November $2100 + $1800 + $550 Triple CPP Payment: When it comes to retirement income in Canada, a lot of buzz surrounds the Canada Pension Plan (CPP). One hot topic right now is the rumor about receiving a “triple CPP payment” of $2100, $1800, and $550 in November 2025. So, let’s get the real story straight—no fluff—explaining what this means, how CPP payments actually work, and what you can really expect. Whether you’re plotting your retirement strategy or helping a loved one understand their pension benefits, knowing the facts about CPP payments is key to cutting through confusion and planning wisely. This article dives deep into what CPP is, who qualifies, how payments are calculated, why the triple payment is a myth, and smart tips to maximize your CPP income.

Table of Contents

November $2100 + $1800 + $550 Triple CPP Payment

The Canada Pension Plan remains a bedrock of financial security for millions across Canada. While rumors about triple payments for November 2025 are just that—rumors—official CPP payments provide a reliable monthly income based on your lifetime contributions. Stay informed, contribute as much as possible, consider timing your retirement benefits wisely. This approach will help you maximize your pension and enjoy a financially secure retirement.

| Topic | Details |

|---|---|

| CPP Payment Date (Nov 2025) | November 26, 2025 |

| Average Monthly CPP Payment | Approximately $848 |

| Maximum Monthly CPP Payment | Approx. $1,433 at age 65 |

| Is Triple CPP Payment a Reality? | No official triple payment of $2100 + $1800 + $550 |

| Eligibility for CPP | Must be 60+, contributed to CPP, and have applied for benefits |

| CPP Enhancement | Increased contributions to boost future benefits |

| Official Resource | Canada Pension Plan Official Site |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is a cornerstone social insurance program designed to provide Canadians with a steady stream of income once they retire or if they become disabled. Established in 1965 as a partnership between the federal government and provinces (except Quebec, which manages its own plan), CPP functions as a contributory system—meaning you pay in while you work to ensure you have a safety net when you stop.

Why does CPP matter? Because it helps millions of Canadians maintain financial independence when the paychecks stop, whether due to retirement, disability, or death.

CPP benefits fall into several categories:

- Retirement pension: Monthly income after you retire.

- Disability benefits: Support if you can no longer work due to a severe disability.

- Survivor benefits: Income for your spouse or dependents if you pass away.

- Post-retirement benefits: Extra income for those who keep working after beginning CPP.

CPP is funded by contributions from employees, employers, and the self-employed. For workers, these payments are automatically deducted from paychecks and matched by employers, with self-employed people paying both shares.

How CPP Payments Work in 2025?

Payment Amounts Explained

For 2025, the average monthly CPP payment for new retirees is approximately $848. This is the typical amount many first-time recipients see after contributing for years. However, if you contributed the maximum amount for a full career (about 39+ years), your monthly payment could reach a maximum of about $1,433. These amounts are annually adjusted for inflation to preserve your buying power.

Understanding how your contributions turn into payments helps take the mystery out of CPP:

- You pay about 5.95% of your annual earnings above the $3,500 base exemption.

- Your employer matches this 5.95%.

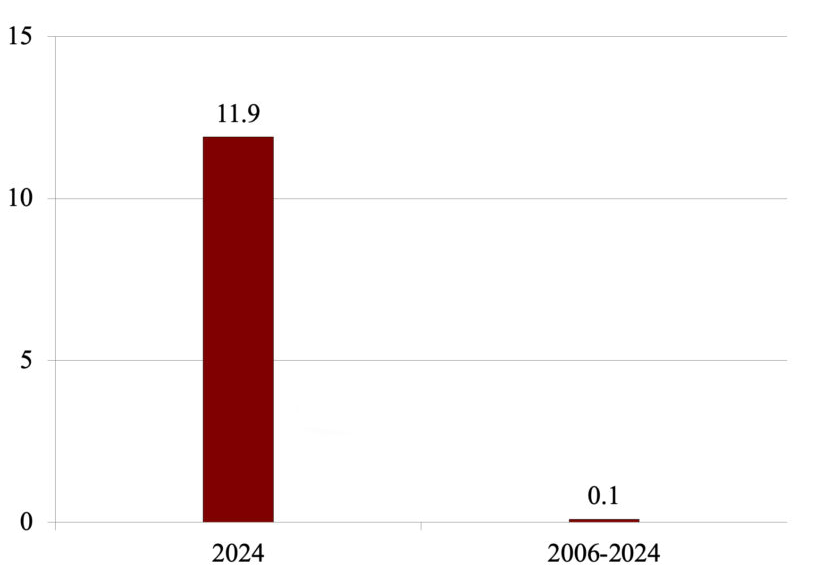

- Self-employed individuals pay both halves (totaling 11.9%).

- Contributions are invested wisely by CPP Investments (CPPIB) to grow the fund and ensure sustainable payments for decades.

The money you pay, combined with investment income, funds your future monthly payments, creating a reliable, long-term income source.

Myth-Busting the “November $2100 + $1800 + $550 Triple CPP Payment”

There’s a lot of hype online about a rumored “triple CPP payment” totaling $2100 + $1800 + $550 sometime in November 2025. Here’s the truth: There is no official or legitimate program from Service Canada or CPP that disburses triple or multiple lump-sum payments in a given month.

CPP payments are made once a month, generally at the end of the month, based on your contribution history and retirement age. The only payment you’ll see for November 2025 is on November 26.

Spreading misinformation about double or triple payments only creates confusion and unneeded anxiety.

2025 CPP Payment Schedule

Making sure you know when payments arrive helps you budget better. Here’s the payment calendar for 2025:

| Month | Payment Date |

|---|---|

| January | 29th |

| February | 26th |

| March | 27th |

| April | 28th |

| May | 28th |

| June | 26th |

| July | 29th |

| August | 27th |

| September | 25th |

| October | 29th |

| November | 26th |

| December | 22nd |

Who Qualifies for CPP?

You might think CPP benefits are automatic, but there are clear eligibility rules and an application process. To qualify:

- You must be at least 60 years old to claim retirement benefits.

- You need to have made at least one valid contribution to the CPP during your working life. Contributions come either from your employment in Canada or through recognized international agreements.

- You must apply to begin receiving payments; CPP does not start automatically when you turn 60 or 65.

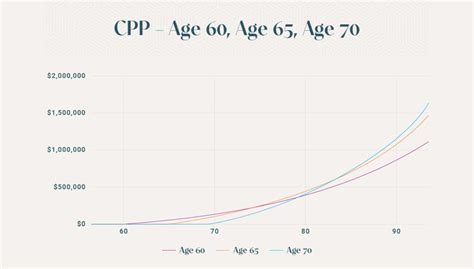

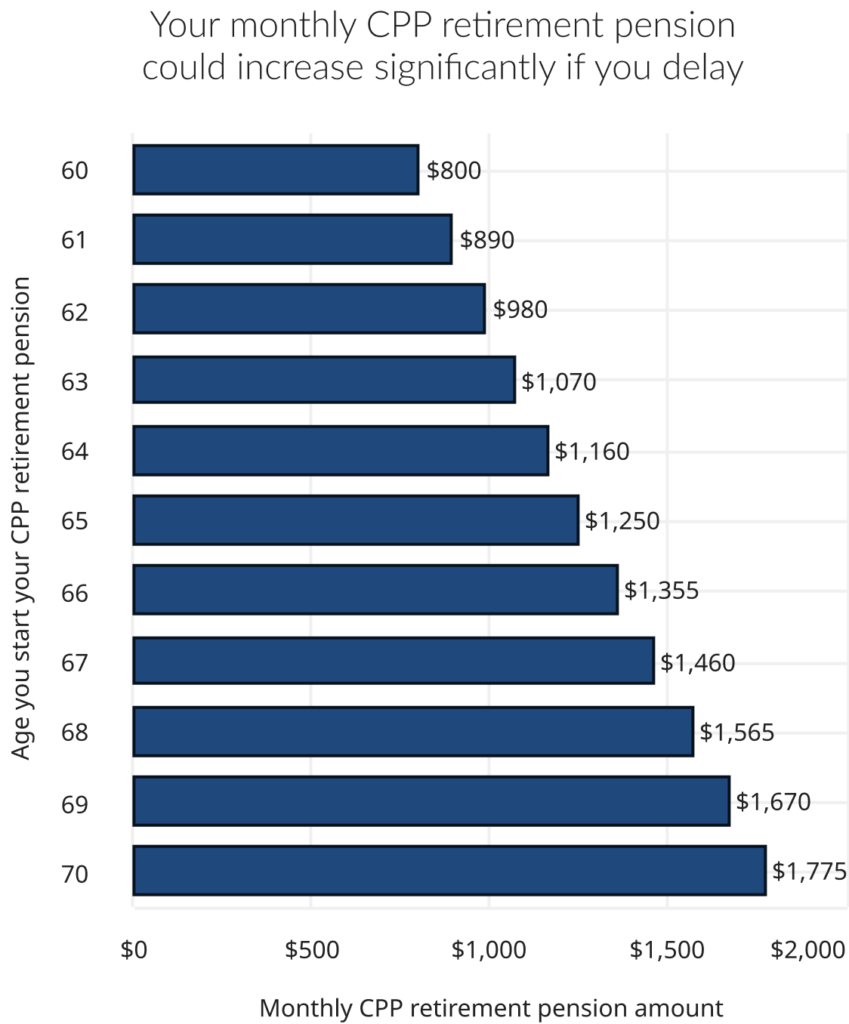

The amount you receive depends on your contribution history and when you apply. Applying between 60 and 65 reduces your payments by 0.6% per month early, whereas delaying your application past 65 until 70 increases your payments by 0.7% per month.

Continuing Work After Taking CPP

An important flexibility feature is the ability to keep working after starting CPP payments, without penalty. In fact, if you work while receiving CPP benefits and are under age 70, you continue to contribute and may receive additional Post-Retirement Benefits. This boosts your income and helps you make the most of your working years.

CPP Enhancement: Building a Better Pension for the Future

Realizing the importance of a sustainable pension system, Canada introduced the CPP Enhancement program in 2019. It gradually increases contribution rates and expands the earnings base to improve future pensions.

The enhancement is designed to address demographic challenges like an aging population and longer life expectancies. By increasing contributions now, younger workers get richer benefits later, ensuring CPP can remain a dependable income source for generations.

How to Maximize Your CPP Benefits

- Max out your contributions: The higher your lifetime contributions, the bigger your payout when you retire. Strive for 39 years of maximum contributions.

- Delay claiming benefits: Waiting beyond 65 can increase your monthly payment by up to 42%.

- Check your contribution record: Regularly review your CPP Statement of Contributions online to catch any errors or missing years.

- Leverage international agreements: If you worked outside Canada, check if agreements between countries can help you qualify or increase your benefits.

- Coordinate with other pensions: Consider how CPP fits with employer pensions and Old Age Security (OAS) to optimize your retirement income.

Contribution and Payment Example

If you earn $50,000 annually:

- You pay approximately 5.95% of earnings over $3,500 in CPP contributions.

- Your employer also pays 5.95%.

- Self-employed people pay both parts (11.9%).

- This amounts to over $5,600 contributed yearly toward your CPP.

When you retire, these contributions and investment earnings support your monthly payments.

Taxes on CPP Benefits

Keep in mind CPP payments are taxable income. When you file your annual tax return, CPP income is included and taxed at your applicable rate. Proper tax planning can help minimize surprises during tax season.

Other CPP Benefits You Should Know

Besides retirement income, CPP covers:

- Disability Benefits: For severe, prolonged disabilities preventing you from working.

- Survivor Benefits: Financial support for your spouse or common-law partner if you die.

- Children’s Benefits: For dependent children of disabled or deceased contributors.

- Post-Retirement Disability Benefits: For those who become disabled after starting retirement benefits.

These payments support various life circumstances, providing Canadians with a broad safety net.

How to Apply for November $2100 + $1800 + $550 Triple CPP Payment?

Applying is straightforward:

- Set up a My Service Canada Account online.

- Gather documents including your Social Insurance Number (SIN), banking info, proof of birth.

- Complete the online application form or mail in a paper application.

- Apply about six months before you want payments to begin.

- Track your application status online or via Service Canada.

Applying early ensures you don’t miss out on payments.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025

The History and Evolution of the Canada Pension Plan

Understanding CPP’s past sheds light on why it functions today. The plan was introduced in 1965 under Prime Minister Lester B. Pearson’s Liberal government to provide a contributory, earnings-related pension program.

Originally, CPP covered retirement and survivor benefits with voluntary disability benefits added later. Over time, Canada faced financing challenges:

- By the mid-1990s, pensions were at risk due to population aging and economic changes.

- In response, 1997 reforms boosted contribution rates from 6% to 9.9% over six years.

- The Canada Pension Plan Investment Board (CPPIB) was created to manage CPP funds professionally, investing to grow the fund for future sustainability.

- Today, the CPP fund is worth hundreds of billions, making it one of the world’s largest pension funds, generating investment income that bolsters contributions.

These reforms and continuous evaluations keep CPP robust for future generations.

Planning Your Retirement with CPP in Mind

With Canadians living longer—over 82 years on average—you’ll likely spend 20+ years in retirement. CPP is just one part of your income puzzle, alongside personal savings, employer pensions, and government programs like Old Age Security (OAS) and Guaranteed Income Supplement (GIS).

By learning the facts about CPP, avoiding misinformation like the triple payment myth, and planning contributions strategically, you secure a better financial future.