OAS $808 and GIS $1,097 Payments: Retirement planning can be stressful enough without confusing headlines making the rounds. Recently, claims have popped up on social media saying: “OAS is $808 and GIS is $1,097 starting October 2025.” At first glance, it sounds like great news. But here’s the catch: those numbers aren’t universal, and they don’t tell the full story.

The truth is that Canada’s Old Age Security (OAS) and Guaranteed Income Supplement (GIS) programs are far more nuanced. Payments depend on factors like age, marital status, income, residency, and even quarterly inflation adjustments. If you’re relying on these programs for your retirement income, it’s critical to know the details. This guide will walk you through what’s real, what’s myth, and how to check your own eligibility.

OAS $808 and GIS $1,097 Payments

So, is it true that OAS will be $808 and GIS $1,097 in October 2025? Yes—for some seniors. But it’s not a blanket rule. Seniors aged 75+ may receive around $808, and single low-income seniors may qualify for $1,097 in GIS. Others will see different amounts depending on age, income, and marital status. The best approach is to stay informed and file your taxes annually. That way, you’ll know exactly where you stand—not just rely on viral posts.

| Topic | Details |

|---|---|

| OAS Payment (Oct–Dec 2025) | $808.45/month (ages 75+) and ~$740/month (ages 65–74), indexed to inflation |

| GIS Payment (Max, Single, July–Sept 2025) | $1,097.75/month; reviewed quarterly |

| Eligibility | OAS: Age 65+, Canadian residency; GIS: Low-income OAS recipients |

| Adjustment | Both OAS & GIS increase quarterly with inflation (Consumer Price Index) |

| Official Info | Government of Canada – OAS & GIS |

What Is Old Age Security (OAS)?

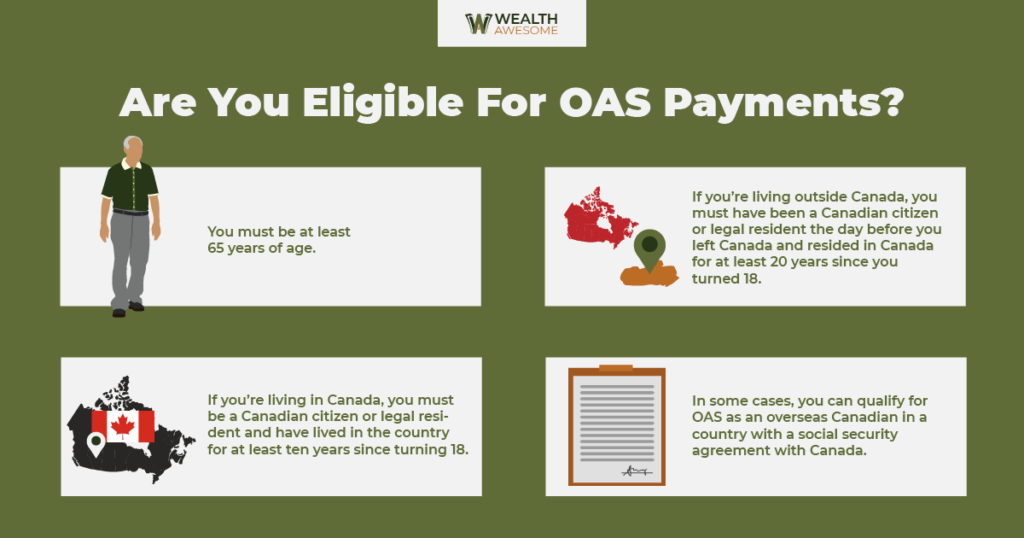

Old Age Security is Canada’s flagship pension program. It is designed to give seniors a baseline monthly income in retirement. Unlike employment-based pensions or even U.S. Social Security, OAS doesn’t require you to have worked or paid into the system—it’s based primarily on residency and age.

How OAS Works

- Eligibility age: You can start receiving OAS at 65.

- Residency requirement: You need at least 10 years of residency in Canada after age 18 to receive a partial pension. For a full pension, you need 40 years of residency.

- Payment adjustments: OAS increases every three months based on the Consumer Price Index. That means your OAS won’t lose value during periods of inflation.

Current OAS Rates (2025)

- Ages 65–74: $734.95/month (July–Sept 2025).

- Ages 75+: $808.45/month (July–Sept 2025).

The boost for seniors 75+ came in 2022, when the government permanently increased their payments by 10% to help offset higher health care and living costs in older age.

OAS Tax Implications

OAS counts as taxable income. If your annual net income is over ~$90,000, you may face a clawback, also known as the OAS recovery tax. At ~$150,000 in income, your OAS may be fully clawed back.

What Is the Guaranteed Income Supplement (GIS)?

The Guaranteed Income Supplement is often described as Canada’s “safety net on top of the safety net.” It’s specifically for low-income seniors who already qualify for OAS. GIS ensures seniors aren’t left struggling to cover rent, utilities, or groceries.

GIS Features

- Eligibility: You must already be receiving OAS.

- Income test: Your GIS amount depends on your annual income (and your spouse’s, if applicable).

- Non-taxable: Unlike OAS, GIS payments are not taxed.

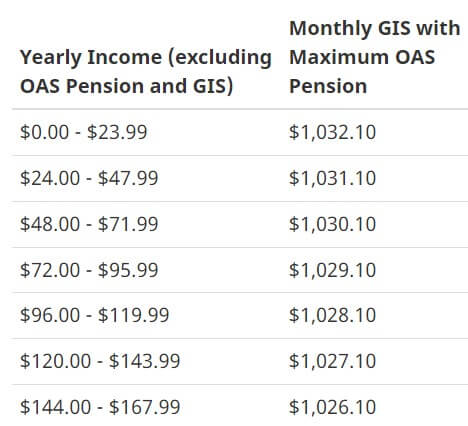

Current GIS Rates (2025)

For July–Sept 2025:

- Single, widowed, or divorced: Up to $1,097.75/month if annual income is near zero.

- Married/common-law: Amounts vary widely depending on whether your spouse also gets OAS/GIS.

For example:

- If both spouses receive OAS, the GIS maximum is lower (around $662 each).

- If only one spouse receives OAS, payments may differ again.

Is the “OAS $808 and GIS $1,097 Payments” Claim True?

The short answer: partially true.

- True for some:

- OAS of $808 is accurate for those aged 75+.

- GIS of $1,097 is accurate for single low-income seniors.

- False for others:

- A 66-year-old will only receive ~$735 in OAS.

- A married couple with modest income may receive far less GIS than $1,097.

So while the numbers are real, they’re maximum amounts, not guarantees for everyone.

Why Payments Change Every Quarter?

One of the biggest misconceptions about OAS and GIS is that the amounts are fixed. In reality, they change every January, April, July, and October.

Why?

Because payments are tied to the Consumer Price Index (CPI). If the cost of living rises, payments go up. If inflation cools down, payments stabilize. Importantly, payments never decrease—they only hold or increase.

This mechanism is designed to protect seniors’ buying power. For example, during inflation spikes in 2022 and 2023, OAS and GIS payments rose more quickly to offset higher costs at the grocery store and gas pump.

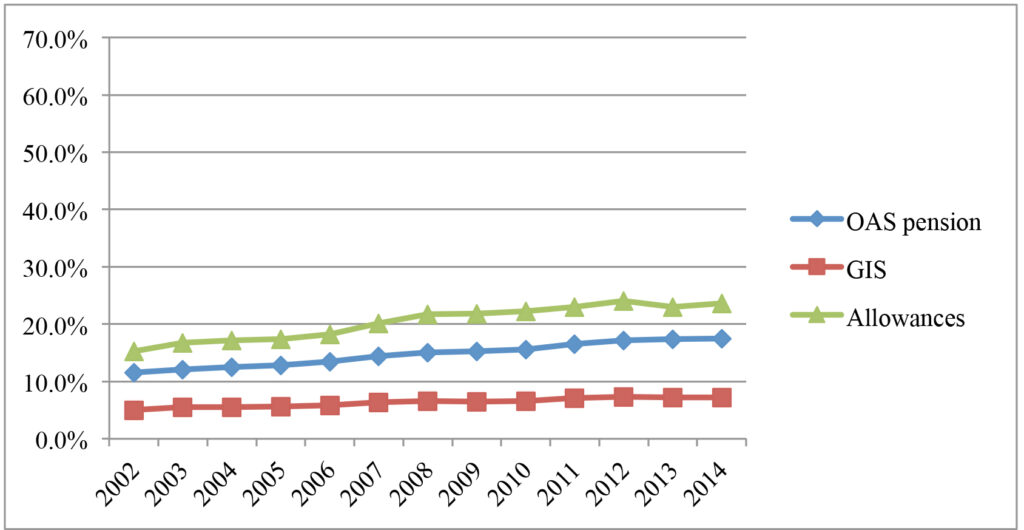

Historical Trends of OAS and GIS

Understanding past trends helps put today’s numbers in perspective:

- 2010: OAS maxed at ~$516/month.

- 2015: Increased to ~$564/month.

- 2020: Climbed to ~$614/month.

- 2025: OAS for those 75+ tops $808/month.

Over 15 years, that’s a jump of more than 56%. GIS has also seen steady increases, reflecting inflation and government efforts to keep seniors out of poverty.

Step-by-Step Guide to Applying for the OAS $808 and GIS $1,097 Payments

Applying doesn’t have to be stressful. Here’s how it works:

- Check for Automatic Enrollment

Many Canadians are auto-enrolled. If that’s you, Service Canada will send a letter before your 65th birthday. - Apply Online

If you’re not auto-enrolled, apply through your My Service Canada Account. - Apply by Paper (if preferred)

Print and mail the OAS/GIS application form. - Provide Proof

You may need to supply documents like citizenship papers, residency history, or proof of marital status. - File Taxes

GIS is income-tested, so you must file annually—even if you had no income.

Common Mistakes Seniors Make

- Not filing taxes → Without filing, GIS can’t be calculated.

- Assuming everyone gets the same payment → Amounts depend on age, marital status, and income.

- Ignoring clawbacks → Higher-income retirees may see OAS reduced.

- Forgetting marital updates → Divorce, marriage, or death of a spouse changes eligibility.

- Delaying application → Missing deadlines can delay payments by months.

How to Maximize Your Benefits?

- Delay OAS until 70: Waiting increases your payments by up to 36%.

- Use TFSA withdrawals: TFSAs aren’t counted as income for GIS purposes, unlike RRSP withdrawals.

- Coordinate with your spouse: Splitting income strategically can help preserve GIS eligibility.

- Plan for quarterly changes: Stay aware of CPI adjustments so you can budget more accurately.

Real-Life Examples

Example 1: Evelyn, 77, Single, No Income

- OAS: $808.45

- GIS: $1,097.75

- Total monthly income: ~$1,906.20

Example 2: George, 67, Married, Modest Joint Income

- OAS: $734.95

- GIS: Reduced due to income

- Total monthly income: ~$1,300

Example 3: Clara, 72, Retired with $50,000 in savings income

- OAS: ~$735

- GIS: None (income too high)

- Total monthly income: Her own savings + OAS

These show how dramatically outcomes can vary.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

OAS and GIS vs U.S. Social Security

For U.S. readers or Canadians comparing across the border:

- Canada’s OAS: Universal pension based on residency.

- Canada’s GIS: Extra benefit for low-income seniors.

- U.S. Social Security: Work-based pension tied to payroll contributions.

- U.S. SSI: Similar to GIS, designed for low-income seniors or disabled people.

Canada’s system is broader, but the U.S. system is more directly tied to employment history.