Millions of Canadians are set to receive additional financial relief in 2025 through the Extra Tax Refund in Canada 2025, a suite of federal and provincial programs aimed at easing cost-of-living pressures. Payments are scheduled to begin in spring 2025, with eligibility based on income, tax filing status, and participation in benefit programs designed to help working and middle-class households.

Table of Contents

Extra Tax Refund In Canada For 2025

| Key Fact | Detail / Statistic |

|---|---|

| Payment Start Date | Spring 2025 |

| Maximum Rebate Amount | CAD 250 (Working Canadians Rebate) |

| Final Carbon Rebate Payment | April 22, 2025 |

| Tax Filing Deadline | April 30, 2025 |

Understanding the Extra Tax Refund in Canada 2025

The Extra Tax Refund in Canada 2025 is not a single lump-sum payment. Instead, it represents a combination of federal rebates and credits, including the Working Canadians Rebate, the Canada Carbon Rebate (CCR), and enhanced GST/HST credits. These measures are part of a broader affordability package announced by the federal government in late 2024.

“Canadians have faced extraordinary cost pressures, and we are putting money back into their pockets,” said Finance Minister Chrystia Freeland during a press conference in Ottawa.

A Historical Tool for Economic Relief

Canada has a long history of using tax rebates and credits to help households during economic downturns. During the 2008 financial crisis, the federal government introduced temporary tax relief measures to stimulate consumer spending. Similarly, during the COVID-19 pandemic, programs like the Canada Emergency Response Benefit (CERB) provided direct payments to millions of Canadians.

“These rebates are consistent with how Canada has historically responded to economic stress,” explained Trevor Tombe, professor of economics at the University of Calgary. “They’re meant to stabilize household finances and maintain spending power.”

How the Working Canadians Rebate Works

The Working Canadians Rebate is a one-time CAD 250 payment for individuals earning up to CAD 150,000 in 2023. It will be distributed automatically in spring 2025 to eligible tax filers. No separate application is required.

Eligibility:

- Must be a Canadian tax resident in 2023 and 2024.

- Must have earned employment income in 2023.

- Must file a 2024 tax return by the April 30 deadline.

According to Finance Canada, the rebate will reach more than 24 million people and cost approximately CAD 6 billion.

Final Carbon Rebate Payment in April 2025

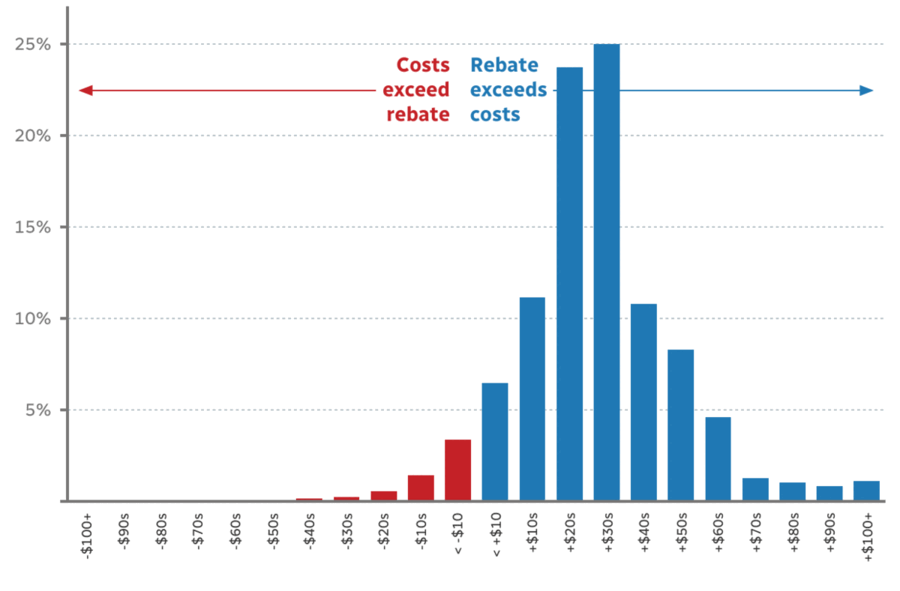

The Canada Carbon Rebate (CCR) will issue its final quarterly payment on April 22, 2025, marking the end of this particular affordability measure. The payment amount varies by province, reflecting differences in carbon pricing.

Examples of single adult payment amounts:

- Ontario: CAD 244

- Alberta: CAD 386

- Manitoba: CAD 264

Households with spouses or dependents receive additional amounts. The Canada Revenue Agency (CRA) has confirmed that recipients must file electronically by April 2, 2025, to receive the payment on time.

GST/HST Credit and Ongoing Support

Low- and modest-income Canadians may also benefit from enhanced GST/HST credits beginning July 2025. Payments are issued quarterly in July, October 2025, and January and April 2026. The credit amount depends on income, marital status, and number of dependents.

“Refundable tax credits like the GST/HST credit provide consistent, structured relief for those who need it most,” said Dr. Sheila Block, a senior economist at the Canadian Centre for Policy Alternatives.

How Provinces May Top Up the Federal Measures

While the rebates are federally administered, some provinces are considering their own top-ups. Alberta has previously issued energy rebates, Quebec has introduced cost-of-living cheques, and British Columbia has adjusted its Climate Action Tax Credit.

For example:

- Alberta is considering an additional CAD 100 top-up to offset high utility costs.

- Quebec has budgeted targeted payments for low-income households.

- British Columbia may align its provincial rebates with federal payments for faster disbursement.

These measures could bring the total benefit for some households to over CAD 800.

How Canada’s Approach Compares Globally

Canada’s 2025 rebate strategy mirrors similar moves in other countries:

- United States: The federal government used stimulus checks during the pandemic to support households.

- United Kingdom: Introduced cost-of-living payments for low-income families in response to energy price surges.

- Australia: Offered targeted tax refunds to working-class citizens during periods of high inflation.

According to the Organisation for Economic Co-operation and Development (OECD), such targeted transfers can help cushion households without adding excessive inflationary pressure, unlike broad-based tax cuts.

How to Maximize Your Refund

To ensure Canadians don’t miss out on their benefits, CRA recommends:

- Filing electronically before the April 30 deadline.

- Signing up for direct deposit to receive funds quickly.

- Claiming all eligible credits and deductions, including medical expenses, tuition, or charitable donations.

- Reviewing eligibility for provincial supplements.

Tax experts also advise reviewing past unused credits that can be carried forward.

Public Opinion and Criticism

Not everyone agrees on the effectiveness of rebates. Opposition MPs have criticized the measures as short-term fixes that do little to address the structural drivers of inflation, such as housing costs and energy prices.

“This is temporary relief, not a long-term solution,” said Conservative MP Pierre Poilievre, adding that broader tax reforms are needed.

On the other hand, advocacy groups argue the payments are necessary. “For many low-income families, $250 or $500 can make a real difference in covering essentials,” said Leah Gazan, NDP MP for Winnipeg Centre.

Economists remain divided. Some warn of potential inflationary effects if consumer demand spikes, while others say targeted transfers are a pragmatic tool in uncertain economic times.

Common Myths About the Extra Tax Refund

| Myth | Fact |

|---|---|

| “You have to apply for the rebate.” | False. If you file your taxes, the payment is automatic. |

| “Everyone gets $250.” | False. Only eligible individuals under income thresholds qualify. |

| “The rebate is taxable income.” | False. It is not taxable and will not affect future benefits. |

| “Payments arrive instantly.” | False. Most arrive within two weeks of filing electronically. |

Broader Economic Impact

According to a Parliamentary Budget Officer (PBO) estimate, the 2025 rebate measures could inject over CAD 12 billion into the economy through combined federal and provincial transfers. While this may support consumer spending, analysts caution against assuming it will fully offset inflationary pressures.

“Relief payments are helpful, but without addressing supply constraints in housing, energy, and infrastructure, they won’t solve the underlying problems,” noted Dr. Armine Yalnizyan, economist and Atkinson Fellow on the Future of Workers.

Looking Ahead

The federal government is expected to monitor economic indicators closely throughout 2025. Adjustments to rebate amounts or new measures could be announced in the spring 2025 budget.

Provinces are also reviewing their own affordability strategies, meaning additional supports may be rolled out later in the year.

Canada Disability Bill 2025: Check C-22 Bill Benefits, Eligibility & New Due Dates

FAQ About Extra Tax Refund In Canada For 2025

Who qualifies for the Extra Tax Refund in Canada 2025?

Canadians who earned income in 2023, file their 2024 tax return on time, and meet income thresholds may qualify for one or more rebates.

How much can I receive?

Eligible individuals can receive up to CAD 250 from the Working Canadians Rebate, plus Canada Carbon Rebate and GST/HST credits, with total benefits exceeding CAD 700 in some cases.

When will payments arrive?

Working Canadians Rebate payments start in spring 2025, the CCR final payment is April 22, and GST/HST credits begin in July 2025.

Do I need to apply?

No. Filing your tax return automatically triggers eligibility review and payment.