Polaris Inc. has announced plans to sell a majority stake in Indian Motorcycle, one of America’s oldest motorcycle brands, to Carolwood LP, a private equity firm. The deal, expected to close in the first quarter of 2026, will create a standalone Indian Motorcycle company, marking a pivotal shift in strategy for the powersports manufacturer and the Polaris Exits Indian Motorcycle brand.

Table of Contents

Polaris’ Strategic Exit from Indian Motorcycle

In its official statement, Polaris said it will retain a minority interest while transferring majority ownership to Carolwood LP. The company framed the move as a way to “unlock value” and focus on its most profitable segments.

Polaris expects the transaction to increase adjusted EBITDA by USD 50 million annually and lift adjusted earnings per share by around USD 1.00. This is largely due to a leaner portfolio and lower capital expenditure in the motorcycle division.

“Indian has been a proud part of Polaris’ story, but this move allows both organisations to pursue their strategic priorities more effectively,” Mike Speetzen, CEO of Polaris, said in the statement.

A Century-Old Brand with Modern Ambitions

Indian Motorcycle was founded in 1901 in Springfield, Massachusetts, predating its archrival Harley-Davidson by two years. It became an early leader in American motorcycling, producing military motorcycles during both World Wars and setting racing records.

However, the brand went through decades of ownership changes and financial instability. When Polaris acquired Indian in 2011, it was widely viewed as a bold attempt to revive a historic nameplate. Over the following decade, Polaris invested heavily in new models, modern design, and technology.

Indian’s relaunch of the Chief and Scout models earned strong critical reception and positioned it as a premium competitor in the cruiser and touring segments. Global expansion followed, with dealerships opening in key markets including India, Europe, and Australia.

“Indian’s comeback is one of the most remarkable revivals in motorcycle history,” said Dr. Laura McKinnon, a senior industry analyst at the Brookings Institution. “Polaris brought engineering discipline and marketing strength to a heritage brand.”

Inside the Deal: What Changes for Indian Motorcycle

The new Indian Motorcycle entity will inherit core assets including manufacturing plants in Spirit Lake, Iowa, and Monticello, Minnesota, as well as design and engineering centres. Around 900 employees are expected to transition to the new company.

The brand will be led by Mike Kennedy, a veteran executive who previously held leadership roles at Harley-Davidson. Kennedy said Carolwood LP intends to invest in product innovation, electric vehicle technology, and international market growth.

“Indian is more than a brand; it’s an institution,” Kennedy said. “Our priority is to build on its legacy while positioning it for the next generation of riders.”

Market Reactions and Strategic Implications

The market reacted positively to the announcement. Polaris’ shares rose 8% in early trading on the New York Stock Exchange, reflecting investor optimism about the company’s streamlined focus.

“Investors see this as a disciplined capital allocation decision,” said Daniel Park, an equity strategist at Morningstar. “Indian was a respected brand but lower-margin compared to Polaris’ off-road segment. The sale simplifies operations and boosts profitability.”

This move is also part of a broader industry trend where large vehicle manufacturers are divesting legacy divisions to concentrate on higher-growth, higher-margin businesses. In recent years, major automakers have sold or spun off underperforming brands to private investors or specialised firms.

Carolwood LP: A Quiet but Ambitious Buyer

Carolwood LP is a New York–based private equity firm with a track record of investing in heritage consumer brands. While not widely known to the general public, it has previously funded restructuring and growth initiatives in the automotive aftermarket sector.

Industry analysts say Carolwood’s acquisition of Indian Motorcycle is likely aimed at building brand value and exploring global expansion, possibly leading to an IPO or secondary sale in the future.

“Private equity often looks for underutilised brand equity,” said Prof. Anand Iyer, head of automotive studies at the Indian Institute of Management, Bangalore. “Indian has strong name recognition worldwide. With targeted investment, it could scale faster than under a large conglomerate.”

Impact on Customers and Dealers

Polaris and Carolwood have assured customers that warranties, spare parts, and after-sales services will continue uninterrupted. Dealer agreements will also remain in effect during the transition period.

Still, some dealers expressed cautious optimism. “Change can be positive, but it comes with uncertainty,” said Mark Ellis, a dealer based in Arizona. “We want clarity on product pipelines and marketing support.”

Customer advocacy groups have urged Carolwood to maintain product quality and service standards, noting that Indian Motorcycle’s premium positioning relies heavily on brand trust.

Indian Motorcycle and the Electric Future

One of the most anticipated aspects of the transition is Indian’s potential entry into the electric motorcycle market. The company previously unveiled concept electric bikes but held back on commercial rollout due to cost pressures.

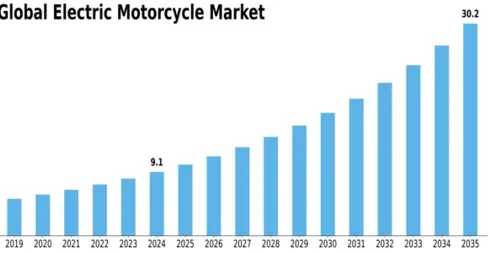

Carolwood’s investment could accelerate this initiative. Electric motorcycles are expected to represent 20–25% of the U.S. two-wheeler market by 2035, according to projections by the International Energy Agency (IEA).

“Indian has a prime opportunity to become a heritage brand that also leads in electric innovation,” said Dr. McKinnon. “That combination could make it very competitive globally.”

A Competitive Landscape Ahead

Indian Motorcycle operates in a segment dominated by Harley-Davidson, along with international players such as BMW Motorrad and Triumph. The company has differentiated itself with performance-oriented cruisers and modern technology.

However, competition is intensifying as Chinese and European manufacturers expand into the American market with aggressive pricing. Electric mobility startups like Zero Motorcycles and LiveWire also present new challenges.

“Indian is at an inflection point,” said Evelyn Torres, senior editor at Cycle World Magazine. “It needs to innovate quickly while protecting the legacy that makes it unique.”

Historical Echoes: This Is Not the First Exit

This is not the first time Indian Motorcycle has changed hands. Since its early 20th-century glory, it has passed through multiple owners, each attempting to restore its former prestige.

Polaris’ stewardship is widely regarded as the most successful revival in modern history, marked by a return to profitability, a modern product lineup, and a dedicated rider community.

“The sale marks the end of one chapter but could be the start of a stronger, more focused era,” Torres added.

Conclusion: A Defining Moment for Indian Motorcycle

Polaris’ decision to sell its majority stake in Indian Motorcycle reflects a strategic shift in priorities and market realities. For Polaris, it is a step toward operational efficiency and shareholder value. For Indian Motorcycle, it is an opportunity for renewed growth and innovation under new ownership.

Whether the brand thrives in this new chapter will depend on Carolwood’s ability to balance heritage with modernisation, and to compete in an increasingly electric and global market.

As the deal moves toward closing in early 2026, both industry watchers and loyal riders will be watching closely.