Nationwide Is Giving Away £175: If you’ve heard the buzz that Nationwide is giving away £175 for switching your bank account, you’re probably thinking: “That’s easy money, right?” Well, yes and no. The deal is real, but it comes with rules you need to follow carefully. Miss even one requirement, and you’ll lose the payout. This article breaks it all down: what you need to do, the hidden catches, how it compares to other bank switching deals, and whether it’s worth your time. We’ll keep things friendly and conversational, but also authoritative — pulling from expert sources, industry statistics, and real-life examples.

Nationwide Is Giving Away £175

Nationwide’s £175 switching bonus is one of the best deals available in the UK right now, but only if you follow the rules. The offer requires:

- A full account switch via CASS,

- £1,000 deposit from outside Nationwide,

- At least two Direct Debits moved,

- One debit card payment,

- And no prior switch bonus since 2021.

For organized savers and bonus hunters, this is easy money. But miss a requirement, and you’ll walk away empty-handed.

| Feature | Details | Source |

|---|---|---|

| Bonus Amount | £175 switching incentive | Nationwide Official Site |

| Eligible Accounts | FlexDirect, FlexAccount, or FlexPlus | Nationwide |

| Minimum Deposit | £1,000 within 31 days (must come from external source) | Nationwide |

| Direct Debits | At least 2 active Direct Debits must transfer | Nationwide |

| Debit Card Usage | Minimum of 1 qualifying transaction | Nationwide |

| Eligibility Restriction | Cannot have claimed a Nationwide switch bonus since Aug 2021 | Nationwide |

| Deadline | Offer subject to withdrawal (check latest terms) | Nationwide |

Why Banks Offer Switching Bonuses?

Switching bonuses are part of a bigger strategy. Banks aren’t giving away hundreds of pounds out of generosity — they want long-term customers.

When you switch, you bring along salary deposits, bill payments, and spending habits. That’s valuable data, and banks hope you’ll stick around for overdrafts, loans, or mortgages.

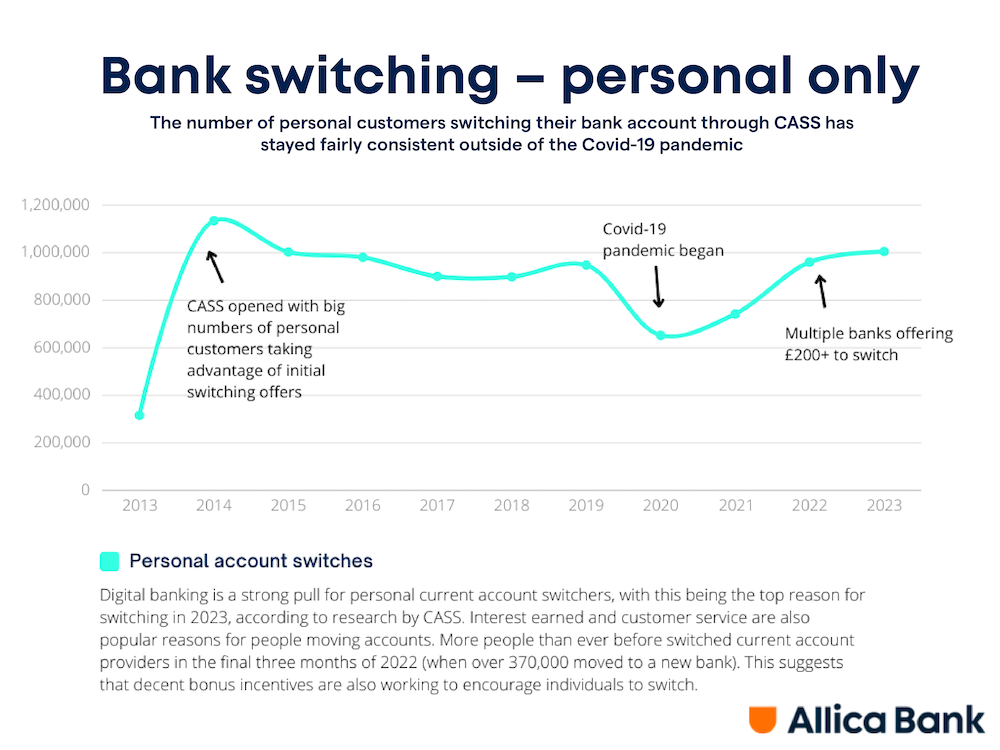

The Current Account Switch Service (CASS) makes it easy to move. According to UK Finance, over 1.3 million people switched accounts in 2024, with Nationwide consistently topping the list of most popular destinations. This explains why the building society keeps rolling out offers like this — it’s a battle for your loyalty.

The Hidden Requirements As Nationwide Is Giving Away £175

The £175 isn’t automatic. You must meet all the conditions:

Full Switch with CASS

Nationwide requires a full switch. That means your old bank account closes and everything — from payments to Direct Debits — is moved. A partial switch won’t qualify.

Deposit £1,000 Within 31 Days

You must pay in at least £1,000 from outside Nationwide. Internal transfers don’t count. Think of a salary deposit or a lump-sum savings transfer.

Two Active Direct Debits

Standing orders don’t work. Direct Debits must come from companies billing you, like your gym, broadband, or streaming services.

Debit Card Transaction

You need at least one purchase using the debit card linked to the new account. Everyday spending like groceries or petrol qualifies. Gambling or crypto payments do not.

Previous Bonus Exclusion

If you’ve had a Nationwide switch bonus since August 2021, you’re excluded.

Why These Rules Exist?

Nationwide wants engaged customers — not people who open an account, pocket the bonus, and abandon it.

- The £1,000 deposit shows you can bring in meaningful funds.

- The two Direct Debits prove you’ll use the account for regular bills.

- The debit card transaction shows spending activity.

- Excluding recent switchers stops repeat bonus hunters.

Comparison With Rival Banks

Nationwide isn’t the only player. Here’s how it stacks up against other UK banks:

| Bank | Switching Bonus | Requirements |

|---|---|---|

| Nationwide | £175 | £1,000 deposit, 2 DDs, debit card use |

| Santander | £175 (varies) | 2 DDs, £1,500 monthly income |

| HSBC | Up to £220 | New customer, £1,500 deposit/month |

| Lloyds | £175 | Open Club Lloyds, 2 DDs |

| First Direct | £175 | Switch with CASS, £1,000 deposit |

Nationwide’s offer is competitive — easier than Santander’s higher deposit requirements, but with slightly more hoops than First Direct.

Common Pitfalls

Missing Direct Debits

A lot of people assume standing orders count, but they don’t. You must have genuine Direct Debits.

Not Meeting the £1,000 Rule

Money must come from outside Nationwide. Moving it between Nationwide accounts won’t qualify.

Overlooking Taxes

Switch bonuses are considered income. If you exceed your Personal Savings Allowance, you may owe tax on the payment, according to HMRC.

Choosing a Paid Account

FlexPlus costs £13 per month. Unless you use its perks (insurance, breakdown cover), fees can eat into your bonus.

Who Should You Consider This Nationwide Is Giving Away £175?

Students and Young Adults

If you’re just starting out, this is an easy way to get extra cash while learning to manage bills.

Families

Parents who already juggle bills can reroute Direct Debits into a new account and collect the reward.

Bonus Hunters

If you haven’t claimed a Nationwide bonus since 2021, it’s a no-brainer.

Who Should Avoid It?

- People unwilling to close their old account.

- Customers who’ve already claimed since 2021.

- Anyone uncomfortable shifting Direct Debits.

Expert Advice

- Martin Lewis of MoneySavingExpert calls switching bonuses “the easiest legal money you’ll ever make” — but stresses that you must follow the rules exactly.

- Which? reminds users that while CASS is reliable (99.5% success rate), small mistakes like forgetting a Direct Debit can cost you the bonus.

- The Financial Conduct Authority (FCA) warns consumers to always check terms before switching, as banks may withdraw offers early.

Step-by-Step Guide

- Pick your account (FlexDirect, FlexAccount, or FlexPlus).

- Apply online at Nationwide’s site.

- Choose a full switch via CASS.

- Move two Direct Debits.

- Deposit £1,000 from outside Nationwide.

- Make one debit card payment.

- Wait for the bonus (usually within 10 working days).

Real-Life Scenarios

- Sarah (working mom): Redirects her salary and two bills, makes a grocery payment, and pockets £175 for school supplies.

- Tom (student): Moves his phone and Spotify bills, deposits student loan money, buys lunch with his debit card, and gets £175 for textbooks.

- David (bonus hunter): Already claimed in 2022, so he’s ineligible. This highlights why the rules matter.

The Bigger Picture: UK Switching Trends

Bank switching is on the rise. According to CASS data, over 9 million switches have taken place since the service launched. Customers are becoming savvier — using switching bonuses as a legitimate way to earn extra money.

Nationwide, Santander, and HSBC are leading the charge in offering incentives. For many, it’s a low-risk way to put free money in your pocket if you’re organized.

Practical Tips to Maximize Value

- Use bills you already pay as Direct Debits. Don’t create new commitments just for the bonus.

- If you want to keep your old bank relationship, open a second account first and switch that.

- Track deadlines carefully — missing the 31-day deposit window voids the bonus.

- Compare with other offers — if you’re eligible for HSBC’s higher payout, weigh the requirements.

£175 Free? Yes, But Nationwide’s Offer Comes with a Catch That’s Catching People Out

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

£200 Cost-of-Living Support in UK October 2025 – Will you get it? Check Eligibility