Major Student Loan Changes: If you’re one of the roughly 40 million federal student loan borrowers in the United States, October 2025 brought some major shifts. The federal government rolled out new regulations that are transforming how loans are repaid, how forgiveness is handled, and the borrowing limits you’ll face. Whether you’re just starting college, managing monthly payments, or a financial pro keeping tabs on federal education policies, this guide breaks it all down clearly and authoritatively, while still sounding friendly and conversational. Let’s dig into what’s new and what it means for you.

Table of Contents

Major Student Loan Changes

October 2025 ushered in a new chapter for federal student loans. Simplified repayment plans, a minimum mandatory payment, a borrowing cap, and renewed forgiveness bring clarity—and some constraints—to millions of borrowers. While these rules may feel tough compared to recent years, they aim to keep the system fair and sustainable. With these tools, borrowers can handle changes confidently and plan for a financially healthy future.

| Topic | Details |

|---|---|

| Impacted Borrowers | Over 40 million federal student loan borrowers |

| New Legislation | Enacted through the One Big Beautiful Bill Act |

| Loan Forgiveness | Resumption of forgiveness for 2 million eligible borrowers under the Income-Based Repayment (IBR) plan |

| Repayment Plans | Streamlined to 2 options: Standard Plan & Repayment Assistance Plan (RAP) |

| Minimum Monthly Payment | Income-driven plans impose a $10 minimum payment (no more $0 payments) |

| Borrowing Limits | New lifetime federal loan cap at $257,500 |

| Repayment Duration | 10 to 25 years, scaled based on total debt amounts |

| Government Services Delays | Possible delays due to partial government shutdown starting October 1, 2025 |

| Official Resource | Full details at Federal Student Aid Website |

Why Major Student Loan Changes Matter?

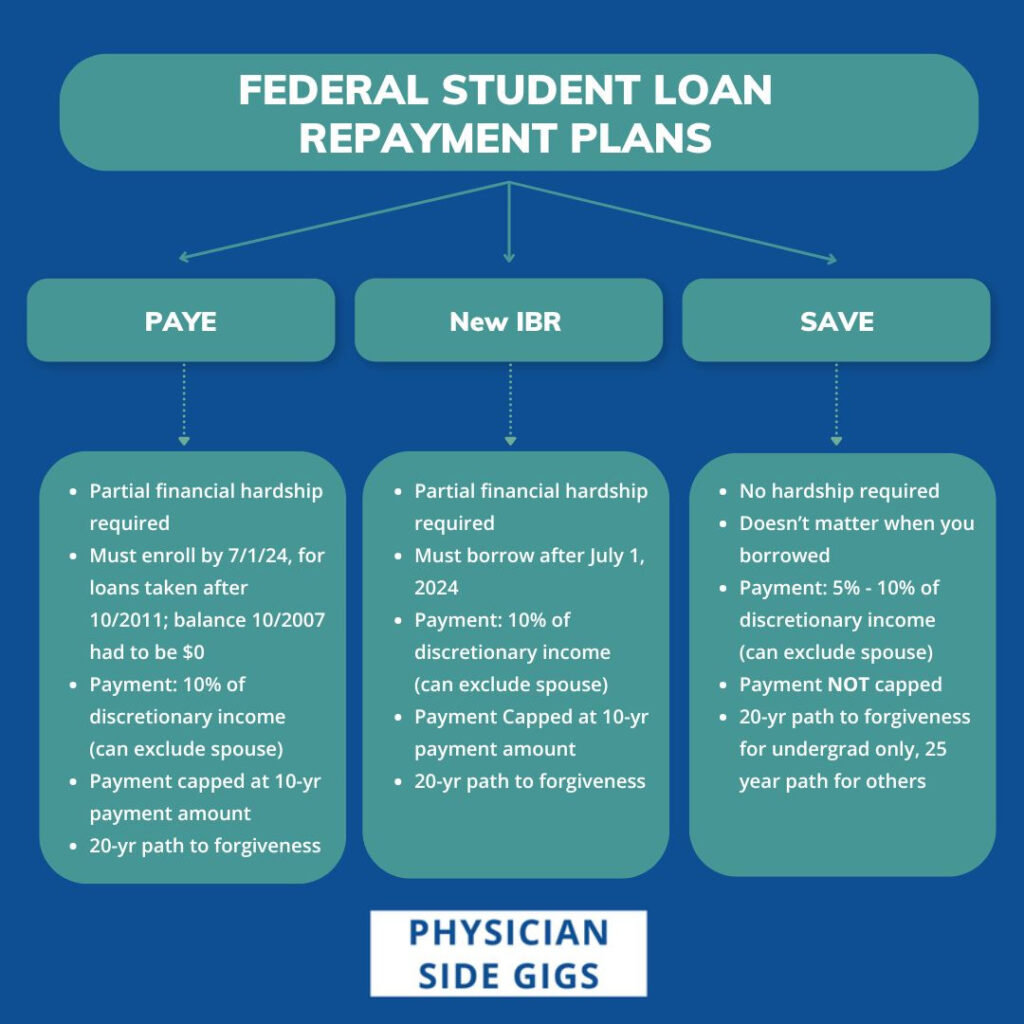

For years, student loans came with generous relief plans like the Biden administration’s SAVE Plan, letting borrowers with limited income pay almost nothing monthly and benefit from early forgiveness. But these days, with new federal laws signed by President Trump, the landscape is evolving.

The government’s goal is to create a sustainable loan system with clearer rules, borrowing caps, minimum payments, and renewed forgiveness—but with stronger controls. This aims to protect taxpayers while still supporting borrowers who face financial hurdles.

How We Got Here: A Quick History Lesson

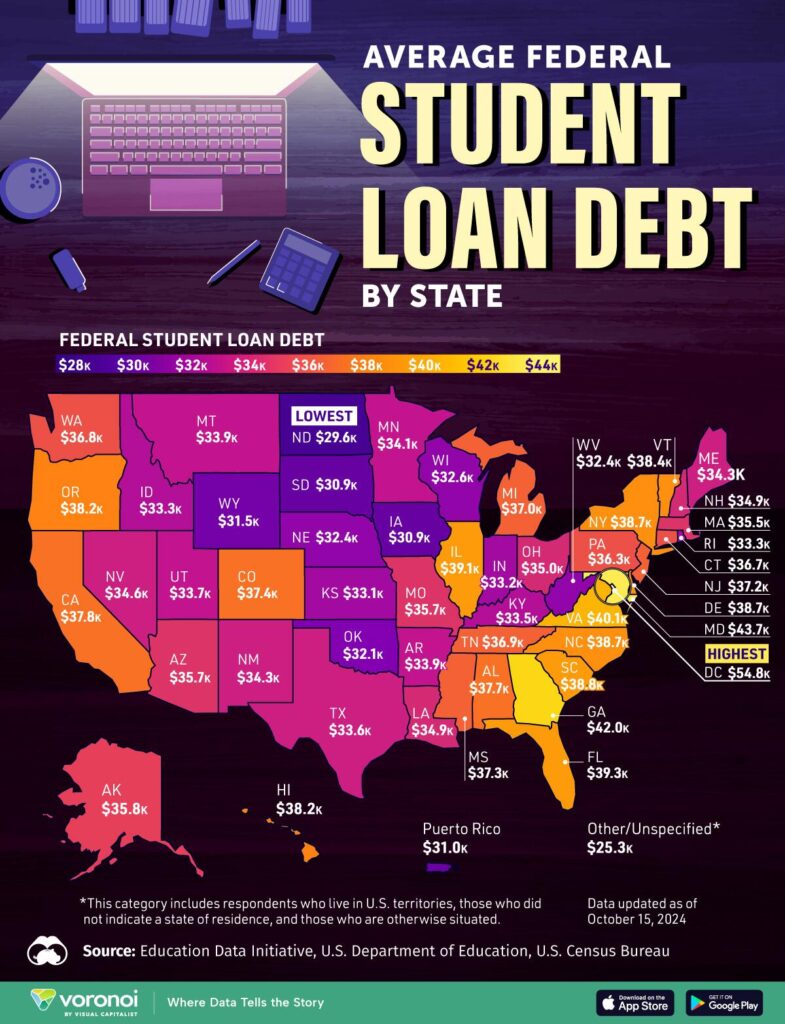

Student debt in the U.S. has surged past $2 trillion. To ease the financial burden, various income-driven repayment plans and forgiveness programs like Public Service Loan Forgiveness (PSLF) emerged. Yet growing defaults and ballooning government expenses pushed lawmakers to toughen policies for fiscal responsibility.

The One Big Beautiful Bill Act, signed in July 2025, represents a landmark in reform—it overhauls federal student aid by simplifying repayment, capping borrowing, and resuming forgiveness programs after a legal and administrative pause.

New Federal Student Loan Repayment Plans

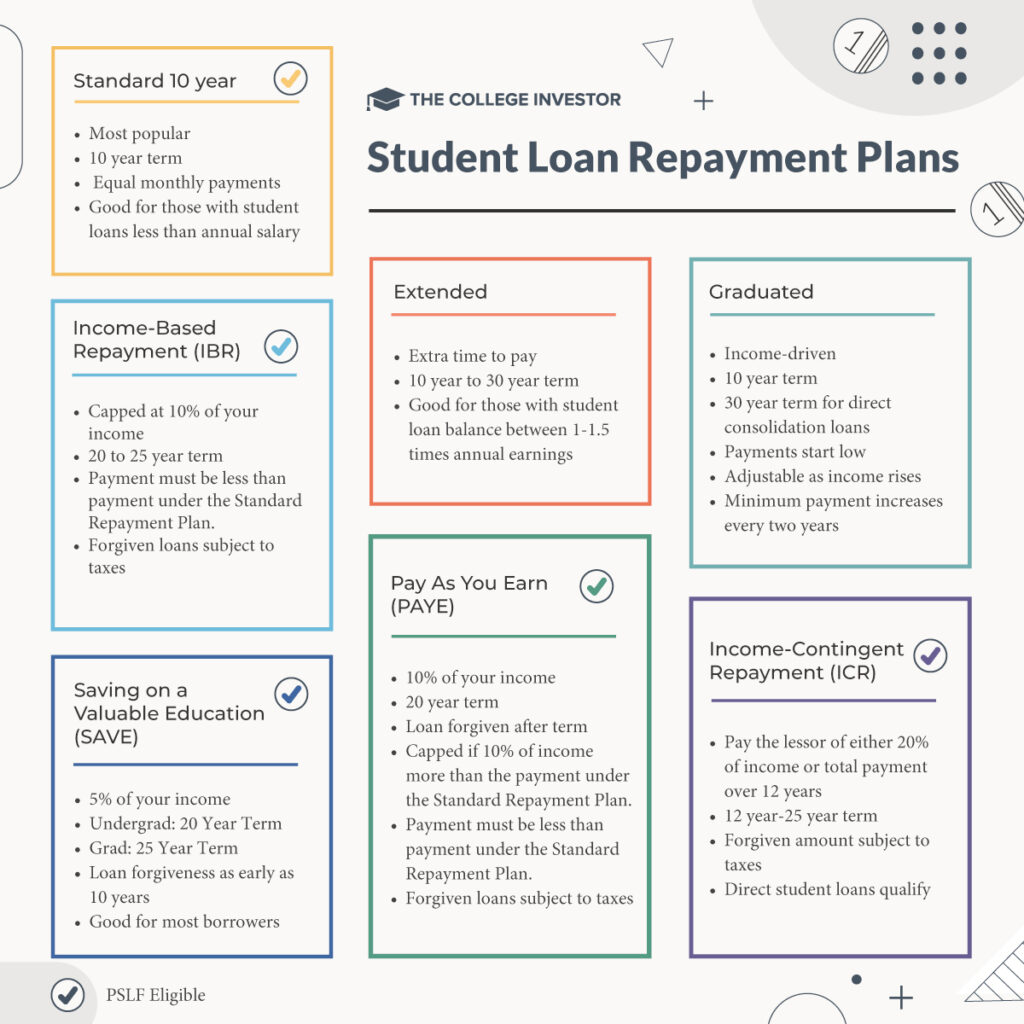

The Two Main Plans Starting October 2025

1. Standard Repayment Plan

Think of this like a fixed-rate mortgage. Your monthly payments stay the same, determined by how much you borrowed:

- Debts <$25,000: repay over 10 years

- $25,000–$49,999: 15 years

- $50,000–$99,999: 20 years

- $100,000+: 25 years

This plan suits borrowers aiming to lower total interest and finish payments as soon as possible.

2. Repayment Assistance Plan (RAP)

This is the new main income-based plan replacing previous options. Payments depend on your Adjusted Gross Income (AGI), but with a catch — it requires a $10 minimum monthly payment, ending the era of $0 monthly dues for low earners.

Benefits of RAP include:

- Government pays interest on unpaid interest to avoid ballooning balances

- Possible reduction of loan principal for very low incomes

- Payments adjust as your income changes, offering flexibility

RAP aims to balance borrower relief with program sustainability.

Loan Forgiveness Is Back — Important Details

Here’s the good news: Loan forgiveness under the Income-Based Repayment (IBR) plan is resuming for approximately 2 million borrowers who meet the criteria after a pause in 2025. If you’ve made 300 qualifying payments (that’s about 25 years or fewer under new rules), your remaining loan balance can be canceled.

Notifications are being sent via email with messages like, “You’re eligible to have your student loan(s) discharged.” The forgiveness process kicks off on October 21, 2025. Borrowers can opt out before that date if they prefer, often for tax planning reasons. Remember, federal student loan forgiveness through 2025 is tax-free nationally, but some states may tax forgiven amounts, so it’s wise to consult a tax pro.

Why the $10 Minimum Payment?

It might look small, but this change is huge. Before, some with very low income paid $0, which was kind to borrowers but costly to taxpayers and encouraged indefinite deferrals.

Now, a mandatory minimum $10 monthly payment hopes to keep borrowers connected to their loans without undue financial strain. This new baseline nudges borrowers to stay current and protect their credit scores.

What About Borrowing Limits?

The new law caps federal student loan borrowing at $257,500 total across all loans. This means whether you’re a first-time undergrad or a multi-degree grad student, your total federal borrowing can’t surpass this amount.

If you’re dreaming of multiple graduate or professional degrees after 2025, this cap may affect your financing plans. Private loans might fill gaps but keep in mind they usually charge higher interest and have fewer protections.

The Economic and Career Impact of Major Student Loan Changes

These changes don’t just affect your monthly bills—they have broader implications:

- Career choices: Forgiveness programs linked to public service jobs may still reduce burdens for those fields but require navigating new eligibility criteria.

- Credit health: Staying on the new minimum payment or standard schedule can build or maintain good credit, which matters for future purchases and loans.

- Financial planning: Understanding your repayment plan helps you budget for other goals such as buying a home, retirement, or family expenses.

Employers offering student loan repayment assistance might also become more valuable as the repayment system tightens.

Navigating the Transition: Practical Tips

Here’s how to prepare and stay ahead:

- Check Your Loan Servicer Account Regularly

Keep tabs on your loan balance, payment history, and communications. Set alerts to avoid missing important updates. - Understand Your Repayment Options

If you’re on older plans, review if switching to RAP or Standard Plan benefits you financially. - Budget for At Least $10 a Month

The minimum payment rule means small payments add up. Planning ahead avoids surprises. - Keep Records of Payments

Documentation helps prove qualification for forgiveness and keeps your account tidy. - Expect Delays

Due to the government shutdown that started October 1, 2025, some loan servicing activities are slower. Patience and follow-up are key. - Stay Informed

Bookmark the Federal Student Aid website and sign up for official newsletters.