November $250 Pension Payment: If you’ve been following financial news lately, you’ve probably noticed the buzz around the $250 pension payment coming in November 2025. It’s more than a one-time cash bump — it’s part of a broader government move to help Aussie seniors, disabled citizens, and caregivers manage skyrocketing everyday costs. In a world where groceries, rent, and medication prices keep going up but incomes often don’t, even a few hundred dollars can make all the difference. This article breaks down everything you need to know about the November 2025 $250 pension payment, from eligibility and timing to how it fits into Australia’s retirement system and what it means for your weekly budget. Whether you’re living on the pension, supporting someone who is, or simply interested in how social support shapes the economy, you’ll get value from this detailed walkthrough.

Table of Contents

November $250 Pension Payment

The November 2025 $250 pension payment underscores a long-standing Australian tradition: looking after its retirees and caregivers when they need it most. In a time where inflation keeps testing household budgets, this payment offers breathing space, comfort, and recognition for those who’ve contributed decades of hard work. Beyond the dollars, it’s a reminder that the pension system is still evolving — ensuring every older Aussie can live with dignity, choice, and stability.

| Feature | Details |

|---|---|

| Payment Amount | $250 one-time supplement |

| Payment Period | Scheduled between late October and November 2025 |

| Recipients | Age Pension, Disability Support, Carer Payment, and Veterans Affairs pension holders |

| Application Process | None; automatic credit via Centrelink |

| Payment Type | Exempt from income tax and doesn’t affect other entitlements |

| Distribution Method | Direct bank transfer through Centrelink |

| Official Resources | Services Australia Website |

What’s the Deal With the November $250 Pension Payment?

The Australian Government confirmed that eligible pensioners will receive a tax-free, one-off $250 payment in November 2025. The move aims to provide relief for people feeling the squeeze of Australia’s high cost of living, especially with inflation impacting essentials like healthcare, fuel, and household goods.

Unlike recurring pension increases that happen twice a year through indexation, this one-time supplement gives recipients an immediate financial cushion. It’s designed to keep things manageable when bills creep a little higher than usual — a form of short-term economic backup rather than a long-term income raise.

What makes this payment particularly valuable is that it’s not taxable, doesn’t affect other Centrelink benefits, and lands automatically in recipients’ existing payment accounts. There’s no extra paperwork or waiting period — just straightforward support.

Why Now? Understanding the Economic Context

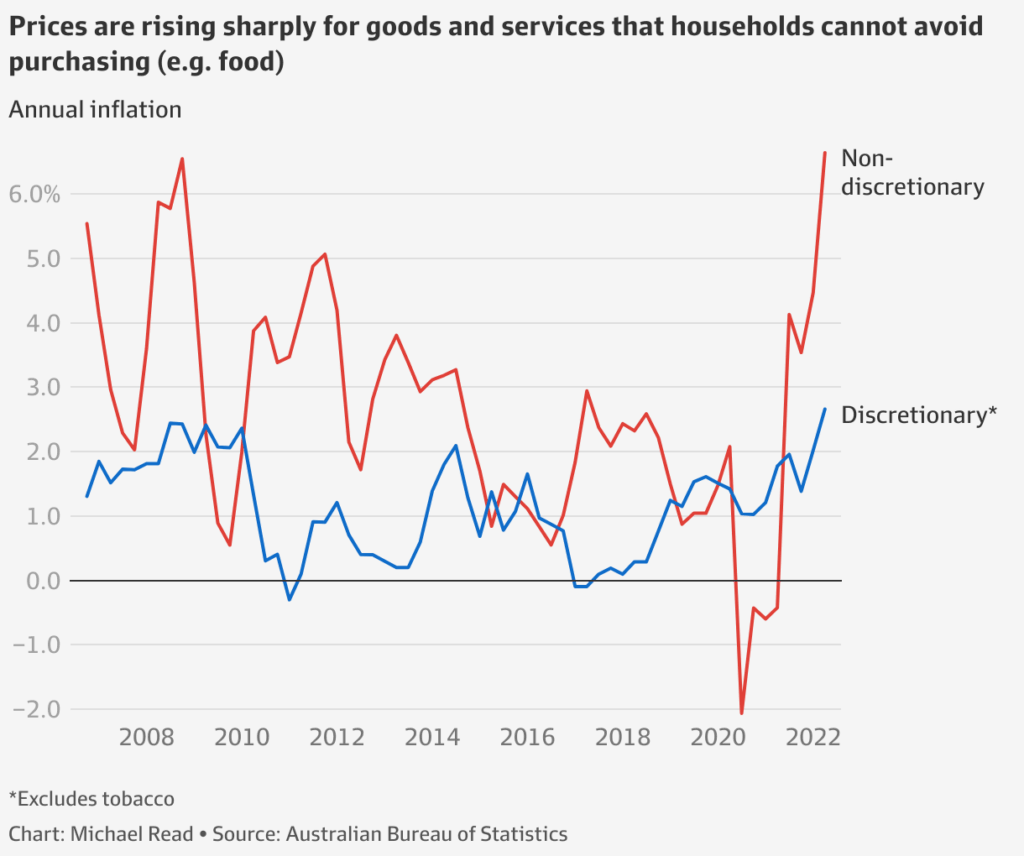

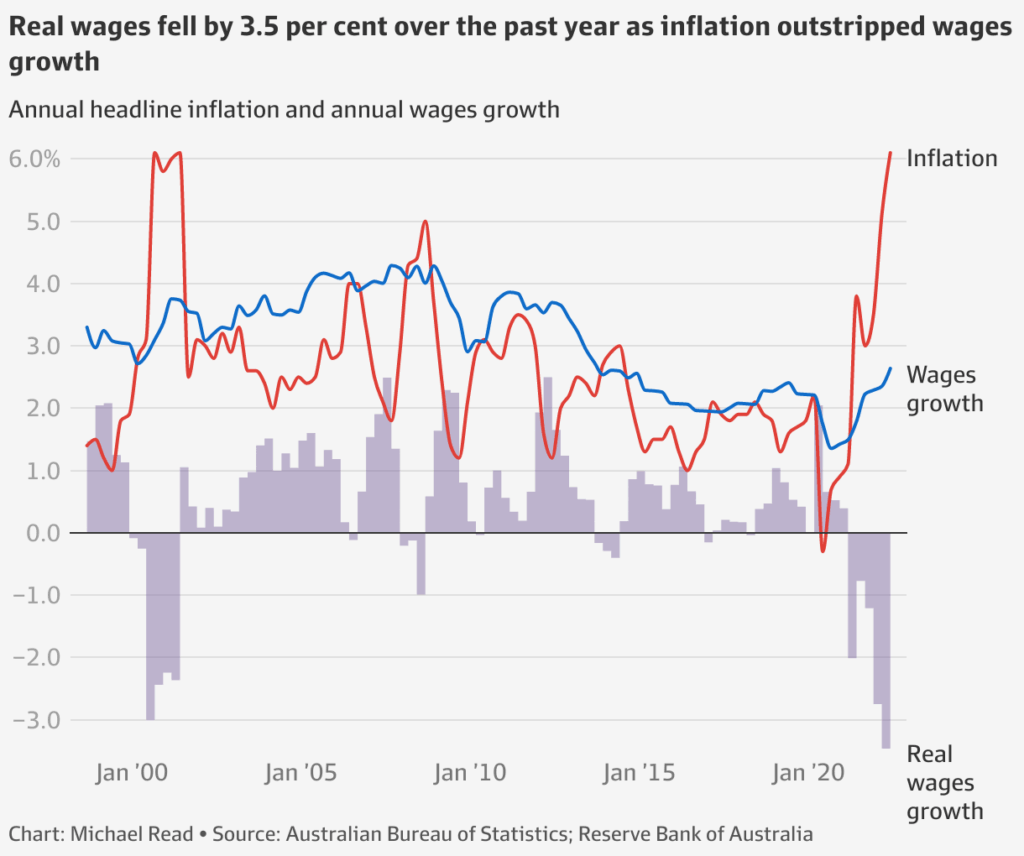

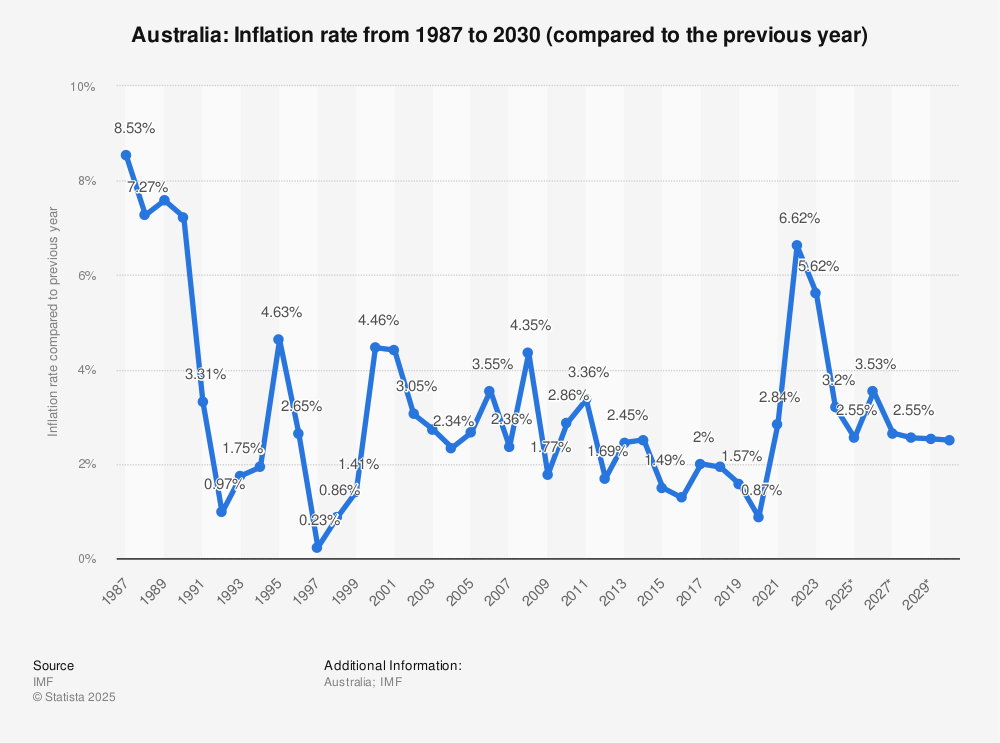

Australia, like most major economies, has dealt with rising inflation over the past few years. Prices of basic necessities jumped 6.8% in 2024, and energy costs have continued tracking upward in 2025. While wage growth slowed, pension indexation didn’t fully offset the sharp increase in living costs.

That gap inspired the government to act. Analysts at the Treasury Department have pointed out that even small, targeted stimulus payments can help stabilize local economies by boosting consumer spending without driving inflation too sharply.

For older Australians, it’s not just about numbers — it’s about relief. Many pensioners budget to the cent. A small jump in rent or utilities can mean giving up a necessity like medication or groceries. This payment ensures they don’t have to make those trade-offs.

Who Qualifies for the November $250 Pension Payment?

The $250 payment will be automatically credited to individuals who are receiving any of the following Centrelink pensions by late October 2025:

- Age Pension: For Australians aged 67 and older, meeting both residency and means test requirements.

- Disability Support Pension (DSP): For individuals permanently unable to work due to disability or illness.

- Carer Payment: For people providing full-time care to someone living with a disability or severe medical condition.

- Veterans’ Affairs Pension: For eligible veterans or their dependents receiving Department of Veterans’ Affairs benefits.

Even if you’re not receiving a full pension due to partial means assessment, you’ll still get the full $250 payment if you’re listed as an active pension recipient.

No separate applications are needed. The government automatically identifies eligible payments based on the Centrelink database and deposits funds directly into registered accounts.

When and How Will You Get Paid?

Payments are expected to roll out gradually from late October through November 2025, depending on your specific pension cycle.

If your regular payment hits your account fortnightly, expect the bonus to be processed close to your usual payment date, appearing as a separate entry (labeled “Cost of Living Supplement” or “Centrelink Bonus”).

Here’s how to stay prepared:

- Log in to myGov linked with your Centrelink account.

- Double-check that your bank details and contact information are up-to-date.

- Review your Centrelink payment summary to track the status of the $250 credit once released.

- For international pensioners (living abroad), verify accounts through Services Australia’s International Services arm.

If payments are delayed beyond November, Services Australia will issue official updates through myGov and their social media channels.

The Long Road: A Brief History of Australia’s Pension System

The story of Australia’s pension safety net is over a century old — and built on a foundation of fairness. The Invalid and Old-Age Pensions Act 1908 marked the birth of formal support for elderly citizens and those unable to work due to disability. By 1909, payments began to Australians over 65 (men) and 60 (women) who met residency and income conditions.

Fast-forward over 100 years, and that original age pension evolved into one of the most robust social protection systems in the world. According to the Australian Bureau of Statistics, today’s pension structure sits on a “three-pillar model”:

- Publicly funded Age Pension

- Mandatory private superannuation savings (Superannuation Guarantee)

- Voluntary super and personal savings

This hybrid design allows retirees to enjoy stable income streams while reducing reliance on government welfare alone — a model the World Bank once labeled “best in class” worldwide.

By 2025, with the average life expectancy nearing 83 years, and nearly 78% of Australians holding super accounts, the pension remains central to national well-being — particularly as costs rise faster than income for those outside the workforce.

How Does the $250 Fit Into the Bigger Picture?

The one-off pension bonus forms part of a larger cost-of-living relief package, complementing other key 2025 initiatives such as:

- Energy Rebate Program: Discounts for electricity bills offered jointly by federal and state governments.

- Rent Assistance Adjustments: Increased maximum rates for renters on income support.

- Pharmaceutical Benefits Scheme (PBS) Discounts: Reductions in medicine costs for concession cardholders.

- Superannuation Changes: Gradual increases in the compulsory Super Guarantee rate to 11.5%, helping workers grow larger nest eggs before retirement.

Combined, these measures create a comprehensive effort to shield low- and fixed-income Australians from the harshest impacts of inflation.

Real-world Example: How Far Can $250 Go?

Let’s put it in perspective.

Imagine you’re a single pensioner living modestly in suburban Perth. Your monthly electricity bill averages $220. With summer approaching, air conditioning costs rise another $90. The $250 bonus easily covers a billing cycle or a month’s worth of groceries, keeping your budget balanced without cutting back on essentials.

It might also offset a trip to the dentist, renewed prescription costs, or fuel savings for those who still drive. These are small but meaningful financial wins that ripple through local economies.

Smart Ways to Use Your November $250 Pension Payment

- Pay down small debts: Chip away at credit card or utility arrears to reduce stress.

- Bulk-buy essentials: Stock up on dry goods and pantry staples when they go on sale.

- Prepare for emergencies: Set aside part of the amount in a savings account for surprise medical or travel needs.

- Invest in your health: Schedule overdue check-ups or health-related purchases like glasses or compression socks.

- Enjoy a simple treat: Everyone deserves a morale boost; grab that favorite meal or short trip you’ve been postponing — within your means.

What If You’re Not Eligible?

Not on a pension yet? No shame in asking for help—other supports exist:

- JobSeeker or Youth Allowance additional payments

- Energy Assistance Vouchers in specific states

- Emergency relief programs via Salvation Army or St. Vincent de Paul

- Advance Payments through Centrelink for eligible recipients facing sudden costs

Australia’s October $400 Centrelink Payment for Pensioners: Eligibility and Payment Date

$1000 Centrelink Advance Payment in November 2025 – Check Deposit Date & Eligibility