Living on Social Security? When it comes to living on Social Security alone, lots of folks wonder if it’s realistically possible to cover all their expenses, especially once the mortgage is paid off. In 2025, this isn’t just wishful thinking—it’s a reality for retirees living in certain parts of the USA. But the big question is: Which states let your Social Security benefits stretch far enough to pay for your day-to-day costs without any financial pinch?

You see, Social Security is the main source of income for nearly 22 million seniors across the country. Yet, with rising costs—particularly in housing, property taxes, and utilities—it’s tough to make ends meet on those checks alone in most places. The good news? A recent analysis shows that in 10 key states, retirees with no mortgage can comfortably live on Social Security earnings, covering all their expenses and even having a bit left over. So if you’re thinking about stretching your retirement benefits or considering a move to a more affordable spot, this guide breaks down exactly where you can live well on Social Security alone, the numbers behind it, and what you need to keep in mind for a secure future.

Living on Social Security?

Living well on Social Security alone may sound like a challenge, but with thoughtful planning and choosing the right state, it’s achievable. Knowing how benefits are calculated, understanding COLA, factoring healthcare and taxes, and aligning lifestyle choices all help stretch your retirement income. States like Delaware, Indiana, and Arizona top the list where your Social Security check can cover essentials and more, ensuring a secure and comfortable retirement.

| Feature | Details |

|---|---|

| Number of states with surplus | 10 states comfortably cover expenses |

| Top state for living on SS | Delaware (+$1,764 annual surplus) |

| Average housing cost (surplus states) | About $510/month |

| States with biggest shortfalls | Vermont (-$8,088 annually) and New Jersey |

| Median monthly Social Security benefit nationwide | Around $1,900 |

| 2025 Social Security COLA (Cost-of-Living Adjustment) | 2.5% increase |

| Maximum taxable earnings for Social Security tax 2025 | $176,100 |

| Earnings limit for workers under full retirement age in 2025 | $23,400 |

| Link to Official SSA Info | Social Security Administration |

A Quick History: Why Social Security Matters?

Understanding Social Security’s importance means knowing a bit about where it came from. Launched in 1935 during the Great Depression, Social Security was created to help workers and their families survive financial hardships after retirement. Today, it remains the largest source of retirement income in the U.S., providing a dependable monthly check for millions who counted on it after decades of work.

How Social Security Benefits Are Calculated?

Before you start planning around your benefits, it’s helpful to understand how Social Security decides what you’ll get.

Your benefits are based on your Average Indexed Monthly Earnings (AIME), which considers your highest 35 years of earnings adjusted for inflation. If you worked less, years with no earnings count as zeros, which lowers your average.

Using your AIME, the Social Security Administration applies “bend points” to calculate your Primary Insurance Amount (PIA)—the base amount you’d get at your full retirement age. For 2025, the PIA formula is:

- 90% of the first $1,226 of your AIME

- 32% of earnings between $1,226 and $7,391

- 15% of earnings above $7,391

The full retirement age varies by birth year but is around age 66-67 for most current retirees. You can claim benefits as early as 62 at a reduced rate, or delay up to age 70 to earn increased monthly payments.

Delaying claiming benefits can add nearly 8% per year in extra income for each year beyond full retirement age, which can make a big difference in monthly checks.

Social Security and Earnings Limits in 2025

If you decide to work while receiving benefits before reaching full retirement age, there’s an earnings limit. In 2025, you can earn up to $23,400 before Social Security reduces your benefits by $1 for every $2 earned above that limit. The limit increases to $62,160 in the year you reach full retirement age, after which earnings do not affect your benefits.

If you continue working beyond full retirement age or delay claiming benefits, you can boost your benefit amount—a strategy worth considering to maximize your monthly income.

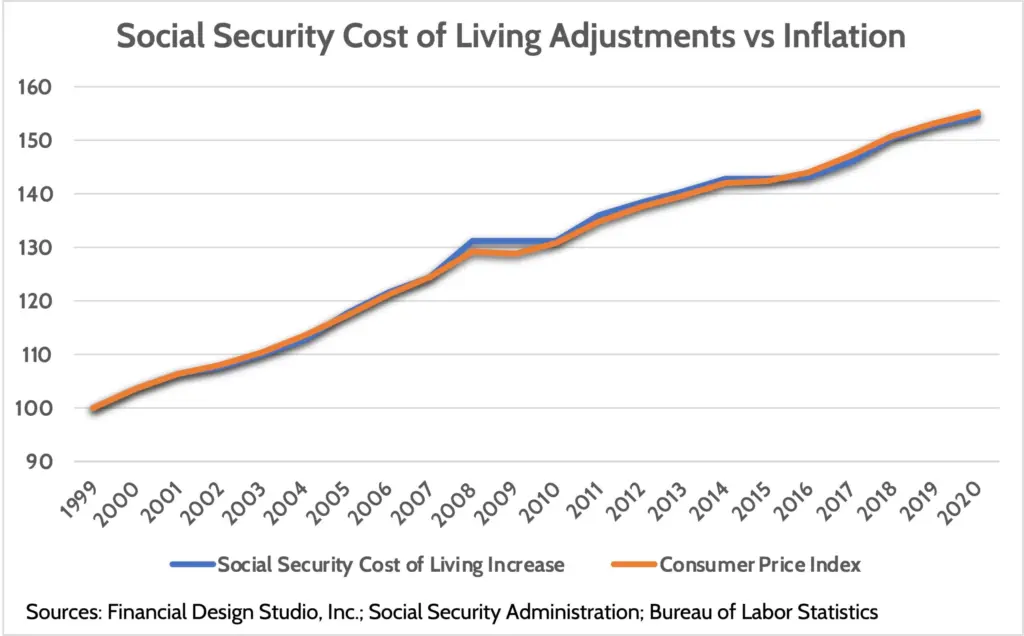

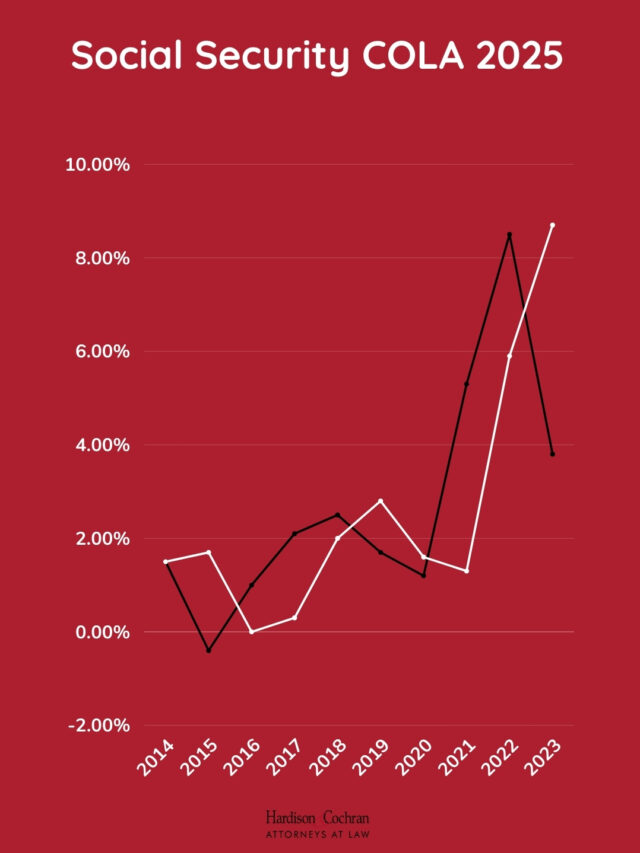

Cost-of-Living Adjustment (COLA) for 2025

The Social Security Administration announced a 2.5% COLA increase for 2025. This means beneficiaries receive slightly higher monthly checks compared to 2024. For example, someone receiving $1,920 monthly in 2024 would see about a $48 increase, bringing the monthly benefit to approximately $1,968 in 2025.

While the COLA helps offset inflation, it may not cover all rising costs, especially in healthcare and housing, which tend to increase faster.

Breaking Down the Cost of Living for Retirees

While your mortgage payment might be gone, there are many other monthly expenses retirees face. Understanding these helps you see how far your Social Security check can stretch.

- Housing: Even mortgage-free homeowners pay property taxes, insurance, maintenance, and utility bills. On average, in the 10 states where Social Security covers all expenses, these costs come to about $510 monthly. In high-cost states, these costs can exceed $1,000.

- Healthcare: Medicare Part B premiums average $185 monthly in 2025, and you should budget additional funds for medications, dental, hearing, and vision care.

- Food: Groceries and dining out usually account for $300–$500 monthly depending on household size and location.

- Transportation: Car payments, fuel, insurance, or public transit fares vary but often cost around $200 monthly.

- Utilities and communications: Electric, water, gas, phone, and internet bills average $150–$250 monthly.

- Other expenses: Clothing, entertainment, and personal care can add $100–$200 per month.

Together, these expenses create a cost of living retirees must match or beat with their Social Security and other income sources.

Living on Social Security: Where Social Security Pays Off the Most

Here are the states where retirees living mortgage-free can live comfortably on Social Security alone, based on median payments and average expenses.

| State | Annual Surplus | Total Monthly Costs | Average Housing Cost | Median Monthly SS Benefit |

|---|---|---|---|---|

| Delaware | +$1,764 | $1,992 | $555 | $2,139 |

| Indiana | +$1,392 | $1,900 | $504 | $2,016 |

| Arizona | +$1,224 | $1,874 | $531 | $1,976 |

| Utah | +$888 | $1,933 | $530 | $2,007 |

| South Carolina | +$828 | $1,860 | $486 | $1,929 |

| West Virginia | +$660 | $1,806 | $398 | $1,861 |

| Alabama | +$576 | $1,805 | $419 | $1,853 |

| Nevada | +$432 | $1,805 | $423 | $1,841 |

| Tennessee | +$156 | $1,870 | $474 | $1,883 |

| Michigan | +$132 | $2,056 | $531 | $2,067 |

Delaware leads with an extra $147 per month leftover after typical living expenses. These states combine affordable living, lower taxes, and moderate healthcare costs making them ideal for stretching Social Security.

States Where Social Security Doesn’t Cover the Basics

Conversely, retirees in states like Vermont, New Jersey, Massachusetts, New York, and New Hampshire face severe deficits living only on Social Security benefits due to higher housing and overall expenses.

| State | Annual Shortfall | Total Monthly Costs | Average Housing Cost | Median Monthly SS Benefit |

|---|---|---|---|---|

| Vermont | -$8,088 | $2,628 | $838 | $1,954 |

| New Jersey | -$7,512 | $2,798 | $1,304 | $2,172 |

| Massachusetts | -$7,345 | $2,634 | $1,007 | $2,022 |

| New York | -$7,248 | $2,578 | $1,065 | $1,974 |

| New Hampshire | -$6,564 | $2,668 | $921 | $2,121 |

In these states, supplemental income, savings, or relocating may be necessary to maintain financial stability.

Taxes and Their Role in Retirement Income

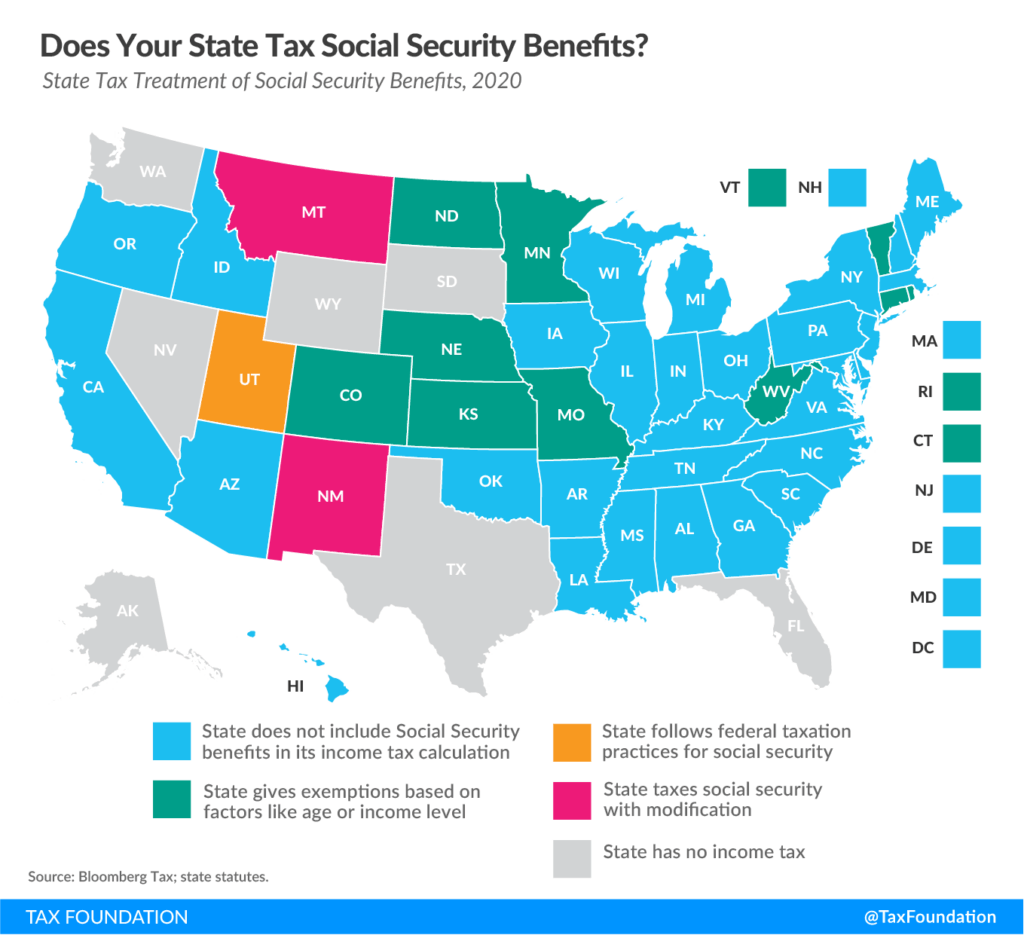

Tax treatment of Social Security benefits varies by state and affects your net retirement income:

- Many top states for Social Security retirees do not tax benefits or provide partial exemptions.

- Other states tax Social Security fully or partially, reducing your income.

- Property tax rates and eligibility for senior exemptions vary widely and can significantly affect budgets.

Prospective retirees should research the tax regulations of the state they plan to live in, as taxes can make a substantial difference in how far your benefits go.

Healthcare: The Largest Variable Expense

Healthcare can be one of the biggest financial challenges in retirement. Medicare Part B premiums alone have increased to $185 per month in 2025. Additional costs for prescriptions, dental work, hearing aids, and vision care are not always covered, demanding careful budgeting.

Choosing a state with affordable healthcare options and supplemental insurance plans suited to your needs can save thousands annually and preserve your Social Security income for living expenses.

Lifestyle Considerations Affecting Expenses

Where and how you choose to live impacts your monthly budget:

- Urban living may offer conveniences and public transit but often at higher housing costs.

- Rural living typically has lower housing expenses but may require a car and more travel.

- Climate affects heating and cooling bills, with northern states tending toward higher winter costs.

- Being close to family or support networks can improve quality of life and reduce some expenses.

Balancing lifestyle desires with financial realities is critical for a successful retirement.

Practical Tips to Maximize Your Social Security Income

- Delay Claiming Benefits: Each year you delay beyond full retirement age increases monthly payments by up to 8%. Waiting until age 70 can make a huge difference.

- Take Advantage of Spousal Benefits: Married couples can claim based on the spouse’s earnings record if it’s more advantageous.

- Work Longer if Possible: Additional working years can raise your benefit amount by replacing lower earning years in the calculation.

- Use Online Planning Tools: The SSA’s Retirement Estimator allows you to see estimated benefits at different claiming ages.

- Plan for Rising Healthcare Costs: Factor healthcare inflation into your budget and explore supplemental insurance.

- Review Your Budget Often: Staying aware of changing costs and tax laws helps adjust your plans proactively.

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule