IRS Confirms $7,830 EITC Refund: Every year when tax season rolls around, one big question fills kitchen tables and office breakrooms across America: “When will my refund arrive, and how much will I get?” For millions of working Americans, the answer is tied to one of the most powerful benefits in the tax code — the Earned Income Tax Credit (EITC).

For 2025, the IRS has confirmed the maximum EITC refund is $7,830 for tax year 2024 returns. That’s a serious chunk of change, especially for families with multiple kids trying to make ends meet in today’s economy. But here’s the kicker: not everyone qualifies for that max amount, and refunds won’t hit bank accounts until at least mid-February. This in-depth guide breaks down everything you need to know — eligibility, refund dates, filing tips, mistakes to avoid, and even smart ways to use your refund. Written in a straight-talk, approachable style, this article blends professional expertise with practical advice you can use right now.

IRS Confirms $7,830 EITC Refund

The $7,830 Earned Income Tax Credit refund for 2025 is more than just a number. It’s a lifeline for millions of Americans working hard to support their families. While the IRS won’t release refunds until mid-February, most taxpayers can expect their money by early March if they file correctly. Plan ahead, avoid scams, and make smart choices with your refund. The EITC has been around for nearly 50 years, and in 2025, it continues to play a key role in keeping families afloat.

| Topic | Details |

|---|---|

| Max EITC Refund (Tax Year 2024) | $7,830 for taxpayers with 3+ qualifying children |

| Refund Issuance Rule | IRS cannot release EITC/ACTC refunds before mid-February (PATH Act) |

| Earliest Refund Availability | Direct deposit refunds may arrive by March 3, 2025 (if filed early and accurate) |

| Eligibility Requirements | Low-to-moderate income workers, valid SSNs, U.S. residency, income/child rules |

| IRS Refund Tracker | Where’s My Refund Tool |

| Future Adjustments | Max EITC for tax year 2025 (filed in 2026) rises to $8,046 |

| Official Source | IRS EITC Page |

A Quick History of the EITC

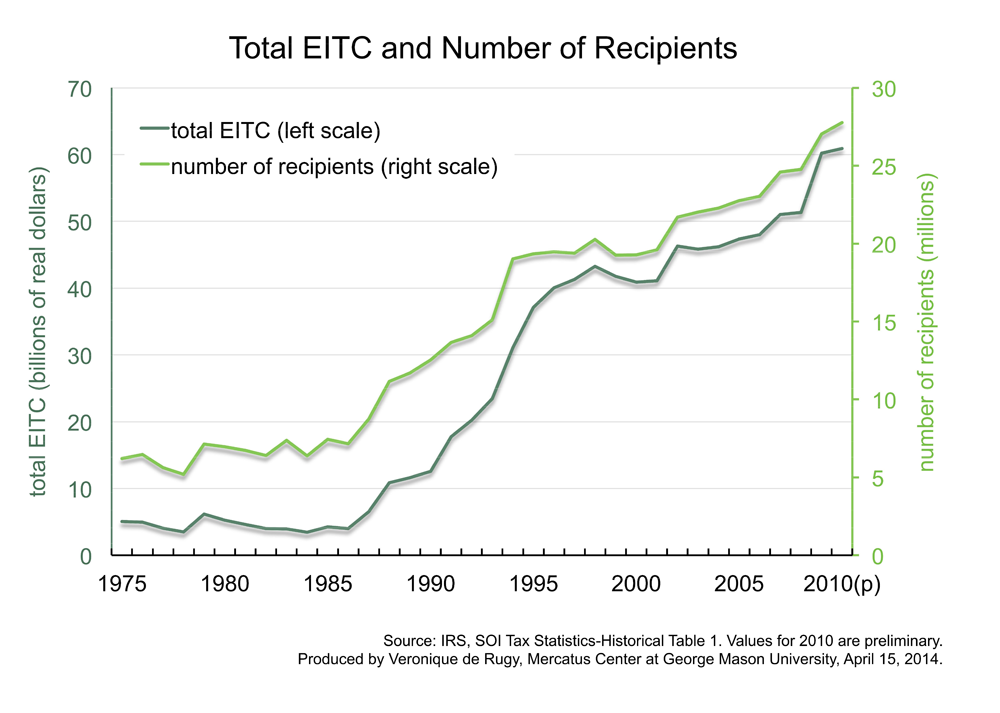

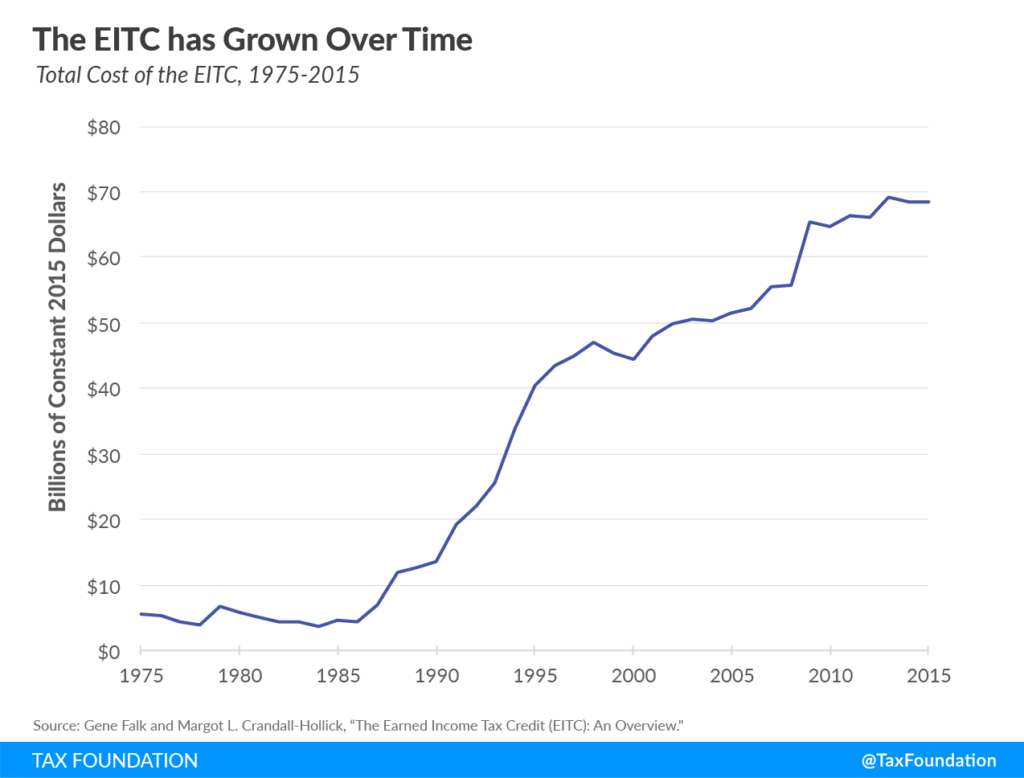

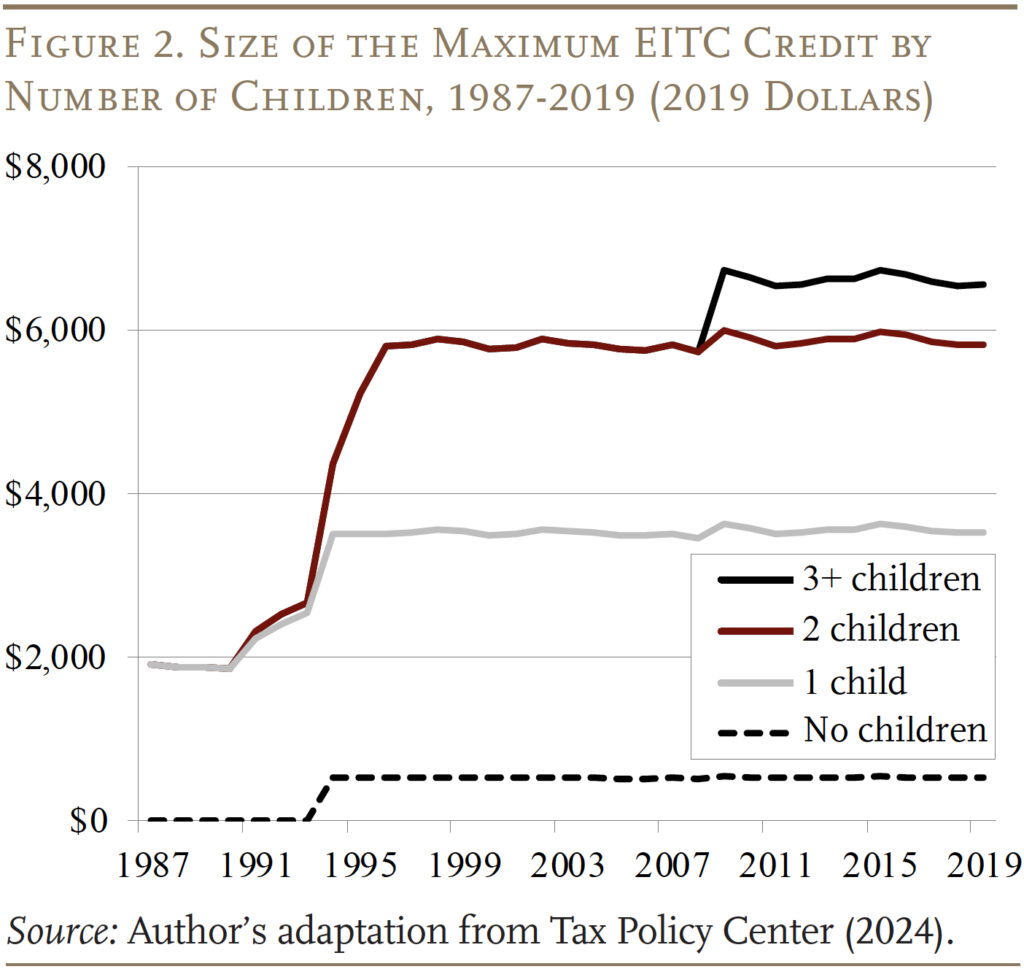

The Earned Income Tax Credit has been around since 1975, originally passed to give working families some relief from rising payroll taxes. Over time, Congress expanded it into one of the nation’s most significant anti-poverty programs.

Today, the EITC is credited with lifting about 5.6 million people out of poverty each year, including 3 million children, according to the Center on Budget and Policy Priorities. It’s not just about tax breaks — it’s about strengthening communities and helping working folks get ahead.

What Exactly Is the EITC?

The EITC is a refundable tax credit. Unlike a deduction, which just lowers taxable income, a refundable credit means you can get money back even if you don’t owe taxes. That’s why the EITC is so valuable — it can turn a zero tax bill into a refund check worth thousands.

Think of it as a reward for working. If you’re hustling, paying into the system, and raising kids, the government is saying: “We’ve got your back.”

In 2023 alone, the IRS reported paying out $64 billion in EITC benefits to over 31 million households. That’s money going straight into the hands of families who need it most.

Why the IRS Confirms $7,830 EITC Refund Matters in 2025?

For tax year 2024 (returns filed in 2025), the IRS raised the maximum credit to $7,830. That’s up about $400 from the previous year, thanks to inflation adjustments. But not everyone qualifies for that maximum.

To get the full $7,830, you need:

- Three or more qualifying children.

- Earned income below $59,899 (single/head of household) or $66,819 (married filing jointly).

- A valid Social Security number.

- Proof your kids lived with you at least half the year.

Single filers without children still qualify, but the maximum is only $632.

Refund Dates: When Will You Get Paid?

Here’s the truth: no one — not even the IRS — can give you an exact date until your return is processed. But the IRS does provide guidelines.

Refund Timeline for 2025:

- January 27, 2025: IRS opens filing season.

- February 15–19, 2025: Refunds with EITC begin processing.

- By March 3, 2025: Most taxpayers who e-filed and used direct deposit should see refunds.

If you file a paper return, expect delays of four to six weeks.

Why Refunds Are Delayed?

The PATH Act of 2015 requires the IRS to hold all refunds involving the EITC or Additional Child Tax Credit until mid-February. Why? Fraud.

Tax refund fraud costs billions each year. Criminals steal Social Security numbers and file fake returns before the real taxpayer gets the chance. By delaying refunds, the IRS has extra time to cross-check income reports from employers and stop fraud before it happens.

So yes, the wait is annoying — but it protects your money.

How to Track Your IRS Confirms $7,830 EITC Refund?

You’ve filed. Now what? Instead of hitting “refresh” on your bank account, use the IRS tools:

- Where’s My Refund?: Updates daily, showing whether your return is “Received,” “Approved,” or “Sent.”

- IRS2Go Mobile App: A free app for refund status updates.

Tip: Don’t call the IRS before March. They won’t have extra info beyond what the tracker shows.

Step-by-Step: How to Claim the IRS Confirms $7,830 EITC Refund

Step 1: Check Eligibility

Use the IRS EITC Assistant.

Step 2: Collect Your Docs

- W-2s or 1099s

- Social Security numbers

- Proof of residency for your kids

Step 3: File Smart

- Use e-file software or IRS Free File.

- Select direct deposit for speed.

- Double-check info to avoid delays.

Step 4: Wait for the Timeline

Remember: no refunds with EITC before mid-February.

Common Mistakes to Avoid

- Wrong filing status (claiming head of household when you don’t qualify).

- Misreporting dependents (claiming a child who doesn’t meet IRS rules).

- Paper filing (always slower).

- Bank account errors (wrong routing numbers can bounce your refund).

Comparison: EITC vs. Child Tax Credit (CTC)

Both credits help families, but they’re different:

- EITC: Based on income and family size. Refundable. Max $7,830 in 2025.

- CTC: Worth up to $2,000 per child, partially refundable.

Good news: You can claim both. In fact, many families do.

Financial Planning: Best Ways to Use Your Refund

Tax refunds can feel like “bonus money,” but using it wisely makes a big difference. Consider:

- Paying off high-interest credit cards.

- Building a $1,000 emergency fund.

- Saving for education or training.

- Putting it toward a down payment or car repairs.

A 2023 survey from Bankrate found that 45% of Americans use refunds to pay off debt, while others save or invest it. Think long-term, not just short-term splurges.

Beware of Tax Season Scams

Every year, scammers pop up like weeds. Watch for:

- Fake IRS calls or emails (the IRS never texts or emails about refunds).

- Tax preparers promising “instant refunds.”

- Identity thieves offering to “help” file your taxes.

Looking Ahead: EITC in 2026

For tax year 2025 (returns filed in 2026), the maximum EITC increases to $8,046. That’s thanks to inflation adjustments. Income limits and phaseouts will also rise slightly, meaning more families may qualify.

$1,000 PFD Stimulus Coming for Everyone in Oct 2025 – Who will get it? Check Eligibility

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement