November $2,200 Direct Deposit for Seniors: If you’re a senior residing in Canada, you’ve most likely come across chatter about a $2,200 direct deposit payment set for November 2025. It’s a hot topic buzzing around social media and news outlets — but what’s the real scoop? Is that $2,200 payment truly headed your way this November? Who qualifies, when does the money arrive, and what do you need to know to be prepared? Let’s clear up the confusion with a detailed, friendly, and expert breakdown that’s simple enough for anyone to grasp but detailed enough for professionals and seniors alike.

Table of Contents

November $2,200 Direct Deposit for Seniors

While the $2,200 payment hype has stirred curiosity, Canadian seniors should focus on the consistent, reliable benefits they are guaranteed: the Old Age Security (OAS) and Canada Pension Plan (CPP) monthly payments due November 26, 2025. The one-time $2,500 CPP top-up scheduled for late November is a significant bonus designed to help manage inflationary pressures. Seniors should ensure their personal information is up-to-date with government portals, watch official payment dates, and stay alert against scams to safekeep these essential income streams.

| Topic | Details |

|---|---|

| Payment Amount in November 2025 | No new $2,200 payment; regular OAS and CPP payments as usual. |

| One-Time CPP Top-Up Payment | $2,500 paid between Nov 27-30 for eligible seniors aged 60+. |

| Regular Pension Payment Date | November 26, 2025 |

| OAS Eligibility | Age 65+, min. 10 years residency post-18, income-based limits |

| How to Check Your Payments | Via Canada.ca OAS and CPP Benefits |

| Avoid Scams | Always use official government websites and be skeptical of unsolicited contacts |

The Truth About the November $2,200 Direct Deposit for Seniors

Despite a lot of online hype, there is no new $2,200 direct deposit payment scheduled for November 2025 for Canadian seniors. The confusion comes mostly from a one-time economic relief payment issued primarily in October 2025. This payment was part of government efforts to help seniors deal with the rising cost of living by automatically supplementing their regular pension payments.

- This $2,200 relief was aimed at seniors aged 65 and older who receive federal benefits like OAS or the Guaranteed Income Supplement (GIS).

- If you didn’t automatically receive this payment, there was an application deadline of September 30, 2025 to claim it.

- November will not repeat this payment amount but will feature regular pension payments and a separate $2,500 CPP top-up payment.

The key takeaway? Don’t hold your breath for a fresh $2,200 at the end of November, but be ready for your usual reliable pension payments plus a one-time CPP bonus.

Payments Scheduled for November 2025

Regular OAS and CPP Monthly Payments

- Seniors can expect their reliable pension checks to land in their bank accounts on November 26, 2025.

- The Old Age Security (OAS) and Canada Pension Plan (CPP) are ongoing benefits. They offer a steady monthly income based on your age, residency, and production history.

- The payments usually adjust slightly every quarter to keep pace with inflation and cost-of-living changes.

$2,500 One-Time CPP Top-Up Payment

- There is a special $2,500 CPP “top-up” bonus for eligible seniors aged 60 and over.

- This payment will be disbursed between November 27-30, 2025.

- It’s a one-time addition that supplements your regular CPP payments to help offset inflationary pressures.

Who Qualifies for These Benefits?

Old Age Security (OAS) Eligibility

OAS isn’t based on how much you worked or contributed but rather on your age and how long you’ve lived in Canada:

- You must be 65 years or older.

- Have lived in Canada for at least 10 years after turning 18 to qualify for partial benefits.

- To get the full OAS pension, you’ll usually need to have lived in Canada for 40 years after age 18.

- If living abroad, eligibility requires Canadian citizenship or legal residence prior to departure and at least 20 years residency in Canada after 18.

- Certain exceptions allow Canadians working abroad for Canadian employers or international organizations to count that time towards residency.

- Eligibility doesn’t require employment, meaning you can receive OAS even if you never worked in Canada.

Canada Pension Plan (CPP) Eligibility

- CPP eligibility is based on contributions made through payroll deductions during your working years.

- You can start receiving CPP as early as age 60 (with reduced payments) or delay until age 70 for increased payments.

- The one-time $2,500 CPP top-up is automatic for qualifying seniors aged 60+, based on your contribution record and years worked.

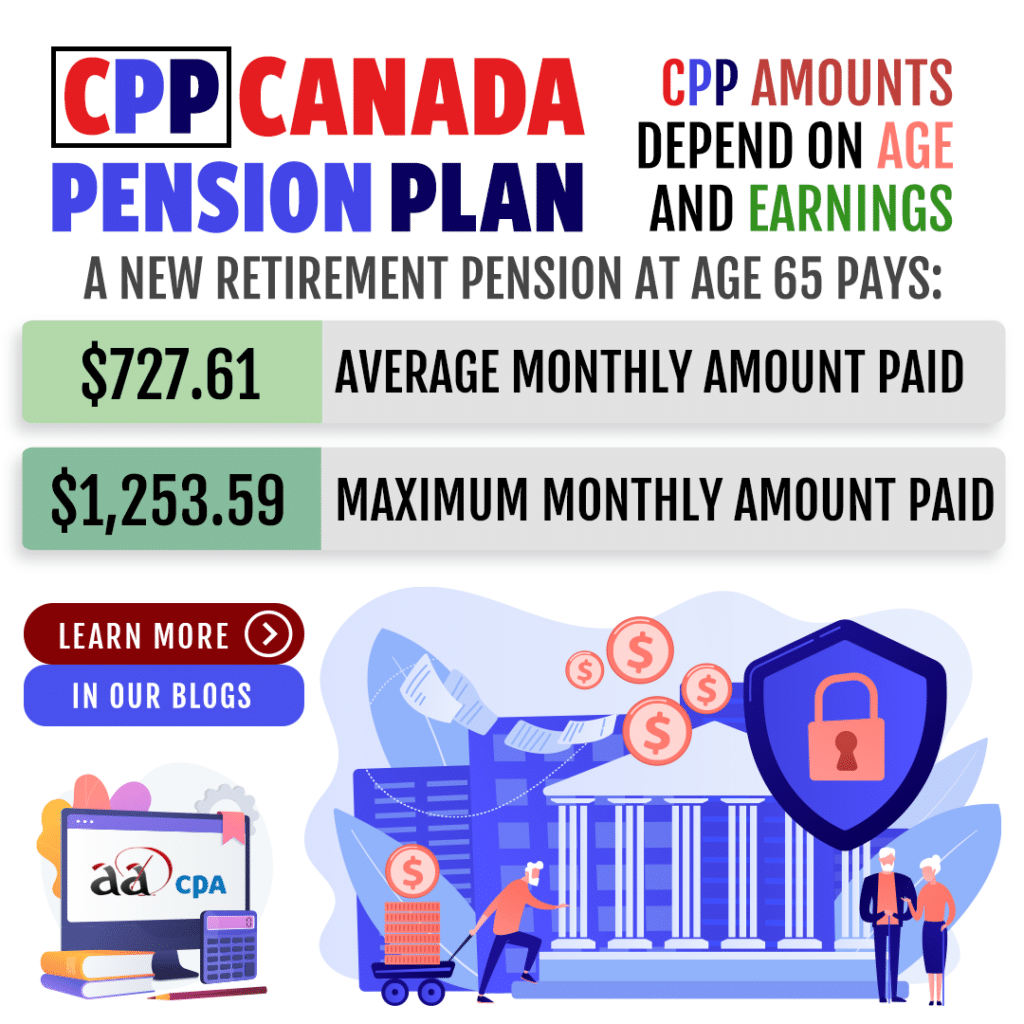

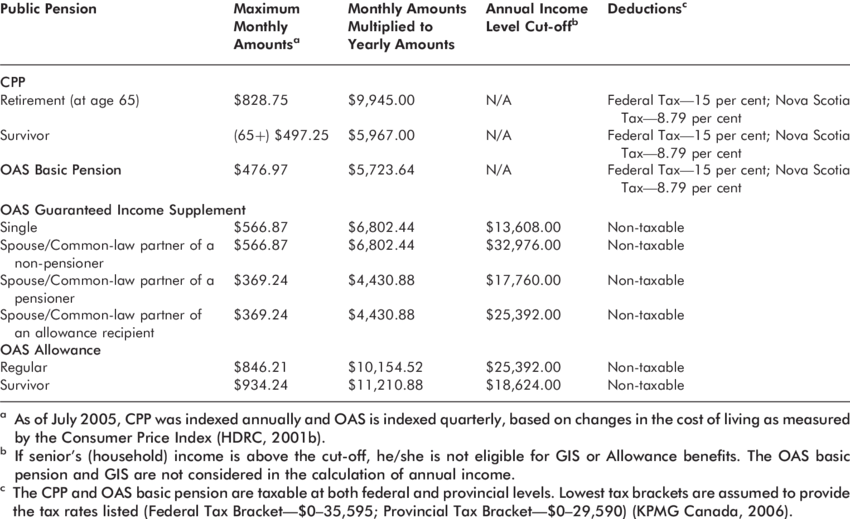

How Much Are These Payments?

Here’s a snapshot of payment amounts:

- Monthly OAS payments for 2025:

- Ages 65 to 74 receive approximately $740 per month.

- Ages 75 and older receive about $814 monthly.

- Guaranteed Income Supplement (GIS) provides extra money for low-income seniors and is non-taxable.

- CPP monthly payments average around $845, with maximum new recipient rates about $1,433.

- The one-time $2,500 CPP top-up payment in November 2025 is a notable financial boost.

These payments are adjusted quarterly to reflect inflation and changes in the Canadian Consumer Price Index, ensuring seniors’ income keeps pace with rising costs.

Understanding CPP: Beyond the Basics

The Canadian Pension Plan is a federally managed program providing financial security to Canadians during retirement, disability, or survivors’ benefits.

- Contribution-based: Workers contribute a percentage of their earnings, matched by employers.

- Benefit amount depends on your lifetime contributions and when you begin taking the pension.

- CPP funds are invested by the CPP Investment Board, which manages over $730 billion in assets as of 2025, helping sustain and grow the program’s capacity.

- Besides the retirement pension, CPP also offers disability and survivor benefits to protect contributors and their families.

For seniors, this means a reliable safety net that adapts to economic fluctuations and increasing life expectancy.

Smart Steps to Manage November $2,200 Direct Deposit for Seniors

Step 1: Confirm Eligibility and Review Contributions

- Use My Service Canada Account to view your CPP contribution records and estimate your pension.

- Check your residency history if applying for OAS.

Step 2: Set Up or Update Direct Deposit

- Direct deposit ensures fast, secure payment directly into your bank account.

- Register or update your information via official CRA or Service Canada portals.

Step 3: Keep Track of Payment Dates

- Mark November 26 for regular OAS and CPP payments.

- Watch for the November 27-30 window for the CPP top-up.

Step 4: Guard Against Scams

- Do not share your Social Insurance Number (SIN), banking information, or personal details with unknown callers or emails.

- Official government communication will not ask for payments or confidential information via phone or email.

The Importance of These Payments for Canadian Seniors

Retirement income programs like OAS and CPP are vital for millions of Canadians aged 65 and up, forming a solid financial foundation that supports basic living costs.

- With inflation pushing grocery, housing, and healthcare costs higher, these payments help seniors maintain independence and quality of life.

- One-time payments like the $2,500 CPP top-up provide temporary relief and flexibility to handle unexpected expenses or rising bills.

- Understanding eligibility, application processes, and payment schedules empowers seniors to plan effectively, ensuring they receive the benefits they deserve.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria