New ₱18,500 GSIS Pension Hike: You’ve probably heard the buzz about a new ₱18,500 GSIS pension hike in 2025—maybe from Facebook, YouTube, or even your barkada chatting over coffee. The idea of higher pensions is exciting, especially for thousands of retired government workers who’ve served decades in public service. But before we pop the confetti, let’s talk facts, context, and what’s actually going on. This guide breaks everything down: what’s real, what’s rumor, how GSIS pensions work, who may qualify, and what steps to take right now to stay ready. It’s designed to be clear enough for a 10-year-old to understand but detailed enough for financial planners, retirees, and HR professionals to use in practice.

Table of Contents

New ₱18,500 GSIS Pension Hike

Here’s the deal: the ₱18,500 GSIS pension hike in 2025 isn’t official yet, but the direction of reform is clear. The government is actively improving retirement benefits, as seen in the 2025 survivorship pension reform and pending bills in Congress. If confirmed, this hike would be life-changing for many retirees, giving them better financial security in a high-cost economy. Whether you’re a retiree, family member, or financial pro helping others, knowledge is your best defense. Stay informed, stay organized, and stay hopeful—the future for GSIS pensioners looks brighter than it has in years.

| Topic | Current Status / Estimate |

|---|---|

| Proposed pension rate | ₱18,500 monthly (unconfirmed) |

| Eligibility for pension increases | Old-age & disability pensioners, 5+ years receiving pension |

| Basic retirement requirement | 15 years of service, minimum age 60 |

| Survivorship pension | Cap lifted; full 50% benefit restored in 2025 |

| Monthly pay date | Every 8th of the month (earlier if holiday) |

| Service year reform proposal | Reduce required service years from 15 to 10 |

| GSIS official website | gsis.gov.ph |

Why the New ₱18,500 GSIS Pension Hike Is Making Headlines?

Let’s face it — the cost of living has been rising. Groceries, electricity, and even maintenance meds cost more than they did a few years ago. A pension hike feels like a breath of fresh air.

The figure ₱18,500 per month started circulating on social media and in local news videos late 2024, sparking hope among pensioners. But here’s the truth: as of October 2025, there’s no official GSIS resolution or law confirming this exact amount.

What exists are ongoing talks and legislative proposals aimed at improving government pensions, plus confirmed GSIS adjustments to related benefits such as survivorship pensions and e-payment schedules.

So yes—there’s movement in the right direction. But ₱18,500 remains a proposed or anticipated amount, not a legally approved one yet.

Understanding the GSIS Pension System

To really grasp how a pension increase would work, let’s unpack the foundation.

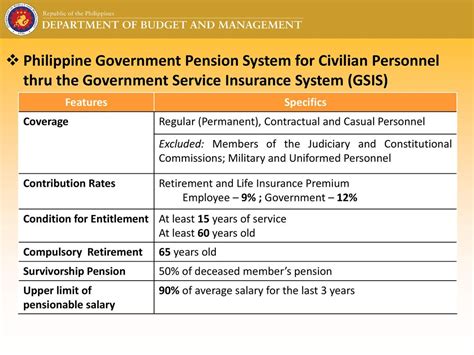

What GSIS Is and Who It Covers

The Government Service Insurance System (GSIS) is the Philippines’ state pension fund for government employees. It’s governed by Republic Act 8291, known as the GSIS Act of 1997, which covers permanent civil servants, teachers, clerks, judges, and most public sector employees.

GSIS provides three key benefits:

- Retirement and pension benefits

- Life insurance coverage

- Social benefits such as survivorship and disability pensions

What it doesn’t cover are military and uniformed personnel (they’re under separate systems like AFP or PNP pension funds).

How Retirement Benefits Work?

To qualify for GSIS retirement:

- You must have at least 15 years of creditable government service.

- You must be at least 60 years old.

- You should not be receiving any other pension from permanent disability or similar programs.

When you retire, you can choose either:

- Option 1: A 5-year lump sum then monthly pension after, or

- Option 2: Immediate monthly pension for life.

After five consecutive years of receiving monthly pension, retirees may become eligible for GSIS pension increases, depending on available budget and policy.

The Current Situation

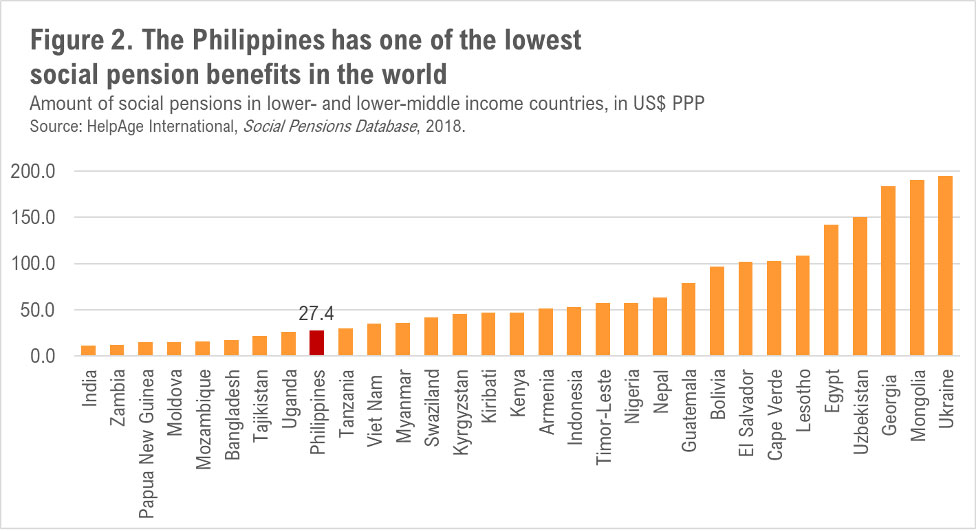

As of now, most retirees earn less than ₱18,500 monthly—many get between ₱8,000 to ₱15,000, depending on salary grade and length of service. That’s why the ₱18,500 proposal is drawing attention—it would significantly improve living conditions for retirees struggling with inflation.

The Legal and Economic Side of Pension Increases

The Legal Foundation

Any pension adjustment requires legal or regulatory authority. Under Section 57 of RA 8291, GSIS pensions may be increased when the actuarial valuation (an analysis of fund sustainability) confirms that the system can afford it.

That’s why each increase needs both technical evaluation and budget approval from the Department of Budget and Management (DBM).

Economic Impact

An ₱18,500 standard pension could impact over 500,000 GSIS pensioners nationwide, costing billions in additional annual funding. That’s why the government needs to ensure financial sustainability before final approval. Experts suggest gradual or tiered implementation might be more realistic than a flat jump for all.

According to the Philippine Statistics Authority (PSA), inflation averaged 3.8% in 2025, which—combined with aging demographics—pressures social protection systems like GSIS to adapt responsibly.

The Survivorship Pension Reform (2025)

Not all GSIS members realize this, but 2025 already brought one major confirmed change: the lifting of the survivorship pension cap.

Before, surviving spouses could receive a survivorship pension capped at 50% of the deceased member’s pension, but not exceeding ₱12,000. In 2025, GSIS removed that cap, allowing full 50% benefits regardless of amount.

This was a landmark win for widows, widowers, and families of deceased government workers—proof that GSIS is listening and updating its policies.

How the New ₱18,500 GSIS Pension Hike Might Be Rolled Out?

Let’s imagine how this could happen if approved.

Step 1: Official Announcement & Legal Approval

GSIS, in coordination with DBM and Congress, will issue an official announcement—either via press release or a new administrative order. Once funding is approved in the national budget, implementation can begin.

Step 2: Identifying Eligible Pensioners

GSIS will audit its database to identify who qualifies—likely those receiving regular pensions for at least 5 years. Pensioners under RA 660 or PD 1146 would also be covered.

Step 3: Policy Release and IRR

Implementing Rules and Regulations (IRR) would explain specifics—like whether the ₱18,500 is a minimum base pension or a flat adjustment across categories.

Step 4: First Payout and Retroactive Pay

Once rolled out, pensioners will receive the updated pension, typically on the 8th of each month, through their GSIS eCard or bank account. If the increase covers previous months, retroactive pay will be credited automatically.

Step 5: Monitoring and Appeals

GSIS will establish a feedback mechanism. Pensioners can appeal if they believe their computation was incorrect or they were wrongly excluded.

Real-Life Scenarios

Let’s make it concrete.

- Maria, a retired teacher since 2018, has been receiving ₱12,800 monthly. Under the hike, her pension could jump to ₱18,500 starting 2025, adding ₱5,700 more each month.

- Ben, who retired in 2024, won’t be eligible immediately if the 5-year rule stays. But if GSIS relaxes that condition, he could see an increase by 2026.

- Laura, a surviving spouse, now enjoys full survivorship benefits thanks to the new rule. She could also benefit from any future pension increase if the ₱18,500 standard applies universally.

SSS ₱1000 Senior Citizen Pension 2025 – Are You Eligible in the Philippines?

₱18,500 GSIS Pension Hike Coming 2025; Are You One of the Beneficiaries? Check Eligibility

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65

What Pensioners Should Do Right Now?

- Stay connected with GSIS updates — Bookmark the official website. Avoid fake Facebook posts and unverified YouTube claims.

- Update your records — Ensure your contact and banking info are correct. Use GSIS eServices or visit your nearest branch.

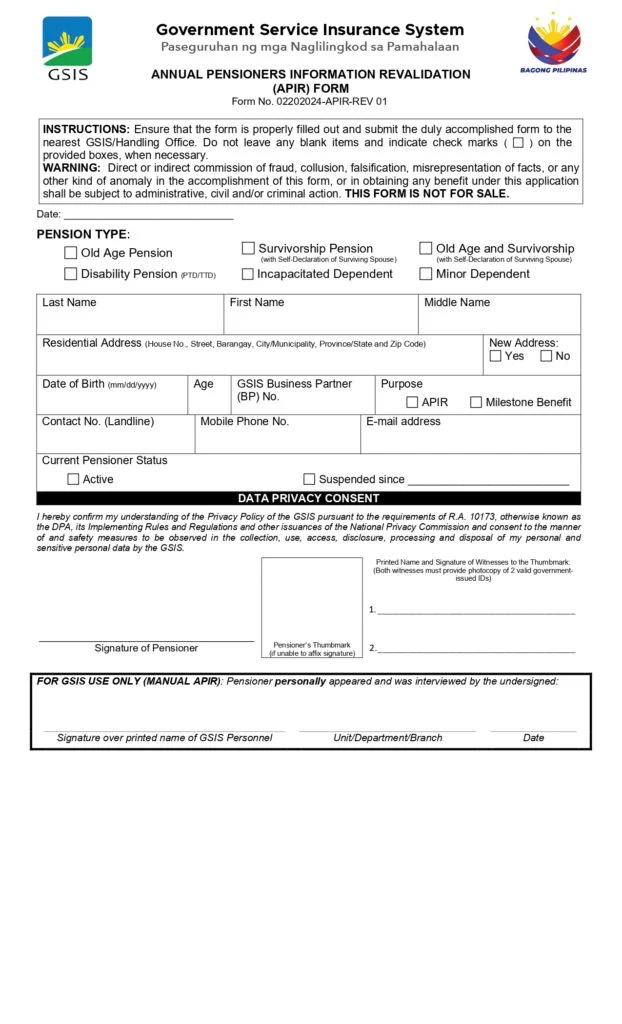

- Join APIR — The Annual Pensioners’ Information Revalidation keeps your status “active.” Miss it, and payments may stop.

- Keep copies of all GSIS communication — This helps in case of errors or disputes.

- Consult professionals — Financial advisors can help plan for taxes, estate distribution, or survivorship claims once the hike takes effect.

- Engage in community advocacy — Senior citizens’ organizations and teachers’ unions often lobby for pension reforms; joining them amplifies your voice.

- Plan ahead — Even with ₱18,500, inflation and healthcare costs can eat into income. Explore supplemental savings or health plans.

Expert Insight: Why Transparency Matters

Policy analysts stress that a transparent rollout is crucial. Without clear eligibility, the public risks confusion or frustration. Experts at the Philippine Institute for Development Studies (PIDS) note that pension sustainability requires balancing benefits with fund solvency. That’s why incremental increases—tied to inflation rates or economic growth—are often favored over one-time hikes.

GSIS, to its credit, has published annual actuarial valuations and audit reports ensuring its funds remain stable. Any hike to ₱18,500 will likely include such validation before release.