Canadians asking about an “extra tax refund” in 2025 should note there is no new federal one-time payout; instead, regular tax refunds and routine benefit credits are being issued on the Canada Revenue Agency’s posted schedules for the year. For individual taxpayers, the most reliable path is to treat refunds as the outcome of your assessment, not as a special program, and to plan cash flow around the official October schedule for GST/HST (Oct 3), Advanced Canada Workers Benefit (Oct 10), Ontario Trillium Benefit where applicable (Oct 10), and the Canada Child Benefit (Oct 20), with any subsequent dates reflected on the federal calendar.

Table of Contents

Extra Tax Refund in Canada for 2025

| Key fact | Detail/Statistic |

|---|---|

| No extra one-time refund in 2025 | No federal announcement of a new special payout; rely on CRA schedules and My Account |

| Average refund last tax season | More than 19 million refunds; average refund was $2,294 |

| How to verify your payments | Check CRA My Account and the official payment dates page |

Processing norms remain stable: electronic filing with direct deposit typically yields the fastest refunds, while paper returns and accounts chosen for review can extend timelines; CRA’s recent filing-season advisory underscores that most refunds reflect over‑withholding rather than any new stimulus, with last season’s average refund reported at $2,294 across more than 19 million refunds. The practical takeaway is twofold: first, monitor CRA My Account and the Government of Canada benefits page for authoritative amounts and dates; second, disregard viral claims of surprise cheques or one‑time windfalls that do not appear on official federal pages, as scheduled benefits and standard assessments are the only confirmed payments in 2025.

What the Extra Tax Refund In Canada actually means

The term “Extra Tax Refund In Canada” has been used online to imply a special new federal payout, but the Government of Canada has not created an extra one-time tax refund for 2025 beyond standard assessments and existing benefits. Officials direct Canadians to the benefits calendar and CRA My Account for verified dates and amounts, cautioning against viral misinformation about supposed new cheques.

What Counts as a Refund in 2025

- Regular tax refunds: A refund occurs when withholdings and instalments exceed your assessed tax; last season, more than 19 million refunds were issued with an average of $2,294, and CRA opened e‑filing for the 2024 return on February 24, 2025.

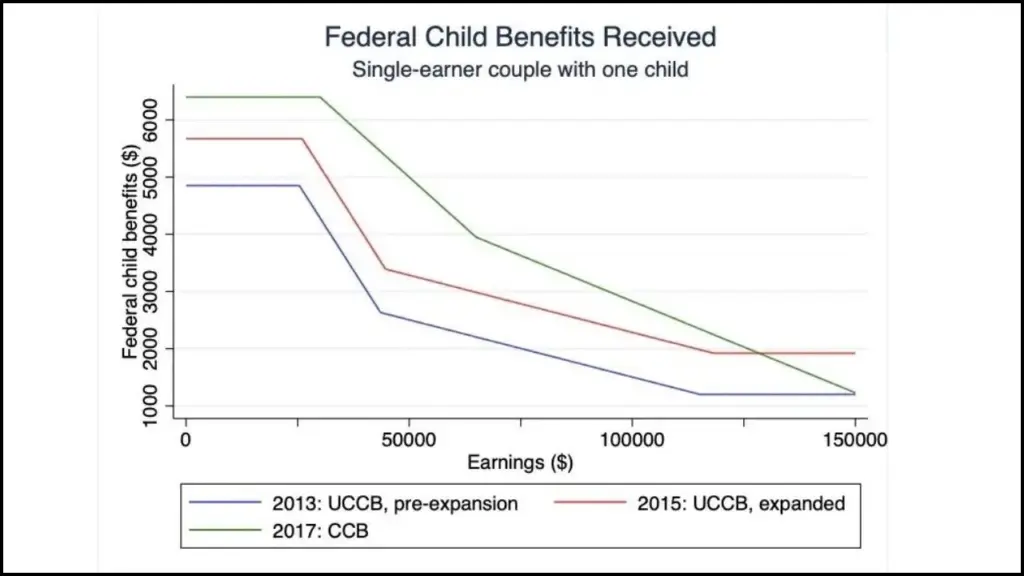

- Benefits and credits: These are distinct from refunds and follow schedules published by the Government of Canada, including the goods and services tax/harmonized sales tax (GST/HST) credit, the Canada Child Benefit (CCB), and the Advanced Canada Workers Benefit (ACWB).

Upcoming Payment Dates and Who Qualifies

The Government of Canada’s schedule lists federal benefits with specific dates; amounts are income-tested and determined by your latest return on file. Eligibility and timing should be verified in CRA My Account to confirm program enrollment and payment method.

Extra Tax Refund Payment Dates Snapshot Table

Is there an Extra Refund in 2025?

There is no new federal one-time “extra tax refund” in 2025; Canadians should consult the CRA’s official calendar rather than rely on social posts that promise unexpected cheques. The Government of Canada pages outline only standard refunds after assessment and routine benefits on fixed dates.

Filing, Refunds, and Timing

- Season timelines: CRA opened e‑filing for 2024 returns on February 24, 2025; most individual filing deadlines were April 30, with self‑employed returns considered on time by June 16, though balances were due April 30 to avoid interest.

- Refund volumes and averages: In the prior season, more than 19 million refunds were issued, averaging $2,294, illustrating that refunds reflect over‑withholding rather than stimulus.

- Policy updates: CRA highlighted changes relevant to 2024 returns, such as Alternative Minimum Tax adjustments and administrative updates, which may affect assessments but do not introduce a special one‑time refund.

How to Verify your Amount and Date

- CRA My Account: Use My Account to confirm eligibility, calculated amounts, and deposit method for refunds and benefits, and to set reminders near payment dates.

- Government calendars: The federal benefits payment dates page lists program schedules and links to details, supporting planning and verification for households.

Quoted Guidance from Official Sources

- “There were more than 19 million refunds issued, with an average refund of $2,294,” the CRA’s tax-filing-season notice states, emphasizing that refund size depends on each filer’s assessment.

- The federal benefits payment dates page directs recipients to program schedules and official links, clarifying that date and eligibility information should be verified on Government of Canada pages and in CRA My Account.

Carbon-related Payments Context

The Government of Canada payments calendar includes dated entries for federal benefits such as the Canada Carbon Rebate, which vary by province and are listed on the schedule; recipients should confirm eligibility and timing in CRA My Account for their jurisdiction. Always rely on the current federal benefits page for accurate dates.

How to Avoid Misinformation About an “Extra” Payout

- Use official pages: Rely on the Government of Canada benefits calendar and CRA filing guidance for authoritative information.

- Confirm in My Account: Check assessed refund amounts, benefit eligibility, and payment methods in CRA My Account.

- Ignore vague claims: Genuine programs appear with clear names, dates, and links on official pages; ambiguous social posts should be treated skeptically.

With no new “extra” federal refund authorized for 2025, Canadians should monitor CRA My Account and the Government of Canada benefits calendar to track standard refunds and scheduled credits, and treat viral claims of surprise cheques with caution. There is no federally authorized “extra tax refund” in 2025; Canadians should expect only their regular tax refunds after assessment and the routine, scheduled benefit payments listed on the Government of Canada’s calendar, and verify all dates and amounts in CRA My Account to avoid misinformation.

FAQs on Extra Tax Refund in Canada for 2025

Do I qualify for any “extra tax refund” in 2025?

What are the next federal benefit payment dates in October 2025?

The schedule lists GST/HST Credit on October 3, Advanced Canada Workers Benefit on October 10, Ontario Trillium Benefit on October 10, and Canada Child Benefit on October 20, for those who qualify

Is there an “extra tax refund” in 2025?

No, there is no new federal one-time payout; refunds are issued after assessment, and routine benefits follow posted calendars.

When are the next CRA payments?

October features GST/HST on October 3, ACWB and OTB on October 10, and CCB on October 20 for eligible recipients.

How large is the typical refund?

The average refund last season was $2,294, though individual results vary based on each tax assessment.

Where should amounts and dates be checked?

Use CRA My Account and the Government of Canada payment dates page for authoritative details.