November OAS & CPP Double Payment: If you are a Canadian senior receiving OAS or CPP benefits, or if you assist others with retirement finances, you’ve probably heard about a “double payment” scheduled for November 2025. So what exactly does it mean? Is it two full months of pension? Who is eligible? And how much money will land in your bank account? This article breaks it all down in simple, easy terms while keeping details accurate and insightful for professionals too. From payment amounts and eligibility to historical context and smart money tips, read on for a comprehensive guide you can trust.

Table of Contents

November OAS & CPP Double Payment

November 2025 offers Canadian seniors a valuable opportunity to receive a one-time CPP boost coupled with regular monthly benefits and ongoing OAS relief payments. While not exactly a “double payment,” this boost helps seniors grapple with inflation and expensive living costs, reinforcing Canada’s commitment to retirement security. Careful tax filing and keeping personal info updated will ensure you or your loved ones don’t miss out. Understanding the rich history of CPP and OAS enhances appreciation for how these programs evolve to support Canadians across generations. At a time when every dollar counts, these payments provide indispensable support.

| Aspect | Details |

|---|---|

| OAS & CPP Payment Month | November 2025 |

| Regular CPP Payment | Approximately $782 |

| CPP One-Time Boost | $758 (for eligible recipients) |

| Total November CPP | Up to $1,540 (regular + boost) |

| OAS One-Time Relief | $2,350 (ongoing one-time relief payments) |

| Eligibility – CPP Boost | Aged 60+, CPP recipient by Nov 1, 2025, income under $85,000, 2024 taxes filed |

| Eligibility – OAS Relief | Aged 65+, Canadian resident/citizen, enrolled in OAS or CPP, priority for income under $70,000 |

| Payment Dates | OAS: Oct 29, 2025; CPP: Nov 26, 2025 |

| Application | Automatic payment—no application needed |

| Official Info Portal | Canada Government Benefits |

What Is the “November OAS & CPP Double Payment” Actually?

Let’s clear up the common misconception: November 2025 will not see two full months of OAS or CPP payments issued back-to-back. Rather, the so-called “double payment” refers to:

- The regular November CPP payment—roughly $782.

- Plus a one-time CPP boost of $758 to help seniors cover inflation and living expenses.

Together this means some will see about $1,540 in CPP payments for November.

Additionally, the ongoing OAS one-time relief payment of about $2,350, introduced in late 2024 and continuing through 2025, is scheduled for deposit around October 29, 2025.

These combined payments don’t represent recurring double pensions but rather temporary boosts to help with financial pressures.

Who Qualifies for the Extra CPP Boost and OAS Relief?

CPP One-Time Boost Eligibility

To receive the $758 one-time CPP boost, seniors must meet these criteria:

- Be 60 years or older as of November 1, 2025.

- Be a CPP recipient by November 1, 2025.

- Have a total annual income under $85,000 for any part of the boost ($758 full boost if income is under $50,000, reduced amounts between $50,000 and $85,000).

- File their 2024 income tax return on time.

If you missed filing taxes or your income surpasses $85,000, you won’t qualify for the boost but will still receive your regular CPP.

OAS One-Time Relief Eligibility

Seniors qualifying for the $2,350 one-time OAS relief payments typically:

- Are aged 65 or older.

- Are Canadian citizens or permanent residents living in Canada.

- Are enrolled in OAS or CPP as of 2025.

- Have income under about $70,000 annually, prioritizing those with lower income to maximize support.

- Have filed their 2023 tax return.

These payments, like CPP boosts, are processed automatically based on available tax and benefit data.

Why Are November OAS & CPP Double Payment Being Issued?

Inflation presents a major challenge for seniors on fixed incomes like OAS and CPP. According to recent data from Statistics Canada, inflation reached roughly 6-7% in 2025, with prices for groceries, rent, utilities, and medications rising significantly.

These one-time payments are designed to reimburse purchasing power losses so seniors can maintain their quality of life while facing these economic pressures. The government aims not only to provide immediate relief but also to showcase ongoing commitment to retirement security.

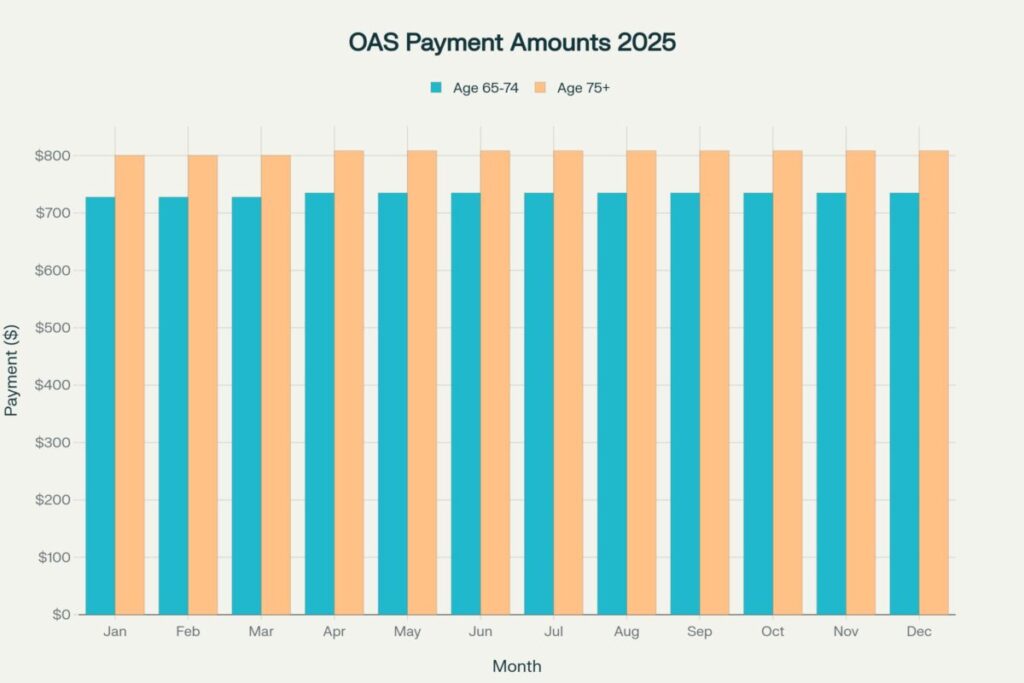

Payment Dates and Amounts in Detail

| Payment Type | Amount (CAD) | Expected Payment Date |

|---|---|---|

| Regular CPP | ~$782 | November 26, 2025 |

| One-Time CPP Boost | $758 | November 26, 2025 |

| Total CPP Payment | ~$1,540 | November 26, 2025 |

| OAS One-Time Relief | $2,350 | October 29, 2025 |

This schedule ensures payments arrive together, giving seniors an enhanced monthly cash inflow.

A Closer Look at Canada’s Pension System

Understanding these payments is easier with some perspective on Canada’s pension landscape:

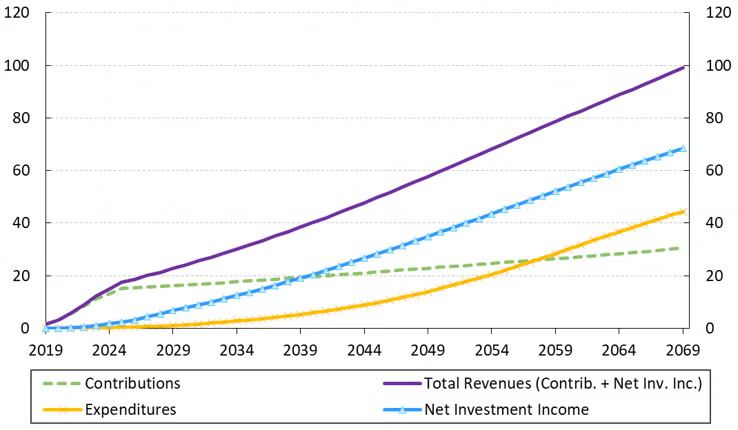

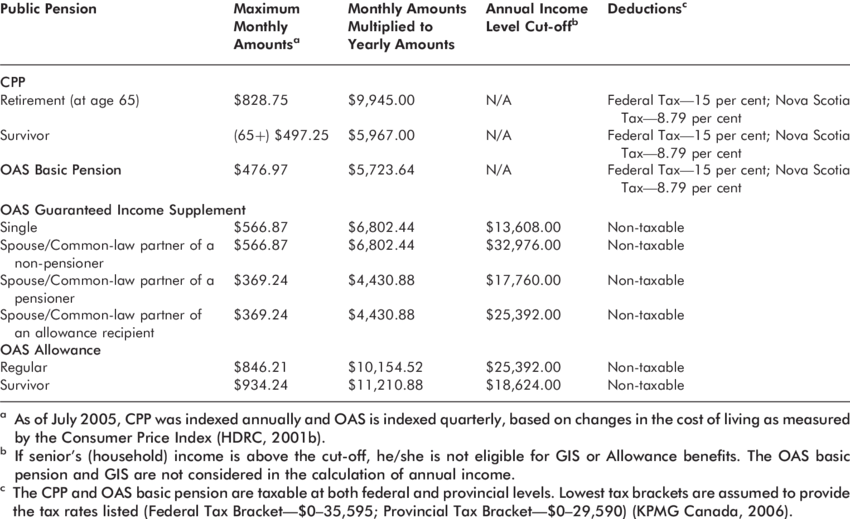

- The Canada Pension Plan (CPP) began in 1965 and is a contributory program. It requires workers and employers to contribute a portion of earnings, creating a fund that supports retirement, disability, and survivor benefits. CPP aims to replace about one-third of a worker’s pre-retirement income once fully matured.

- Old Age Security (OAS) predates CPP and is funded through general taxation to provide a foundation pension to most Canadians 65 and over, regardless of contribution history.

- The CPP has undergone enhancements since 2019 to gradually increase its replacement rate from 25% to 33% of earnings, enhancing future payouts without additional current costs for most contributors.

- The coupled system helps balance fairness and sustainability, combining earnings-related pensions (CPP) with universal flat support (OAS).

Government agencies like the Canada Pension Plan Investment Board (CPPIB) professionally manage CPP funds, aiming for long-term growth supporting future generations.

How to Make Sure You Receive November OAS & CPP Double Payment?

- File your taxes on time. This is a must since eligibility calculations come from tax returns. Omissions can delay or disqualify you from boosts.

- Regularly update banking and personal information with CRA via their My Account portal or through phone support.

- Check payment status online to track deposit dates and amounts.

- If payments or boosts don’t appear as expected, contact CRA or Service Canada promptly.

- Watch official mail and digital communications for notices or requests.

Smart Financial Tips for Managing the Boost

- Focus on covering essential costs: housing, utilities, food, and prescriptions.

- If possible, pay down high-interest debts to reduce financial pressure.

- Consider splitting the payment—set aside some as savings or emergency funds.

- Use funds to prep homes for colder months through energy-saving upgrades.

- Consult a financial advisor to incorporate the boost into your wider retirement plan.

- Explore additional provincial or local programs that complement federal benefits.

The Evolution and Sustainability of Canada’s Pension System

Canada’s pension system has evolved significantly since the mid-20th century to balance social welfare and financial sustainability. The Canada Pension Plan (CPP), established in 1965, was a landmark social program designed to provide income security through compulsory contributions by employees and employers. Over time, reforms have strengthened the CPP’s financial health, including the creation of the Canada Pension Plan Investment Board (CPPIB) in 1997 to professionally manage funds. These strategic investments aim for long-term growth, ensuring CPP can meet obligations for generations to come. Understanding this history reminds us that the current boosts and relief payments reflect a system adapting to economic realities like inflation while maintaining pension sustainability.

Planning Ahead: How Seniors Can Use the Boost Wisely

Receiving the one-time CPP and OAS boosts is a valuable opportunity for seniors to bolster their financial security. Beyond covering monthly bills like rent, utilities, and groceries, it’s wise to consider using part of the funds to pay down outstanding high-interest debts or create an emergency savings stash for unexpected expenses. Seniors might also think about minor home improvements, such as weatherproofing or energy-efficient upgrades, which can reduce future costs. Consulting a financial advisor can help tailor these payments into a broader retirement plan, balancing immediate needs with long-term financial well-being, ensuring this boost supports both today’s essentials and tomorrow’s peace of mind.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria