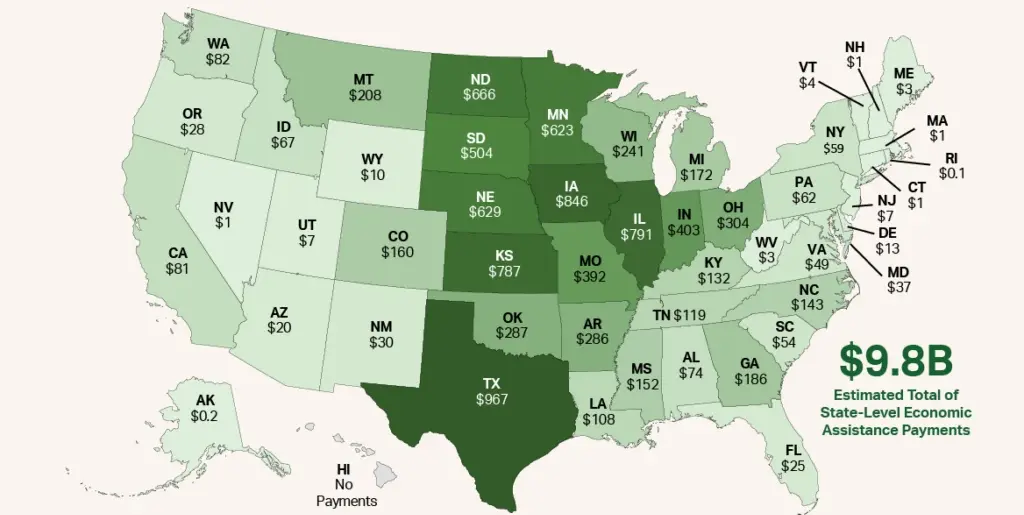

The government’s $400 relief checks are now rolling out to eligible individuals across the U.S., providing much-needed financial assistance amid rising inflation. This new round of payments follows previous state-level rebates aimed at easing the economic burden for families and individuals. Here’s what you need to know about the checks, including eligibility criteria, the distribution timeline, and how to receive your payment.

Table of Contents

$400 Relief Checks

| Key Fact | Detail |

|---|---|

| Amount of Relief Check | $400 |

| Eligibility | Varies by state, generally based on income and tax filing status. |

| Distribution Start Date | Began in September 2025, continuing through November. |

| Who’s Eligible | Low to middle-income earners, tax filers for 2023 or 2024. |

| Payment Method | Direct deposit or mailed check, depending on previous tax refunds. |

Background on the $400 Relief Check Program

As part of a series of state-level financial support measures, the $400 relief check aims to provide immediate financial relief to individuals struggling with inflation. This program is a direct response to the rising costs of living, exacerbated by the economic aftermath of the COVID-19 pandemic and subsequent inflationary pressures.

The payments, typically distributed to qualifying taxpayers, are expected to offer some financial breathing room for millions of Americans. While the initiative began with localized efforts in certain states, it has since expanded to include nationwide payments, with distribution starting in late September and continuing into the fall.

How the U.S. Economy Led to Relief Measures

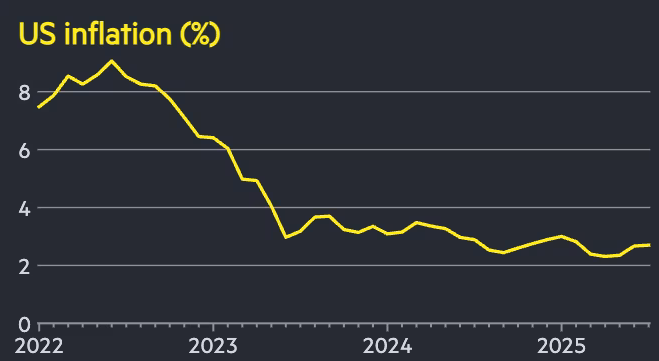

The decision to offer these relief checks is not an isolated action. The ongoing strain on American families due to inflation, high healthcare costs, and supply chain disruptions has made it increasingly difficult for many to manage their finances. Inflation, for example, reached its highest levels in decades, with consumer prices rising 9.1% from a year earlier as of mid-2025. The Federal Reserve’s interest rate hikes in an effort to control inflation have further strained household budgets.

The pandemic’s economic toll is also still being felt. Disruptions to labor markets, remote work shifts, and the global supply chain crisis have left many Americans struggling to make ends meet. Relief checks, in this context, are viewed as a temporary yet vital lifeline.

A Comparison with Previous Stimulus Payments

The $400 relief checks follow a pattern established by earlier rounds of pandemic stimulus checks, including the $1,200 payments issued in 2020 and the $600 checks in 2021. However, these new payments are more targeted, with states deciding who qualifies based on income thresholds.

The previous payments were larger, but this round is seen as a response to current economic conditions rather than a reaction to a pandemic. While many critics argue that the checks are insufficient to address the systemic issues of wage stagnation and rising living costs, they are nonetheless an attempt by states to provide immediate relief.

Who is Eligible for the $400 Relief Payment?

Eligibility for the relief checks varies by state, though the general criteria are based on income levels and tax filing status. In states like New York and Virginia, residents who filed state taxes for 2023 or 2024 are automatically considered for the rebate. Below is a closer look at eligibility in some of the key states.

New York State

In New York, residents who filed a 2023 state tax return will receive a rebate ranging from $200 to $400, based on income level. The checks are targeted primarily at lower and middle-income residents.

- Single Filers:

- Up to $75,000 in income: $200 rebate

- $75,001–$150,000: $150 rebate

- Married Filing Jointly:

- Up to $150,000: $400 rebate

- $150,001–$300,000: $300 rebate

Eligible individuals will receive the payment in the same manner they received their 2023 tax refund, either by direct deposit or check, depending on the filing method used for the return.

Virginia State

Virginia has also introduced similar payments for its residents, with rebates up to $400 for joint filers. The state is issuing rebates based on the 2024 tax filings, with payments expected to be sent by mid-November.

- Single Filers: Up to $200 rebate

- Married Filing Jointly: Up to $400 rebate

These rebates are contingent on tax liability and filing status, meaning that residents must have paid state taxes to be eligible for the payments.

Other States Offering Relief

Several other states, such as California, Colorado, and Illinois, are also providing similar financial assistance. California, for example, has launched its own rebate program, providing payments ranging from $200 to $1,000 depending on household income. In Colorado, residents who filed taxes in 2023 are receiving $500 relief checks, while Illinois offers up to $100 per person for tax filers.

When Can You Expect Your $400 Relief Check?

The $400 relief checks are being issued over the course of several months, beginning in late September 2025.

For those eligible, payments will either be sent via direct deposit (if bank information was provided in the most recent tax filing) or mailed as paper checks.

- New York: Payments began being mailed on September 26, 2025, and will continue through October and November. Direct deposit payments will follow shortly after.

- Virginia: Rebate payments are set to be issued by November 2025, with direct deposit payments being prioritized over paper checks.

Residents should check their tax records to ensure the correct address or bank account details are on file to avoid delays in receiving the check.

Impact on Vulnerable Communities

These relief checks are particularly important for vulnerable communities that have borne the brunt of the economic hardships during the pandemic and inflationary periods. Low-income families, seniors, and individuals with disabilities are among those who stand to benefit the most.

For instance, Maria Gonzalez, a 63-year-old retired teacher from Brooklyn, New York, shared how the $400 relief check would help her cover medical expenses that have surged since her retirement. “Every little bit helps when you’re on a fixed income. This check will allow me to pay for some prescriptions that I’ve been putting off,” Gonzalez said.

Experts emphasize that these relief checks are vital for keeping vulnerable families afloat, as rising food and gas prices continue to put a strain on household budgets. For many, these checks could cover essential items like groceries, rent, and utilities.

Future Considerations: Will More Relief Be Offered?

As states continue to face economic challenges, more relief measures are possible. Financial experts suggest that, depending on the evolving economic landscape, similar rebate programs or additional stimulus payments may be considered in the coming months.

However, such decisions are highly dependent on state budgets, the national economic outlook, and political considerations. In the meantime, the ongoing rollout of the $400 relief checks is expected to ease financial burdens for millions of households.

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans

COLA Increase Confirmed for 2026 – Here’s When the Official Report Will Be Released

IRS Announces Major 2026 Tax Overhaul – Seniors Get Bigger Deductions and Relief Bonuses

FAQs About $400 Relief Checks

Q: Do I need to apply for the $400 relief check?

No, in most states, if you filed a 2023 or 2024 tax return, you will automatically receive the rebate.

Q: How will the payment be delivered?

The relief payment will be sent via direct deposit or paper check, depending on how you received your previous tax refund.

Q: Is this program available nationwide?

While several states are issuing $400 relief checks, eligibility criteria vary. Check with your local tax authority for more details.