IRS Announces Major 2026 Tax Overhaul: The IRS just confirmed one of the most significant tax updates in recent years — and it’s great news for America’s seniors. Starting in 2026, taxpayers aged 65 and older will see larger standard deductions, an exclusive “Senior Bonus Deduction,” and simpler filing options. This new plan, part of the One Big Beautiful Bill Act of 2025, marks a major shift in how older Americans are taxed. It aims to reduce the financial strain of inflation, medical costs, and fixed incomes that many retirees face. Whether you’re already retired, planning to retire soon, or helping a parent file taxes, understanding these new rules could save thousands in the coming years.

Table of Contents

IRS Announces Major 2026 Tax Overhaul

The IRS’s 2026 tax overhaul marks a turning point for senior taxpayers. With a larger standard deduction, an enhanced 65+ addition, and the new Senior Bonus Deduction, retirees can enjoy substantial relief while navigating a simpler filing process. Still, this benefit isn’t automatic. Seniors should start preparing now — reviewing income, planning withdrawals, and consulting professionals — to make sure they qualify for the full advantage. After decades of paying into the system, this time, the system is finally paying something back.

| Feature | Details (Tax Year 2026) | Who Benefits |

|---|---|---|

| Standard Deduction | $16,100 (Single) / $32,200 (Married Jointly) / $24,150 (Head of Household) | All taxpayers |

| Additional 65+ Deduction | +$2,050 (Single) / +$1,650 per spouse (Married) | Seniors and blind taxpayers |

| Senior Bonus Deduction | Up to $6,000 per person / $12,000 per couple | Seniors 65+ |

| Income Phase-Out | Starts at $75,000 (Single) / $150,000 (Married Jointly) | Higher-income seniors |

| Duration | 2025–2028 (temporary) | Seniors, retirees, and older workers |

Why the IRS Announces Major 2026 Tax Overhaul?

This overhaul didn’t come out of nowhere. Rising living costs and shrinking retirement savings have created new challenges for America’s aging population. According to AARP, nearly 50% of older adults live on less than $60,000 a year, and healthcare costs continue to rise faster than inflation.

The IRS and Congress designed the One Big Beautiful Bill Act (OBBB) to address these pressures by updating deductions, adjusting income thresholds, and offering targeted relief for those over 65. The goal: let seniors keep more of their hard-earned money and simplify the tax filing process.

IRS Commissioner Danny Werfel summarized the mission this way:

“Our goal is to make tax filing fairer and easier for every American, especially those who have spent a lifetime working and now deserve a simpler, lighter tax burden.”

The Bigger Standard Deduction for 2026

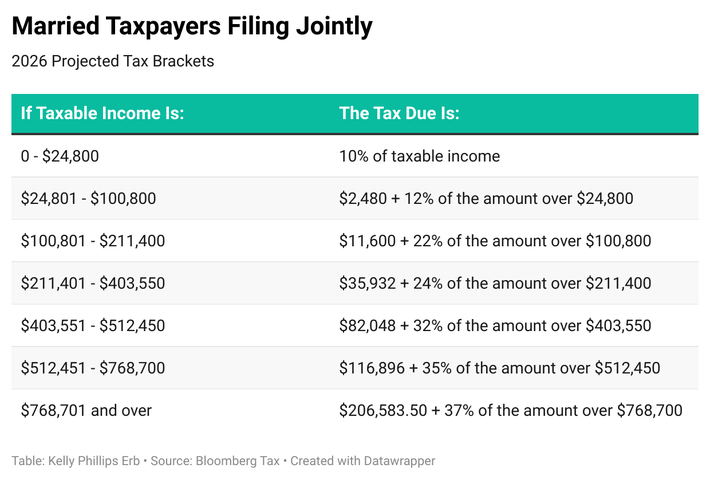

Let’s start with the foundation — the standard deduction. This is the portion of your income the IRS doesn’t tax before applying rates or credits. For 2026, that deduction is increasing across the board:

- Single Filers: $16,100

- Married Filing Jointly: $32,200

- Head of Household: $24,150

That’s an increase of roughly $350–$700 from 2025, reflecting inflation adjustments. For most taxpayers — around nine out of ten, according to IRS data — this single change means lower taxable income without the hassle of itemizing deductions.

If you’ve been itemizing expenses like mortgage interest or charitable donations, now’s the time to compare totals. You might find the new standard deduction saves you more time and money.

The Extra Deduction for Seniors Age 65 and Older

Here’s where older Americans start to see real benefits. Seniors aged 65 or older — and those who are legally blind — get an additional deduction stacked on top of the standard one.

In 2026, that means:

- $2,050 extra for single filers

- $1,650 per spouse if filing jointly (up to $3,300 total for a senior couple)

This effectively raises the income threshold before you owe any federal income tax. For example, a retired couple both over 65 could combine the standard deduction and their age-based addition for a total of $35,500 in tax-free income.

This change also keeps seniors aligned with inflation, offering a steady buffer against the rising cost of everyday essentials like utilities, medication, and groceries.

The New “Senior Bonus Deduction” Explained

The most talked-about part of the overhaul is the Senior Bonus Deduction, which debuts in 2025 and continues through 2028. This bonus gives older taxpayers an additional $6,000 deduction per person, or $12,000 per couple, on top of all other deductions.

Unlike many tax breaks, this one does not require itemizing. You can take it even if you’re using the standard deduction — which most retirees do.

Here’s how it stacks up for a married couple, both over 65, filing jointly:

| Deduction Type | Amount (2026) |

|---|---|

| Standard Deduction | $32,200 |

| Age 65+ Addition | $3,300 |

| Senior Bonus Deduction | $12,000 |

| Total | $47,500 |

In this example, the couple could exclude $47,500 of income from taxes entirely. Depending on their bracket, that could translate to $1,500–$2,500 in annual savings.

For a single filer aged 65 or older, the total deduction could reach about $24,150, meaning nearly a quarter of their income could be shielded from federal tax.

Who Qualifies for the Major 2026 Tax Overhaul?

To qualify, you must:

- Be 65 or older by December 31, 2026.

- File your taxes as an individual, head of household, or married filing jointly.

- Have an Adjusted Gross Income (AGI) below:

- $75,000 for single filers

- $150,000 for married couples filing jointly

If your income exceeds those limits, the deduction phases out gradually — meaning it decreases as your income rises, disappearing completely at roughly double the thresholds.

The IRS will apply these limits automatically when you file, so you won’t need to fill out any extra forms or worksheets to claim it.

Real-Life Examples of How This Works

Example 1: Retired Single Senior

Mary, age 68, receives $48,000 annually from Social Security and a pension.

Her deductions for 2026 would include:

- $16,100 standard deduction

- $2,050 65+ addition

- $6,000 senior bonus deduction

That’s $24,150 total, bringing her taxable income down to about $23,850. Compared to 2025, that’s roughly $700 less in taxes owed.

Example 2: Retired Couple

David and Carol, both 70, have $115,000 in combined income from IRA withdrawals and part-time work.

Their deductions:

- $32,200 standard

- $3,300 65+ addition

- $12,000 senior bonus deduction

Total: $47,500

Their taxable income drops to $67,500. In practical terms, this could reduce their federal tax bill by $1,800–$2,000, depending on their bracket.

Why These Changes Matter?

Retirees are being squeezed by the cost of living like never before. A 2025 report by AARP showed that housing and healthcare now account for nearly 60% of spending among seniors, while Social Security benefits increased only 3.2% last year.

This new tax overhaul is designed to close that gap by giving older Americans a direct and measurable boost in after-tax income. The higher deductions mean seniors can keep more money for essentials and enjoy more flexibility in managing savings.

Financial planner Mark J. Kohler, CPA, explains:

“This new senior deduction isn’t just symbolic. It’s a real, tangible benefit that rewards older Americans for decades of contribution and gives them some breathing room in retirement.”

How to Prepare for the 2026 Tax Year?

Even though the overhaul takes effect for tax year 2026, smart planning starts now. Here are some steps to make sure you’re positioned to take advantage:

- Verify Your Age Qualification

If you’ll turn 65 any time during 2026, you qualify for both the 65+ and Senior Bonus deductions. - Track Your Income

If your adjusted gross income (AGI) hovers near the phase-out limits ($75K single / $150K married), consider managing withdrawals from retirement accounts or deferring income when possible. - Max Out Retirement Contributions

If you’re still working part-time, use “catch-up contributions” to 401(k)s or IRAs to reduce your taxable income. - Time Your Withdrawals

Strategic timing of IRA or 401(k) withdrawals can help keep your income below the phase-out range. - Consult a Tax Professional

A CPA or enrolled agent can help tailor a plan specific to your situation. Many offer free consultations for seniors. - Use Free IRS Resources

The IRS’s Tax Counseling for the Elderly (TCE) and Free File programs provide assistance for those over 60.

Comparing 2025 vs. 2026 Senior Tax Rules

| Category | 2025 | 2026 | Change |

|---|---|---|---|

| Standard Deduction (Single) | $15,750 | $16,100 | +$350 |

| Age 65+ Addition (Single) | $1,900 | $2,050 | +$150 |

| Senior Bonus Deduction | Not available | $6,000 | +$6,000 |

| Married Joint Total (Both 65+) | ~$35,000 | ~$47,500 | +$12,500 |

| Phase-Out Threshold | N/A | $75K / $150K | New limit introduced |

As the table shows, the 2026 system offers a dramatic jump in deductions for qualifying seniors, with total potential write-offs increasing by more than 30%.

Common Misconceptions About the 2026 Tax Overhaul

- Myth 1: Seniors won’t pay any taxes at all.

That’s false. The deductions reduce taxable income but don’t eliminate taxes entirely. - Myth 2: The Senior Bonus Deduction applies automatically to everyone.

It only applies if you meet the age and income requirements. - Myth 3: You must itemize to get the bonus.

Not true. You can claim it along with the standard deduction. - Myth 4: This law is permanent.

The Senior Bonus Deduction expires after 2028, unless Congress renews it.

$3000 on Average Confirmed By IRS As 2025 Tax Refunds: Check Eligibility & Payment Credit Date

IRS $1,390 Direct Deposit Relief in 2025 – Full Eligibility & Key Facts Explained

IRS Confirms $7,830 EITC Refund for 2025 – Check Exact Payout Dates & Who Gets It

The Bigger Picture: A Step Toward Fairer Taxation

This overhaul isn’t just about numbers — it’s about fairness. For decades, seniors have faced a growing tax burden even as healthcare and living costs skyrocketed. The IRS 2026 updates finally recognize the economic challenges facing older Americans and provide meaningful, straightforward relief.

If you’re approaching retirement, now is the time to adjust your tax strategy. Whether you’re managing investments, planning charitable donations, or timing withdrawals, aligning with these new rules can mean the difference between owing money and getting a refund.

Financial educator Nancy LeaMond of AARP put it simply:

“This isn’t just about taxes — it’s about dignity in retirement. The IRS’s changes will help millions of Americans keep the stability they’ve worked for their entire lives.”