New CPP/OAS and GIS Payment: If you’re a Canadian senior or getting ready for retirement, keeping up with the latest updates on the Canada Pension Plan (CPP), Old Age Security (OAS), and Guaranteed Income Supplement (GIS) payments is key to keeping your finances on track. These government programs offer vital financial support that forms the backbone of many retirees’ incomes. Whether you’re receiving benefits now or considering applying soon, this article unpacks everything you need to know about the November 2025 payments—including amounts, eligibility, payment schedules, new rules, and practical tips to help you get the most from your benefits. The info is carefully explained in simple language, so whether you’re a newbie to retirement planning or a seasoned pro, you’ll find insights that are easy to grasp and actionable. Let’s get to it.

Table of Contents

New CPP/OAS and GIS Payment

Being informed about the November 2025 CPP, OAS, and GIS payments lets you better plan and secure your retirement finances. Max CPP payments can hit $1,433 monthly, OAS reaches $740, and GIS supplements low income seniors with up to $1,100 monthly. Stay proactive—use official tools to verify your eligibility, update your personal information regularly, and consider your best start age for CPP to maximize your benefits. These federal programs provide vital financial support that helps Canadian seniors live with security and dignity.

| Benefit Program | Maximum Monthly Payment (2025) | Typical Payment Example | Payment Date (Nov 2025) |

|---|---|---|---|

| CPP | $1,433 | Average $848 | November 26, 2025 |

| OAS (Age 65-74) | $740.09 | $727.67 (max typical) | Late Nov 2025 (27-29) |

| GIS (Single) | $1,105.43 (max) | $657.75 (average single) | Late Nov 2025 |

What Are CPP, OAS, and GIS? The Essentials Explained

These programs are the pillars of retirement support in Canada:

- Canada Pension Plan (CPP): This is a contributory pension program where your monthly retirement payment depends on how much you contributed from your earnings during your working years. The more you contributed, the bigger the payout.

- Old Age Security (OAS): This non-contributory pension is available to most Canadians aged 65 or older who meet residency requirements. You don’t need to have worked, just lived in Canada long enough.

- Guaranteed Income Supplement (GIS): This is an income-tested benefit paid on top of OAS to low-income seniors to help them meet basic living expenses. It’s tax-free and critical for those with modest means.

Together, these benefits offer a dependable income foundation in retirement, helping seniors maintain financial stability.

Details for November 2025 New CPP/OAS and GIS Payment

Canada Pension Plan (CPP) in November 2025

- The maximum CPP payment for individuals starting their pension at age 65 in 2025 is $1,433 per month.

- The average monthly payment to new recipients is approximately $848.

- The payment for November 2025 will be deposited on November 26.

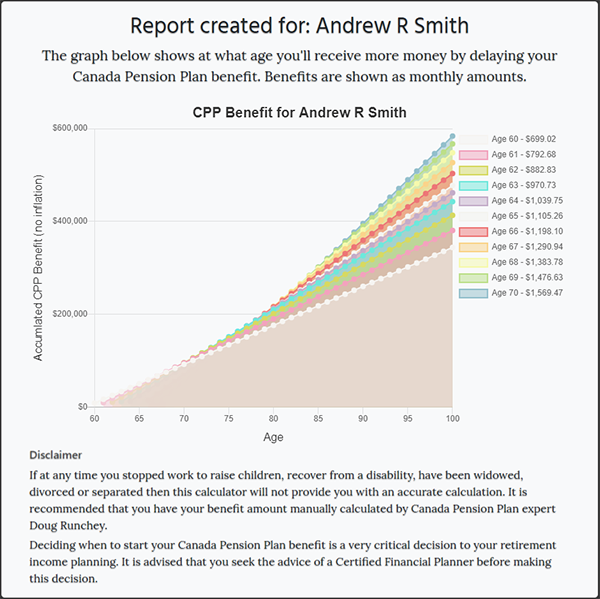

- If you defer starting your CPP beyond age 65 (up to age 70), your monthly payment increases by 0.7% per month, adding up to a 42% boost at age 70 compared to starting at 65.

- You can start receiving CPP as early as age 60, but payments are reduced by 0.6% per month if taken before 65.

How CPP Contributions Work?

- Contributions are mandatory if you’re 18 or older, earning more than $3,500 annually (outside Quebec which has its own plan).

- The contribution rate in 2025 is 5.95% on annual earnings up to $71,300 plus an additional 4% on earnings up to $81,200.

- Self-employed Canadians pay both employee and employer portions, making their max contribution $8,860.20 for the year.

- CPP’s post-retirement benefit allows working retirees aged 60 to 70 who continue contributing to increase their overall retirement income.

Old Age Security (OAS) for November 2025

- OAS pension payments for seniors aged 65-74 max out at $740.09 per month as of 2025.

- Seniors 75 and older receive a 10% increase, around $814 per month.

- November OAS payments are scheduled for the last business days of November, typically between the 27th and 29th.

- This benefit is taxable and may be clawed back if your annual income exceeds roughly $90,997 (2024 threshold, may be adjusted).

- OAS eligibility requires at least 10 years of Canadian residency after age 18; 20 years or more if residing outside Canada.

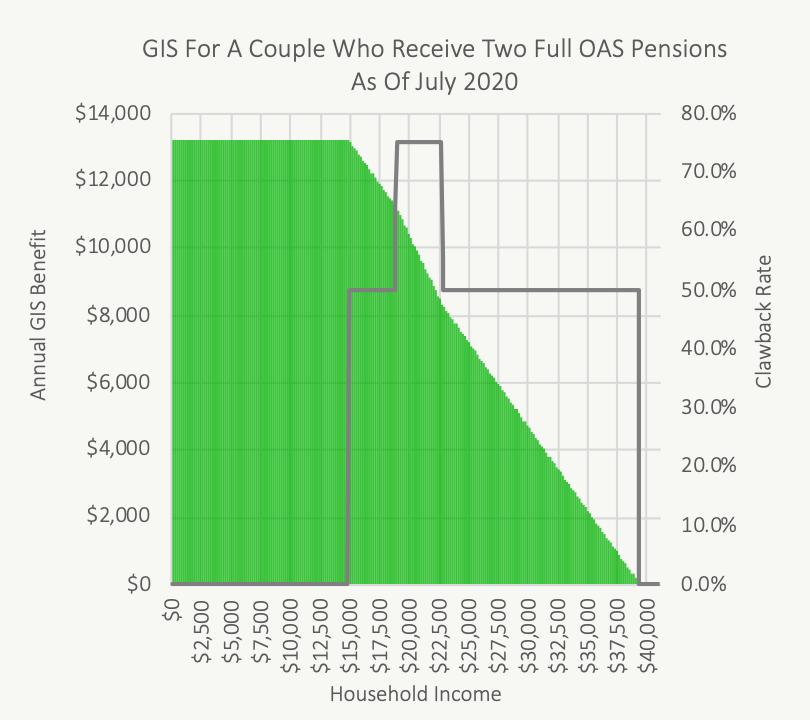

Guaranteed Income Supplement (GIS): What to Expect

- GIS payments provide crucial additional support for low-income pensioners, with max payments estimated at $1,105.43 monthly for singles.

- Average payments often hover near $657.75 monthly, depending on income and marital status.

- GIS is non-taxable and paid with OAS benefits, generally in late November.

- Eligibility is income-based, must apply or be automatically enrolled if receiving OAS and qualifying financially.

- New rules effective October 2025 exclude those under sponsorship agreements from GIS eligibility while sponsorship liability lasts.

Why These Benefits Matter More Than Ever?

In the face of inflation and rising living costs, the security of CPP, OAS, and GIS income is a financial lifesaver for seniors. Health expenses, housing, utilities, food, and medications put pressure on fixed incomes. These programs provide stability and help prevent seniors from falling into poverty.

Navigating Eligibility: Who Can Get These Benefits?

CPP Eligibility

- To qualify, you must have made at least one valid contribution to CPP.

- You must be 60 years or older.

- Contributions reflect your work history since age 18.

- Even if you’re still working between 60-70, you can collect CPP and receive additional post-retirement benefits for continuing contributions.

- Survivor and disability benefits are also part of CPP’s broader program.

OAS Eligibility

- Must be 65 or older.

- Canadian citizen or legal resident.

- Lived in Canada for at least 10 years after age 18 if residing in Canada.

- If living outside Canada, 20 years of residency is required after age 18, or eligibility under international social security agreements.

- Special OAS allowances exist for 60-64-year-olds in certain low-income situations or for survivors.

GIS Eligibility

- Must receive OAS, be 65+ and meet strict income limits (e.g., singles below ~$22,440/year).

- Income includes employment, pension, and other sources.

- Cannot be under sponsorship agreement as of new 2025 rules.

- Marital status affects thresholds and payments; couples receive combined benefits with adjusted limits.

How to Maximize Your Government Benefits: A Practical Guide

Step 1: Evaluate Your CPP Contributions and Plan Your Retirement Age

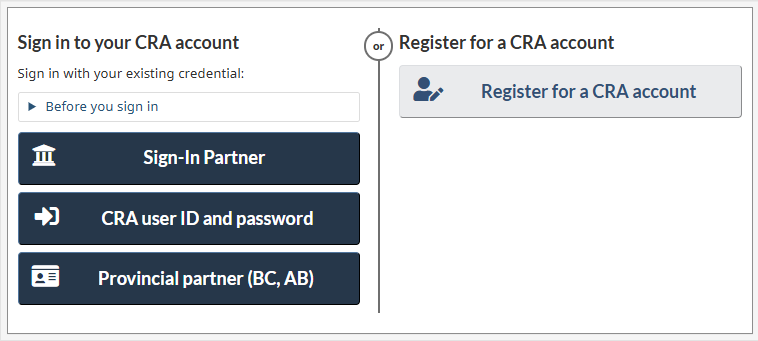

- Visit your My Service Canada Account to track CPP contributions and estimate monthly benefits.

- Decide when to start CPP: early (60) means lower monthly payment, late (up to 70) means bigger monthly checks.

- Consider your health, income needs, and life expectancy.

Step 2: Plan OAS and GIS Applications Carefully

- Apply for OAS automatically if eligible; otherwise, apply via Service Canada.

- Apply or confirm GIS if your income is low; the government usually applies these automatically if they have your income info.

- Reporting changes in residence, marital status, or income promptly can help avoid overpayments or missed payments.

Step 3: Take Advantage of Other Benefits and Credits

- Seniors’ Home Renovation Tax Credit, GST/HST credits, provincial programs.

- Explore health benefits and discounts available locally.

Emerging Trends: The $2,500 Monthly Pension Plan

2025 has seen the introduction of a new government initiative aimed at combining CPP, OAS, and GIS into a streamlined benefit package targeting up to $2,500 monthly for eligible seniors. This change aims to give more stable, predictable income and reduce paperwork for seniors. Qualifying individuals will be automatically transitioned to this enhanced plan based on age, residency, contribution, and income criteria.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria