Massive £575 Windfall for 4 Million Pensioners: If you’re one of the 4 million pensioners in the UK, get ready for the biggest boost to your state pension in years—a £575 annual increase starting April 2026. This windfall is part of the government’s commitment to the triple lock policy, which protects pensioners’ income by linking increases to the highest of inflation, average wage growth, or a minimum 2.5%. Whether you’re currently receiving your pension or planning for retirement, this comprehensive guide breaks down the details, from eligibility and calculations to tax implications, practical advice, and the history behind this vital policy.

Table of Contents

Massive £575 Windfall for 4 Million Pensioners

The £575 annual pension boost, effective April 2026, marks a major milestone in UK pension policy, providing millions of pensioners with much-needed financial relief. The triple lock ensures that pensions keep pace with economic realities, safeguarding the income of retirees. While tax considerations may reduce some benefits, smart planning and awareness can help pensioners maximize their income and benefit packages. Staying informed, applying for benefits on time, and consulting experts when necessary will help retirees make the most of their financial support in retirement.

| Feature | Details |

|---|---|

| Total Increase | £575 per year (approx. £11 extra per week) |

| Number of Pensioners Impacted | 4 million UK pensioners |

| Effective Date | April 2026 |

| Reason | Annual adjustment under UK government “triple lock” policy |

| New State Pension Weekly Rate | About £241 (rising from £230.25) |

| Tax Implications | Potential for increased income tax due to frozen tax thresholds |

| How to Claim | Automatic for current recipients; new claimants must apply |

| Official Information & Claims | gov.uk State Pension Guide |

What’s Behind the Massive £575 Windfall for 4 Million Pensioners?

The triple lock guarantees an annual uplift to the UK state pension by the highest of three measures:

- Inflation (measured by the Consumer Price Index),

- Average wage growth,

- Or a statutory minimum increase of 2.5%.

For 2026, average earnings growth stood at 4.7%, triggering this largest boost in recent years—an increase that translates to roughly £11 extra per week or £575 annually for pensioners.

The rationale behind this system is to ensure pensioners’ income keeps pace with the cost of living and wage rises, preventing pensions from losing purchasing power over time.

Who Benefits? Eligibility Explained

- Around 4 million pensioners currently drawing the state pension will get this automatic increase.

- It applies primarily to those receiving the new State Pension (for individuals who reached pension age after April 6, 2016) as well as many on the older Basic State Pension.

- Pensioners who already receive the pension do not need to apply; the boost will be applied automatically.

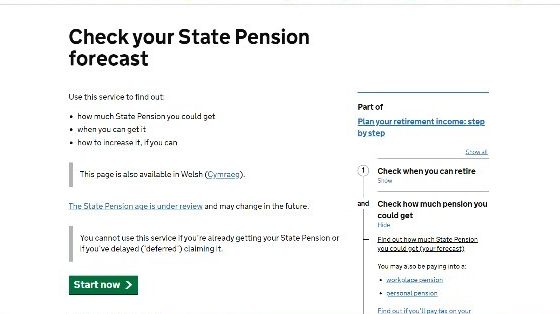

- Individuals approaching the state pension age must apply via the Pension Service. They will be notified approximately three months before they become eligible.

- It’s important to have your National Insurance number ready during the application process.

Breaking Down the Numbers: What You’ll Actually Receive

- For those on the new State Pension, weekly payments will rise from approximately £230.25 to about £241.

- Those on the old Basic State Pension will see increases from around £176.45 to £184.75 per week.

- Over a year (52 weeks), this adds up to approximately £575 extra annually.

- This increase is especially significant for pensioners living on fixed incomes where every pound counts for essentials such as heating, food, and healthcare.

The Importance of This Increase

With inflation pressures and a rising cost of living, particularly energy and food prices, this boost is a critical relief for pensioners. It helps improve affordability of everyday expenses, maintaining retirees’ dignity and comfort in their later years.

However, the full benefit may be tempered for some by new tax realities, which we explore below.

Tax Implications: What Pensioners Must Know

While the boost adds income, pensioners should be aware of potential tax consequences:

- The UK government has frozen income tax personal allowances and thresholds until April 2028, meaning the threshold at which income becomes taxable remains at £12,570 per year.

- The increase means the new State Pension alone is set to exceed this tax-free allowance by 2027, forcing many pensioners to pay income tax on at least part of their pension.

- For example, the new State Pension is expected to reach £241.90 per week by April 2027, totaling approximately £12,578 annually, crossing the personal allowance threshold by just a few pounds.

- This results in pensioners paying tax on a small amount of their pension income, potentially resulting in a modest tax bill for some.

- Additionally, those with other sources of income, like private pensions or savings, may owe even more tax.

- Pensioners should consider consulting HMRC guidelines or financial advisors to plan effectively and take advantage of potential tax relief options such as tax-free lump sums or ISAs.

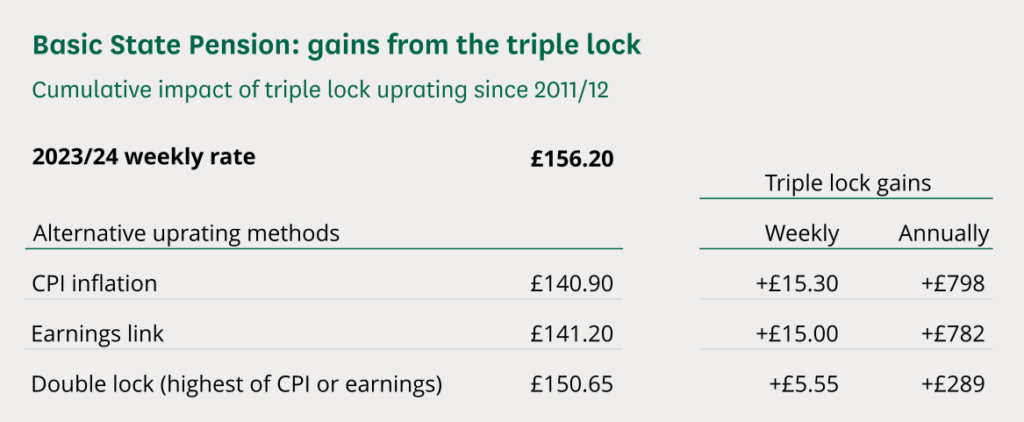

The History and Significance of the Triple Lock

The triple lock was introduced in 2010 as a government commitment to ensure state pensions keep pace with economic conditions and living costs:

- Before the triple lock, pension increases often lagged behind inflation and wage growth, shrinking pensioners’ real income over time.

- The triple lock guarantees yearly increases linked to wages or inflation, whichever is higher, ensuring pensioners don’t lose out.

- This policy has become central to UK retirement income policy, widely supported by pensioner groups.

- Critics argue that it puts pressure on public finances, especially with an aging population, raising questions about its sustainability in the long term.

- Nonetheless, the triple lock remains a key protective measure for pensioners, evidenced by the substantial £575 increase scheduled for 2026.

Impact of Massive £575 Windfall for 4 Million Pensioners on Related Benefits

The pension increase may influence other benefits you receive:

- Pension Credit, a means-tested benefit designed to top up low incomes, may be affected if your income rises significantly.

- Other winter or cold weather payments may also be impacted, as eligibility depends on income thresholds.

- Pensioners receiving benefits linked to income should reassess their eligibility after the pension rise.

- Trusted resources like Age UK provide detailed advice on navigating these changes.

How to Claim Massive £575 Windfall for 4 Million Pensioners?

- If you are already receiving state pension payments, the £575 increase will come automatically—no action required.

- For those nearing pension age, the Pension Service will send a claim invitation approximately three months prior.

- You can claim the pension online, by telephone, or by post—using your National Insurance number and bank details.

- If you continue working past state pension age, you may choose to defer your pension to increase future payments.

- It’s worth reviewing your options carefully, as deferral can increase your weekly pension by 1% for every 9 weeks deferred.

DWP Announces UK Income Support Rates for 2025 – Are You Eligible?

£230 DWP State Pension Boost in 2025: What Pensioners Need to Know? Check Eligibility Criteria

DWP Clamps Down on Winter Fuel Payments; Pensioners Will Have to Give It Back

Practical Tips for Pensioners to Maximize Their Benefits

- Check your National Insurance record to ensure you have enough qualifying years to get the full pension.

- If you’re still working, consider whether deferring your pension could boost your long-term income.

- Stay updated on tax changes and their impact on your pension income.

- Look into additional savings vehicles like ISAs or private pensions to supplement your retirement income.

- Consult with financial advisors or pension experts to tailor a plan fitting your lifestyle and financial goals.

- Regularly review your income sources and benefits to avoid surprises from tax liabilities or benefit changes.