To help you stay ahead, here’s a month-by-month SSI payment schedule for 2025. Remember, these dates apply only to SSI recipients.

| Month | Payment Date |

|---|---|

| January 2025 | December 31, 2024 (early, since Jan 1 is holiday) |

| February 2025 | February 1, 2025 |

| March 2025 | February 28, 2025 (early, since March 1 is Saturday) |

| April 2025 | April 1, 2025 |

| May 2025 | May 1, 2025 |

| June 2025 | May 30, 2025 (early, since June 1 is Sunday) |

| July 2025 | July 1, 2025 |

| August 2025 | August 1, 2025 |

| September 2025 | August 29, 2025 (early, since Sept 1 is holiday) |

| October 2025 | October 1, 2025 |

| November 2025 | October 31, 2025 (early, since Nov 1 is Saturday) |

| December 2025 | December 1, 2025 |

SSI vs. October Social Security Payments

These double-payment quirks apply only to SSI (Supplemental Security Income). If you’re receiving retirement benefits, SSDI (Social Security Disability Insurance), or survivor benefits, your payments run on a totally different schedule.

Those checks usually fall on Wednesdays, based on your birth date. So, unless your payment date also collides with a holiday or weekend, you won’t see this “two-check” situation.

Historical Context: Has This Happened Before?

Yes, it has. This isn’t new—it’s been happening for decades. Anytime the first of the month lands on a Saturday, Sunday, or a holiday, SSI payments are bumped up.

For example:

- In 2022, recipients saw early checks in April, September, and December.

- In 2024, SSI recipients received two checks in May and November.

- In 2025, it’ll happen in January, March, June, September, and October.

So if you’re noticing this for the first time, know it’s a normal part of SSA’s payment system.

How Payments Are Delivered: Direct Deposit vs Paper Checks

The majority of SSI recipients today receive their benefits through direct deposit or the Direct Express debit card system. This method is faster, safer, and avoids issues like lost or delayed paper checks.

But some folks—especially older recipients—still get paper checks in the mail. Here’s the catch: if your check gets delayed because of a holiday weekend, postal slowdown, or weather disaster, your payment could show up later than expected. That’s one reason why SSA strongly recommends direct deposit.

Why the SSA Pays Early (Instead of Later)?

You might wonder, “Why doesn’t the SSA just wait until Monday instead of moving payments up?” It’s all about avoiding delays. Many Americans rely on SSI as their main or only source of income. If SSA held back until after the weekend, families might struggle to pay rent, buy groceries, or cover utilities.

By sending payments ahead of time, SSA ensures no one has to wait longer than expected.

Budgeting Tips When You Get October Social Security Payments

Here’s where things can get tricky. Since you’re technically receiving November’s check in October, it’s easy to think you’ve got extra cash to spend. But beware—that money needs to stretch into next month.

Step 1: Separate the Payments Mentally

Think of the October 31st check as November’s rent money—not as “bonus” income.

Step 2: Use Banking Tools

Transfer the second deposit into savings or a separate account to avoid temptation.

Step 3: Plan Ahead for Bills

Utilities, insurance, and medical bills don’t care about the SSA’s quirky schedule.

Step 4: Use Automatic Payments Carefully

Avoid overdrafts in November—remember, no new check will arrive that month.

Tax & Reporting Considerations

Good news: SSI payments are not taxable. You don’t have to report them on your federal tax return. So even if you receive two in October, it won’t change your IRS situation.

However, SSI timing could impact state programs or income-based benefits like SNAP or Medicaid if your bank balance looks higher than usual when the state checks eligibility. If you’re close to the limit, keep documentation handy showing that one of the checks is next month’s benefit paid early.

Impact on Households

For many families, SSI is a lifeline. According to SSA data, about 55% of SSI recipients have no other source of income. That means when two checks arrive in one month, it can feel like a blessing—at least at first.

But without careful planning, households may spend both payments quickly and end up struggling by mid-November. Financial planners often recommend that families treat the early check as untouchable until the new month begins.

Real-Life Example

Let’s say Maria, a single mom in Oklahoma, receives $943 per month in SSI (the standard federal benefit in 2024, which adjusts yearly).

- October 1: Maria receives $943 for October.

- October 31: Maria receives $943 for November.

If Maria thinks she has almost $2,000 in October and spends freely, she’ll be in trouble by mid-November. But if she sets aside that Halloween deposit, she’ll be just fine until December’s check hits on December 1, 2025.

Data & Facts You Should Know

- As of 2023, over 7.5 million Americans receive SSI benefits.

- The federal SSI benefit is $943/month for individuals and $1,415/month for couples (2024 figures).

- SSI is designed to support people with limited income who are elderly, blind, or disabled.

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Living on Social Security? These States Make It Possible to Cover All Your Expenses