$300 Canada Federal Payment: If you’re living in Canada and have been hearing buzz about a $300 federal payment dropping in October 2025, you’re not alone. Folks across the country are wondering: Is this legit? And if so, how can you get in on it? This detailed article breaks it down clearly and friendly, providing expert and trustworthy information. Whether you’re juggling bills, curious about government benefits, or want to understand how this payment fits into the bigger financial picture, you’ll find everything here. In short, yes — the Canadian government is rolling out a one-time $300 payment in October 2025 aimed at helping people manage the rising cost of living. Here’s what you need to know: who qualifies, when the money hits, how it’s delivered, how it connects with other benefits, and practical advice to maximize this boost. Let’s dive right in.

Table of Contents

$300 Canada Federal Payment

The October 2025 $300 federal payment is a real, one-time financial boost from the Canadian government to help Canadians manage rising living costs. It’s automatic, no-application-needed, and targets low- to moderate-income individuals 19 and older who filed 2024 taxes. Getting the funds smoothly means filing your taxes on time and keeping your CRA profile updated. This payment works with other benefits to ease financial strain, helping Canadians build a more stable present and future.

| Feature | Details |

|---|---|

| Payment Amount | $300 one-time federal payment |

| Eligibility | Canadian residents 19+ who filed 2024 taxes, low- to moderate-income households |

| Payment Dates | Started late September 2025, continued through October |

| Delivery Method | Direct deposit (preferred) or mailed cheque |

| Purpose | Provide relief amid inflation and rising living costs |

| Related Benefits | Canada Child Benefit, GST/HST Credit, Advanced Canada Workers Benefit also paid in October |

| How to Check Status | CRA My Account portal or direct deposit notifications |

| For official info and update | Canada Revenue Agency (CRA) website. |

What’s This $300 Canada Federal Payment All About?

The $300 federal payment is part of Canada’s ongoing effort to support folks feeling squeezed by inflation—things like groceries, gas, rent, and utilities have been climbing, and the government wants to ease that pinch. This payment is a one-time financial boost designed to hit the bank accounts or mailboxes of those who need it most, without hassle or extra paperwork.

The good news: If you’re eligible, you don’t have to apply. The Canada Revenue Agency (CRA) uses your 2024 tax filing info to figure out who’s qualified, then deposits or mails out the cash automatically. No forms, no waiting in line. Just keep an eye on your CRA account or mailbox.

Who Qualifies for the $300 Federal Payment?

Understanding eligibility is key:

- You must be a resident of Canada.

- Be at least 19 years old as of the payment date.

- Have filed your 2024 income tax return and had it assessed by the CRA.

- Your income should fall below certain low- to moderate-income thresholds set by the CRA.

- The payment primarily targets those who need most help—seniors, low-income workers, students, and families balancing tight budgets.

If you meet these criteria, you’re likely in line to get the payment. The CRA uses income data from your latest tax return, so keeping your filing current is crucial.

When Will the $300 Canada Federal Payment Arrive?

The distribution started in late September 2025 and will continue through October 2025. Payments are spread out much like other federal benefits, to keep the process smooth and manageable.

This timing lines up with other October benefits like:

- GST/HST Credit (paid October 3, 2025)

- Advanced Canada Workers Benefit (paid October 10, 2025)

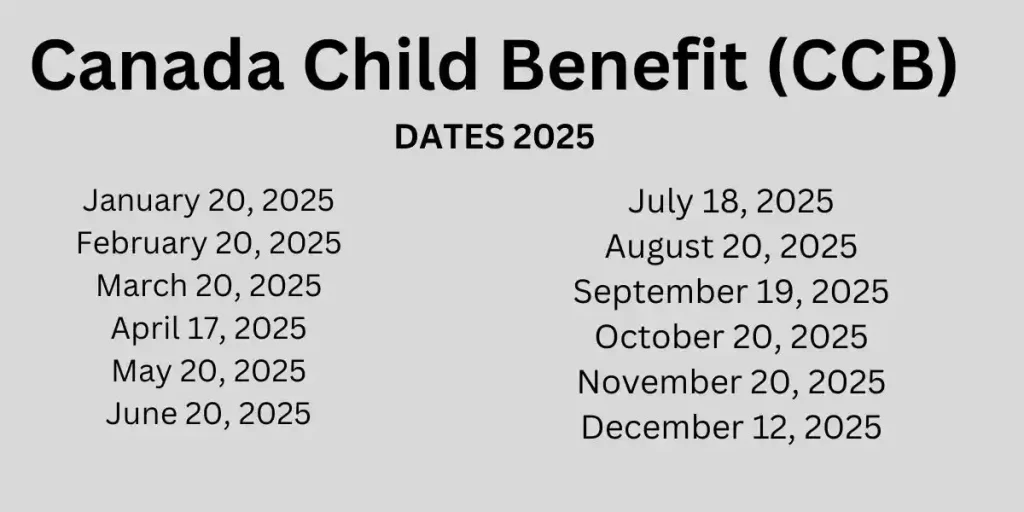

- Canada Child Benefit (paid October 20, 2025)

This packaged approach uses the CRA’s existing system for getting funds to Canadians efficiently.

How Will You Get the Money?

The $300 will usually arrive in one of two ways:

- Direct deposit into the bank account you registered with the CRA (fast and secure).

- Mailed cheque if you don’t have direct deposit set up.

To avoid delays, verify your direct deposit information in your CRA My Account.

How This Fits With Other Federal Benefits?

You might be familiar with federal benefit programs many Canadians rely on, and the $300 payment slots in alongside them, helping with affordability:

- Canada Child Benefit (CCB): Helps families with children.

- GST/HST Credit: Refunds part of the sales tax to low-income individuals.

- Advanced Canada Workers Benefit (ACWB): Supports low-income workers.

While those programs are ongoing, the $300 payment offers a broad one-time boost targeting inflation. It complements other measures like the $250 relief payment earlier in 2025.

Provincial Benefits to Watch For

On top of federal aid, provinces often offer benefits tailored to residents:

- Ontario Energy and Property Tax Credit: Helps with energy and property taxes.

- British Columbia’s Climate Action Tax Credit: Supports families facing higher energy bills.

- Québec Solidarity Tax Credit: Offers relief for cost-of-living increases.

These provincial programs are additional ways to ease your financial load. Check your provincial government’s official website for details.

Tips to Avoid Scams Related to Government Payments

Whenever payments are issued, scammers try to take advantage. Stay safe by remembering:

- The CRA never calls or emails asking for your banking info or passwords.

- Legitimate payments do not require any fees or charges.

- Only check your payment status through the official CRA website or My Account online portal.

- Report any suspicious calls, emails, or texts to the CRA or local police.

Keep your personal information locked down and stay alert.

Smart Ways to Use Your $300 Canada Federal Payment

Here’s how to make the most of your $300 boost:

- Pay down high-interest debt like credit cards or payday loans.

- Start or add to an emergency fund for unexpected expenses.

- Restock household essentials such as groceries and fuel.

- Invest in yourself—consider a course, certification, or tools to boost your career.

Treat this payment as a stepping stone towards better financial stability.

The Bigger Picture: Canada’s Economy in 2025

Rising inflation and costs continue to challenge Canadian households. The government’s support payments aim to:

- Support low- and middle-income Canadians financially.

- Stabilize consumer spending to keep the economy moving.

- Encourage saving and investment for long-term resilience.

Being aware of economic trends helps you understand why such payments matter and how they support everyday Canadians.

How to Ensure You Receive the Payment Without Delay?

To get your payment promptly, follow these steps:

- File your 2024 taxes on time. The CRA needs this info to confirm eligibility.

- Register or update direct deposit with your CRA My Account.

- Keep your mailing address current with the CRA for cheque delivery.

- Regularly check your CRA My Account for payment updates and notifications.

- Beware of scams and confirm details only on official CRA channels.

$5.695M CRA Class Action Settlement 2025, Check Payment Date, Latest News

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility