The U.S. Internal Revenue Service (IRS) has announced key changes for the 2026 tax year that could significantly impact your refund. New tax brackets, higher standard deductions, and adjustments for inflation will reshape how much taxpayers owe, potentially leading to higher refunds for many. These changes aim to prevent “bracket creep” and alleviate some of the tax burden for middle-class families.

Table of Contents

IRS 2026 Update

| Key Fact | Detail/Statistic |

|---|---|

| New Tax Brackets | Higher income thresholds for each bracket |

| Standard Deduction Increase | $32,200 for married couples, up from $31,500 |

| Earned Income Tax Credit | Maximum credit of $8,231 for 3+ children |

| Tax Filing Changes for Seniors | Additional $6,000 deduction for seniors |

| Official Website | IRS.gov |

The U.S. Internal Revenue Service (IRS) has revealed significant updates to the federal tax system for the 2026 tax year, which may have notable implications for your tax return and refund. In response to ongoing inflation and calls for fairer tax policies, these changes include new tax brackets, larger standard deductions, and increased tax credits. While these shifts could benefit many taxpayers, the ultimate effect will vary depending on income, filing status, and other individual circumstances.

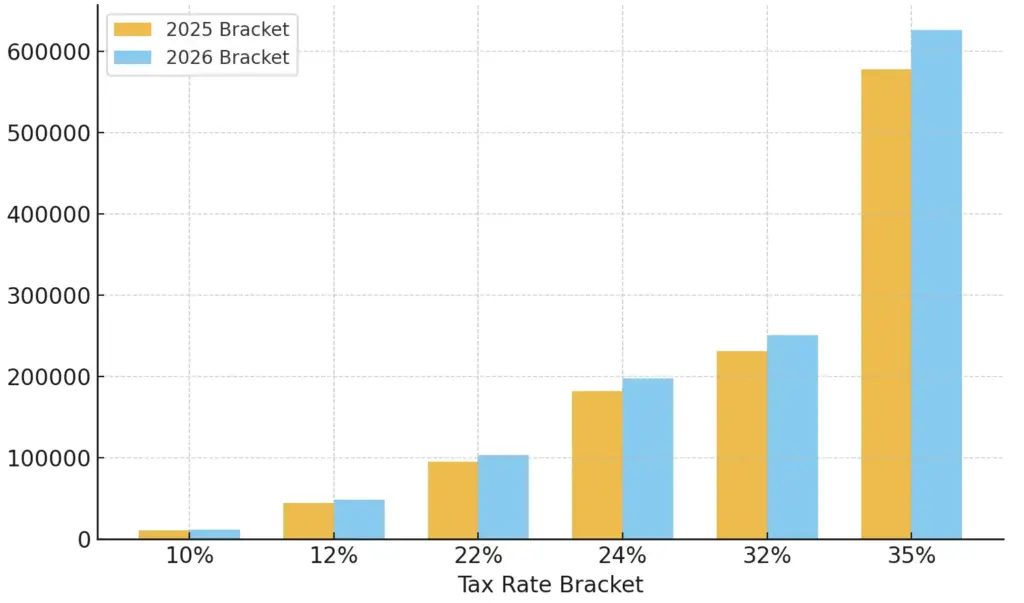

Updated Tax Brackets for 2026

The IRS’s 2026 adjustments primarily aim to keep taxpayers from being unfairly pushed into higher tax brackets due to inflation—an issue often referred to as “bracket creep.” The income thresholds for each bracket have been increased by roughly 2.3%, aligning them with rising living costs.

For instance, the highest tax rate of 37% will now apply to single filers earning over $640,600, and to married couples filing jointly making more than $768,700. These changes ensure that the tax system remains more in line with current economic conditions.

The IRS also raised the lower tax brackets, so more middle-income families will benefit from lower tax rates on their earnings. Single taxpayers in the 12% tax bracket, for example, will be taxed at a lower rate for income up to $44,800, while married couples can earn up to $89,600 without reaching the next tax level. This broader adjustment is aimed at reducing the tax burden on families, particularly in the face of ongoing inflation.

These adjustments are based on the Consumer Price Index (CPI) and are intended to reflect the real purchasing power of American households. Economists argue that these changes help to mitigate the negative impact of inflation on tax filers, especially those whose wages have been stagnating despite rising costs of living.

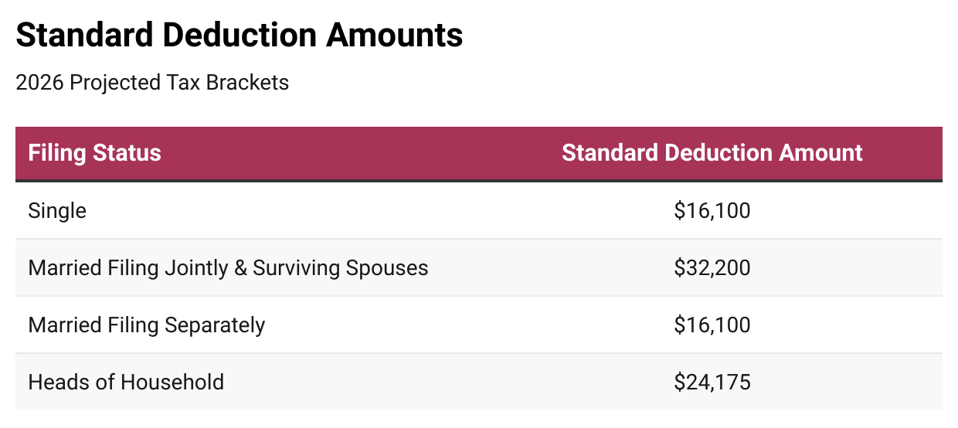

Increased Standard Deductions

One of the most significant changes in 2026 will be a rise in the standard deduction amounts. This increase is intended to shield more taxpayers from taxable income, helping those who do not itemize deductions.

The standard deduction for single filers will rise to $16,100, up from $15,750 in 2025. For married couples filing jointly, the deduction will increase to $32,200 from $31,500. Heads of household will see a similar increase, with the deduction growing to $24,150, up from $23,625 in 2025.

These adjustments will directly reduce taxable income, lowering the total amount many people owe to the government, and may ultimately lead to higher refunds for some taxpayers.

In recent years, the number of people who itemize deductions has steadily decreased, as many taxpayers found that taking the standard deduction was more beneficial. These increases further incentivize taxpayers to claim the standard deduction, which simplifies the filing process.

Enhanced Tax Credits for Families

For low- to moderate-income taxpayers, the IRS has also expanded certain tax credits. The Earned Income Tax Credit (EITC), which benefits working families, will be larger in 2026. For instance, taxpayers with three or more children may qualify for up to $8,231, an increase from $8,046 in 2025.

Additionally, the Child Tax Credit remains at $2,200 per qualifying child, following its increase in previous years. This consistent amount provides financial relief for many families with dependents.

Another important tax relief measure is the adoption credit, which will rise to $17,670, with up to $5,120 being refundable. These credits are designed to alleviate the financial burden on those raising children or supporting other dependents.

In a broader context, the IRS is working to make tax credits more accessible to a wider range of families. The goal is to offer support to those who are economically disadvantaged but still earn enough to pay federal taxes. Expanding the scope of these credits helps to ensure more Americans benefit from federal relief programs.

Special Deductions for Seniors

Seniors will see specific benefits under the 2026 tax law changes. In addition to the standard deduction increases, individuals aged 65 and older will qualify for an additional deduction of $1,650, while married couples where both spouses are over 65 can claim up to $3,300 in additional deductions.

Notably, the new One Big Beautiful Bill Act (OBBBA) includes a temporary $6,000 bonus deduction for seniors. This bonus deduction is available through 2028 but is subject to a phase-out for those with modified adjusted gross incomes above $75,000 ($150,000 for married couples). The bonus is designed to provide extra relief for seniors during retirement.

This adjustment is expected to have a significant impact on retirement planning, as seniors who depend on fixed incomes can benefit from a reduced tax burden. For many, this could mean a larger refund or reduced taxes owed.

Potential Impact on Refunds

The combination of increased tax credits, higher deductions, and adjusted tax brackets could result in larger refunds for many American taxpayers, particularly those in the middle-income brackets or those with qualifying dependents. For example, a middle-income married couple with two children could see a tax cut of approximately $1,240 for the 2025 tax year, which will be reflected in their 2026 refund.

Taxpayers who benefit from these changes may also see a reduction in their tax withholding throughout the year, resulting in a larger paycheck. However, the overall effect on your refund will depend on various factors, including the amount of taxes you’ve paid during the year, your filing status, and any applicable credits or deductions you can claim.

Moreover, many households may find that these changes allow them to reallocate funds toward other pressing financial needs, such as education expenses or savings for retirement.

What About High-Income Earners?

While the changes may primarily benefit middle- and lower-income households, high-income earners are also impacted by the new tax brackets. The IRS’s increase in the top threshold for the 37% tax rate will offer some relief to wealthy taxpayers, though the overall structure of the tax code remains progressive.

For those in the highest income brackets, the changes may reduce the amount of taxes owed or lessen the pressure to pay additional taxes. However, critics of the tax system may argue that these adjustments are not enough to address growing income inequality. The ongoing debate about wealth distribution and tax fairness continues to shape policy discussions at the federal level.

Tax Planning for 2026

As these changes are expected to have broad implications for many taxpayers, it is important for individuals and families to update their tax planning strategies. Whether you are preparing for retirement, managing investment income, or simply looking to minimize your tax burden, understanding the nuances of the 2026 tax code is crucial.

Tax professionals and financial planners recommend that taxpayers review their withholding to ensure that they are taking full advantage of the new deductions and credits. For example, seniors can benefit from the additional deductions, while families may want to explore opportunities to maximize their Child Tax Credit or Earned Income Tax Credit.

Conclusion

The IRS’s 2026 updates reflect a broader trend of tax policy adjustments aimed at addressing the economic realities many families face. The new tax brackets, increased standard deductions, and enhanced tax credits could offer substantial relief for individuals and families, especially in the wake of rising costs due to inflation. However, taxpayers should consult with a tax professional to fully understand how these changes will affect their specific financial situation.

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

FAQ About IRS 2026 Updates

1. How will the new 2026 tax brackets affect my refund?

The new tax brackets are designed to reduce the amount of tax you owe, potentially leading to a larger refund. Your refund will depend on your total taxable income, deductions, and any tax credits you qualify for.

2. What is the new standard deduction for 2026?

The standard deduction for single filers will be $16,100, and for married couples filing jointly, it will be $32,200. These increases help lower your taxable income.

3. Are there any changes for seniors in 2026?

Yes, seniors aged 65 and older can claim additional deductions, including a temporary $6,000 bonus deduction introduced by the One Big Beautiful Bill Act.