Extra $2967 Social Security Direct Deposit: If you’re wondering about that extra $2967 Social Security direct deposit coming your way in November 2025, you’ve landed at the right spot. Let’s break down what’s really happening with Social Security payments this November, who qualifies, when to expect your cash, and how to manage it smartly. When it comes to Social Security payments, the talk of extra or early deposits can stir up a lot of buzz. This November 2025, there’s a special calendar twist causing some beneficiaries to get their Social Security Supplemental Security Income (SSI) money a bit earlier than usual—on October 31, 2025. But before you start dreaming of a bonanza, it’s important to know this isn’t extra money or a surprise bonus. It’s about scheduling, eligibility, and timely payments, all designed to keep things smooth for millions of Americans relying on these benefits.

Table of Contents

Extra $2967 Social Security Direct Deposit

In summary, the rumored extra $2967 Social Security direct deposit for November 2025 is a misinterpretation. What is actually happening is an early deposit of regular SSI benefits on October 31, 2025, due to November 1 falling on a Saturday. The federal SSI payment caps remain $967 for individuals and $1,450 for couples, with some variability due to other income and state supplements. Being proactive with budgeting, tracking payments, and understanding eligibility and COLA changes keeps your financial planning strong.

| Feature | Details |

|---|---|

| Early Payment Date | October 31, 2025 (for November SSI benefits) |

| Maximum SSI Payment (2025) | $967 for individuals, $1,450 for couples |

| Additional Payment Mentioned | $2967 not a standard federal payment—likely a combined or state supplement figure |

| Eligibility Requirements | Age 65+, blind, or disabled with limited income and resources |

| Next Regular SSI Payment | December 1, 2025 |

| Payment Method | Direct deposit preferred; paper checks may take longer due to mailing |

| Official Info Source | Social Security Administration (SSA) |

Why Are Some Extra $2967 Social Security Direct Deposit Coming Early in November 2025?

Typically, Social Security and SSI payments are sent on the first day of the month. However, if the first lands on a weekend or a federal holiday, the payment is shifted to the preceding business day. For November 2025, November 1 falls on a Saturday, so instead of waiting until Monday, the Social Security Administration (SSA) is sending payments early on October 31, 2025.

This means that SSI recipients will see their November benefit deposited in their accounts one day early, on October 31. It’s crucial to understand this early payment is not an extra or stimulus check. Rather, it’s a scheduling tweak that ensures timely benefit delivery ahead of a weekend.

Because of this, no separate SSI payment will be issued during November itself. Instead, the October 31 deposit covers the full month of November for those eligible. This adjustment avoids disruptions for millions who depend on these funds for essentials such as rent, utilities, food, and medicine. It’s a practical fix reflecting the government’s effort to maintain punctual benefits.

Who Qualifies for This Payment?

Eligibility for SSI—and therefore the early November payment—requires strict compliance with SSA rules. To qualify, a person must meet the following:

- Age 65 or older OR

- Be legally blind, with visual acuity of 20/200 or less in the better eye with corrective lenses, or a very narrow field of vision, OR

- Be disabled, meaning unable to engage in substantial gainful activity due to a physical or mental impairment expected to last at least 12 months or result in death.

Additionally, recipients must:

- Have very limited income — For 2025, single individuals typically must have a gross monthly income under about $2,019 and couples under about $2,985.

- Possess limited resources, usually less than $2,000 for individuals and $3,000 for couples; certain assets like a primary home and some vehicle equity are excluded.

- Be a U.S. citizen or certain qualified noncitizens.

- Reside within the 50 states, District of Columbia, or Northern Mariana Islands.

- Not be institutionalized in a government-funded care facility.

- Have filed an SSI application and be already approved for benefits.

SSI also considers blended income types, including wages, Social Security payments, pensions, and in-kind benefits like food or shelter. The SSA conducts thorough income and resource reviews to ensure ongoing eligibility.

This careful eligibility process ensures the program targets those in genuine financial and medical need, primarily older adults, blind individuals, and Americans with disabilities who have limited means.

How Much Will You Receive?

The maximum federal SSI payment amount in 2025 is:

- $967 per month for individuals

- $1,450 per month for eligible couples

It’s important to note these are maximum federal amounts. Actual payments vary because:

- Your other income sources such as wages, pensions, Social Security benefits, or even unearned income can reduce your SSI payment.

- State supplements: Many states add their own amounts to SSI payments, which vary widely. For example, California and New York offer monthly supplements, potentially increasing total monthly income.

- Your living arrangement impacts benefits. Those living with others who provide food or shelter might have reduced payments.

The $2967 figure you might have heard is not a federal standard. It could be attributed to a sum of federal payment plus state supplements or additional benefits, possibly combined with other relief or reimbursements specific to certain recipients. However, for most, the maximum SSI federal payment noted above is the baseline.

When Will the Next Payment Arrive?

Since the November SSI payment is made early on October 31, no SSI payment will be made during the month of November itself.

The next scheduled SSI payment will be December 1, 2025. This scheduling means recipients will face a longer than usual wait period between payments, roughly a month.

For budgeting, this gap can pose challenges, especially for low-income beneficiaries who depend on prompt monthly payments. Planning ahead is vital.

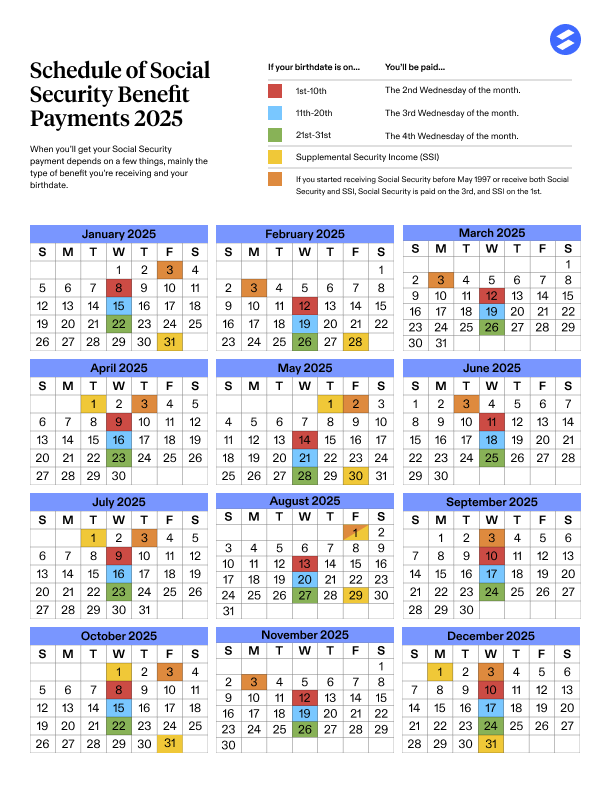

Other Social Security benefits—such as retirement, disability, and survivors benefits—have different, regular schedules mostly related to birthdates, which proceed unaffected by the early SSI payment.

How to Be Prepared: Practical Tips for Beneficiaries

Living on SSI means every dollar is precious. Here’s how to manage the early payment and month-long gap effectively:

- Budget carefully for November: Allocate part of your October 31 payment to cover rent, utilities, groceries, medicine, and transportation through November. Setting aside about a third of your received payment can help avoid shortfalls.

- Track your payment: SSA recommends beneficiaries monitor their bank statements or the SSA online account at SSA My Account to ensure payment was successfully deposited. Paper checks may require additional time for mail delivery—plan accordingly.

- Stay informed and proactive: If by November 3 you haven’t received your payment, contact SSA immediately at 1-800-772-1213 for help. Be aware of processing delays during holidays or due to administrative issues.

- Beware of scams: The SSA will never call, email, or text asking for sensitive information like your Social Security number or bank details. Always verify SSA communications through official SSA websites or phone lines.

- Seek additional help: If budgeting is tough, explore local assistance programs such as food banks, utility relief funds, or Medicaid benefits that can supplement your needs during lean months.

How to Check Your Extra $2967 Social Security Direct Deposit Status?

Confirming your Social Security or SSI payment status is straightforward:

- Log into your personal SSA account via the SSA website, where you can view payment history, check upcoming payment dates, and update personal info.

- Call the SSA toll-free number at 1-800-772-1213 for live assistance during business hours. Representatives can verify payment status and address account concerns.

- Review your bank statements for recent deposits.

Checking periodically avoids surprises and helps you plan your finances by confirming when money hits your account.

What If Your Payment Is Delayed?

Delays happen occasionally due to bank processing problems, incorrect account info, or SSA administrative issues. If your payment hasn’t arrived by a few days after October 31:

- Double-check that your bank account and mailing address info with SSA is current and accurate.

- Contact SSA as soon as possible to report the issue and initiate investigation.

- Retain any correspondence or documentation for future reference.

Payments are lifelines for many, so quick action is key to resolving issues and receiving your money promptly.

Cost-of-Living Adjustment (COLA) for 2025

Beyond payment dates and eligibility, it’s important to note SSA’s annual Cost-of-Living Adjustment (COLA), designed to help benefits keep up with inflation.

For 2025, the COLA was about 3.2%, meaning Social Security and SSI payments rose compared to 2024. This adjustment helps meet rising costs of essentials like food, housing, and medicine.

COLA calculations are based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). As inflation fluctuates, SSA adjusts benefits to maintain beneficiaries’ purchasing power.

Other Social Security Programs to Know About

Social Security is a broad system. Apart from SSI, key programs include:

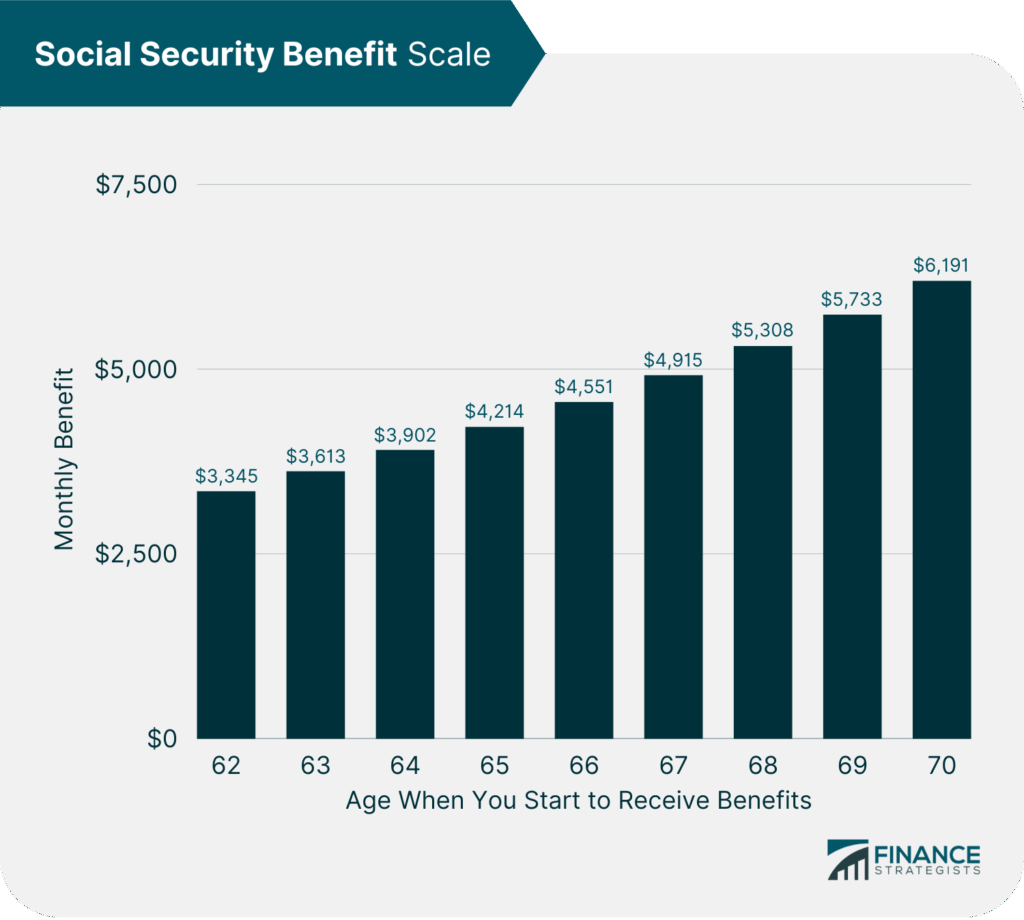

- Retirement Benefits: Monthly income for workers who have reached eligible age (usually 62 or older) and have earned sufficient work credits.

- Social Security Disability Insurance (SSDI): For adults with disabilities who meet SSA’s medical and work credit criteria; benefits are based on prior payroll contributions.

- Survivor Benefits: Financial support to family members after a worker’s death.

SSI differs because it’s need-based rather than contribution-based and helps individuals with limited income regardless of prior work history.

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

Social Security 2026 Hike Fizzles Out – Largest Medicare Deduction in History Takes a Bite

Seniors 63+ Getting a New Social Security Payment in Days; Check Eligibility & Payment Date