IRS Unveils Senior-Friendly Tax Changes: If you’re aged 65 or older and getting ready for the 2026 tax season, there’s some real good news coming your way from the IRS. For tax year 2026, the IRS has introduced a bunch of changes aimed at making taxes lighter and simpler for seniors. These updates include bigger standard deductions, a brand-new bonus deduction specifically for seniors, and inflation-adjusted tax brackets—all designed to help you keep more of your hard-earned money. Whether you’re filing solo or as a couple, these changes can mean significantly lower taxable income and less tax owed.

This article breaks down exactly what’s new, why it matters, and how you can maximize these benefits. It’s written in plain English, so even if tax talk usually makes your head spin, by the end, you’ll feel confident and ready to tackle your taxes like a pro.

Table of Contents

IRS Unveils Senior-Friendly Tax Changes

The IRS’s 2026 tax updates deliver significant relief for seniors with bigger deductions, a new $6,000 bonus deduction, and inflation-updated tax brackets. These changes allow many seniors to keep more of their income and simplify tax time. Staying informed, organized, and seeking expert help when needed ensures you leverage these benefits fully. With this clear understanding and practical tips, you can approach your 2026 taxes confidently and get the refund you deserve.

| Feature | Amount 2026 | Amount 2025 | Notes |

|---|---|---|---|

| Standard Deduction (Married Joint) | $32,200 | $31,500 | General inflation adjustment |

| Standard Deduction (Single) | $16,100 | $15,750 | Inflation bump |

| Additional Deduction (65+) Single/HOH | $2,050 | $2,000 | Extra deduction for seniors |

| Additional Deduction (65+ Spouse) | $1,650 per qualifying individual | $1,600 per qualifying individual | Applies per spouse filing jointly |

| Senior Bonus Deduction (65+ new) | $6,000 | N/A | New deduction under “One Big Beautiful Bill” |

| Additional Deduction for Blind | Double the above amounts | Double the above amounts | For seniors who are also blind |

IRS Unveils Senior-Friendly Tax Changes: The Lowdown

To start, the basic standard deduction is rising across all filing statuses to keep pace with inflation:

- Married couples filing jointly get a standard deduction of $32,200 (up $700 from 2025)

- Single filers will see it rise to $16,100 (up $350)

- Heads of household get bumped to $24,150 (up $525)

For seniors aged 65 or older, the IRS piles on extra deductions:

- Single filers and heads of household receive an additional $2,050.

- Married couples get an extra $1,650 per spouse over 65.

- If you are also blind, these amounts double — so the deductions can rise even higher.

Introducing the brand-new $6,000 Senior Bonus Deduction, effective 2025 through 2028. This is a separate deduction available whether you itemize or take the standard deduction. It phases out for single taxpayers earning above $75,000 and married couples above $150,000.

Why These IRS Unveils Senior-Friendly Tax Changes Matter to You?

With inflation squeezing budgets nationwide, these tax adjustments are a welcome relief for many seniors living on fixed incomes. Here’s why:

- Lower taxable income means you pay less tax overall.

- The new bonus deduction helps seniors who itemize deductions, offering a tax break no matter how you file.

- Bigger deductions can also reduce the chance that your Social Security benefits become taxable.

- If you’re a tax professional working with seniors, understanding these changes means you can guide clients more effectively to maximize savings.

Stop and think about it—if you’re married and both 65+, you could find yourself with over $12,000 in extra deductions next year just because of age-related perks.

How to Make the Most of Your Senior Tax Benefits?

- Know Your Filing Status: Your standard deduction depends on whether you file single, married jointly, or head of household. Don’t forget the extra deductions if you or your spouse are over 65.

- Choose Between Standard and Itemized Deduction: Most seniors take the standard deduction, especially with these hikes, but if your deductible expenses exceed that amount, itemizing makes sense. The $6,000 senior bonus deduction applies either way.

- Keep Good Records: Save all receipts for medical expenses, charitable giving, and other deductible costs. Good documentation comes in handy if you itemize or need to explain deductions to the IRS.

- Watch Your Income: The $6,000 senior bonus deduction phases out for higher earners—single filers making more than $75,000 and couples over $150,000. Knowing where you stand helps you plan withdrawals or report income strategically.

- Plan Retirement Income Wisely: Large IRA or 401(k) distributions can push income beyond thresholds where deductions phase out.

- Check Social Security Taxability: Since Social Security benefits may become partially taxable based on your combined income, bigger deductions might help reduce that taxable portion.

- Consult a Pro When Needed: Tax rules can be tricky. Tax preparers and financial advisors familiar with senior tax breaks can help you claim every dollar you’re entitled to.

Step-by-Step Senior Tax Filing Guide

- Gather Tax Documents: Collect all W-2s, 1099s, SSA-1099 (Social Security benefits), medical bills, receipts for donations, and investment records.

- Confirm Age Requirement: Verify you or your spouse are 65 or older by December 31, 2026.

- Choose Deduction Method: Calculate whether standard or itemizing deductions benefits you most, factoring in the new senior bonus deduction.

- Fill Out Tax Forms: Use Form 1040 and related schedules as needed. Free IRS filing tools and commercial software simplify this process for seniors.

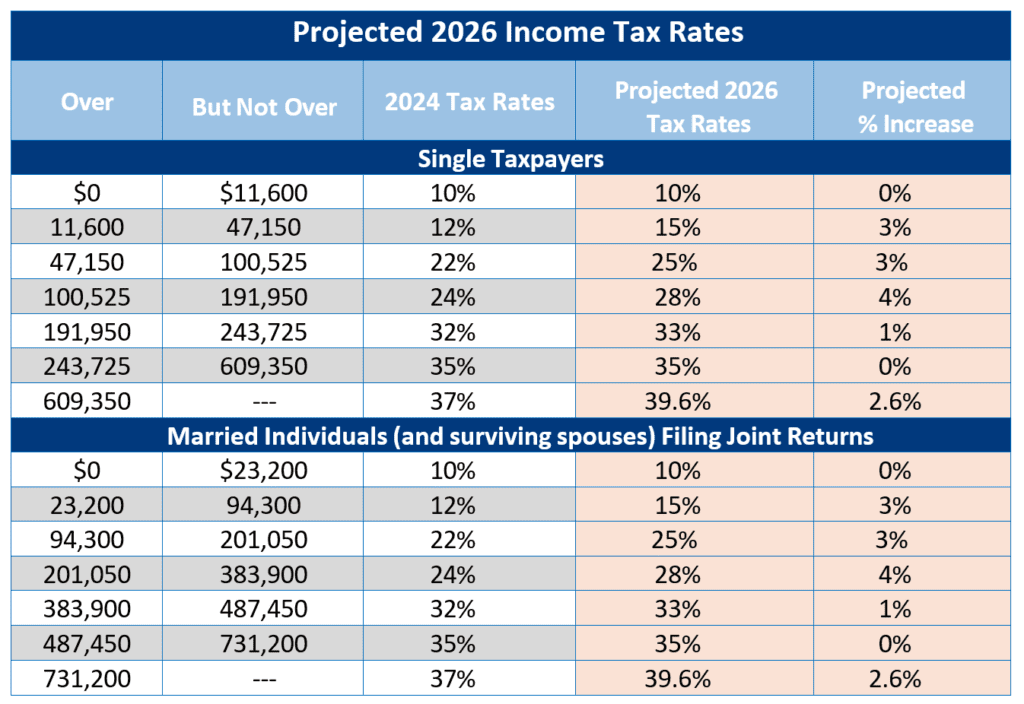

- Check Your Tax Bracket: Know the updated 2026 brackets to see where your income fits—this can impact planning for Roth conversions or withdrawals.

- File Early: Avoid last-minute hassle, reduce errors, and potentially get your refund sooner by filing earlier.

Additional Advice for Seniors

- Consider adjusting your tax withholding to avoid surprises at tax time. The IRS’s online withholding estimator can help.

- Look into IRS Volunteer Income Tax Assistance (VITA) programs if you need free tax help.

- Understand that these federal tax changes don’t automatically affect your state taxes. Check state rules or consult your tax pro.

- Keep an eye on any new tax laws beyond 2028, when some senior tax benefits may expire or change.

Senior Tax Planning Strategies for 2026

For seniors, smart tax planning goes beyond just knowing the deductions; it’s about timing income and managing withdrawals efficiently. Since Required Minimum Distributions (RMDs) from retirement accounts like traditional IRAs or 401(k)s become taxable income, planning when and how much to withdraw can help keep you in a lower tax bracket and maximize the new deductions.

One solid strategy is to consider Roth IRA conversions in lower-income years, since Roth withdrawals are tax-free later and don’t trigger RMDs. This reduces future taxable income and can ease tax burdens for you and your heirs.

Maximizing contributions to tax-advantaged accounts like HSAs or catch-up contributions to retirement plans (up to $31,000 total for those over 50 in 2025) can also lower taxable income now, leveraging the bigger standard deductions.

IRS Child Tax Credit Refund in October 2025: Check Payment Amount & Eligibility Update

$3000 on Average Confirmed By IRS As 2025 Tax Refunds: Check Eligibility & Payment Credit Date

IRS Confirms $7,830 EITC Refund for 2025 – Check Exact Payout Dates & Who Gets It