Millions of U.S. families are closely watching for the IRS Child Tax Credit Refund in October 2025, as the agency continues processing returns and determining eligibility. The credit, a longstanding tool to reduce child poverty and ease family financial burdens, has undergone adjustments in recent years due to new legislation.

IRS Child Tax Credit in October 2025

| Key Fact | Detail |

|---|---|

| Maximum Child Tax Credit (per child) | $2,200 for 2025 |

| Refundable Portion (Additional CTC) | Up to $1,700 |

| Income Phaseout Threshold | $200,000 (single) / $400,000 (married) |

| October 2025 Refunds | Processed only after tax returns filed and reviewed |

| Official Website | IRS |

For now, families awaiting the October 2025 Child Tax Credit Refund must monitor IRS updates and ensure compliance with eligibility rules. The agency has not announced any additional round of advance payments, making the timing of refunds dependent entirely on individual filings.

As the tax season continues, lawmakers face mounting pressure to revisit whether future credits should include automatic payments, particularly as inflation and child poverty remain pressing concerns.

What Families Can Expect in October 2025

Refunds in October 2025 will not arrive as blanket payments to all eligible households. Instead, the Internal Revenue Service (IRS) will continue issuing refunds based on completed tax returns. Families who filed early or whose returns required additional verification may see their payments during this period.

“Refund timing depends on when returns were filed and whether they include refundable credits,” the IRS said in its latest public guidance.

The agency emphasized that taxpayers should use the “Where’s My Refund?” tool on its website for real-time updates, rather than relying on unofficial schedules circulating online.

Eligibility Rules and Credit Structure

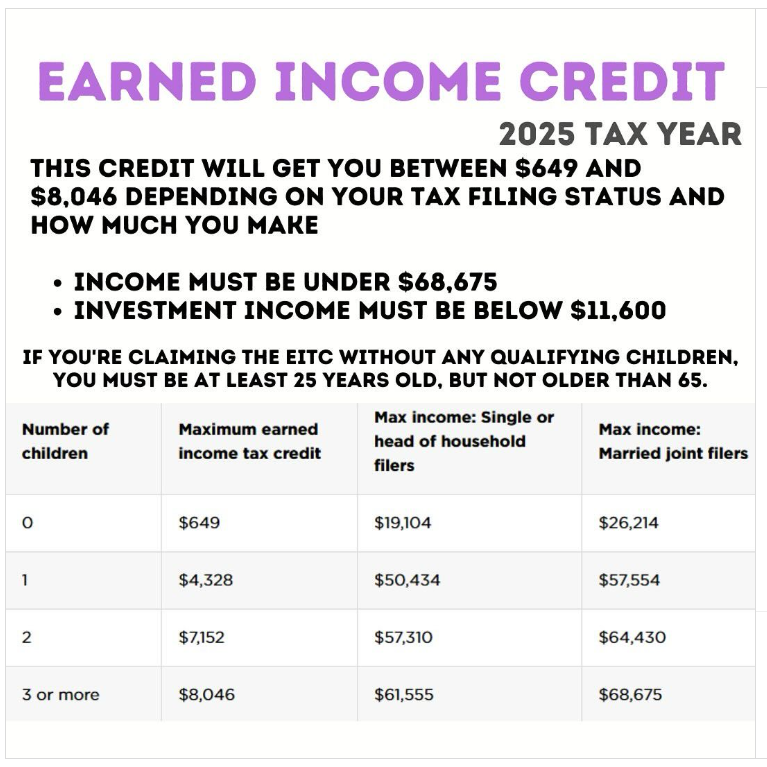

The Child Tax Credit (CTC) for the 2025 tax year provides up to $2,200 per qualifying child. However, only a portion is refundable through the Additional Child Tax Credit (ACTC), capped at $1,700 per child. Families with tax liability greater than the credit amount will see it applied against what they owe, while those with lower liability may qualify for a partial refund.

Eligibility requirements remain strict. A child must be under 17 at the end of the tax year, have a valid Social Security number, and reside with the claimant for more than half of the year. Income thresholds also apply, with the credit phasing out for single filers earning above $200,000 and married couples filing jointly above $400,000.

“Many families assume the full credit is refundable, but that is not the case,” explained Elaine Maag, senior fellow at the Urban-Brookings Tax Policy Center. “The refundable cap means lower-income families may not see the entire benefit.”

Advance Payments vs. Annual Refunds

Unlike during the pandemic years of 2021–2022, when Congress authorized monthly advance payments, the 2025 credit remains tied to the annual tax filing process. Lawmakers debated reviving monthly installments earlier this year, but no measure passed.

As a result, October 2025 payments will only reflect processed returns, not pre-scheduled disbursements. Tax experts warn families to avoid misinformation about “automatic October checks.”

“The Child Tax Credit is no longer distributed in advance installments,” noted Mark Steber, chief tax information officer at Jackson Hewitt. “Refunds come only after the IRS processes eligible returns.”

Processing Delays and Verification

The IRS continues to flag some returns for manual review, especially when dependent information or income thresholds are unclear. This has led to delays in issuing refunds. Families with mismatched records may need to provide additional documentation.

According to the Treasury Inspector General for Tax Administration, CTC-related claims remain among the most scrutinized credits because of prior fraud risks. The IRS urges taxpayers to file accurately and retain supporting records to prevent delays.

Broader Policy Context

The Child Tax Credit has been at the center of debates about poverty reduction and family support. According to the Center on Budget and Policy Priorities, expansions in 2021 temporarily lifted nearly 3 million children out of poverty, though those provisions expired.

Critics argue the current structure fails to support the poorest households because of its refundability cap. Supporters counter that it balances fiscal responsibility with targeted relief. Discussions about a new expansion are expected during the next congressional session.

Social Security Disability Insurance (SSDI) Payments in October 2025: Check Payout Amount and Date

SSI and SSDI Payments in October 2025: Check Official Payment Schedule and Eligibility Criteria!

FAQ

1. Will every family receive a Child Tax Credit refund in October 2025?

No. Refunds are only issued after tax returns are filed and processed. Some families may receive them in October, but not all.

2. What is the maximum Child Tax Credit for 2025?

The maximum is $2,200 per child, with a refundable cap of $1,700 through the Additional Child Tax Credit.

3. Are October payments automatic like in 2021?

No. There are no advance monthly payments in 2025. Refunds only follow the filing of a tax return.

4. Who qualifies for the 2025 Child Tax Credit?

Eligible children must be under 17, have a valid Social Security number, and live with the taxpayer for more than half of the year. Income limits also apply.

5. How can families check refund status?

The IRS recommends using its official “Where’s My Refund?” tool for the most accurate updates.