List of Canada Benefits: If you’re living in Canada, November 2025 brings a crucial lineup of government benefits aimed at supporting unemployed individuals, low-income earners, families with children, and seniors. The Canadian government’s programs provide financial assistance to help cover everyday costs such as groceries, rent, heating, and health needs during the winter season. Understanding what benefits are available, their payment schedules, eligibility requirements, and how to maximize them is essential for both individuals and professionals managing family or client finances. This comprehensive guide breaks down these programs simply, providing easy-to-understand yet detailed insights with expert-level trustworthiness.

Table of Contents

List of Canada Benefits

Navigating government benefits in November 2025 can be straightforward and empowering with the right knowledge. Canada offers a range of programs that together form a financial safety net supporting families, seniors, workers, and unemployed citizens. From the Canada Child Benefit to newly implemented Grocery Card programs and one-time federal payments, these supports help Canadians meet living costs year-round. Staying informed on eligibility and payment dates, filing taxes promptly, and managing benefits carefully can ensure that you maximize the assistance designed to keep you financially secure in these challenging economic times.

| Benefit Name | Eligible Group | Payment Date(s) | Typical Amount/Details |

|---|---|---|---|

| Canada Child Benefit (CCB) | Families with children under 18 | November 20, 2025 | Up to $619 per child monthly * |

| GST/HST Credit | Low/middle-income individuals | October 3, 2025 (quarterly) | Up to $496 quarterly |

| Canada Workers Benefit (CWB) | Low-income workers | Early November 2025 | Up to $1,518 annually |

| Old Age Security (OAS) | Seniors aged 65+ | November 27, 2025 | Up to $713 monthly (inflation-adjusted) |

| Canada Pension Plan (CPP) | Retirees and disabled Canadians | November 27, 2025 | Avg. $1,307 monthly |

| $300 One-Time Federal Payment | Low/mid-income Canadians | November 20-30, 2025 | One-time payment |

| Grocery Card Program | Low/mid-income families | Early November 2025 | Prepaid grocery card; amount varies |

| Climate Action Incentive Payment (CAIP) | Qualifying provinces residents | November 15, 2025 | Approx. $188 per adult quarterly |

What List of Canada Benefits Can You Expect in November 2025?

Canada Child Benefit (CCB)

The Canada Child Benefit remains one of the most significant supports for Canadian families, offering tax-free monthly payments to help cover the costs of raising children under 18. On November 20, 2025, families can expect their regular CCB payments, which may be as high as $619 per child depending on household income and number of children. This benefit helps families manage expenses such as clothing, school supplies, extracurricular activities, and food. It aims to reduce child poverty nationwide and is adjusted annually to reflect inflation and cost of living increases.

To receive the CCB, parents or guardians must file taxes annually, as eligibility and amount calculations rely on reported income. Accessing CRA’s My Account makes it easy to track payments and update information.

GST/HST Credit

The GST/HST Credit is designed to provide relief to low- and moderate-income families and individuals by offsetting part of the sales tax they pay. Although no payment is scheduled exactly in November, Canadians will have received their previous quarterly payment on October 3. This credit typically totals around $496 per quarter for those eligible, and it is automatically calculated based on your prior tax returns.

This credit is an essential support for reducing everyday living costs and is distributed alongside other credits for energy and property taxes in certain provinces. Staying current on tax filings is necessary to maintain eligibility and avoid delays.

Canada Workers Benefit (CWB)

The Canada Workers Benefit supports employed Canadians who earn low incomes, providing them with an annual tax credit of up to $1,518. Early November 2025 usually brings an advanced installment of this payment, aimed at boosting income during the winter months when expenses rise.

To qualify, taxpayers must meet specific income thresholds and report their income through annual tax returns. The benefit encourages workforce participation by supplementing wages, helping lessen poverty levels among working Canadians.

Old Age Security (OAS) and Canada Pension Plan (CPP)

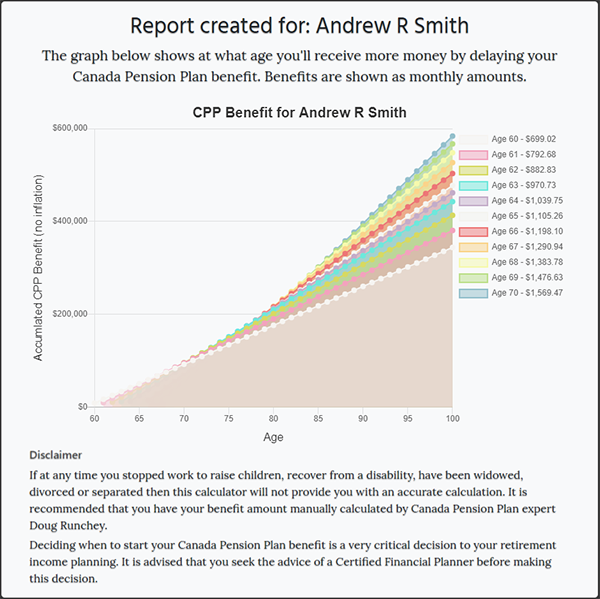

For seniors and retirees, Old Age Security (OAS) and Canada Pension Plan (CPP) are fundamental parts of retirement income. Scheduled for payment on November 27, 2025, the OAS benefit is inflation-adjusted, averaging about $713 monthly. CPP payments, also arriving on the same date, average $1,307 per month but vary based on individual contribution history and retirement age.

These steady income streams ensure a dignified retirement, covering living expenses like rent, utilities, and healthcare costs. Seniors must apply separately for these benefits, especially CPP, and keep their information current.

One-Time $300 Federal Payment

Acknowledging the increasing cost of essentials such as heating and food, a one-time $300 federal payment will be issued to many eligible low- and middle-income Canadians between November 20 and 30, 2025. This payment is part of a broader government effort to ease financial pressures as winter approaches. Eligibility details and distribution methods are confirmed by official government channels shortly before disbursement.

Grocery Card Program

The Grocery Card Program, newly introduced in 2025, provides low- and middle-income families with prepaid cards for groceries, alleviating food insecurity exacerbated by inflation. Early November will see the initial rollout of this program, which spans various provinces and targets vulnerable households. The exact card values depend on income and family size but are designed to cover a meaningful portion of monthly grocery bills.

Climate Action Incentive Payment (CAIP)

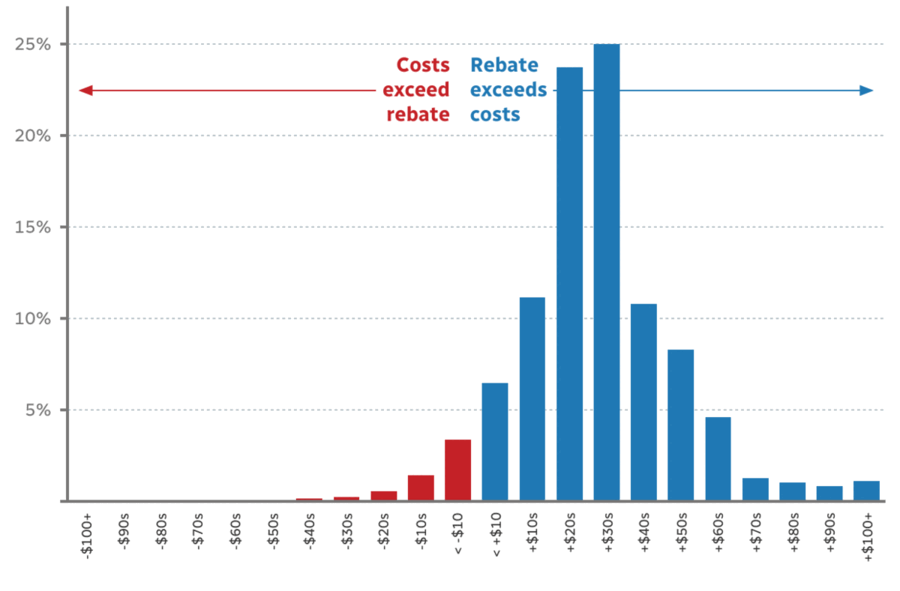

Residents of certain provinces—including Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, and Saskatchewan—are eligible for the Climate Action Incentive Payment, formerly the Canada Carbon Rebate. This payment compensates for carbon pricing costs and is scheduled for November 15, 2025, with an average amount of approximately $188 per eligible adult per quarter.

Employment Insurance and Provincial Supports

Unemployed Canadians can tap into Employment Insurance (EI), which provides temporary financial assistance while they seek new work. The weekly maximum EI payment is about $695 in 2025, based on prior earnings. EI requires an application and adherence to job search requirements and may be complemented by training programs.

Additionally, provinces and territories administer supplementary benefits such as income assistance, disability support, and housing subsidies. These vary in eligibility, benefit amounts, and payment schedules but are critical for those facing economic hardship beyond federal supports. Beneficiaries should inquire locally for tailored aid.

How to Maximize Your Canada Benefits: Practical Tips?

- File Your Taxes on Time: All key benefits depend on your tax return for eligibility and amount calculation. Filing early helps avoid delays.

- Keep Your Information Accurate: Changes in marital status, address, or dependents must be promptly updated with the CRA and provincial agencies to ensure payments are processed correctly.

- Set Up Direct Deposit: Receiving payments via direct deposit to your bank account greatly speeds access and reduces risk of loss or delay.

- Stay Aware of Scams: The government never contacts you asking for payments or private information by phone or email. Always use official “.gc.ca” websites for management and verification.

- Budget Benefits Wisely: Use these funds first for essentials—housing, utilities, groceries, and medical needs—to maintain stability during lean months.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada $3500 Old Age Security Payment November 2025 – Who will get it? Check Eligibility

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Impact of Benefits on Financial Planning

Timing and reliability of these benefits provide vital financial predictability. For working families, the CCB and CWB offer steady and supplemental incomes to cover child-rearing costs and living expenses. Seniors can confidently plan month-to-month knowing OAS and CPP contributions support their needs.

Low-income workers benefit from increased cash flow helping to minimize debts or build emergency savings. Early knowledge of payment schedules enables proactive budgeting, allowing recipients to prioritize bills and avoid costly short-term credit.